India Potassium Iodate Market Size, Share, Trends and Forecast by Grade, Application, and Region, 2026-2034

India Potassium Iodate Market Size and Share:

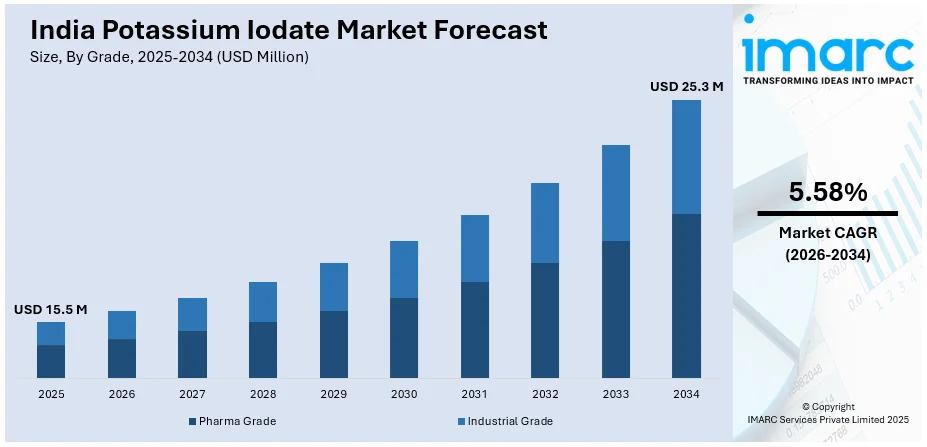

The India potassium iodate market size reached USD 15.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 25.3 Million by 2034, exhibiting a growth rate (CAGR) of 5.58% during 2026-2034. The India potassium iodate market is growing due to its expanding use in pharmaceutical formulations and emergency kits, along with increasing demand from the chemical sector for its reliable oxidizing properties in specialty, laboratory, and industrial processing applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.5 Million |

| Market Forecast in 2034 | USD 25.3 Million |

| Market Growth Rate 2026-2034 | 5.58% |

India Potassium Iodate Market Trends:

Growing Use in Pharmaceutical Applications

Potassium iodate serves a particular yet significant function in the pharmaceutical industry, being utilized as both a reagent and an active component in iodine-containing formulations. It aids in the creation of antiseptics, disinfectants, and pharmaceuticals designed to address iodine deficiency and manage conditions related to the thyroid. A vital usage is in the creation of radiological emergency kits, where it assists in preventing the thyroid gland from taking in radioactive iodine, especially during exposure to nuclear events. These applications necessitate pharmaceutical-grade quality, which requires high purity, consistent batches, and complete traceability throughout the supply chain. Moreover, manufacturers need to follow strict production and examination protocols, which increases expenses but also permits improved pricing and greater profit margins. Although the volumes utilized in pharmaceuticals are smaller than those in food fortification, this sector remains appealing because of its high value density and demand driven by regulations. According to the India Brand Equity Foundation (IBEF), the Indian pharmaceutical sector is anticipated to attain a market value of US$ 130 billion by 2030 and US$ 450 billion by 2047, leading to an expected increase in the need for specialized inputs such as potassium iodate. Suppliers catering to this segment position themselves as premium manufacturers, often bundling iodate with other pharma-grade compounds to serve broader formulation needs.

To get more information on this market Request Sample

Rise in Chemical Processing and Specialty Applications

The growing application of potassium iodate in the chemical sector is offering a favorable market outlook, particularly in areas that need dependable oxidizing agents. Potassium iodate is appreciated for its reliable reactivity, stability during storage, and compatibility with various chemical reactions. It is used in processes that include synthesis, oxidation, and testing, especially in laboratories and chemical production environments centered on high-purity results. Furthermore, according to IBEF, an investment of Rs. By 2025, the Indian chemicals and petrochemicals sector is projected to reach 8 lakh crore (US$ 107.38 billion). With India's ongoing investment in specialty and fine chemicals, the demand for niche compounds such as potassium iodate is increasing. These procedures frequently necessitate minor yet exact amounts of oxidizing agents, and the consistent effectiveness of iodate makes it a favored option. It is also employed in developing reagents for research and quality assurance, especially in industries like agrochemicals, coatings, and polymers, where chemical integrity is essential. The growing focus on backward integration and in-house formulation development among chemical manufacturers is further encouraging the uptake of such specialty inputs. With India's chemical sector growing both in domestic and export-oriented production, the consistent demand for potassium iodate in lab, pilot, and full-scale processes helps sustain its position as a dependable intermediate.

India Potassium Iodate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on grade and application.

Grade Insights:

- Pharma Grade

- Industrial Grade

The report has provided a detailed breakup and analysis of the market based on the grade. This includes pharma grade and industrial grade.

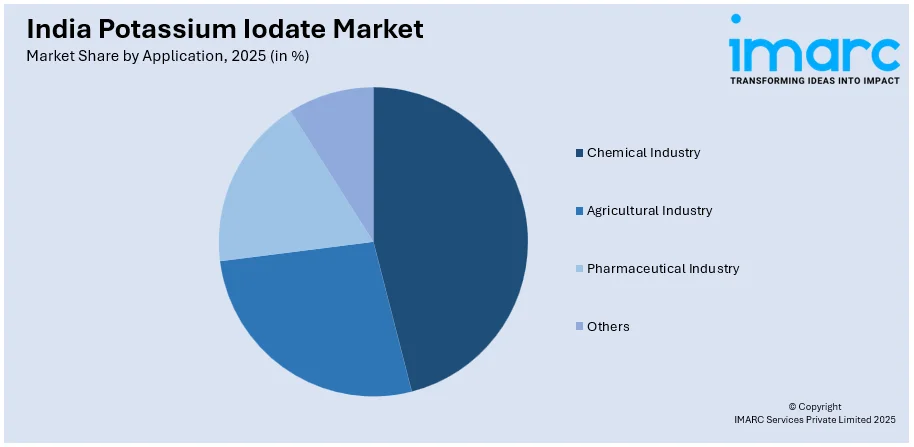

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Chemical Industry

- Agricultural Industry

- Pharmaceutical Industry

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chemical industry, agricultural industry, pharmaceutical industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Potassium Iodate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Pharma Grade, Industrial Grade |

| Applications Covered | Chemical Industry, Agricultural Industry, Pharmaceutical Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India potassium iodate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India potassium iodate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India potassium iodate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The potassium iodate market in India was valued at USD 15.5 Million in 2025.

The India potassium iodate market is projected to exhibit a CAGR of 5.58% during 2026-2034, reaching a value of USD 25.3 Million by 2034.

The India potassium iodate market is driven by rising demand in the pharmaceutical and food industries, increasing focus on iodine deficiency prevention, government initiatives for fortified salt production, and expanding applications in chemical formulations, contributing to steady growth and enhanced public health awareness across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)