India POS Terminals Market Size, Share, Trends and Forecast by Mode of Payment Acceptance, Type, End-User Industry, and Region, 2025-2033

India POS Terminals Market Overview:

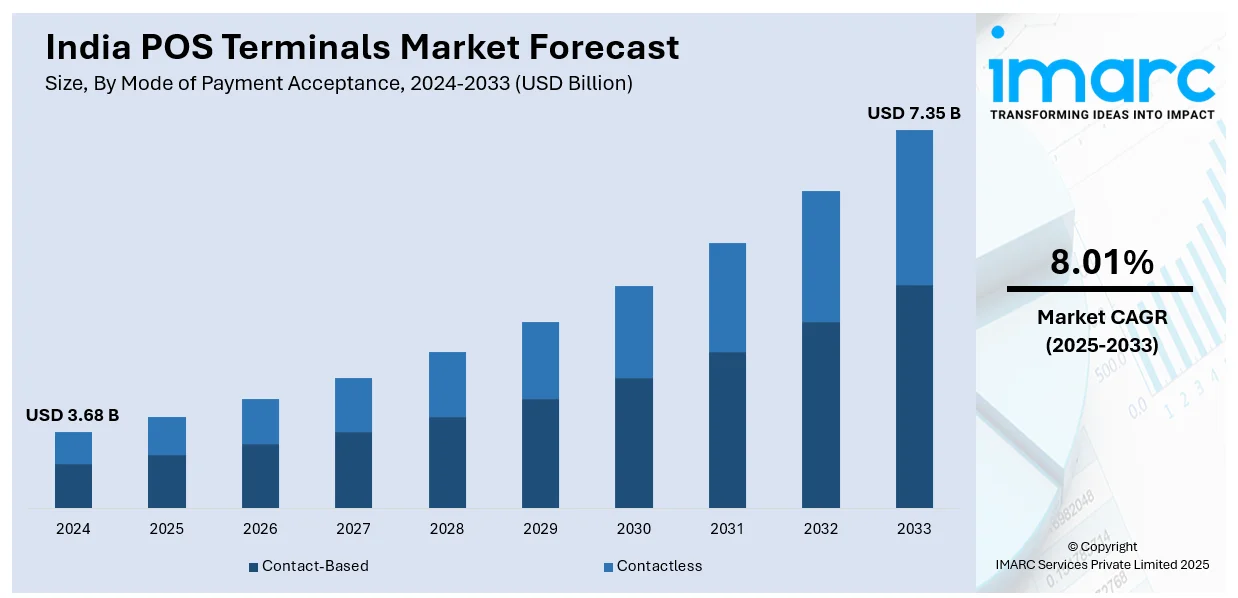

The India POS terminals market size reached USD 3.68 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.35 Billion by 2033, exhibiting a growth rate (CAGR) of 8.01% during 2025-2033. The market is driven by the surge in digital payments, government initiatives including Digital India, and the growing preference for contactless transactions. Increased smartphone penetration, affordable cloud-based POS solutions, and demand from SMEs are further augmenting the India POS terminals market share. Additionally, RBI’s push for secure digital payments accelerates adoption across retail and hospitality sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.68 Billion |

| Market Forecast in 2033 | USD 7.35 Billion |

| Market Growth Rate 2025-2033 | 8.01% |

India POS Terminals Market Trends:

Rapid Adoption of Contactless Payment Solutions

The increasing adoption of contactless payment solutions is majorly driving the India POS terminals market growth. With the rise of digital payments and government initiatives such as Digital India, businesses are shifting towards NFC-enabled POS terminals that support tap-and-go transactions. India's digital payments ecosystem witnessed significant growth, with transaction volumes growing from 2,071 Crore during 2017-18 to 18,737 Crore in 2023-24, mostly driven by UPI. As a result, UPI transactions are now allowed in seven countries, which is fueling the demand for point-of-sale (POS) terminals, at least in India and potentially internationally as well. The increase in digital payments is another growth driver for India's POS terminal market as the value of UPI transactions skyrocketed from INR1 Lakh Crore (approximately USD 1,219.51 Million) to 200 Lakh Crore (USD approximately 2,439.02 Million). In addition, the COVID-19 pandemic further accelerated this trend as consumers and merchants prioritized hygiene and convenience. Major players in the market, such as Pine Labs and Razorpay, are introducing advanced POS devices with QR code scanning and UPI integration to cater to the growing demand. Additionally, the Reserve Bank of India (RBI) has been promoting secure and seamless digital transactions, encouraging small and medium-sized enterprises (SMEs) to adopt POS systems. As a result, the market is witnessing a rise in demand for mobile POS (mPOS) terminals, especially in the retail, hospitality, and healthcare sectors, driving overall market expansion.

To get more information on this market, Request Sample

Growth of Cloud-Based POS Systems for SMEs

The increasing preference for cloud-based POS systems among small and medium enterprises (SMEs) is creating a positive India POS terminals market outlook. Traditional POS systems require high upfront costs and maintenance, making them less accessible for smaller businesses. However, cloud-based POS solutions offer affordable, scalable, and real-time transaction management, enabling SMEs to streamline operations efficiently. These systems provide features such as inventory tracking, sales analytics, and remote access, which help businesses enhance productivity. Providers such as Instamojo and Mswipe are offering subscription-based models, making advanced POS technology more affordable. Additionally, the integration of artificial intelligence (AI) and data analytics in cloud POS systems allows merchants to gain customer insights and improve decision-making. On 28th January 2025, Godrej Enterprises Group announced plans to invest INR 1,200 Crore (approximately USD 146.34 Million) over the next three years in digital transformation and artificial intelligence (AI) initiatives for enhancing customer experience across its log of business sectors. This includes investments in AI-powered personalization, advanced data analytics, and an organization-wide reskilling initiative that will deliver 600,000 hours of training to employees. This strategy formation comes as a reaction to the growing demand for digital solutions in India, most notably impacting markets such as those for cloud POS sectors driven by AI-embedded customer interaction and automation. With the growing emphasis on digital transformation, cloud-based POS terminals are expected to dominate the market, particularly in tier-2 and tier-3 cities where SMEs are rapidly expanding.

India POS Terminals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on mode of payment acceptance, type, and end-user industry.

Mode of Payment Acceptance Insights:

- Contact-Based

- Contactless

The report has provided a detailed breakup and analysis of the market based on the mode of payment acceptance. This includes contact-based and contactless.

Type Insights:

- Fixed Point-of-sale-Systems

- Mobile/Portable Point-of-sale Systems

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes fixed point-of-sale-systems and mobile/portable point-of-sale systems.

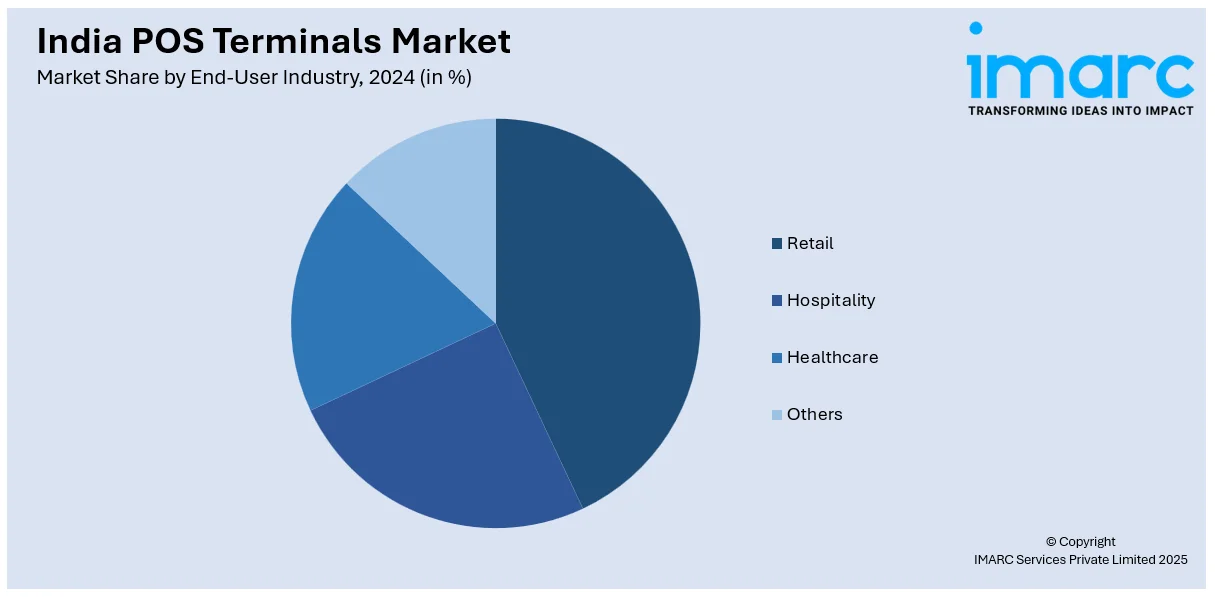

End-User Industry Insights:

- Retail

- Hospitality

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes retail, hospitality, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India POS Terminals Market News:

- February 2025: The Madurai Corporation has launched a doorstep tax payment system utilizing point of sale (POS) technology, allowing residents to settle their taxes without the need to visit the corporation office. Revenue assistants, armed with POS devices, facilitate the collection of payments for property tax, water tax, underground drainage maintenance fees, professional tax, and service charges directly from residents. Payments can be processed through credit or debit cards, UPI ID, or by scanning a QR code, providing a seamless and cashless experience.

India POS Terminals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modes of Payment Acceptance Covered | Contact-Based, Contactless |

| Types Covered | Fixed Point-of-sale-Systems, Mobile/Portable Point-Of-Sale Systems |

| End-User Industries Covered | Retail, Hospitality, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India POS terminals market performed so far and how will it perform in the coming years?

- What is the breakup of the India POS terminals market on the basis of mode of payment acceptance?

- What is the breakup of the India POS terminals market on the basis of type?

- What is the breakup of the India POS terminals market on the basis of end-user industry?

- What is the breakup of the India POS terminals market on the basis of region?

- What are the various stages in the value chain of the India POS terminals market?

- What are the key driving factors and challenges in the India POS terminals?

- What is the structure of the India POS terminals market and who are the key players?

- What is the degree of competition in the India POS terminals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India POS terminals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India POS terminals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India POS terminals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)