India Polyurethane Adhesives & Sealants Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

India Polyurethane Adhesives & Sealants Market Overview:

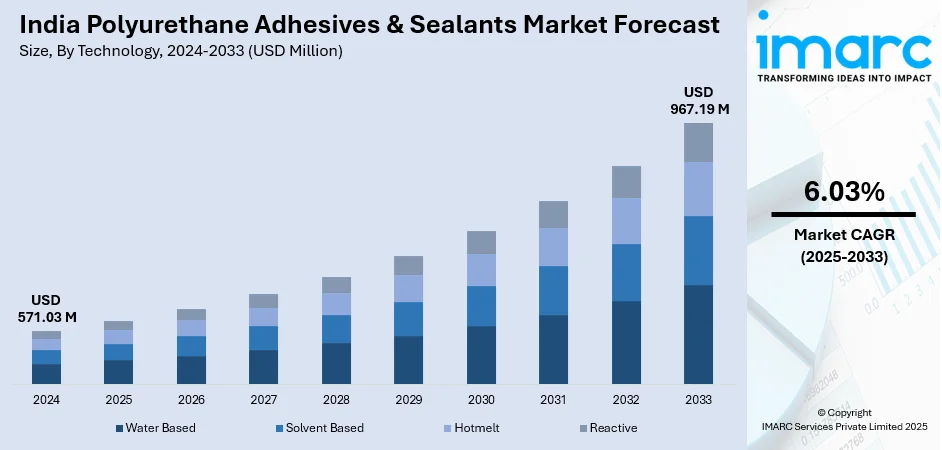

The India polyurethane adhesives & sealants market size reached USD 571.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 967.19 Million by 2033, exhibiting a growth rate (CAGR) of 6.03% during 2025-2033. The rising number of infrastructure projects, owing to favorable government initiatives, such as the Smart Cities Mission, the increasing focus in the automotive industry on lightweight, proliferation of fuel-efficient vehicles, and ongoing advancements in reactive technology are among the primary factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 571.03 Million |

| Market Forecast in 2033 | USD 967.19 Million |

| Market Growth Rate 2025-2033 | 6.03% |

India Polyurethane Adhesives & Sealants Market Trends:

Rising Demand for Green Buildings and Sustainable Construction

India’s construction sector is witnessing a surge in demand for polyurethane (PU) adhesives and sealants, driven by a growing focus on sustainability and government-backed initiatives like the Smart Cities Mission. The shift toward eco-friendly, low-VOC adhesives is fueled by the rapid expansion of green buildings, supported by the Indian Green Building Council (IGBC). India’s green building market is projected to grow rapidly over the near-term, significantly boosting demand for sustainable adhesives. As of 2022, Indian Green Building Council (IGBC)-certified buildings have conserved over 45 billion kWh of energy, saved 14 billion liters of water, and reduced 40 million tons of greenhouse gas emissions. The country now has 14,510 green building projects, covering a footprint of 12.3 billion sq. ft., with 5,820 fully operational projects. Additionally, the Smart Cities initiative, with a planned investment of INR 2.05 lakh crore (USD 25 billion) by 2025, is accelerating PU adhesive adoption in infrastructure projects. Reflecting the industry’s sustainability shift, low-VOC adhesives are expected to comprise over 40% of the Indian adhesives market by 2025. The superior durability, flexibility, and weather resistance of PU adhesives further solidify their growing role in India’s evolving construction landscape.

To get more information on this market, Request Sample

Rapidly Expanding Automotive Industry and Increasing EV Adoption

India’s automotive and electric vehicle (EV) sectors are experiencing rapid expansion, fueling the demand for advanced bonding solutions like polyurethane (PU) adhesives. These adhesives play a crucial role in vehicle lightweighting, enhancing structural integrity and improving crash resistance. The Indian EV market is expected to grow at a CAGR of 57.23% between 2025 and 2033, significantly boosting PU adhesive demand. In 2023, total EV sales stood at approximately 1.6 million units, surging to over 2 million units in 2024, a 24% increase, reflecting rising consumer adoption. This growth has propelled EV penetration in India’s overall vehicle market to 8%, up from 6.8% the previous year. The Indian government actively supports EV adoption through initiatives like the Electric Mobility Promotion Scheme (EMPS) and the FAME scheme, aiming for 30% EV penetration by 2030. Additionally, India’s automotive adhesives market is projected to reach USD 1.2 billion by 2025, with PU adhesives dominating the segment. Meanwhile, the rapidly expanding lightweight vehicle market is further accelerating PU adhesive adoption as manufacturers prioritize fuel efficiency and performance-driven designs.

India Polyurethane Adhesives & Sealants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on technology and application.

Technology Insights:

- Water Based

- Solvent Based

- Hotmelt

- Reactive

The report has provided a detailed breakup and analysis of the market based on the technology. This includes water based, solvent based, hotmelt, and reactive.

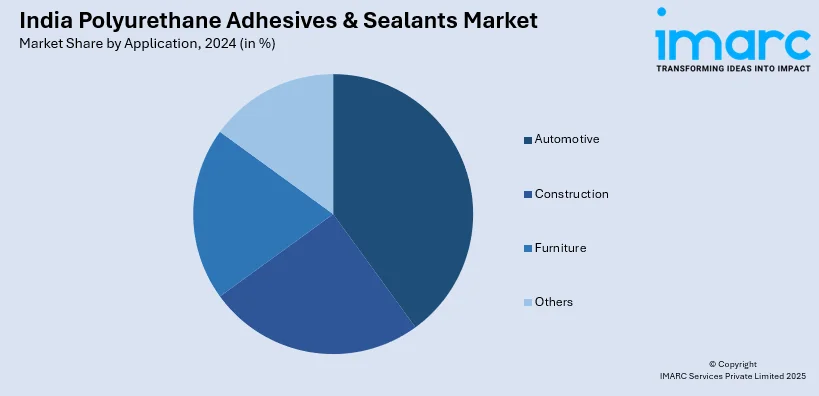

Application Insights:

- Automotive

- Construction

- Furniture

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, construction, furniture, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polyurethane Adhesives & Sealants Market News:

- August 2024: Toyo Ink India revealed its intention to increase the manufacturing capacity for solvent-based adhesives at its Gujarat factory in India. The factory will commence operations in April 2026, increasing the Gujarat site's adhesive capacity by 3.5 times what it now produces.

- April 2024: Global Polyurethanes announced the investment of INR 9 crore in its PU Adhesive and Foam Project in Nashik, Maharashtra. The investment is intended to improve manufacturing capacity and fulfill market demand. The 0.49-acre complex will have cutting-edge gear and superb infrastructure. The investment will be used to upgrade technologies and expand the manufacturing facility, increasing production efficiency and output quality.

India Polyurethane Adhesives & Sealants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Water Based, Solvent Based, Hotmelt, Reactive |

| Applications Covered | Automotive, Construction, Furniture, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India polyurethane adhesives & sealants market performed so far and how will it perform in the coming years?

- What is the breakup of the India polyurethane adhesives & sealants market on the basis of technology?

- What is the breakup of the India polyurethane adhesives & sealants market on the basis of application?

- What are the various stages in the value chain of the India polyurethane adhesives & sealants market?

- What are the key driving factors and challenges in the India polyurethane adhesives & sealants?

- What is the structure of the India polyurethane adhesives & sealants market and who are the key players?

- What is the degree of competition in the India polyurethane adhesives & sealants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polyurethane adhesives & sealants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polyurethane adhesives & sealants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polyurethane adhesives & sealants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)