India Power Grids Market Size, Share, Trends and Forecast by Component, Energy Source, and Region, 2025-2033

India Power Grids Market Overview:

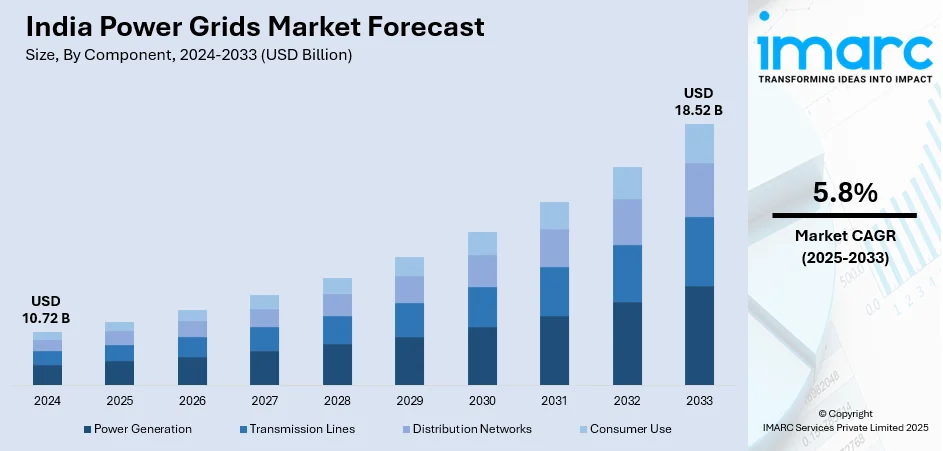

The India power grids market size reached USD 10.72 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.52 Billion by 2033, exhibiting a growth rate (CAGR) of 5.8% during 2025-2033. The rising electricity demand, government initiatives for grid modernization, renewable energy integration, and smart grid adoption are the factors propelling the growth of the market. Urbanization, industrial growth, and investments in transmission infrastructure further boost market expansion, ensuring reliable power distribution and minimizing transmission losses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.72 Billion |

| Market Forecast in 2033 | USD 18.52 Billion |

| Market Growth Rate (2025-2033) | 5.8% |

India Power Grids Market Trends:

Advancing Renewable Energy and Grid Modernization

India's power industry is experiencing a transformation, spurred by increased renewable energy use and system upgrading. An increasing emphasis on solar, wind, and biopower is changing the energy landscape, reducing reliance on traditional sources. Investments in transmission infrastructure and smart grid technology improve efficiency, reduce losses, and ensure reliable electricity distribution. Government policies continue to encourage renewable energy integration, resulting in a more sustainable and resilient power grid. As industrial and consumer demand increases, advances in grid dependability and energy storage gain traction. With a strong emphasis on sustainability and innovation, the industry is gradually transforming into a more efficient and ecologically friendly electricity ecology. As of January 2025, India's total installed power capacity is 466.26 GW, with renewable energy sources, i.e., solar, wind, and biopower) accounting for around 35% of the energy mix. To satisfy rising industrial and consumer demand, the government will continue to prioritize grid modernization, renewable integration, and transmission infrastructure expansion, assuring efficient electricity distribution and minimizing losses, according to industry reports.

To get more information on this market, Request Sample

Expanding HVDC Infrastructure for Renewable Energy Integration

The energy sector is shifting toward large-scale high-voltage direct current (HVDC) projects to improve grid efficiency and renewable energy integration. Long-distance transmission infrastructure investments are expanding to guarantee that power is transferred seamlessly between renewable energy centers and high-demand locations. This change helps to balance electrical supply volatility while lowering reliance on traditional energy sources. With a rising emphasis on sustainability, more activities are aimed at increasing capacity to handle renewable energy, notably from wind and solar sources. Advanced power transmission technologies are being used to improve grid stability and efficiency, tackling the problem of integrating massive volumes of clean energy. These achievements are consistent with national goals to increase renewable capacity and improve energy infrastructure to ensure long-term sustainability. For instance, in November 2024, Power Grid Corporation of India Ltd (POWERGRID) awarded a contract to a partnership of Hitachi Energy India Limited and Bharat Heavy Electricals Limited (BHEL) to develop and execute a ±800 kV, 6,000 MW HVDC connection. This 1,200-kilometer bidirectional system would transport renewable energy from Khavda, Gujarat, to Nagpur, Maharashtra, helping India achieve its objective of integrating 500 GW of renewable energy into the grid.

India Power Grids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component and energy source.

Component Insights:

- Power Generation

- Transmission Lines

- Distribution Networks

- Consumer Use

The report has provided a detailed breakup and analysis of the market based on the component. This includes power generation, transmission lines, distribution networks, and consumer use.

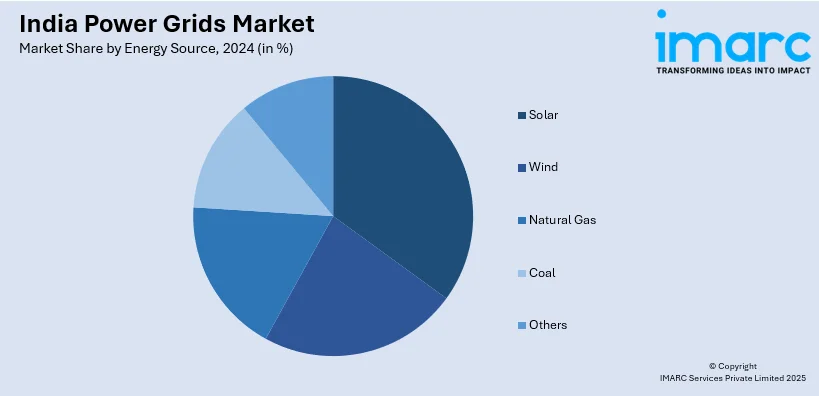

Energy Source Insights:

- Solar

- Wind

- Natural Gas

- Coal

- Others

A detailed breakup and analysis of the market based on the energy source have also been provided in the report. This includes solar, wind, natural gas, coal, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Power Grids Market News:

- In January 2025, Hartek Group’s Power Systems unit secured an INR 117 Crore contract from Power Grid Corporation of India Limited (PGCIL) in Gujarat. The project includes extending a 765kV AIS substation and upgrading a 400/220kV substation. This reinforces Hartek’s role in strengthening India’s power grid, improving transmission efficiency, and integrating renewable energy to meet rising energy needs.

- In February 2024, GE Vernova's Grid Solutions company received multi-million-dollar contracts from Power Grid Corporation of India Limited (PGCIL) to deliver 765 kV shunt reactors for a variety of transmission projects, including those in Rajasthan and Karnataka. These reactors, manufactured by GE T&D India's Vadodara factory, are intended to improve grid stability and efficiency, hence helping India's ambitions for renewable energy integration and energy transformation.

India Power Grids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Power Generation, Transmission Lines, Distribution Networks, Consumer Use |

| Energy Sources Covered | Solar, Wind, Natural Gas, Coal, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India power grids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India power grids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India power grids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The power grids market in India was valued at USD 10.72 Billion in 2024.

The India power grids market is projected to exhibit a CAGR of 5.8% during 2025-2033, reaching a value of USD 18.52 Billion by 2033.

The primary factors influencing the India power grids market are the swift growth of renewable energy production, rising electricity demand due to urbanization and industrial activities, and the upgrade of outdated transmission and distribution systems. Additionally, government initiatives aimed at improving grid reliability and smart metering play a crucial role in promoting infrastructure improvements and investment in cutting-edge grid technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)