India Polypropylene Staple Fiber Market Size, Share, Trends and Forecast by Product Type, Fiber Diameter, Application, End Use Industry, and Region, 2025-2033

India Polypropylene Staple Fiber Market Overview:

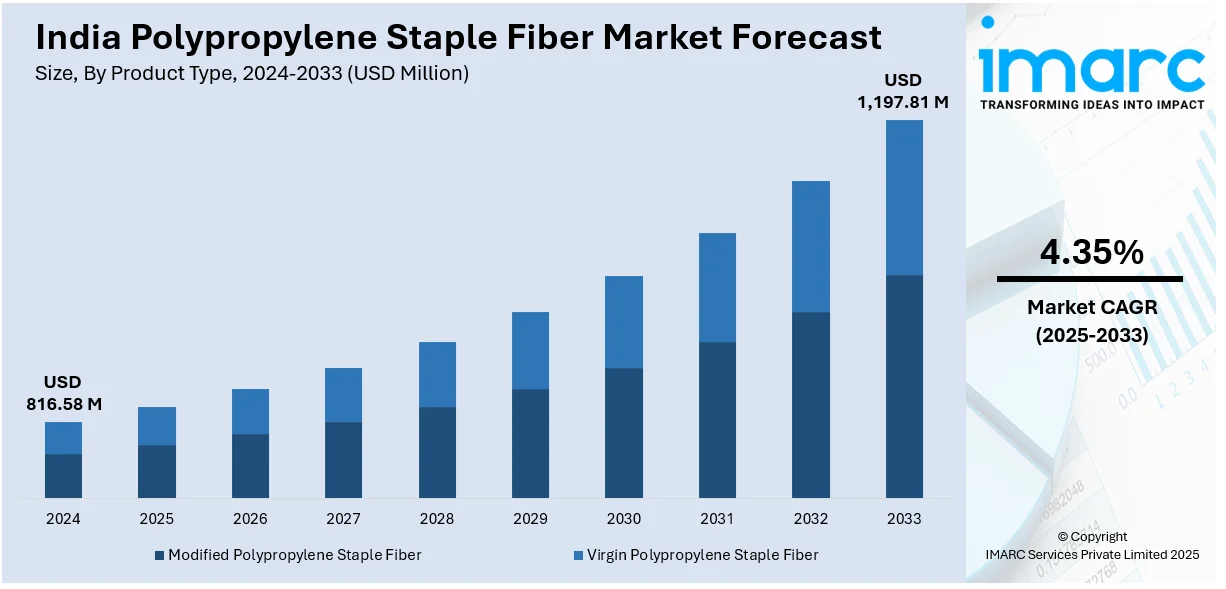

The India polypropylene staple fiber market size reached USD 816.58 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,197.81 Million by 2033, exhibiting a growth rate (CAGR) of 4.35% during 2025-2033. The India polypropylene staple fiber market is growing due to rising demand from the textile industry for durable synthetic materials and ongoing technological advancements in fiber production that improve quality, efficiency, and application across multiple sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 816.58 Million |

| Market Forecast in 2033 | USD 1,197.81 Million |

| Market Growth Rate 2025-2033 | 4.35% |

India Polypropylene Staple Fiber Market Trends:

Growing Demand from the Textile Industry

The Indian polypropylene staple fiber market is witnessing growth, mainly because of the rising demand from the textile sector. Polypropylene staple fibers are greatly appreciated in textile manufacturing because of their lightweight nature, strength, and resistance to moisture. With an increase in disposable incomes in India, there is a clear shift toward textiles made from synthetic fibers. This trend is especially noticeable in the growing need for cost-effective, high-quality materials utilized in apparel, household textiles like drapes, and furniture upholstery. These materials provide improved durability and comfort while also aligning with the changing preferences of Indian shoppers. As per the India Brand Equity Foundation (IBEF), the Indian textiles and apparel market is projected to increase at a compound annual growth rate (CAGR) of 10%, aiming for US$ 350 billion by 2030, while exports are estimated to reach US$ 100 billion. The expansion in the textile industry is leading to higher use of polypropylene staple fiber in making carpets, nonwoven fabrics, and various textile products. The growth of the textile market, both locally and internationally, boosts the uptake of polypropylene staple fiber, establishing it as an essential material to satisfy the needs of the changing textile and apparel sectors in India.

To get more information on this market, Request Sample

Technological Advancements in Fiber Production

With modern techniques in fiber extrusion and processing, manufacturers are now able to produce high-quality fibers with enhanced properties, such as increased tensile strength, better thermal stability, and improved resistance to chemicals. Advancements like cutting-edge spinning technologies and modern processing machinery are enhancing production efficiency, allowing producers to address a wider variety of applications, ranging from textiles to automotive. Furthermore, the transition towards more sustainable manufacturing practices is vital for lowering production expenses while maintaining environment-friendly standards. This is especially crucial as sectors aim to satisfy user needs for eco-friendly products. For example, in 2025, Oerlikon Manmade Fibers Solutions held its Innovation and Technology Day in Daman, drawing more than 300 attendees and highlighting progress in the production of manmade fibers, featuring sustainable solutions and technological innovations. Occurrences such as these emphasize the sector's ongoing commitment to fostering innovation and teamwork. Through continuous investments in research and development (R&D), manufacturers are concentrating on producing specialized fibers for specific applications, thereby enhancing the growth of the polypropylene staple fiber market in India by boosting both product performance and availability.

India Polypropylene Staple Fiber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, fiber diameter, application, and end use industry.

Product Type Insights:

- Modified Polypropylene Staple Fiber

- Virgin Polypropylene Staple Fiber

The report has provided a detailed breakup and analysis of the market based on the product type. This includes modified polypropylene staple Fiber and virgin polypropylene staple Fiber.

Fiber Diameter Insights:

- Fine

- Medium

- Coarse

A detailed breakup and analysis of the market based on the Fiber diameter have also been provided in the report. This includes fine, medium, and coarse.

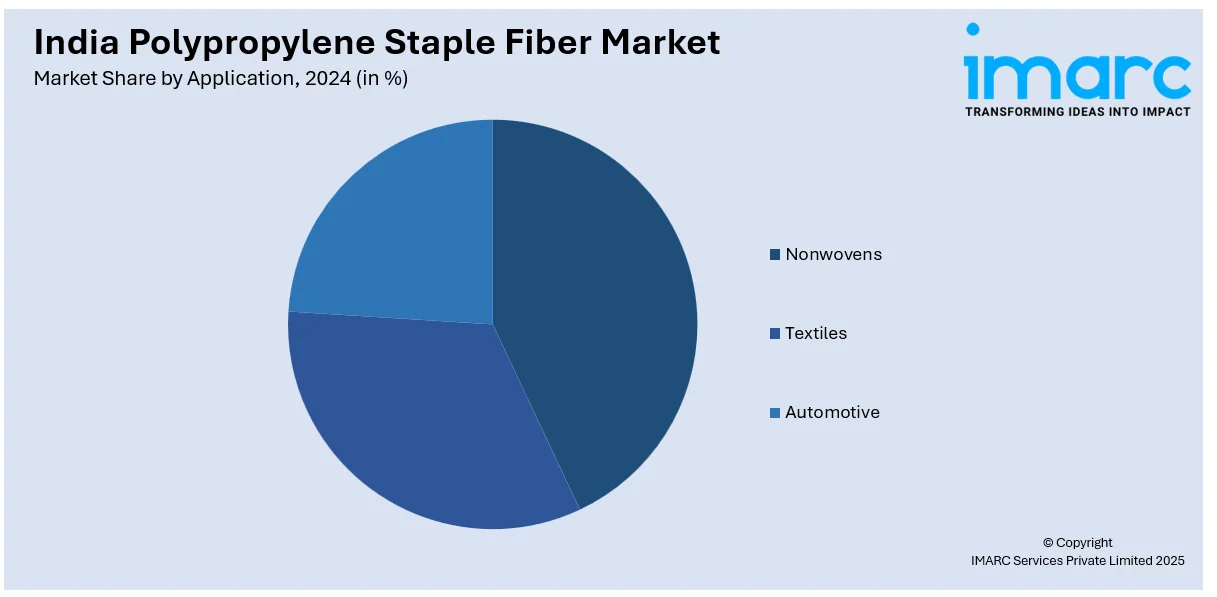

Application Insights:

- Nonwovens

- Textiles

- Automotive

The report has provided a detailed breakup and analysis of the market based on the application. This includes nonwovens, textiles, and automotive.

End Use Industry Insights:

- Automotive

- Construction

- Textile

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, construction, and textile.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polypropylene Staple Fiber Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Modified Polypropylene Staple Fiber, Virgin Polypropylene Staple Fiber |

| Fiber Diameters Covered | Fine, Medium, Coarse |

| Applications Covered | Nonwovens, Textiles, Automotive |

| End Use Industries Covered | Automotive, Construction, Textile |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India polypropylene staple fiber market performed so far and how will it perform in the coming years?

- What is the breakup of the India polypropylene staple fiber market on the basis of product type?

- What is the breakup of the India polypropylene staple fiber market on the basis of Fiber diameter?

- What is the breakup of the India polypropylene staple fiber market on the basis of application?

- What is the breakup of the India polypropylene staple fiber market on the basis of end use industry?

- What is the breakup of the India polypropylene staple fiber market on the basis of region?

- What are the various stages in the value chain of the India polypropylene staple fiber market?

- What are the key driving factors and challenges in the India polypropylene staple fiber market?

- What is the structure of the India polypropylene staple fiber market and who are the key players?

- What is the degree of competition in the India polypropylene staple fiber market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polypropylene staple fiber market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polypropylene staple fiber market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polypropylene staple fiber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)