India Power Management IC Market Size, Share, Trends, and Forecast by Product, Application, and Region, 2025-2033

India Power Management IC Market Size and Share:

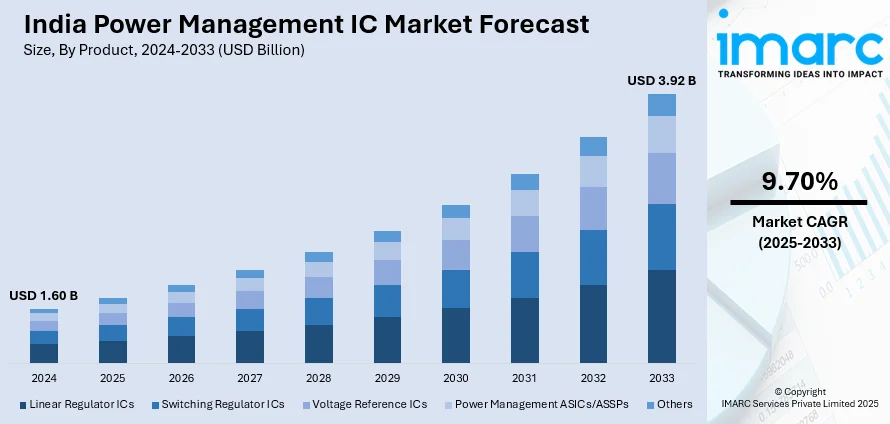

The India power management IC market size was valued at USD 1.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.92 Billion by 2033, exhibiting a CAGR of 9.70% from 2025-2033. The market is influenced by rapid urbanization, growing consumer electronics penetration, and supportive government policies, which promote local manufacturing. Moreover, the growth of 5G networks, the growing need for energy-efficient solutions in electric vehicles (EVs), and the increasing use of IoT devices drive market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.60 Billion |

| Market Forecast in 2033 | USD 3.92 Billion |

| Market Growth Rate (2025-2033) | 9.70% |

The rise in urbanization and a growing middle class has resulted in increased adoption of consumer electronics, making power management solutions effective. Government programs such as ‘Make in India’ and the effort toward digitization have encouraged local as well as international players to set up manufacturing facilities within the nation, further fueling market growth. Furthermore, the growth of the telecommunication industry, especially with the introduction of 5G networks, has generated greater demand for PMICs to provide dependable and efficient functionality of communication hardware.

To get more information on this market, Request Sample

Some of the emerging trends in the India PMIC market are a greater emphasis on energy efficiency and sustainability. There is a growing trend among manufacturers to design PMICs for renewable energy applications, which fits with India's ambitious target of adding 500 gigawatts of clean energy by 2030. The automotive sector's transition to EVs also offers a significant opportunity, as EVs need sophisticated power management solutions. In addition, the exponential growth in IoT devices requires smaller and more power-efficient PMICs, which is revolutionizing the market dynamics in the country.

India Power Management IC Market Trends:

Rising Demand for Energy-Efficient Solutions

India's power management IC market is experiencing strong pulled towards energy efficiency due to increasing power consumption in consumer electronics and industrial applications. As the government is placing increased focus on sustainability and power conservation, manufacturers are creating PMICs that minimize power wastage and optimize battery performance. Increasing use of smart devices, including smartphones, wearables, and IoT-enabled devices, further boost demand for high-performance, compact, and power-efficient power management solutions. The latest addition to this sector is the introduction of the Energy Conservation Building Code (ECBC) by the Government of India. ECBC sets a minimum level of energy efficiency standards for new commercial buildings with an aim to reduce the energy consumption and facilitate the use of energy-saving technologies, such as advanced power management ICs. Adoption of ECBC induces the use of PMICs conforming to the standards outlined, which induce innovation and optimization in developing energy management systems.

Growth of Electric Vehicles and Renewable Energy

The transition towards electric mobility in India has been a major driver for the PMIC market since electric vehicles require sophisticated power management solutions to maximize batteries, improve charging efficiency, and enable energy conversion. Due to the government policy of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, the uptake of EVs is gaining momentum, generating demand for sophisticated PMICs. Also, the ambitious renewable energy plans of India, including setting up solar and wind energy, need efficient power management technologies to provide maximum storage and supply of energy. The most advanced step in this sector is the creation of green power management systems for Light Electric Vehicles (LEVs) on Hybrid Energy Storage Solutions (HESS). This advanced strategy combines several energy storage systems to enhance EV battery efficiency and lifespan, breaking energy density and charging time bottlenecks. HESS deployment in LEVs is a crucial step towards more efficient and reliable electric transport in India.

Integration of 5G and IoT Technologies

The rollout of 5G networks and increased adoption of IoT devices are impacting the growth of the market. Efficient power management solutions with high efficiency are required to support ultra-low-latency and high-speed applications for 5G infrastructure. Meanwhile, the increased adoption of IoT in applications such as healthcare, manufacturing, and smart homes is driving demand for ultra-low-power PMICs that provide higher device performance and extended battery life. This trend is motivating PMIC manufacturers to develop more sophisticated and application-oriented PMIC solutions to meet the evolving requirements of an interconnected ecosystem. Due to these technological advancements, companies are striving to develop PMICs that solve the specific power requirements of 5G and IoT devices. For instance, some of the new developments include PMICs that manage power efficiently in 5G network-run devices, maintaining minimum energy consumption while delivering high performance. These developments are crucial to facilitating the seamless convergence of 5G and IoT technologies into everyday applications to realize a connected, energy-friendly world.

India Power Management IC Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India power management IC market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Linear Regulator ICs

- Switching Regulator ICs

- Voltage Reference ICs

- Power Management ASICs/ASSPs

- Others

Voltage reference ICs held the largest market share of 30.6% in 2024, as they are used to ensure precision and stability in electronic circuits across industries. Voltage reference ICs provide a stable voltage output, which is essential for accurate measurement in automotive, industrial automation, telecommunication, and medical electronics. The growth of consumer electronics, electric vehicles, and high-end computing in India has also triggered the need for precise voltage regulation. Moreover, the increasing deployment of IoT devices and smart sensors has boosted the demand for reliable voltage reference ICs, making them a key segment in the power management space.

Analysis by Application:

- Communication

- Computing Devices

- Consumer Electronics

- Automotive

- Healthcare

- Others

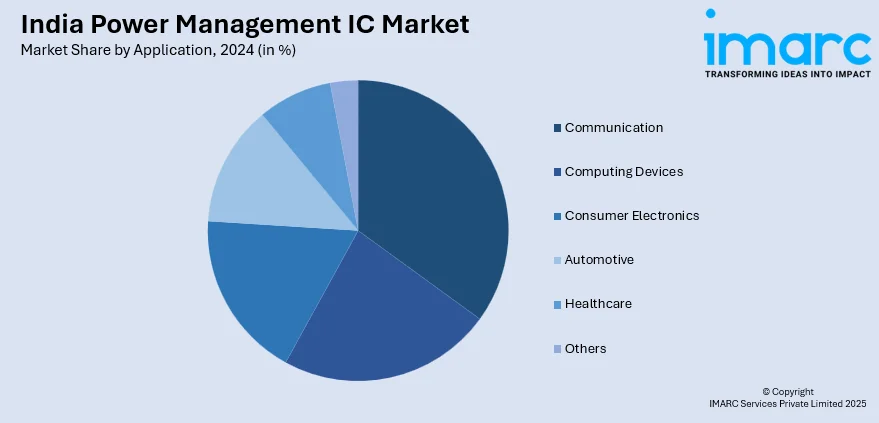

The consumer electronics segment is the largest application in India's PMIC market, which held a market share of 38.5% in 2024 because of the high growth of smartphones, laptops, wearables, and home automation products. With increasing discretionary incomes and the need to produce local electronics under the "Make in India" initiative, the market for efficient power management solutions has exploded. PMICs are critical chips for battery management, power management, and power efficiency in compact and portable solutions. Additionally, the growth in 5G technology, gaming devices, and AI-based intelligent devices has accelerated further demand for high-performance PMICs, making consumer electronics the top application segment in India's power management IC market.

Analysis by Region:

- North India

- West and Central India

- South India

- East India

North India dominated the market in 2024 with a revenue share of 41.5%. The region presents a top opportunity for PMICs with its thriving manufacturing environment, IT parks, and growing telecom networks. Delhi-NCR city cluster of Gurugram and Noida is specifically known to have one of the most concentrated clusters of technology companies, data centers, and electronics assembly units, all of which need efficient solutions for power management. Further, the availability of automobile and industrial automation industries in Punjab and Haryana is also driving higher PMIC adoption, particularly for EVs and renewable energy. Smart city and 5G infrastructure installations from the government are also driving demand for advanced power management solutions across the region.

West and Central India are two of the key regions in the PMIC market, led by Maharashtra, Gujarat, and Madhya Pradesh, which have some of India's largest industrial, automotive, and electronics manufacturing hubs. Mumbai and Pune are leading the PMIC demand as a result of high penetration in IT, financial, and high-performance computing markets, while Gujarat is also transforming into a semiconductor and EV battery manufacturing industry. The renewable energy projects of solar and wind power in the region are also driving the demand for power management ICs that ensure maximum energy efficiency. Smart infrastructure and metro rail projects in Ahmedabad and Nagpur cities are also driving the demand for power management solutions.

South India is a major hotspot for electronics manufacturing and semiconductor design, and therefore a leading geography for PMIC demand. Cities such as Bangalore, Hyderabad, and Chennai host large chip design companies, electronics R&D labs, and telecom infrastructure companies, which fuel power-efficient IC demand. Growing production of electric vehicles in Tamil Nadu and Karnataka, encouraged by government schemes, is also driving demand for high-end power management solutions. Moreover, South India is a primary driver of cloud computing and data center growth, which drives the demand for power-efficient solutions for high-performance computing. IoT and AI application growth in smart city initiatives further solidifies the market for PMICs in South India.

East India is an emerging market for PMICs because of government initiatives at infrastructure investments, industrial development, and clean energy initiatives. Other markets such as West Bengal, Odisha, and Jharkhand are also experiencing increasing applications of PMICs in the power grid, expansion of telecommunications, and automation of industry. Development of the IT sector as well as manufacture of electronic products in areas around Kolkata is also speeding up the demand for efficient power utilization. In addition, the growth of green energy plans, such as hydroelectric and solar power in the Northeast, is opening up new business prospects for power management technology. With ongoing efforts to increase manufacturing and digital integration, East India's PMIC demand will continue to grow.

Competitive Landscape:

According to studies, it has been found that major players in the market are engaged in research and development (R&D) to introduce innovative and more efficient solutions, particularly focusing on materials like silicon carbide (SiC) and gallium nitride (GaN) to enhance the boundaries of power density, efficiency, and thermal performance. They are expanding their product portfolios and entering into strategic partnerships and acquisitions to enhance their technological capabilities and market reach. Moreover, companies are investing to expand their manufacturing capabilities to meet the growing demand from the renewable energy sector and consumer electronics market. Besides this, they are adopting environmentally friendly practices in their operations and product designs.

The report provides a comprehensive analysis of the competitive landscape in the India power management IC market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Turntide Technologies, one of the leading companies in electrification solutions, announced the launch of power electronics product series featuring low and high-voltage power electronics in order to support India’s increasing need for sustainable transportation. This development is projected to fuel the demand for advanced PMIC.

- September 2024: Tata Electronics announced plans to develop the first semiconductor Fab of India in Dholera, Gujarat, in partnership with Powerchip Semiconductor Manufacturing Corporation (PSMC), Taiwan. The new Fab is planned to manufacture chips for applications including power management IC, microcontrollers (MCU), display drivers, and high-performance computing logic, catering to markets covering AI, computing, data storage, automotive, and wireless communication.

India Power Management IC Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Linear regulator ICs, switching regulator ICs, voltage reference ICs, power management ASICs/ASSPs, others |

| Applications Covered | Communication, computing devices, consumer electronics, automotive, healthcare, others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India power management IC market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India power management IC market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India power management IC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The power management IC market in India was valued at USD 1.60 Billion in 2024.

The market is driven by rapid urbanization, growing consumer electronics penetration, and supportive government policies, which promote local manufacturing. Moreover, the growth of 5G networks, the growing need for energy-efficient solutions in electric vehicles (EVs), and the increasing use of IoT devices drive market growth.

The India power management IC market is projected to exhibit a CAGR of 9.70% during 2025-2033, reaching a value of USD 3.92 Billion by 2033.

Consumer electronics application exhibits a clear dominance in the market. The segment’s growth is attributed to the increasing demand for smartphones, laptops, wearables, and IoT devices, driven by rising disposable incomes, technological advancements, and the growing adoption of 5G networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)