India Power Quality Equipment Market Size, Share, Trends and Forecast by Equipment, Phase, End Use, and Region, 2025-2033

India Power Quality Equipment Market Overview:

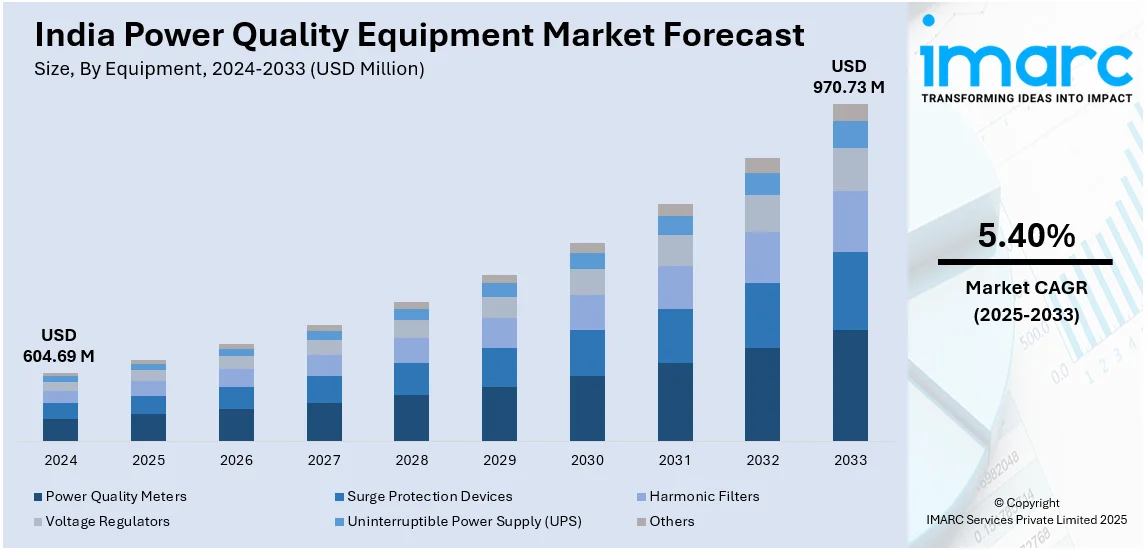

The India power quality equipment market size reached USD 604.69 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 970.73 Million by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The India power quality equipment market share is expanding, driven by the increasing reliance on renewable energy systems integrated with power grids that require advanced monitoring equipment, along with the growing investments in data center infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 604.69 Million |

| Market Forecast in 2033 | USD 970.73 Million |

| Market Growth Rate (2025-2033) | 5.40% |

India Power Quality Equipment Market Trends:

Increasing adoption of renewable energy

The rising adoption of renewable energy is offering a favorable India power quality equipment market outlook. Solar and wind energy sources, while eco-friendly, are often inconsistent due to weather variations, leading to voltage instability and power imbalances. This fluctuation requires power quality equipment like voltage regulators, harmonic filters, and power conditioners to ensure smooth and stable energy flow. As India invests heavily in renewable energy projects to attain sustainability goals and minimize carbon emissions, industries, commercial spaces, and residential sectors increasingly rely on power quality solutions to maintain a reliable electricity supply. Additionally, renewable energy systems integrated with power grids require advanced monitoring equipment to manage energy distribution and prevent disruptions. Government initiatives promoting solar rooftops, wind farms, and green energy expansion further drive the demand for these technologies. According to the information provided on the official website of the IBEF, in the Indian Interim Budget for 2024-2025, the financial allocation for the development of solar power grid infrastructure rose to INR 8,500 Crore (USD 1.02 Billion), a notable increase compared to the sum of INR 4,970 Crore (USD 0.60 Billion) in 2023-2024. As renewable energy usage is growing, power quality equipment is becoming essential to ensure system reliability, grid stability, and uninterrupted power flow across various sectors.

To get more information on this market, Request Sample

Expansion of data centers

The expansion of data centers is impelling the India power quality equipment market growth. Data centers house critical information technology (IT) infrastructure that requires uninterrupted power to maintain server performance, data storage, and network operations. Even minor power disruptions can lead to data loss, equipment damage, and costly downtime, making power quality equipment essential. Devices, such as uninterruptible power supplies (UPS), voltage stabilizers, surge protectors, and harmonic filters, help maintain consistent power flow, ensuring data centers operate without interruptions. As cloud computing, digital transformation, and online services broaden, India witnesses a rapid expansion in data center infrastructure, further increasing the demand for these solutions. Major tech companies and telecom providers are investing heavily in building data centers, especially in metro cities and IT hubs, to meet rising digital needs. In December 2024, ST Telemedia Global Data Centers (STT GDC) India, a worldwide participant in the data center sector, revealed that it entered a memorandum of understanding (MoU) with the Uttar Pradesh government to create India’s inaugural artificial intelligence (AI) city in Lucknow. The initiative sought to improve the artificial intelligence (AI) ecosystem through the creation of sophisticated data centers and computing infrastructure for different industries, startups, research organizations, and the government. Apart from this, with the surge of the Internet of Things (IoT) and big data analytics, data centers require advanced power monitoring systems to manage high power loads efficiently. Power quality equipment also aids data centers in meeting energy efficiency standards by minimizing power wastage and refining system performance.

India Power Quality Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on equipment, phase, and end use.

Equipment Insights:

- Power Quality Meters

- Surge Protection Devices

- Harmonic Filters

- Voltage Regulators

- Uninterruptible Power Supply (UPS)

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes power quality meters, surge protection devices, harmonic filters, voltage regulators, uninterruptible power supply (UPS), and others.

Phase Insights:

- Single Phase

- Three Phase

A detailed breakup and analysis of the market based on the phases have also been provided in the report. This includes single phase and three phase.

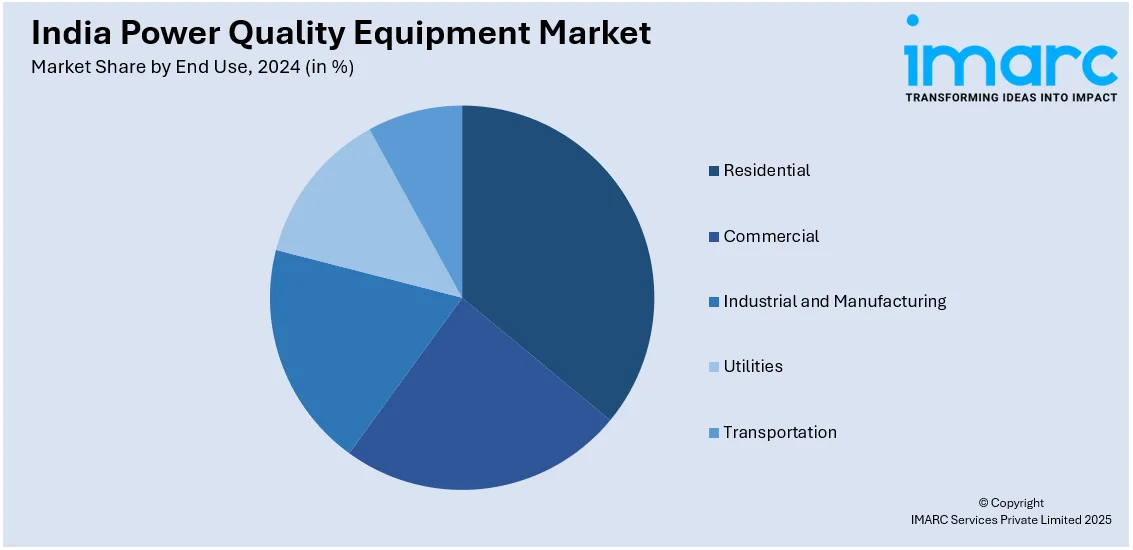

End Use Insights:

- Residential

- Commercial

- Industrial and Manufacturing

- Utilities

- Transportation

A detailed breakup and analysis of the market based on the end uses have also been provided in the report. This includes residential, commercial, industrial and manufacturing, utilities, and transportation.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Power Quality Equipment Market News:

- In October 2024, Hitachi Energy launched the ‘Relion REF650’, a flexible protection and control relay intended for various applications in India. Created for the medium voltage power distribution network, this product provided enhanced flexibility, modularity, and improved security relative to earlier versions. The item's built-in simplicity of the interface allowed it to effectively meet the evolving power quality needs of utility and industrial facilities nationwide.

- In September 2024, Tata Power Delhi Distribution Limited teamed up with Nissin Electric Co. Ltd. to unveil a demonstration project to deliver electricity from India's first Micro Substation featuring a Power Voltage Transformer (PVT) to guarantee reliable power for regions lacking a power grid. It aimed to assess environmental adherence, the dependability of power supply, and the efficiency of power quality. Following the installation and testing of the equipment at a substation located on the outskirts of Delhi, the company planned to commence operations in March 2025.

India Power Quality Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Covered | Power Quality Meters, Surge Protection Devices, Harmonic Filters, Voltage Regulators, Uninterruptible Power Supply (UPS), Others |

| Phases Covered | Single Phase, Three Phase |

| End Uses Covered | Residential, Commercial, Industrial and Manufacturing, Utilities, Transportation |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India power quality equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India power quality equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India power quality equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The power quality equipment market in India was valued at USD 604.69 Million in 2024.

The India power quality equipment market is projected to exhibit a (CAGR) of 5.40% during 2025-2033, reaching a value of USD 970.73 Million by 2033.

Regular voltage fluctuations, grid instability, and increasing application of sensitive electronics are key drivers in India's power quality equipment industry. Industrialization, renewable energy integration, and adherence to international standards propel demand for uninterruptible power supply (UPS) systems, voltage regulators, and harmonic filters. Urbanization and infrastructure developments also create a need for strong power conditioning and monitoring solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)