India POS Device Market Size, Share, Trends and Forecast by Component, Terminal Type, Business Size, Industry Vertical, and Region, 2025-2033

India POS Device Market Size and Share:

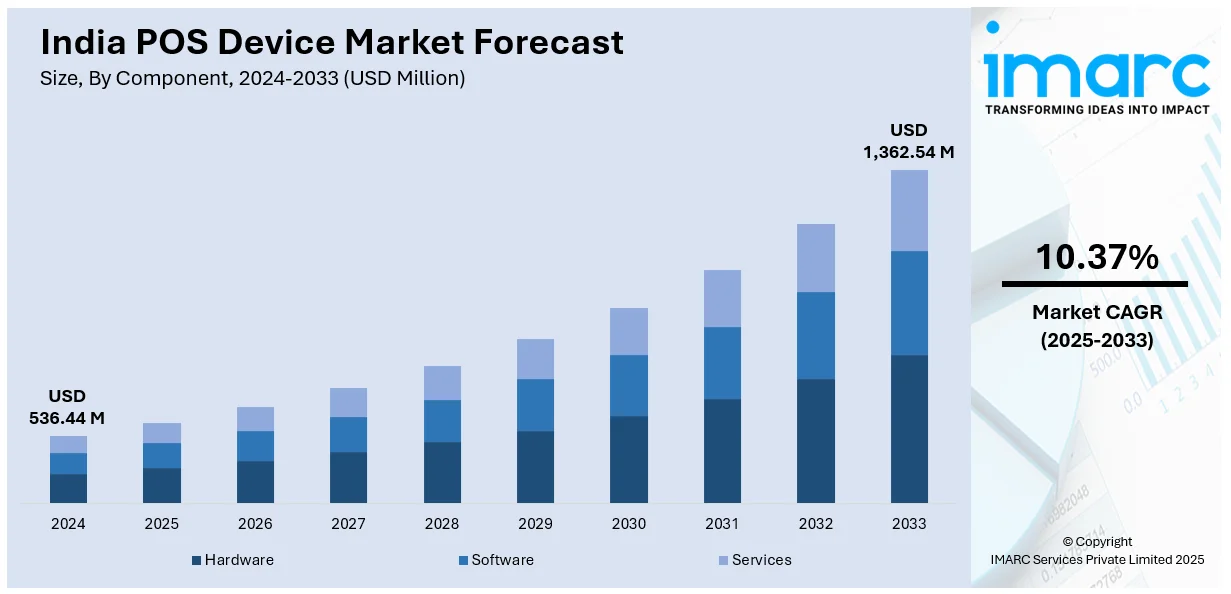

The India POS device market size was valued at USD 536.44 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,362.54 Million by 2033, exhibiting a CAGR of 10.37% during 2025-2033. West and Central India dominated the market, holding a significant market share of over 35% in 2024. This is due to widespread retail expansion, strong SME adoption, and supportive digital payment infrastructure. State-led initiatives and higher consumer footfall in urban centers further boosted POS device penetration across these regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 536.44 Million |

|

Market Forecast in 2033

|

USD 1,362.54 Million |

| Market Growth Rate (2025-2033) | 10.37% |

The India POS device market is driven by several key factors. Rapid digitalization and government initiatives like Digital India and demonetization have accelerated the adoption of cashless transactions, boosting POS deployment across sectors. The rise of e-commerce and organized retail has increased the need for efficient, real-time payment solutions. Growth in small and medium enterprises (SMEs) and increasing demand for contactless and mobile payments have also played a significant role. Moreover, rising consumer preference for quick and secure transactions is pushing businesses to adopt POS technology. Improved internet connectivity and smartphone penetration, especially in Tier 2 and Tier 3 cities, are expanding the market further. Additionally, POS devices are increasingly integrated with inventory and billing systems, offering end-to-end solutions that enhance operational efficiency for merchants.

To get more information on this market, Request Sample

The market is witnessing rapid innovation focused on multifunctional payment solutions. Devices now integrate QR, NFC, and soundbox features, catering to evolving merchant needs. Emphasis is on expanding access in smaller towns, enhancing convenience for both retailers and customers, and driving broader digital payment acceptance across underserved regions. For instance, at the Global FinTech Fest 2024, Visa introduced several innovations to enhance India's POS device market. Collaborations include HDFC Bank's all-in-one POS integrating QR and soundbox, Paytm's NFC Card Soundbox combining card tap and QR payments, and Pine Labs Mini for Tier 3–6 cities. These solutions aim to expand digital payment acceptance, especially among small merchants and underserved regions.

India POS Device Market Trends:

Widespread Shift to Digital Payments

The shift toward cashless transactions has significantly accelerated the adoption of point-of-sale devices across India. This movement reflects changing consumer habits, increased comfort with digital interfaces, and growing merchant acceptance of non-cash payments. Businesses are now prioritizing efficient and integrated payment solutions to handle rising volumes and offer seamless customer experiences. The surge in electronic payments is also influencing innovation in hardware and software, prompting the development of smarter, faster, and more secure POS systems. This evolution is not limited to urban centers but is steadily expanding into tier 2 and 3 cities, reshaping the retail payment ecosystem. According to the Department of Financial Services, digital payment transactions increased from 220 Crores in FY 2013–14 to 18,592 Crores in FY 2023–24. Over the same period, the transaction value rose from INR 952 Lakh Crore to INR 3,658 Lakh Crore.

Digital Wallet Growth Fueling POS Demand

The growing use of digital wallets is reshaping how payments are made across India, with notable momentum coming from rural regions. This shift reflects a deeper penetration of digital financial services beyond traditional urban strongholds. As more consumers embrace wallet-based transactions, businesses across sectors are upgrading to POS systems that can seamlessly accept a wider range of digital payments. This changing payment behavior is encouraging wider deployment of modern, contactless-enabled devices in both organized and unorganized retail settings. The increased comfort with mobile payments is also driving demand for more integrated and user-friendly POS interfaces. For example, a recent Reserve Bank of India report shows a 40% rise in digital wallet users nationwide over the past two years, with rural areas contributing significantly through a 35% increase in adoption, highlighting broader digital payment penetration beyond urban centers.

Incentivized Payments Boosting POS Uptake among Small Merchants

The recent push to support low-value digital payments is accelerating the adoption of POS systems by small merchants across India. Financial incentives and the waiver of transaction fees are making it easier for micro and small businesses to accept digital payments without added cost burdens. This move is strengthening the viability of UPI-enabled POS devices in everyday transactions, particularly in lower-ticket-size retail settings. The initiative is also helping expand the digital payment ecosystem beyond large retail chains, encouraging informal and small-scale vendors to embrace electronic payment infrastructure for enhanced customer reach and operational efficiency. For instance, the Union Cabinet approved an INR 1,500 Crore incentive scheme for FY 2024–25 to augment low-value BHIM-UPI (P2M) transactions. It ensures zero MDR and provides a 0.15% incentive on payments up to INR 2,000 made to small merchants, encouraging wider digital payment adoption.

India POS Device Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India POS device market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, terminal type, business size, and industry vertical.

Analysis by Component:

- Hardware

- Software

- Services

Hardware stood as the largest component in 2024, holding around 56.4% of the market, primarily due to its crucial role in facilitating secure and efficient transactions. The growing retail and hospitality sectors demand robust POS systems for smooth operations, driving the need for reliable hardware like terminals, card readers, and printers. As digital payment adoption accelerates, businesses require advanced, secure hardware to handle high transaction volumes while ensuring data security. Additionally, government initiatives promoting cashless transactions further boost the demand for POS hardware. With the rise of contactless and mobile payments, hardware innovation is also key, as businesses upgrade to support newer payment methods. This demand for technologically advanced, durable hardware underpins the dominant position of hardware in the market.

Analysis by Terminal Type:

- Fixed POS Terminals

- Mobile POS Terminals

Fixed POS terminals led the market with around 65.2% of market share in 2024 due to their widespread use in retail, hospitality, and service industries. These terminals offer stability, reliability, and faster transaction processing, making them the preferred choice for businesses handling high-volume transactions. With the surge in digital payments and government efforts to promote cashless transactions, the demand for fixed POS systems has grown substantially. These terminals provide enhanced security features like EMV chip cards and encryption, making them ideal for preventing fraud. Moreover, fixed POS terminals are often integrated with backend systems, enabling businesses to manage inventory, sales, and customer data effectively. As the retail and service sectors expand, fixed POS terminals remain essential for facilitating seamless transactions.

Analysis by Business Size:

- Turnover<5 Million INR

- Turnover 5 Million INR–50 Million INR

- Turnover 50 Million INR and Above

Turnover 5 Million INR–50 Million INR led the market in 2024, driven by small and medium-sized enterprises (SMEs) across various industries. This segment includes retail businesses, restaurants, and service providers that are increasingly adopting POS devices to streamline operations and improve customer experience. As SMEs grow and diversify, their need for reliable and cost-effective payment solutions intensifies. The turnover range also reflects businesses transitioning from traditional cash-based transactions to digital payments, which is supported by government initiatives like Digital India. Moreover, the affordability and scalability of POS devices within this turnover range make them an attractive option for businesses looking to enhance efficiency and security without high upfront costs, further driving market growth.

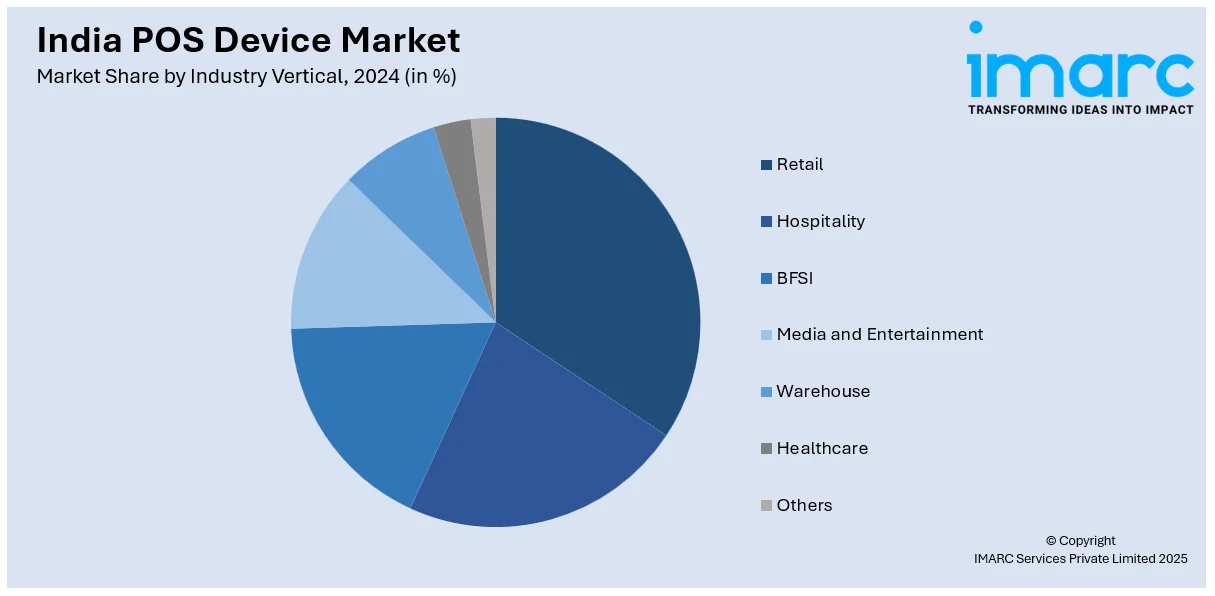

Analysis by Industry Vertical:

- Retail

- Hospitality

- BFSI

- Media and Entertainment

- Warehouse

- Healthcare

- Others

Retail led the market with around 37% of market share in 2024 due to the sector's rapid expansion and the increasing shift towards digital payments. With the rise of organized retail, e-commerce, and consumer demand for faster, secure transactions, retail businesses are adopting POS devices to enhance customer experience and streamline payment processes. Additionally, government initiatives promoting cashless transactions, such as the Digital India campaign, have further accelerated this trend. Retail businesses are increasingly integrating POS systems with inventory management and customer loyalty programs to improve operational efficiency. The growing preference for contactless payments and mobile wallets in the retail sector also drives POS adoption. As the retail market continues to grow, POS devices become an essential tool for facilitating seamless transactions and managing customer interactions.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

In 2024, West and Central India accounted for the largest market share of over 35%, owing to their thriving retail and service sectors. These regions are home to major commercial hubs like Mumbai, Pune, Ahmedabad, and Indore, where businesses increasingly adopt POS systems to cater to growing consumer demand for digital payment options. The region's robust economic activity, coupled with high digital payment adoption, has significantly boosted POS device demand. Government initiatives such as promoting cashless transactions and supporting small businesses in these regions further fuel this growth. Additionally, the increasing presence of international and regional retail chains, as well as the expansion of small and medium-sized enterprises (SMEs), drives the need for secure and efficient payment systems. This combination of factors positions West and Central India as key drivers in the POS device market.

Competitive Landscape:

The market is witnessing steady growth, fueled by rising digital transactions, supportive government policies, and increasing retail digitization. Common recent developments include frequent product launches, strategic partnerships, and technology collaborations to enhance payment efficiency and customer experience. Research and development efforts are focused on integrating AI and contactless technologies. Government initiatives are pushing financial inclusion and digital payment infrastructure. Among these, product launches and partnerships are the most commonly observed practices, driven by the competitive need for innovation and expanded service offerings across sectors like retail, logistics, and food delivery. The report provides a comprehensive analysis of the competitive landscape in India POS device market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Jubilant FoodWorks launched Elate, India’s first Android-based POS and order-taking system tailored for the food-service industry. Elate integrates with JFL’s D2C platforms and supports tech-driven restaurant experience across Domino’s and other company brands.

- March 2025: Zaggle acquired a 45.3% stake in POS software firm Effiasoft for INR 36.7 crore, with plans to raise it by another 5.6%. Effiasoft, which reported INR 24.6 crore turnover, offers billing and inventory services via its Justbilling platform.

- September 2024: Zomato launched a POS developer platform to help restaurants enhance operations through real-time API testing, inventory and payroll management, and analytics integration. The platform supports scalable features, streamlining development and onboarding for POS partners across its growing network.

- August 2024: HDFC Bank launched an All-In-One POS device for MSMEs, combining POS, QR scanner, and Soundbox features. Supporting multiple payment modes and real-time audio alerts, the device enhances transaction management, integrates with SmartHub Vyapar.

- April 2024: BharatPe launched BharatPe One, an all-in-one payment device combining a POS, a QR code, and a speaker. Initially rolling out in 100 cities, it supports tap-and-pay, QR, and card payments, targeting small and medium businesses.

India POS Device Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Terminal Types Covered | Fixed POS Terminals, Mobile POS Terminals |

| Business Sizes Covered | Turnover<5 Million INR, Turnover 5 Million INR–50 Million INR, Turnover 50 Million INR and Above |

| Industry Verticals Covered | Retail, Hospitality, BFSI, Media and Entertainment, Warehouse, Healthcare, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India POS device market from 2019-2033.

- The India POS device market research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India POS device industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The POS device market in India was valued at USD 536.44 Million in 2024.

The growth of the market is driven by increased digital payments adoption, government initiatives promoting cashless transactions, a growing retail sector, expanding e-commerce, and the rising demand for contactless payments. Additionally, advancements in mobile POS technology and improved internet infrastructure support market expansion.

The POS device market is projected to exhibit a CAGR of 10.37% during 2025-2033, reaching a value of USD 1,362.54 Million by 2033.

Hardware accounted for the largest share, holding around 56.4% of the market in 2024. This is due to the demand for reliable, secure, and efficient payment systems, driven by the retail sector's growth, increased transaction volumes, and digital payment adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)