India Poultry Feed Market Size, Share, Trends and Forecast by Nature, Form, Additives, Animal Type, Distribution Channel, and Region, 2025-2033

Market Overview:

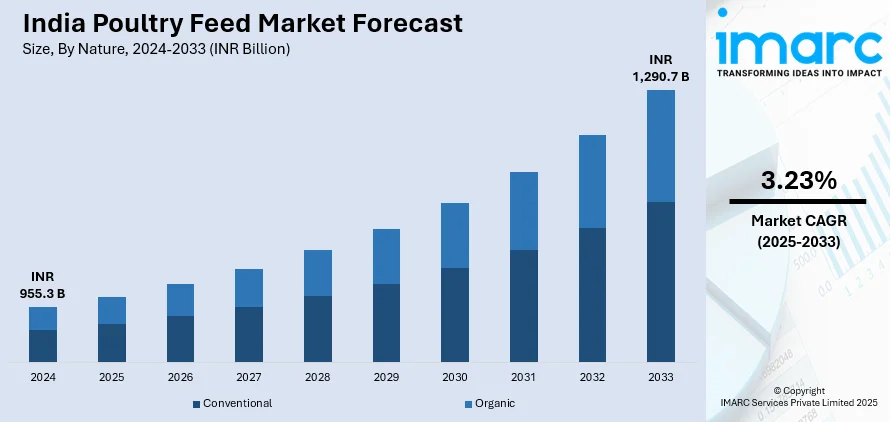

The India poultry feed market size reached a value of INR 955.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach a value of INR 1,290.7 Billion by 2033, exhibiting a CAGR of 3.23% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 955.3 Billion |

|

Market Forecast in 2033

|

INR 1,290.7 Billion |

| Market Growth Rate 2025-2033 | 3.23% |

Poultry feed refers to the formulated food products produced for the consumption of chickens, ducks, geese, quails, and turkeys. It is manufactured using various ingredients, such as wheat, rice, barley, oats, corn, millet, flax, milk, supplements, and fish oil. It is a rich source of water, proteins, carbohydrates, fats, vitamins A and D, calcium, phosphorous, and riboflavin. Poultry feed promotes weight gain, boosts immunity, minimizes stress, alleviates digestive issues, strengthens bones, and prevents diseases. It is produced by carefully selecting and mixing ingredients to offer a highly nutritional diet that protects the health of poultry animals while also improving the quality of end products such as meat and eggs. It also helps to increase productivity, improve profitability, minimize costs, and enhance food safety.

To get more information of this market, Request Sample

The rising consumption of poultry-based products, such as eggs and meat, as it provides several health benefits, such as building muscles, strengthening bones, increasing blood production, boosting the immune system, and improving hair and skin health, are among the key factors driving the market growth. In line with this, the increasing demand for enhanced and enriched poultry feed that is produced by selecting and blending ingredients to provide a highly balanced and nutritionally diet that assists in maintaining the health of the animals and improving the quality of poultry products, such as meat, milk, or eggs, is propelling the market growth. Furthermore, the changing dietary habit and rising demand for poultry-based dishes, such as chicken biryani, roast duck, turkey burger, egg salad, stews, noodles, prosciutto, risotto, and grilled quail, is providing an impetus to the market growth. Apart from this, increasing initiatives by the Government of India (GoI), such as the animal husbandry infrastructure development fund (AHIDF) and national livestock mission to boost poultry production, establish poultry feed plants, and promote rural poultry entrepreneurship through financial incentives, are favoring the market growth. Additionally, the recent development of non-genetically modified organism (GMO) poultry feeds that are cost-effective, nutrient-rich, offer longer shelf-life, and increase resistance to insects, viruses, and disease is positively influencing the market growth. Moreover, the introduction of new products with various flavors, such as ginger, clove, and sweet pepper, that stimulates hunger is creating a positive outlook for the market. Other factors, including easy product availability across e-commerce platforms, extensive research and development (R&D) activities for the development of innovative feed formulations, and increasing awareness among poultry farmers regarding the importance of high-quality feed, are anticipated to drive the market growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India poultry feed market, along with forecasts at the regional level from 2025-2033. Our report has categorized the market based on nature, form, additives, animal type and distribution channel.

Nature Insights:

- Conventional

- Organic

The report has also provided a detailed breakup and analysis of the India poultry feed market based on the nature. This includes conventional and organic. According to the report, conventional represented the largest segment.

Form Insights:

- Mashed

- Pellets

- Crumbles

- Others

A detailed breakup and analysis of the India poultry feed market based on the form has also been provided in the report. This includes mashed, pellets, crumbles, and others. According to the report, pellets for the highest market share.

Additives Insights:

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acid

- Feed Enzymes

- Feed Acidifiers

- Others

The report has also provided an exhaustive breakup and analysis of the market based on the additives. This includes antibiotics, vitamins, antioxidants, amino acid, feed enzymes, feed acidifiers, and others.

Animal Type Insights:

- Layers

- Broilers

- Turkey

- Others

The report has also provided an exhaustive breakup and analysis of the market based on the animal type. This includes layers, broilers, turkey, and others. According to the report, broilers accounted for the highest market share.

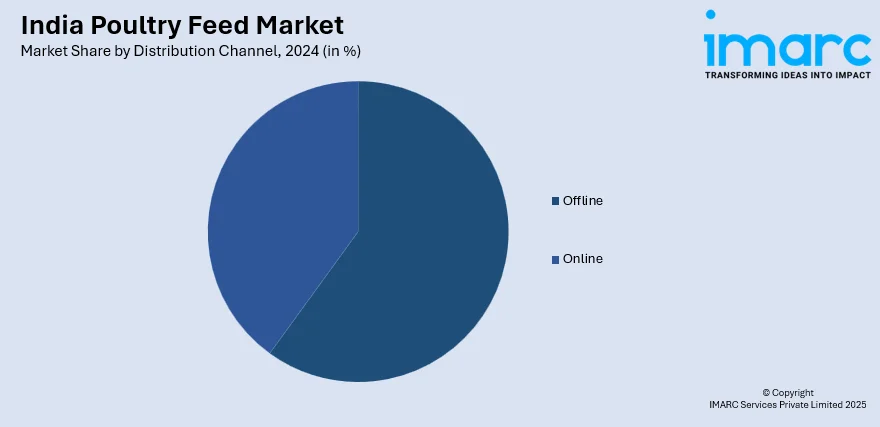

Distribution Channel Insights:

- Offline

- Online

The report has also provided an exhaustive breakup and analysis of the market based on the distribution channel. This includes offline and online. According to the report, offline accounted for the highest market share.

Regional Insights:

- Maharashtra

- Tamil Nadu

- Uttar Pradesh

- Gujarat

- Karnataka

- West Bengal

- Rajasthan

- Andhra Pradesh

- Telangana

- Madhya Pradesh

- Delhi NCR

- Punjab

- Haryana

- Others

The report has also provided a comprehensive analysis of all the major regional markets that include the Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, Karnataka, West Bengal, Rajasthan, Andhra Pradesh, Telangana, Madhya Pradesh, Delhi NCR, Punjab, Haryana, and Others. According to the report, the Maharashtra was the largest market for Indian poultry feed. Some of the factors driving the Maharashtra poultry feed market included rising consumption of poultry-based products, growing demand for poultry dishes, increasing government initiatives, etc. For each of the regions covered, the report provides historical and current market trends, market drivers, market segmentation, key players, and market forecast.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India poultry feed market. This includes market structure, market player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant. Detailed profiles of all major companies have also been provided. Some of the companies covered include Alltech, Ayurvet Limited, Godrej Agrovet Limited, Henraajh Feeds India Private Limited, Hindustan Animal Feeds, JAPFA Comfeed India Private Limited, Maharashtra Feeds Pvt.Ltd., Protinex Advance Feed Industries, SKM Animal Feeds and Foods (India) Ltd., etc. Kindly, note that this only represents a partial list of companies, and the complete list has been provided in the report. For the companies covered, the report provides business overview, services offered, business strategies, SWOT analysis, and major news and events.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion |

| Natures Covered | Conventional, Organic |

| Forms Covered | Mashed, Pellets, Crumbles, Others |

| Additives Covered | Antibiotics, Vitamins, Antioxidants, Amino Acid, Feed Enzymes, Feed Acidifiers, Others |

| Animal Types Covered | Layers, Broilers, Turkey, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, Karnataka, West Bengal, Rajasthan, Andhra Pradesh, Telangana, Madhya Pradesh, Delhi NCR, Punjab, Haryana, Others |

| Companies Covered | Alltech, Ayurvet Limited, Godrej Agrovet Limited, Henraajh Feeds India Private Limited, Hindustan Animal Feeds, JAPFA Comfeed India Private Limited, Maharashtra Feeds Pvt.Ltd., Protinex Advance Feed Industries, SKM Animal Feeds and Foods (India) Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India poultry feed market performed so far and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India poultry feed market?

- What are the key regional markets?

- Which region represent the most attractive India poultry feed markets?

- What is the breakup of the market based on the nature?

- What is the breakup of the market based on the form?

- What is the breakup of the market based on the additives?

- What is the breakup of the market based on the animal type?

- What is the breakup of the market based on the distribution channel?

- What is the competitive structure of the India poultry feed market?

- What is the market positioning of various players in the India poultry feed market?

- What are the top winning strategies?

- What are the strengths and weaknesses of key players?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)