India Plastic Additives Market Size, Share, Trends and Forecast by Additive Type, Plastic Type, Application, Function, and Region, 2025-2033

Market Overview:

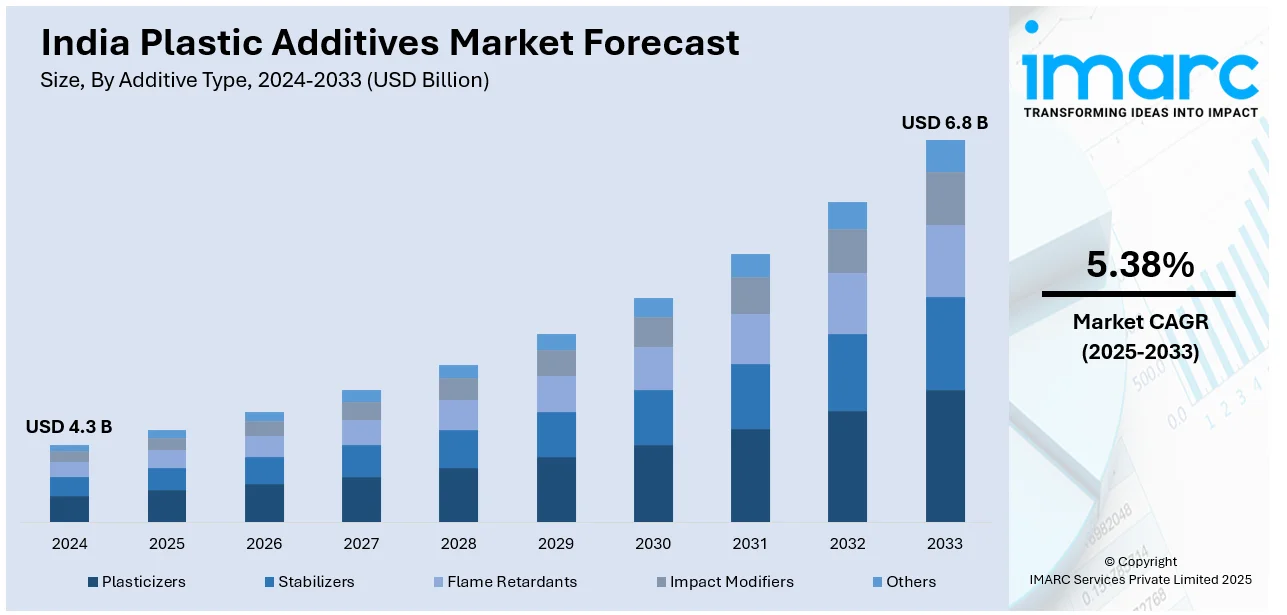

India plastic additives market size reached USD 4.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.38% during 2025-2033. The increasing demand for plastic products across various industries, including packaging, automotive, construction, and electronics, due to their lightweight, durable, and versatile characteristics is primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.3 Billion |

|

Market Forecast in 2033

|

USD 6.8 Billion |

| Market Growth Rate 2025-2033 | 5.38% |

Plastic additives are substances incorporated into polymers during the manufacturing process to enhance or modify their properties. These additives play a crucial role in improving the performance, durability, and versatility of plastic materials. Common plastic additives include stabilizers, plasticizers, colorants, fillers, and flame retardants. Stabilizers protect plastics from degradation caused by exposure to heat, light, and oxygen, thereby extending their lifespan. Plasticizers increase flexibility and workability, making plastics more adaptable for various applications. Colorants add pigments or dyes to achieve desired hues, while fillers enhance strength and reduce costs by incorporating inert materials. Flame retardants mitigate the combustibility of plastics, enhancing their safety. The judicious use of these additives allows manufacturers to tailor plastics to specific requirements, making them suitable for diverse industries such as packaging, construction, automotive, and electronics.

To get more information on this market, Request Sample

India Plastic Additives Market Trends:

The plastic additives market in India is experiencing robust growth, driven by a confluence of factors that underscore its indispensability in diverse industries. Primarily, the escalating demand for lightweight and durable materials in the automotive sector has propelled the market forward. Furthermore, the increasing emphasis on sustainable and eco-friendly solutions has spurred the utilization of additives that enhance recyclability and reduce environmental impact. In addition, the ever-evolving consumer preferences for aesthetically appealing and versatile plastic products have fueled innovation in additive formulations. Moreover, stringent regulations addressing safety and performance standards in packaging materials have accentuated the need for specialized additives, contributing to market expansion. Simultaneously, advancements in technology have ushered in a new era of additive manufacturing, further augmenting the demand for specialized plastic additives. Additionally, the growing awareness regarding the adverse effects of plastic waste on human health and the environment has prompted manufacturers to invest in R&D of bio-based additives, opening new avenues for market growth. In conclusion, the plastic additives market in India is witnessing a dynamic evolution driven by a combination of factors ranging from industry-specific demands to regulatory imperatives and technological advancements. This multifaceted landscape underscores the pivotal role of plastic additives in shaping the future of materials innovation and sustainability.

India Plastic Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on additive type, plastic type, application, and function.

Additive Type Insights:

- Plasticizers

- Stabilizers

- Flame Retardants

- Impact Modifiers

- Others

The report has provided a detailed breakup and analysis of the market based on the additive type. This includes plasticizers, stabilizers, flame retardants, impact modifiers, and others.

Plastic Type Insights:

- Commodity Plastic

- Engineering Plastic

- High Performance Plastic

A detailed breakup and analysis of the market based on the plastic type have also been provided in the report. This includes commodity plastic, engineering plastic, and high performance plastic.

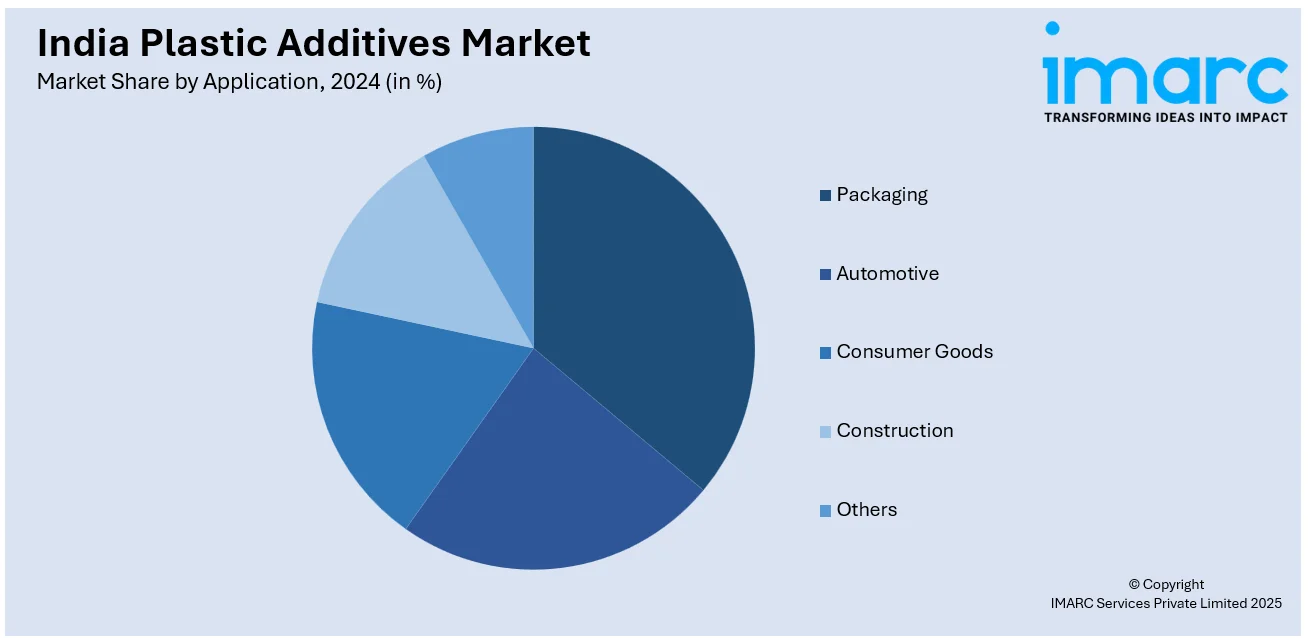

Application Insights:

- Packaging

- Automotive

- Consumer Goods

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes packaging, automotive, consumer goods, construction, and others.

Function Insights:

- Property Modifiers

- Property Stabilizers

- Property Extenders

- Processing Aids

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes property modifiers, property stabilizers, property extenders, and processing aids.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Plastic Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Additive Types Covered | Plasticizers, Stabilizers, Flame Retardants, Impact Modifiers, Others |

| Plastic Types Covered | Commodity Plastic, Engineering Plastic, High Performance Plastic |

| Applications Covered | Packaging, Automotive, Consumer Goods, Construction, Others |

| Functions Covered | Property Modifiers, Property Stabilizers, Property Extenders, Processing Aids |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India plastic additives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India plastic additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India plastic additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plastic additives market in India was valued at USD 4.3 Billion in 2024.

The India plastic additives market is projected to exhibit a CAGR of 5.38% during 2025-2033, reaching a value of USD 6.8 Billion by 2033.

The India plastic additives market is driven by growing demand from packaging, automotive, and construction sectors, rising polymer consumption, focus on product durability and performance, increasing industrialization, adoption of specialty additives for heat, UV, and flame resistance, and government initiatives supporting plastics manufacturing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)