India Polyurethane Synthetic Leather Market Size, Share, Trends and Forecast by Application, and Region, 2025-2033

India Polyurethane Synthetic Leather Market Overview:

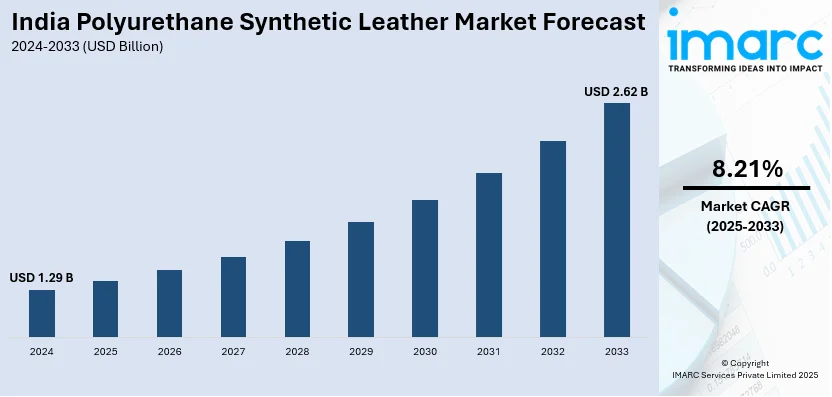

The India polyurethane synthetic leather market size reached USD 1.29 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.62 Billion by 2033, exhibiting a growth rate (CAGR) of 8.21% during 2025-2033. The market is driven by the rising product demand in the automotive upholstery, fashion, and furniture sectors, owing to its durability and eco-friendly properties, increasing restrictions on leather items, numerous advancements in polyurethane leather manufacturing, and the growing preference for sustainable, high-performance material.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.29 Billion |

| Market Forecast in 2033 | USD 2.62 Billion |

| Market Growth Rate 2025-2033 | 8.21% |

India Polyurethane Synthetic Leather Market Trends:

Rising Demand for Sustainable and Eco-Friendly Alternatives

The growing emphasis on sustainability is reshaping India’s polyurethane (PU) synthetic leather market, driven by stricter environmental regulations and increasing consumer preference for eco-friendly alternatives. With 46% of Indian consumers viewing climate change as a major threat, 60% are also actively shifting towards sustainable products, even willing to pay a 13.1% premium (vs price base lines) for ethically sourced goods. In response, manufacturers are prioritizing PU leather over traditional PVC-based synthetic leather, which contains harmful chemicals. Furthermore, government regulations, such as India's National Green Tribunal restrictions on tannery pollution, have accelerated the move away from real leather, on account of worries about animal suffering and carbon footprints. The Indian vegan leather sector is expanding rapidly, notably in footwear, apparel, and automobile upholstery segments, with major brands such as PUMA and Adidas introducing eco-friendly PU leather items. The growing demand for water-based PU leather, which removes the need for solvents, is also helping to improve sustainability and durability, putting the industry on track for considerable growth.

To get more information on this market, Request Sample

Expanding Applications in Automotive and Furniture Industries

India’s automotive and furniture industries are expanding rapidly, driving the demand for high-quality PU synthetic leather. Known for its flexibility, durability, and cost-effectiveness, PU leather has become the preferred choice for car seats, steering covers, and interior trims. In September 2024, India’s total production of passenger vehicles, 3-wheelers, 2-wheelers, and quadricycles reached 2,773,039 units, significantly boosting the adoption of PU synthetic leather in automotive interiors as manufacturers seek lightweight, durable, and aesthetically appealing materials. Simultaneously, India’s furniture market, valued at USD 23.8 billion in 2024, is projected to reach USD 44.2 billion by 2033, growing at a CAGR of 6.40% from 2025 to 2033, driven by increasing urbanization and rising disposable incomes. PU synthetic leather is extensively used in sofas, chairs, and office furniture due to its wear resistance and affordability. Leading brands and e-commerce platforms, such as Pepperfry and Urban Ladder, are also expanding their PU leather-based product offerings, further propelling the market growth.

India Polyurethane Synthetic Leather Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application.

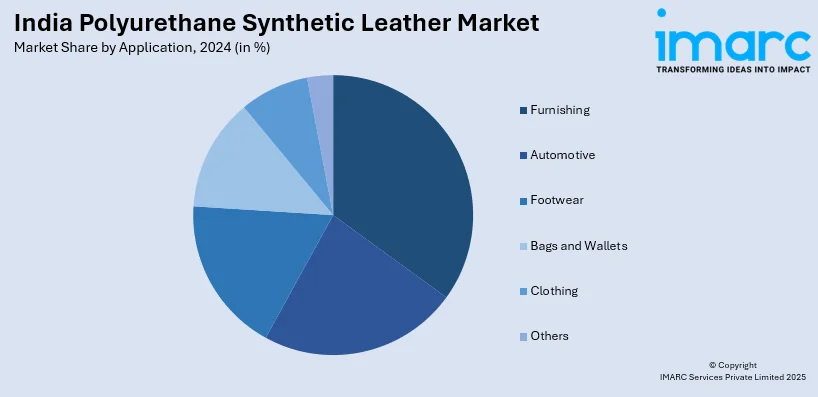

Application Insights:

- Furnishing

- Automotive

- Footwear

- Bags and Wallets

- Clothing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes furnishing, automotive, footwear, bags and wallets, clothing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polyurethane Synthetic Leather Market News:

- July 2024: BASF unveiled Haptex® 4.0, a fully recyclable polyurethane solution for synthetic leather manufacturing. Haptex 4.0 is created with no waste residue, resulting in a more sustainable production method. It is both inexpensive and durable, making it an excellent choice for a variety of applications.

- May 2024: BASF opened the Polyurethane Technical Development Center in Mumbai to help develop polyurethane applications, including synthetic leather. The Center, which spans around 2,000 square meters, features cutting-edge application equipment. It provides increased customer support services, including troubleshooting, bespoke formulations, line trials, and client training sessions.

India Polyurethane Synthetic Leather Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Furnishing, Automotive, Footwear, Bags & Wallets, Clothing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polyurethane synthetic leather market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polyurethane synthetic leather market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polyurethane synthetic leather industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polyurethane synthetic leather market in India was valued at USD 1.29 Billion in 2024.

The India polyurethane synthetic leather market is projected to exhibit a CAGR of 8.21% during 2025-2033, reaching a value of USD 2.62 Billion by 2033.

The India polyurethane synthetic leather market is driven by rising demand from automotive and footwear industries, growth in affordable fashion, increased use in upholstery and furnishing, lightweight and durable material advantages, and government restrictions on animal leather, pushing manufacturers toward sustainable and cost-effective alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)