India Polyurethane Foam Market Size, Share, Trends and Forecast by Structure, Product Type, Density, End Use Industry, and Region, 2025-2033

Market Overview:

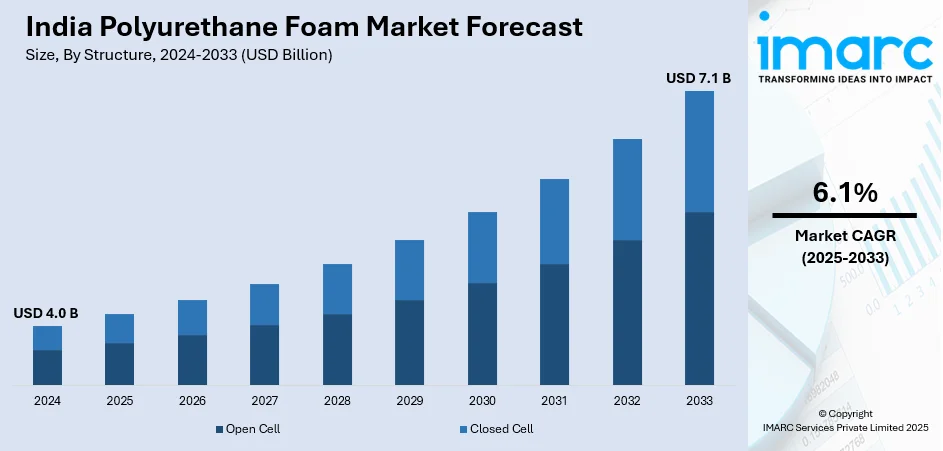

India polyurethane foam market size reached USD 4.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.1% during 2025-2033. The increasing demand for flexible polyurethane foam in applications such as furniture, bedding, and automotive seating that can be influenced by consumer trends, fashion, and design preferences, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.0 Billion |

|

Market Forecast in 2033

|

USD 7.1 Billion |

| Market Growth Rate 2025-2033 | 6.1% |

Polyurethane foam is a versatile and widely used material known for its excellent insulation and cushioning properties. Formed by combining two liquid components, polyol, and isocyanate, through a chemical reaction, it expands into a lightweight and durable foam. This material has extensive applications in various industries, including construction, automotive, and furniture manufacturing. In construction, it serves as an efficient thermal insulator, enhancing energy efficiency in buildings. In the automotive sector, polyurethane foam contributes to lightweighting and improved fuel efficiency. Additionally, its use in furniture provides comfortable and resilient seating. Despite its widespread use, concerns have been raised about the environmental impact of certain types of polyurethane foam, prompting ongoing research into more sustainable alternatives and recycling methods.

To get more information on this market, Request Sample

India Polyurethane Foam Market Trends:

The polyurethane foam market in India is witnessing significant growth due to several interconnected factors. Firstly, the escalating demand for lightweight and high-performance materials across diverse industries, including automotive, construction, and packaging, propels the polyurethane foam market forward. Additionally, stringent energy efficiency regulations regionally are steering the construction sector toward adopting polyurethane foam as an excellent insulation solution. This demand surge is further compounded by the material's exceptional thermal insulation properties and cost-effectiveness. Furthermore, the automotive industry's inclination towards lightweight materials to enhance fuel efficiency and reduce emissions serves as another driving force for the polyurethane foam market. The foam's ability to contribute to vehicular weight reduction without compromising on safety aligns with the automotive sector's sustainability goals. The growing awareness and emphasis on sustainable practices among consumers also contribute to the surge in demand for polyurethane foam, given its recyclability and eco-friendly features. In conclusion, the polyurethane foam market experiences robust growth driven by the collective impact of increased demand for lightweight materials, energy efficiency requirements, automotive industry preferences, and a growing emphasis on sustainability across various sectors. This interconnected web of factors positions polyurethane foam as a key player in meeting contemporary industrial needs.

India Polyurethane Foam Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on structure, product type, density, and end use industry.

Structure Insights:

- Open Cell

- Closed Cell

The report has provided a detailed breakup and analysis of the market based on the structure. This includes open cell and closed cell.

Product Type Insights:

- Flexible Foam

- Rigid Foam

- Spray Foam

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes flexible foam, rigid foam, and spray foam.

Density Insights:

- Low Density

- Medium Density

- High Density

The report has provided a detailed breakup and analysis of the market based on the density. This includes low density, medium density, and high density.

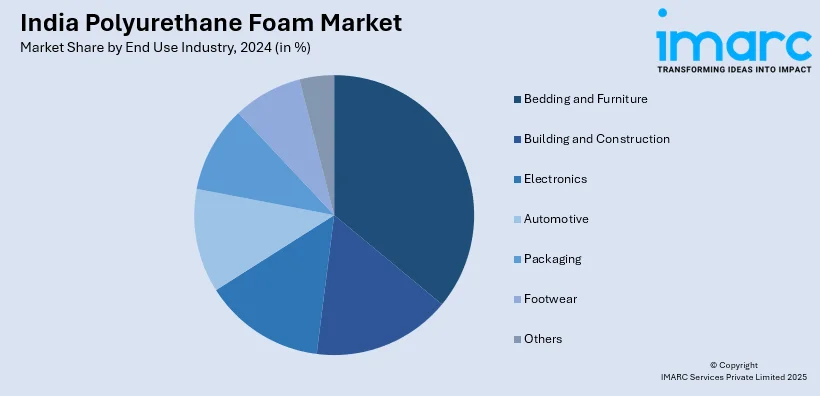

End Use Industry Insights:

- Bedding and Furniture

- Building and Construction

- Electronics

- Automotive

- Packaging

- Footwear

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes bedding and furniture, building and construction, electronics, automotive, packaging, footwear, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polyurethane Foam Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Structures Covered | Open Cell, Closed Cell |

| Product Types Covered | Flexible Foam, Rigid Foam, Spray Foam |

| Densities Covered | Low Density, Medium Density, High Density |

| End Use Industries Covered | Bedding and Furniture, Building and Construction, Electronics, Automotive, Packaging, Footwear, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India polyurethane foam market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India polyurethane foam market?

- What is the breakup of the India polyurethane foam market on the basis of structure?

- What is the breakup of the India polyurethane foam market on the basis of product type?

- What is the breakup of the India polyurethane foam market on the basis of density?

- What is the breakup of the India polyurethane foam market on the basis of end use industry?

- What are the various stages in the value chain of the India polyurethane foam market?

- What are the key driving factors and challenges in the India polyurethane foam?

- What is the structure of the India polyurethane foam market and who are the key players?

- What is the degree of competition in the India polyurethane foam market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polyurethane foam market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polyurethane foam market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polyurethane foam industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)