India Plastic Recycling Market Size, Share, Trends and Forecast by Type, Source, End User, and Region, 2025-2033

Market Overview:

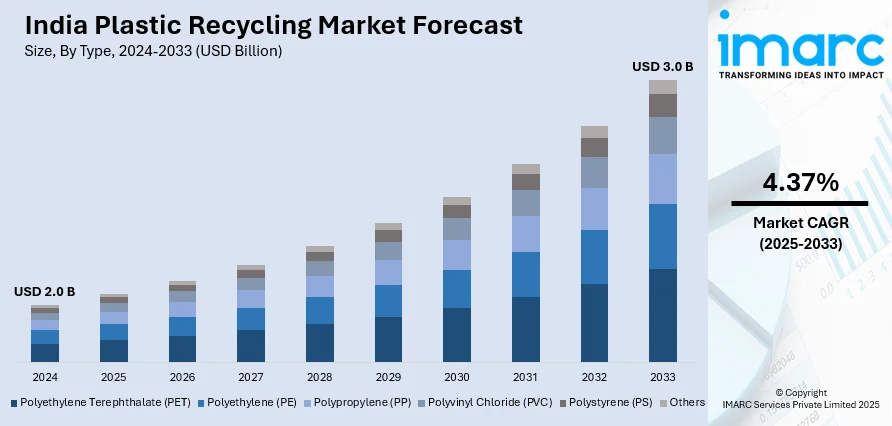

India plastic recycling market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033. The increasing advances in recycling technologies, including sorting, cleaning, and processing techniques, which contribute to the efficiency and cost-effectiveness of plastic recycling, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.0 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Market Growth Rate (2025-2033) | 4.37% |

Plastic recycling is a crucial process aimed at mitigating the environmental impact of plastic waste. It involves collecting, sorting, cleaning, and processing used plastic materials to create new products. The first step is the collection, where plastic waste is gathered from various sources. Next, the collected plastics are sorted based on their resin type, as different plastics require distinct recycling methods. After sorting, the plastics undergo cleaning to remove contaminants such as labels and adhesives. The cleaned materials are then melted and formed into pellets, which can be used to manufacture a variety of products. Recycling plastics helps conserve resources, reduce energy consumption, and minimize the amount of plastic pollution in landfills and oceans, contributing to a more sustainable and environmentally friendly approach to plastic usage. Public awareness and participation in recycling programs play a vital role in the success of plastic recycling initiatives.

To get more information on this market, Request Sample

India Plastic Recycling Market Trends:

The plastic recycling market in India is experiencing robust growth, primarily driven by a surge in environmental awareness and the urgent need to mitigate the escalating regional plastic pollution crisis. To begin with, heightened public consciousness about the detrimental impact of plastic waste on ecosystems has spurred governments and organizations to implement stringent regulations favoring recycling practices. Consequently, this has created a conducive regulatory environment that incentivizes businesses to invest in plastic recycling technologies and infrastructure. Moreover, the increasing demand for sustainable and eco-friendly products has propelled manufacturers to incorporate recycled plastics into their production processes. This shift towards circular economies has not only reduced the dependence on virgin plastics but has also fostered a market for recycled plastic materials. Additionally, advancements in technology have enhanced the efficiency of plastic recycling, making it more cost-effective and scalable. Furthermore, collaborations and partnerships between stakeholders in the plastic supply chain, such as producers, recyclers, and consumers, have played a pivotal role in fostering a closed-loop system. This collaborative approach ensures a steady supply of post-consumer plastic feedstock for recycling facilities, addressing one of the key challenges in the recycling value chain. In conclusion, the plastic recycling market in India is being propelled by a confluence of environmental consciousness, regulatory support, technological innovations, and collaborative efforts across industries.

India Plastic Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, source, and end user.

Type Insights:

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes polyethylene terephthalate (PET), polyethylene (PE), polypropylene (PP), Polyvinyl chloride (PVC), polystyrene (PS), and others.

Source Insights:

- Bottles

- Films

- Fibers

- Foams

- Others

A detailed breakup and analysis of the market based on source have also been provided in the report. This includes bottles, films, fibers, foams, and others.

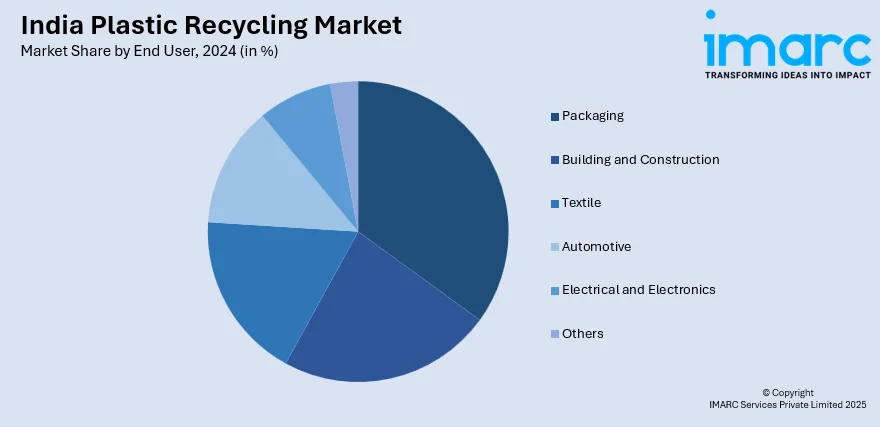

End User Insights:

- Packaging

- Building and Construction

- Textile

- Automotive

- Electrical and Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes packaging, building and construction, textile, automotive, electrical and electronics, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include the North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Plastic Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyethylene Terephthalate (PET), Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Others |

| Sources Covered | Bottles, Films, Fibers, Foams, Others |

| End Users Covered | Packaging, Building and Construction, Textile, Automotive, Electrical and Electronics, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India plastic recycling market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India plastic recycling market?

- What is the breakup of the India plastic recycling market on the basis of type?

- What is the breakup of the India plastic recycling market on the basis of source?

- What is the breakup of the India plastic recycling market on the basis of end user?

- What are the various stages in the value chain of the India plastic recycling market?

- What are the key driving factors and challenges in the India plastic recycling?

- What is the structure of the India plastic recycling market and who are the key players?

- What is the degree of competition in the India plastic recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India plastic recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India plastic recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India plastic recycling industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)