India Plasterboard Market Size, Share, Trends and Forecast by Form, Type, and Region, 2025-2033

India Plasterboard Market Overview:

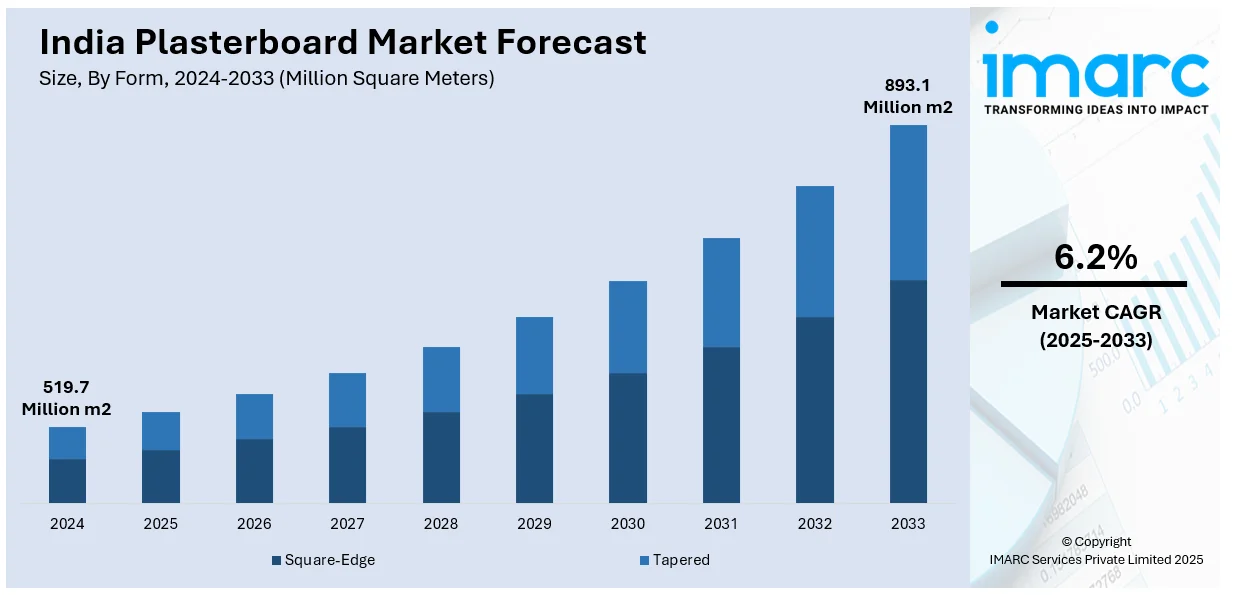

The India plasterboard market size reached 519.7 Million Square Meters in 2024. Looking forward, IMARC Group expects the market to reach 893.1 Million Square Meters by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for sustainable and eco-friendly plasterboards and growing adoption of fire-resistant and moisture-resistant plasterboards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 519.7 Million Square Meters |

| Market Forecast in 2033 | 893.1 Million Square Meters |

| Market Growth Rate (2025-2033) | 6.2% |

India Plasterboard Market Trends:

Rising Demand for Sustainable and Eco-Friendly Plasterboards

A considerable demand for eco-sustainable products has emerged in the India plasterboard market, providing proof of increasing environmental concern, in addition to regulatory support concerning green building materials. Emissions regulations to limit carbon footprints are becoming stringent, compelling manufacturers to invest in the use of recycled gypsum and low-carbon production technologies aimed at sustainability. For instance, in June 2024, as per industry reports, India's gypsum-based products market is projected to reach US$ 30 million by 2030, driven by an increasing demand in construction, sustainability initiatives, and regulatory compliance. Governmental programs detailed in the Energy Conservation Building Code (ECBC) and Leadership in Energy and Environmental Design (LEED) certification criteria are enabling the adoption of sustainable plasterboards in both commercial and residential building. Recycled content in plasterboards, particularly synthetic gypsum produced from industrial by-products, becomes a market differentiator in the market. Manufacturers are also utilizing renewable materials and energy-efficient processes as pathways to sustainability. The demand for eco-friendly plasterboards is also fueled by a growing awareness among builders, architects, and end users of the health benefits of non-toxic, low-VOC materials. With the rapid growth of the construction industry in India, an increase in sustainable plasterboard demand is anticipated, especially in the urban centers where green buildings are gaining acceptance. Companies that are actively engaged in eco-product innovations and environmental compliance will enjoy a competitive advantage in this ever-shifting marketplace.

To get more information on this market, Request Sample

Growing Adoption of Fire-Resistant and Moisture-Resistant Plasterboards

Fire safety and moisture resistance have become critical considerations in India’s construction industry, driving demand for specialized plasterboards. With rapid urbanization and increasing high-rise construction, regulatory authorities are enforcing stricter fire safety codes, particularly in commercial and residential buildings. As a result, builders and developers are incorporating fire-resistant plasterboards in walls and ceilings to enhance structural safety. These boards are engineered to delay the fire’s progression, providing occupants additional time to escape and reducing damage. Simultaneously, moisture-resistant plasterboards are gaining popularity, especially in India with high humidity levels and areas prone to water exposure, such as kitchens and bathrooms. These boards are treated with water-repellent additives to prevent degradation, mold growth, and structural weakening caused by moisture infiltration. The hospitality, healthcare, and institutional construction sectors are among the primary adopters of these advanced plasterboards, given their need for durability and compliance with safety standards. Manufacturers are focusing on product innovation, developing multi-functional plasterboards that offer both fire and moisture resistance, catering to the growing safety and quality demands of India’s construction sector. For instance, in June 2024, Saint-Gobain India announced its plans to expand its gypsum business, aiming for US$4.3 billion in revenue across operations by 2032 as part of its new investment phase. This move reinforces the company’s commitment to innovation, focusing on energy-efficient, recyclable, and high-durability plasterboards to meet evolving industry needs. As regulatory standards continue to tighten, the adoption of performance-enhanced plasterboards is set to expand across various infrastructure projects.

India Plasterboard Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on form, type, and end-user sector.

Form Insights:

- Square-Edge

- Tapered

The report has provided a detailed breakup and analysis of the market based on the form. This includes square-edge and tapered.

Type Insights:

- Standard Plasterboard

- Fire-Resistant Plasterboard

- Thermal Insulated Plasterboard

- Moisture-Resistant Plasterboard

- Sound-Resistant Plasterboard

- Impact-Resistant Plasterboard

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes standard plasterboard, fire-resistant plasterboard, thermal insulated plasterboard, moisture-resistant plasterboard, sound-resistant plasterboard, and impact-resistant plasterboard.

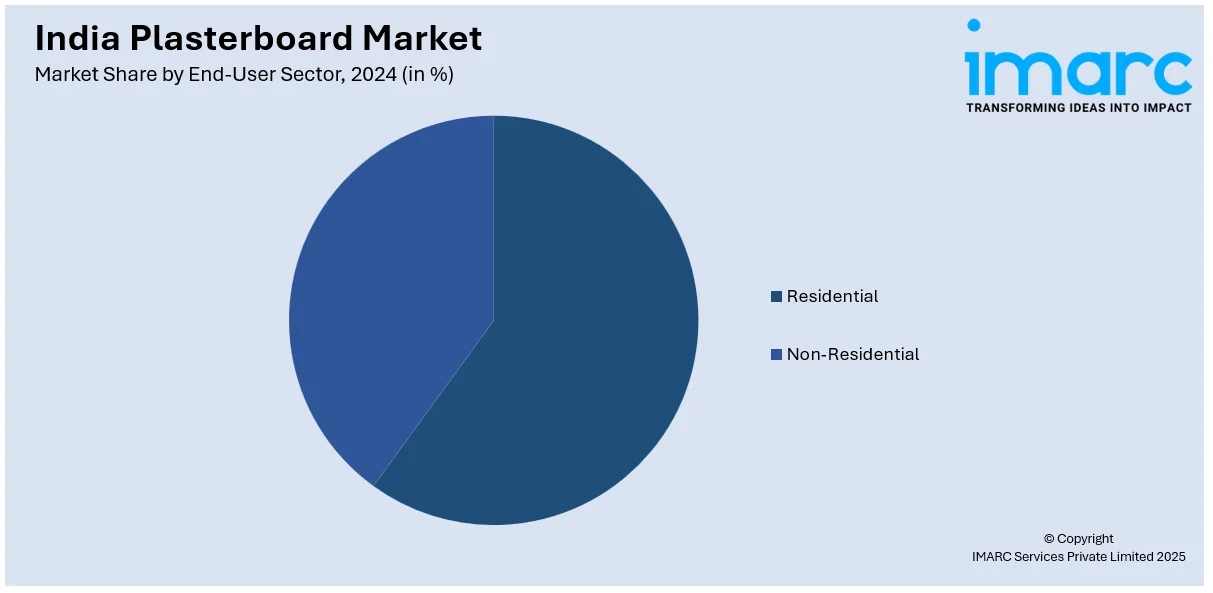

End-User Sector Insights:

- Residential

- Non-Residential

A detailed breakup and analysis of the market based on the end-user sector have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Plasterboard Market News:

- In September 2024, Knauf India, a leading building materials company and part of the global Knauf Group, announced its mandate ensuring all its plasterboard products comply with BIS ISI norms. Among the first in India to meet new regulations, Knauf emphasizes quality and innovation, offering advanced drywall systems, gypsum ceilings, and plasterboards while maintaining global and local standards.

India Plasterboard Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Square Meters |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Square-Edge, Tapered |

| Types Covered | Standard Plasterboard, Fire-Resistant Plasterboard, Thermal Insulated Plasterboard, Moisture-Resistant Plasterboard, Sound-Resistant Plasterboard, Impact-Resistant Plasterboard |

| End-User Sectors Covered | Residential, Non-Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India plasterboard market performed so far and how will it perform in the coming years?

- What is the breakup of the India plasterboard market on the basis of form?

- What is the breakup of the India plasterboard market on the basis of type?

- What is the breakup of the India plasterboard market on the basis of end-user sector?

- What is the breakup of the India plasterboard market on the basis of region?

- What are the various stages in the value chain of the India plasterboard market?

- What are the key driving factors and challenges in the India plasterboard?

- What is the structure of the India plasterboard market and who are the key players?

- What is the degree of competition in the India plasterboard market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India plasterboard market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India plasterboard market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India plasterboard industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)