India Polymer Stabilizer Market Size, Share, Trends and Forecast by Type, End-User, and Region, 2025-2033

India Polymer Stabilizer Market Overview:

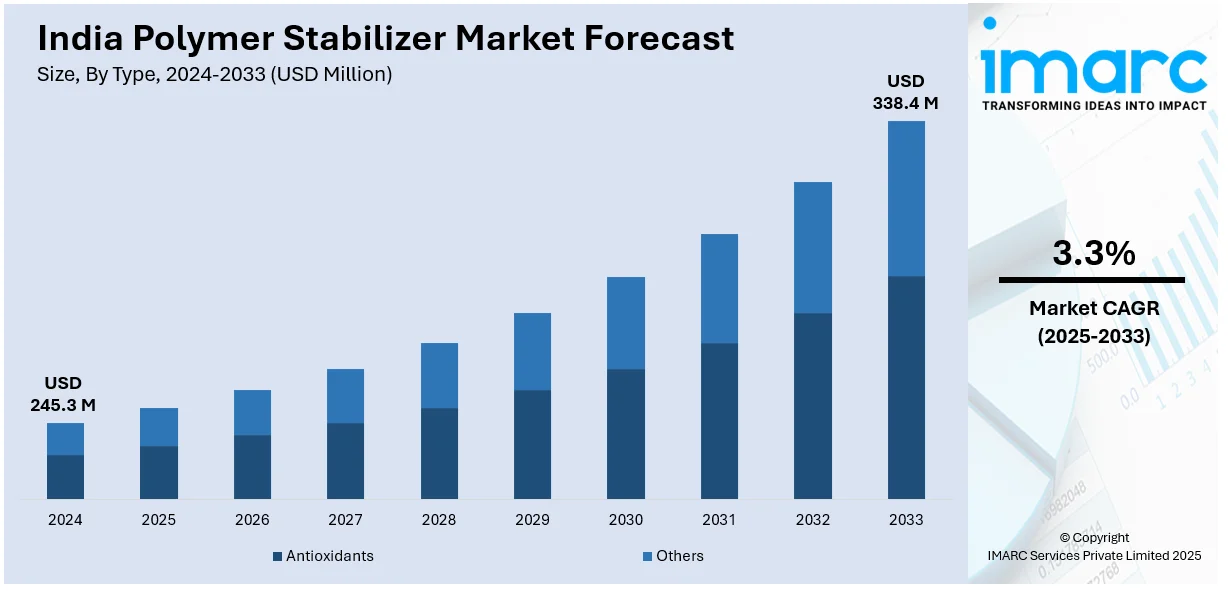

The India polymer stabilizer market size reached USD 245.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 338.4 Million by 2033, exhibiting a growth rate (CAGR) of 3.3% during 2025-2033. The market is expanding due to the rising demand for durable plastics in packaging, automotive, and construction industries. Increased adoption of UV stabilizers in outdoor applications, stringent environmental regulations promoting eco-friendly stabilizers, and rapid industrialization are further propelling market growth. Advancements in polymer processing technologies also contribute to demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 245.3 Million |

| Market Forecast in 2033 | USD 338.4 Million |

| Market Growth Rate 2025-2033 | 3.3% |

India Polymer Stabilizer Market Trends:

Growing Demand for Non-Toxic and Eco-Friendly Stabilizers

With enhanced environmental consciousness and tighter regulations, India's polymer stabilizer market is moving towards a green direction. Conventional stabilizers using heavy metals like lead and cadmium are being replaced with non-toxic substitutes like calcium-zinc and organic stabilizers. Government policies, like the Plastic Waste Management Rules, are promoting the use of green stabilizers that meet international environmental norms. Further, the increasing demand for bio-based plastics in food packaging and consumer products is fueling demand for stabilizers with low environmental footprints. As global multinationals intensify their sustainability agendas, the Indian market is experiencing a spurt in investments geared towards the development of next-generation stabilizers that balance regulatory compliance with improved polymer performance. For instance, in February 2023, Waldies unveiled eco-friendly PVC stabilizers at PlastIndia 2023 and announced a new manufacturing site in Dausa, Rajasthan, with a 24,000 TPA capacity. The new facility will serve the Northwest market, strengthening Waldies' position as a leading PVC stabilizer manufacturer in Asia.

To get more information on this market, Request Sample

Rising Demand for High-Performance Stabilizers in Automotive and Construction Sectors

Growing applications in the automotive and construction sectors are driving demand for advanced stabilizers that help improve durability and resistance to weather. In the automotive industry, stabilizers for polymers play a vital role in producing lightweight, fuel-efficient parts, including dashboards, bumpers, and interior trims. The increasing trend towards electric vehicles (EVs) is also driving demand for polymer-based parts that need efficient thermal and UV stabilization. In the building and construction industry, stabilizers perform a crucial function in increasing the lifespan of PVC pipes, window frames, and insulating materials. As India's infrastructure development schemes pick up pace, high-performance stabilizers, especially heat and UV stabilizers, are expected to gain demand, providing higher material durability in harsh weather conditions. For instance, in July 2024, BASF launched Tinuvin® NOR® 211 AR, a high-performance heat and light stabilizer for plasticulture. It enhances agricultural plastics' durability against UV radiation, heat, sulfur, and chlorine exposure. The product supports downgauging, reducing plastic waste while improving efficiency. It is part of BASF’s VALERAS® portfolio, emphasizing sustainability, energy efficiency, and emission reduction.

India Polymer Stabilizer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end-user.

Type Insights:

- Antioxidants

- Heat Stabilizer

- Light Stabilizer

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes antioxidants (heat stabilizer and light stabilizer) and others.

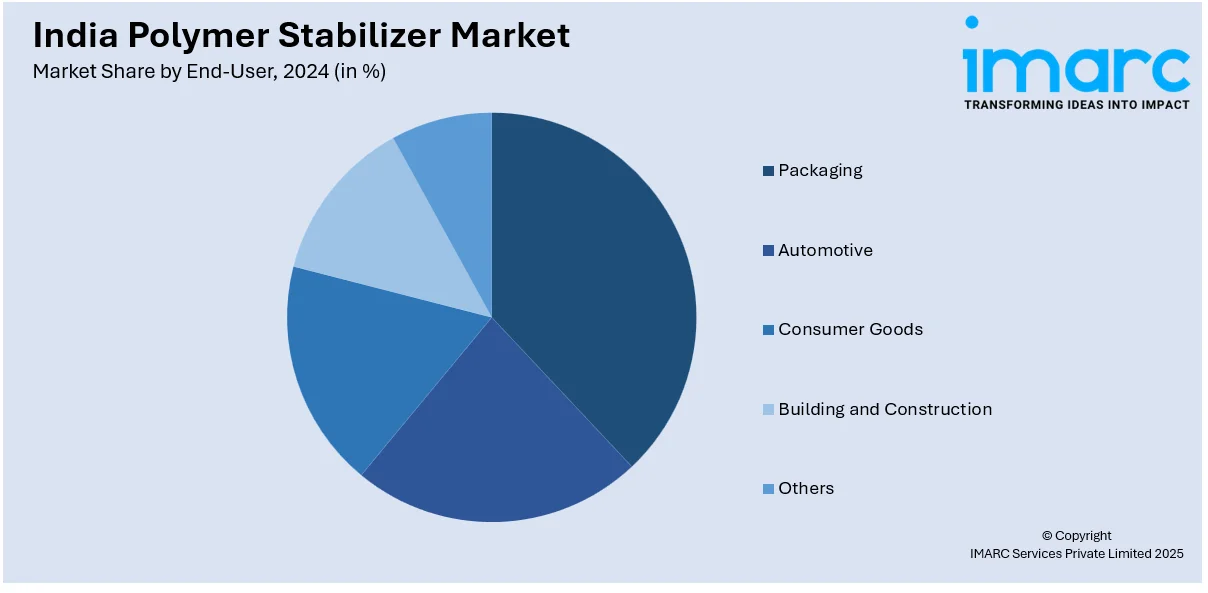

End-User Insights:

- Packaging

- Automotive

- Consumer Goods

- Building and Construction

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes packaging, automotive, consumer goods, building and construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polymer Stabilizer Market News:

- In May 2024, Clariant, which operates in India through several entities, introduced new sustainable polymer solutions at NPE 2024, including AddWorks® PPA, a PFAS-free polymer processing aid, and AddWorks PKG 158, an antioxidant for polyolefins with recycled content. The company also launched Licolub® PED 1316, a wax for improved PVC processing. These innovations aim to enhance plastics recycling, improve safety, and reduce environmental impact.

- In November 2023, Baerlocher India inaugurated a new GHG emission-optimized PVC stabilizer manufacturing facility in Dewas, Madhya Pradesh. The facility focuses on sustainable additives, including calcium-based PVC stabilizers and metal soaps. Equipped with a 500KWp rooftop solar installation, the facility is projected to generate 0.75 million kWh of renewable energy annually, reducing carbon emissions by 698 metric tons.

India Polymer Stabilizer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End-Users Covered | Packaging, Automotive, Consumer Goods, Building and Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India polymer stabilizer market performed so far and how will it perform in the coming years?

- What is the breakup of the India polymer stabilizer market on the basis of type?

- What is the breakup of the India polymer stabilizer market on the basis of end-user?

- What are the various stages in the value chain of the India polymer stabilizer market?

- What are the key driving factors and challenges in the India polymer stabilizer?

- What is the structure of the India polymer stabilizer market and who are the key players?

- What is the degree of competition in the India polymer stabilizer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polymer stabilizer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polymer stabilizer market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polymer stabilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)