India Power Rental Market Size, Share, Trends and Forecast by Fuel Type, Equipment Type, Power Rating, Application, End Use Industry, and Region, 2025-2033

Market Overview:

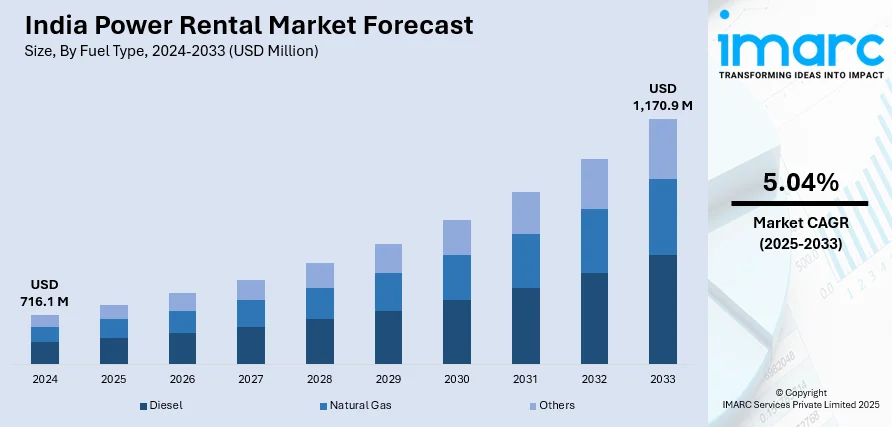

India power rental market size reached USD 716.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,170.9 Million by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033. The growing urbanization and industrial activities, which lead to an increased demand for temporary power solutions during construction projects and infrastructure development, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 716.1 Million |

| Market Forecast in 2033 | USD 1,170.9 Million |

| Market Growth Rate (2025-2033) | 5.04% |

Power rental refers to the temporary provision of electrical power equipment and services to meet short-term energy needs. This service is crucial in situations where a consistent and reliable power supply is required, but a permanent infrastructure is impractical or unavailable. Power rental companies offer a range of equipment, including generators, transformers, and distribution panels, to diverse sectors such as construction, events, emergency response, and industrial operations. These services ensure uninterrupted power during planned maintenance, emergencies, or events, allowing businesses and organizations to function seamlessly. Power rental offers flexibility and scalability, enabling clients to tailor their energy solutions to specific requirements. It plays a vital role in mitigating the impact of power outages, supporting critical operations, and maintaining productivity in various industries. Overall, power rental provides a reliable and efficient solution for meeting temporary power demands across different applications and sectors.

To gain detailed insights into the report, Request Sample

India Power Rental Market Trends:

The power rental market in India is experiencing significant growth, driven by a myriad of factors that collectively shape its trajectory. Firstly, the escalating demand for reliable and uninterrupted power supply in various industries propels the market forward. Industries such as manufacturing, construction, and events management require a steadfast power source, creating a sustained need for rental power solutions. Additionally, the rise in construction activities and infrastructure development contributes to the market's expansion, as these projects often demand temporary power solutions. Moreover, the increasing frequency and severity of natural disasters underscore the importance of resilient power infrastructure. In the aftermath of such events, the power rental market has become a crucial player in providing emergency power solutions for affected regions. Furthermore, the growing awareness and adoption of sustainable practices drive the demand for clean energy solutions, leading to the incorporation of eco-friendly power rental options. This shift aligns with the regional emphasis on reducing carbon footprints, thus influencing the market dynamics. In conclusion, the power rental market in India is intricately linked to a multitude of factors, ranging from industrial demands and infrastructure projects to the imperative need for reliable power in emergencies and the growing preference for sustainable energy solutions.

India Power Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on fuel type, equipment type, power rating, application, and end use industry.

Fuel Type Insights:

- Diesel

- Natural Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, natural gas, and others.

Equipment Type Insights:

- Generator

- Transformer

- Load Bank

- Others

A detailed breakup and analysis of the market based on the equipment type have also been provided in the report. This includes generator, transformer, load bank, and others.

Power Rating Insights:

- Up to 50 kW

- 51 -500 kW

- 501 -2,500 kW

- Above 2,500 kW

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes up to 50 kW, 51 -500 kW, 501 -2,500 kW, and above 2,500 kW.

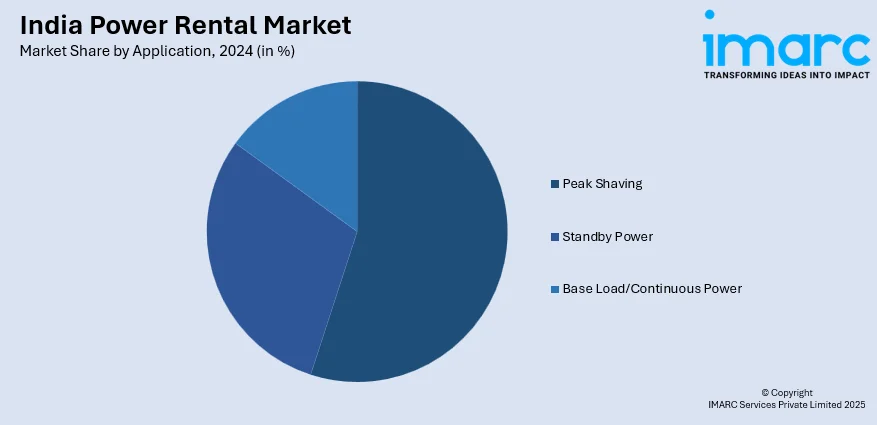

Application Insights:

- Peak Shaving

- Standby Power

- Base Load/Continuous Power

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes peak shaving, standby power, and base load/continuous power.

End Use Industry Insights:

- Utilities

- Oil and Gas

- Events

- Construction

- Mining

- Data Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes utilities, oil and gas, events, construction, mining, data centers, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Power Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Natural Gas, Others |

| Equipment Types Covered | Generator, Transformer, Load Bank, Others |

| Power Ratings Covered | Up to 50 kW, 51 -500 kW, 501 -2,500 kW, Above 2,500 kW |

| Applications Covered | Peak Shaving, Standby Power, Base Load/Continuous Power |

| End Use Industries Covered | Utilities, Oil and Gas, Events, Construction, Mining, Data Centers, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India power rental market performed so far and how will it perform in the coming years?

- What is the breakup of the India power rental market on the basis of fuel type?

- What is the breakup of the India power rental market on the basis of equipment type?

- What is the breakup of the India power rental market on the basis of power rating?

- What is the breakup of the India power rental market on the basis of application?

- What is the breakup of the India power rental market on the basis of end use industry?

- What are the various stages in the value chain of the India power rental market?

- What are the key driving factors and challenges in the India power rental?

- What is the structure of the India power rental market and who are the key players?

- What is the degree of competition in the India power rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India power rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India power rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India power rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)