India Powder Coatings Market Size, Share, Trends and Forecast by Resin Type, Coating Method, Application, and Region, 2026-2034

India Powder Coatings Market Size and Share:

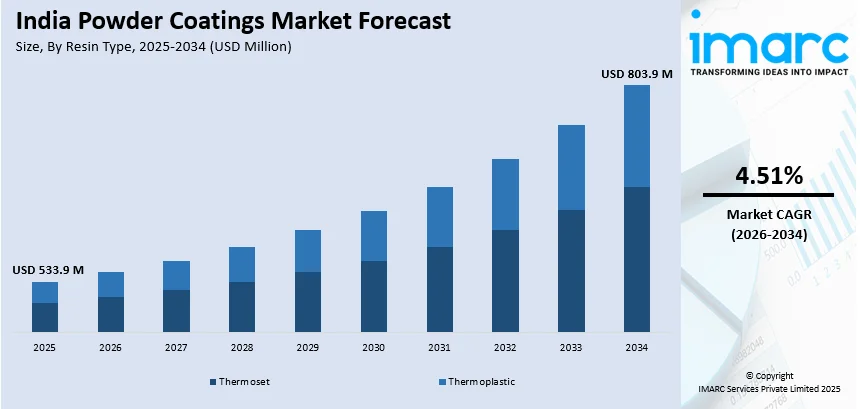

The India powder coatings market size reached USD 533.9 Million in 2025. The market is projected to reach USD 803.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.51% during 2026-2034. The market is growth is attributed to rising demand from automotive, consumer durables, and construction sectors. The shift toward low-VOC, sustainable coatings and technological advancements in durability and efficiency are driving growth. Additionally, increasing industrialization, infrastructure projects, and regulatory compliance further strengthen market expansion across key industries.

Market Insights:

- On the basis of region, the market is divided into North India, South India, East India, and West India

- Based on the resin type, the market is categorized as thermoset (epoxy, polyester, epoxy polyester hybrid, and acrylic) and thermoplastic (polyvinyl chloride (PVC), nylon, polyolefin, and polyvinylidene fluoride (PVDF)).

- On the basis of the coating method, the market is segmented into electrostatic spray and fluidized bed.

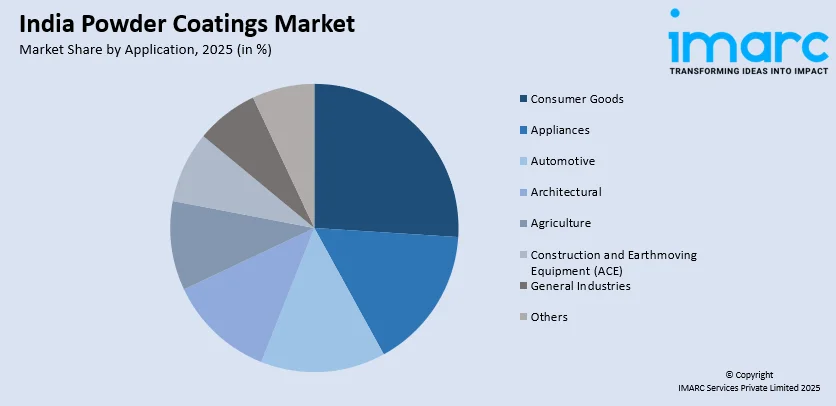

- Based on the application, the market is categorized as consumer goods, appliances, automotive, architectural, agriculture, construction and earthmoving equipment (ACE), general industries, and others.

Market Size and Forecast:

- 2025 Market Size: USD 533.9 Million

- 2034 Projected Market Size: USD 803.9 Million

- CAGR (2026-2034): 4.51%

India Powder Coatings Market Trends:

Rising Demand for Environmentally Friendly Coatings

India's powder coatings market is experiencing a robust shift to sustainable, low-emission coatings as industries turn away from solvent-based options. Powder coatings have no volatile organic compounds (VOCs), and thus they are the choice of companies that are sustainability and regulation focused. The increasing use of green building materials, energy-efficient appliances, and environmentally friendly automotive finishes is driving this trend. For instance, as per industry reports, India ranked third on the U.S. Green Building Council’s 2024 LEED list, certifying 370 projects spanning 8.5 Million gross square meters, highlighting its strong commitment to sustainable building practices. Additionally, advancements in powder coating formulations, such as low-temperature curing and high-durability coatings, are expanding their application in industries aiming to reduce energy consumption. With stricter environmental regulations and a rising focus on corporate sustainability, demand for powder coatings with improved recyclability and minimal waste generation is expected to increase significantly, thereby propelling India powder coatings market growth.

To get more information on this market Request Sample

Expanding Application Across Consumer Durables and Automotive Sectors

The consumer durables and automotive industries are driving demand for powder coatings due to their durability, corrosion resistance, and aesthetic appeal. In consumer appliances, powder coatings enhance surface protection while allowing for a variety of finishes, making them a preferred choice for refrigerators, washing machines, and air conditioners. The automotive sector is adopting powder coatings for components such as wheels, chassis, and engine parts, as they offer superior heat and impact resistance. The rising middle-class population and increasing disposable income are fueling growth in both sectors, leading to higher consumption of premium-quality coatings. For instance, as per industry reports, in 2024, India's middle class makes up 31% of the population, reflecting its growing economic influence and expanding consumer base. Furthermore, as manufacturers look for cost-effective, long-lasting solutions, powder coatings are replacing traditional liquid-based paints in many applications.

Technological Advancements in Coating Materials

The market is experiencing consistent innovation in the formulations of resin and application technology, which is augmenting the India powder coatings market share. New resin systems like polyurethane, polyester-epoxy hybrids, and thermoplastic powders are evolving to support industry-specific performance requirements. These new-generation coatings offer superior resistance against UV radiation, corrosion, moisture, and high heat, widening their scope of use. For example, polyester-based powders are gaining popularity for outside structures on account of weather resistance, whereas polyurethane powders are employed for applications requiring higher mechanical properties. On the equipment side, improvements in electrostatic spray hardware and fluidized bed processes are making the process more efficient, curbing overspray, and allowing superior finish quality. Producers are also investing in low-bake and ultra-thin film coatings, which conserve energy and increase applicability to heat-sensitive substrates. The entry of antimicrobial powder coatings, especially post-pandemic, has further opened avenues in healthcare equipment, electronics, and public infrastructure. These developments are helping manufacturers differentiate themselves in a competitive marketplace.

Expansion of Architectural Applications

Powder coatings are seeing rapid growth in architectural applications across India, particularly in urban and semi-urban regions where infrastructure projects are expanding. This, in turn, is enhancing the India powder coatings market outlook. These coatings are widely used for aluminum profiles, window frames, doors, curtain walls, and façade systems because of their ability to provide superior weather resistance, UV stability, and color retention. With real estate developers and government-backed projects focusing on modern designs and long-lasting construction materials, powder coatings are being adopted as a standard in the building sector. The increased demand for decorative finishes in both residential and commercial projects has further expanded their use. Unlike conventional coatings, powder-based alternatives can achieve varied textures and gloss levels without compromising durability, which makes them appealing for architects and designers. Additionally, the rapid rise of smart cities and urban redevelopment projects has accelerated demand, as these initiatives emphasize materials that combine durability, aesthetics, and sustainability. This trend is expected to continue as India invests heavily in large-scale infrastructure upgrades.

Growth, Opportunities, and Barriers in the India Powder Coatings Market:

- Growth Drivers: The market is being driven by rising demand from automotive, appliances, and infrastructure sectors, where powder coatings are preferred for durability and cost efficiency. Increasing consumer awareness of eco-friendly products has boosted the adoption of low-VOC and sustainable coating solutions. Government initiatives like “Make in India” are expanding domestic manufacturing, creating higher consumption of industrial coatings. Technological advancements in resin formulations and application processes are further enhancing performance and expanding end-use applications.

- Market Opportunities: Urbanization and smart city projects are creating strong demand for powder coatings in architectural and construction applications. Growing penetration of consumer appliances in rural and semi-urban areas offers new avenues for market expansion. The trend toward customization and decorative finishes presents opportunities for manufacturers to offer diverse textures, colors, and specialty coatings. Rising foreign investment and collaborations are enabling the introduction of advanced and niche powder coating products in the Indian market.

- Market Challenges: Volatility in raw material prices poses significant cost pressures for manufacturers and affects profit margins. As per the India powder coatings market analysis, limited awareness among smaller industries about the long-term benefits of powder coatings continues to restrict adoption. The requirement for specialized equipment and curing ovens increases capital costs, making entry difficult for small-scale users. Strong competition from established players and the presence of low-cost alternatives in certain applications also create barriers to growth.

India Powder Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on resin type, coating method, and application.

Resin Type Insights:

- Thermoset

- Epoxy

- Polyester

- Epoxy Polyester Hybrid

- Acrylic

- Thermoplastic

- Polyvinyl Chloride (PVC)

- Nylon

- Polyolefin

- Polyvinylidene Fluoride (PVDF)

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes thermoset (epoxy, polyester, epoxy polyester hybrid, and acrylic) and thermoplastic (polyvinyl chloride (PVC), nylon, polyolefin, and polyvinylidene fluoride (PVDF)).

Coating Method Insights:

- Electrostatic Spray

- Fluidized Bed

A detailed breakup and analysis of the market based on the coating method have also been provided in the report. This includes electrostatic spray and fluidized bed.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Goods

- Appliances

- Automotive

- Architectural

- Agriculture, Construction and Earthmoving Equipment (ACE)

- General Industries

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes consumer goods, appliances, automotive, architectural, agriculture, construction and earthmoving equipment (ACE), general industries, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Powder Coatings Market News:

- August 2025: PPG and Asian Paints announced the 15-year renewal of their joint venture agreements in India, extending both partnerships from 2026 through 2041 to continue serving industrial, protective, marine, packaging, automotive, and powder coatings markets. The joint ventures have leveraged PPG’s global technical expertise alongside Asian Paints’ local operational control. The extension reflects the ventures’ past successes and the strong growth potential in the powder coatings market in India.

- July 2025: JSW Paints agreed to acquire a 74.76% majority stake in Akzo Nobel India for approximately USD 1.64 Billion (INR 140.36 Billion), including debt, via definitive agreements with its Dutch parent company. The deal, which positions JSW Paints among the top four coatings producers in India, does not include AkzoNobel’s powder coatings business or its International Research Centre, both of which it will retain. JSW Paints aims to integrate these renowned decorative and industrial brands and significantly bolster its market presence.

- July 2025: AkzoNobel introduced its Interpon 600 and 610 Low-E powder coatings in China and India, energy-efficient, pure polyester-based formulations that cure at 150 °C, significantly lower than the typical 200°C requirement. These coatings reduce energy consumption by up to 20% and accelerate curing by as much as 25%, all while maintaining high-performance finishes and offering anti-gassing properties to prevent surface defects. Designed for broad industrial applications, this innovation supports manufacturers’ operational efficiency and sustainability goals. AkzoNobel also announced the launch of Interpon D2525 stone-effect powder coating in India in April 2023, offering aluminum surfaces a natural stone look without the cost or complexity of real stone. The company aims to ensure super durability, a 25-year warranty, and sustainability benefits, including zero VOCs and waste reduction.

- February 2025: The Board of Directors of Akzo Nobel India approved a binding proposal from its parent company, AkzoNobel N.V., for the acquisition of Akzo Nobel India's powder coatings business at a value of INR 2,073 Crore, along with the purchase of its International Research Centre (R&D) for INR 70 Crore. Additionally, the agreement includes the transfer of intellectual property rights pertaining to the decorative paints business in India, Bangladesh, Bhutan, and Nepal for INR 1,152 Crore. This strategic move aims to enable Akzo Nobel India to concentrate exclusively on its liquid paints and coatings segment, operating as an independent entity with its own brands and technologies. The transaction is contingent upon approval by Akzo Nobel India’s shareholders and the supervisory board of AkzoNobel N.V.

- February 2024: Arkema announced an investment in India’s powder coatings sector to expand low-VOC and lower-carbon coating solutions. Its Navi Mumbai facility supports innovation in high-solid, waterborne, and UV/LED/EB coatings, providing enhanced technical support and development capabilities.

India Powder Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered |

|

| Coating Methods Covered | Electrostatic Spray, Fluidized Bed |

| Applications Covered | Consumer Goods, Appliances, Automotive, Architectural, Agriculture, Construction and Earthmoving Equipment (ACE), General Industries, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India powder coatings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India powder coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India powder coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The powder coatings market in India was valued at USD 533.9 Million in 2025.

The India powder coatings market is projected to exhibit a CAGR of 4.51% during 2026-2034, reaching a value of USD 803.9 Million by 2034.

The India powder coatings market is driven by expanding manufacturing sectors, rising urban infrastructure, and increasing demand in automotive, appliance, and furniture industries. Growing preference for eco-friendly, durable coatings and government initiatives like “Make in India” also support market growth across both industrial and consumer applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)