India Polycarbonate Resin Market Size, Share, Trends and Forecast by Resin Type, Product Type, End User, and Region, 2025-2033

India Polycarbonate Resin Market Overview:

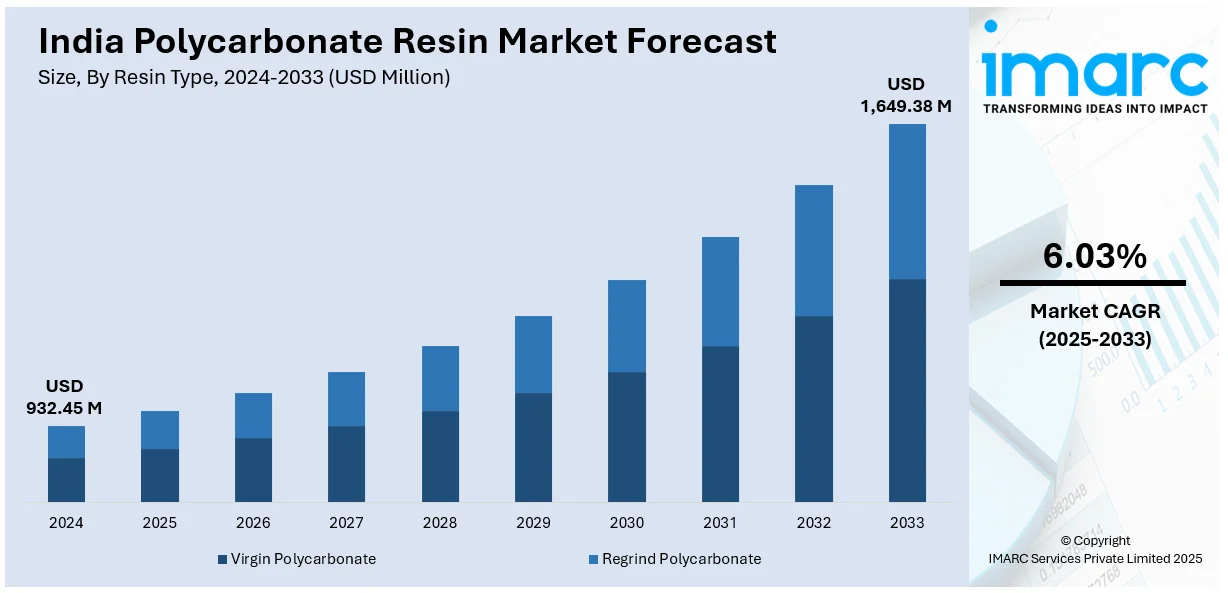

The India polycarbonate resin market size reached USD 932.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,649.38 Million by 2033, exhibiting a growth rate (CAGR) of 6.03% during 2025-2033. The market is driven by rising demand from the automotive and electronics sectors, fueled by lightweight material needs and digitalization. The implementation of government initiatives including "Make in India" and PLI schemes enhance domestic production, while EV adoption and 5G expansion further accelerate growth. Increasing consumer disposable income is also expanding the India polycarbonate resin market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 932.45 Million |

| Market Forecast in 2033 | USD 1,649.38 Million |

| Market Growth Rate 2025-2033 | 6.03% |

India Polycarbonate Resin Market Trends:

Growing Demand for Polycarbonate Resin in Automotive Applications

The increasing demand from the automotive sector is significantly supporting the India polycarbonate resin market growth. Polycarbonate resin is widely used in automotive components such as headlamp lenses, sunroofs, dashboards, and interior trims due to its high impact resistance, lightweight properties, and optical clarity. With the Indian automotive industry expanding, driven by rising vehicle production and consumer preference for fuel-efficient and lightweight vehicles, the demand for polycarbonate resin is accelerating. The automotive industry in India produced 30.6 million vehicles in 2024, of which 4.27 Million passenger cars, 0.95 Million commercial vehicles, and 19.5 Million two-wheelers were sold domestically. In December, it recorded production of 1.92 million units, reflecting strong market demand. The trend of expanding the automotive sector is seen as having a positive effect on the market, driven by increasing automotive production. Additionally, government initiatives, including "Make in India" and stricter emission norms, are pushing automakers to adopt advanced materials, further enhancing market growth. The shift toward electric vehicles (EVs) also presents new opportunities, as polycarbonate resin is ideal for battery housings and charging components. As a result, manufacturers are investing in capacity expansions and technological advancements to meet the growing demand, positioning polycarbonate resin as a key material in India's changing automotive landscape.

To get more information on this market, Request Sample

Rising Adoption in Electronics and Electrical Industries

Another major trend in the Indian polycarbonate resin market is its increasing use in the electronics and electrical sectors. Polycarbonate resin is favored for manufacturing durable, heat-resistant, and flame-retardant components such as mobile phone casings, LED light covers, power sockets, and switches. With India's booming consumer electronics market, driven by rising disposable incomes and digitalization, the demand for high-performance plastics such as polycarbonate is growing rapidly. Additionally, the government's push for domestic electronics manufacturing under the Production Linked Incentive (PLI) scheme is encouraging local production of electronic components, further propelling market demand. The expansion of 5G infrastructure and smart devices is also contributing to the need for robust and lightweight materials. According to an industry report, India's 5G user base is expected to reach 970 Million by 2030, which is equivalent to 74% of mobile subscribers. This expansion is driven by innovations in Generative AI and a growing appetite for high-quality services. By the end of 2024, 5G subscriptions were expected to touch 270 Million, pointing to rapid change in India's telecom industry. This expansion has found a huge opportunity in the polycarbonate resin sector. As a result, polycarbonate resin suppliers are focusing on product innovation and sustainability to cater to the changing requirements of the electronics industry, creating a positive India polycarbonate resin market outlook.

India Polycarbonate Resin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on resin type, product type, and end user.

Resin Type Insights:

- Virgin Polycarbonate

- Regrind Polycarbonate

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes virgin polycarbonate and regrind polycarbonate.

Product Type Insights:

- Injection Molded Products

- Polycarbonate Sheets

- Polycarbonate Tubes/Pipes

- Polycarbonate Films

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes injection molded products, polycarbonate sheets, polycarbonate tubes/pipes, polycarbonate films, and others.

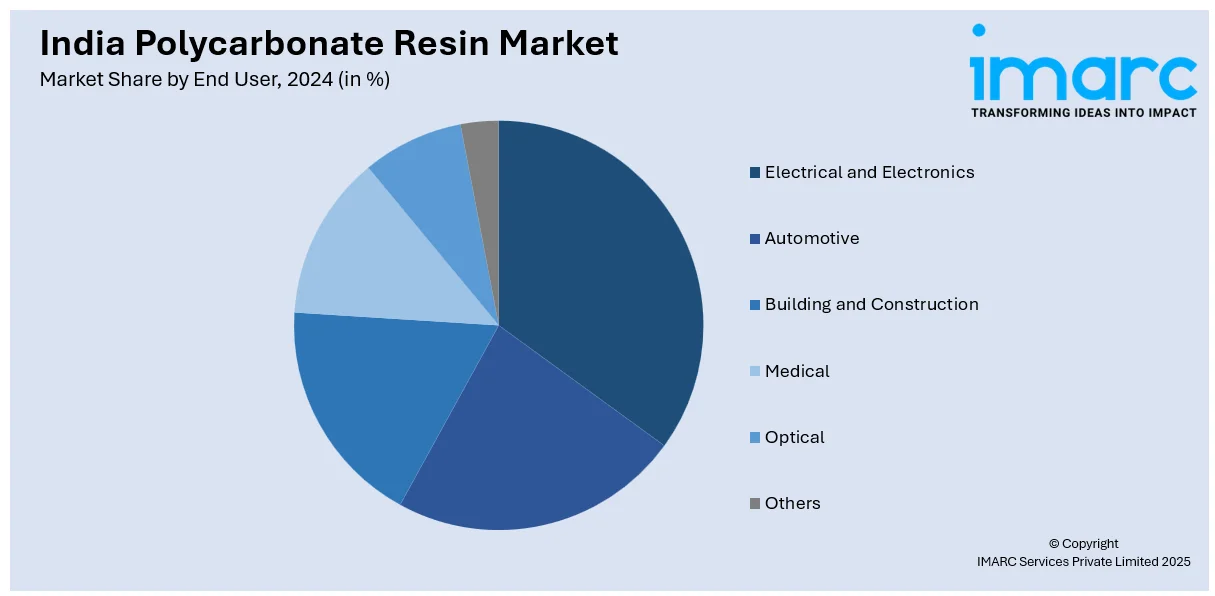

End User Insights:

- Electrical and Electronics

- Automotive

- Building and Construction

- Medical

- Optical

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes electrical and electronics, automotive, building and construction, medical, optical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polycarbonate Resin Market News:

- November 14, 2024: Deepak Chem Tech Limited (DCTL) announced plans to invest INR 5,000 Crore (approximately USD 609.76 Million) in the construction of a polycarbonate resin manufacturing plant in Dahej in Gujarat, which aims to have an annual production capacity of 165,000 Metric Tonnes and is projected to be operational by the fiscal year 2028. The plant will manufacture high-end polycarbonate resins specifically designed for automotive, electronics, and aerospace markets, given the rapid growth of engineering polymers in India. With this collaboration, India will have access to world-class technology and the globally recognized CALIBRE resins, managing to enhance the country on the polycarbonate resin map.

India Polycarbonate Resin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Virgin Polycarbonate, Regrind Polycarbonate |

| Product Types Covered | Injection Molded Products, Polycarbonate Sheets, Polycarbonate Tubes/Pipes, Polycarbonate Films, Others |

| End Users Covered | Electrical and Electronics, Automotive, Building and Construction, Medical, Optical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polycarbonate resin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polycarbonate resin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polycarbonate resin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polycarbonate resin market in India was valued at USD 932.45 Million in 2024.

The India polycarbonate resin market is projected to exhibit a CAGR of 6.03% during 2025-2033, reaching a value of USD 1,649.38 Million by 2033.

The polycarbonate resin market in India benefits from rising demand in automotive, electronics, and construction. Lightweight, durable materials gain traction as industries push for better performance and design flexibility. Urban growth, infrastructure projects, and consumer electronics sales support usage. Manufacturers invest in production capacity and product innovation, responding to growing applications that need strong, heat-resistant polycarbonate solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)