India Pipes and Fittings Market Size, Share, Trends, and Forecast by Type, Technology, Application, Vertical, and Region, 2026-2034

India Pipes and Fittings Market Overview:

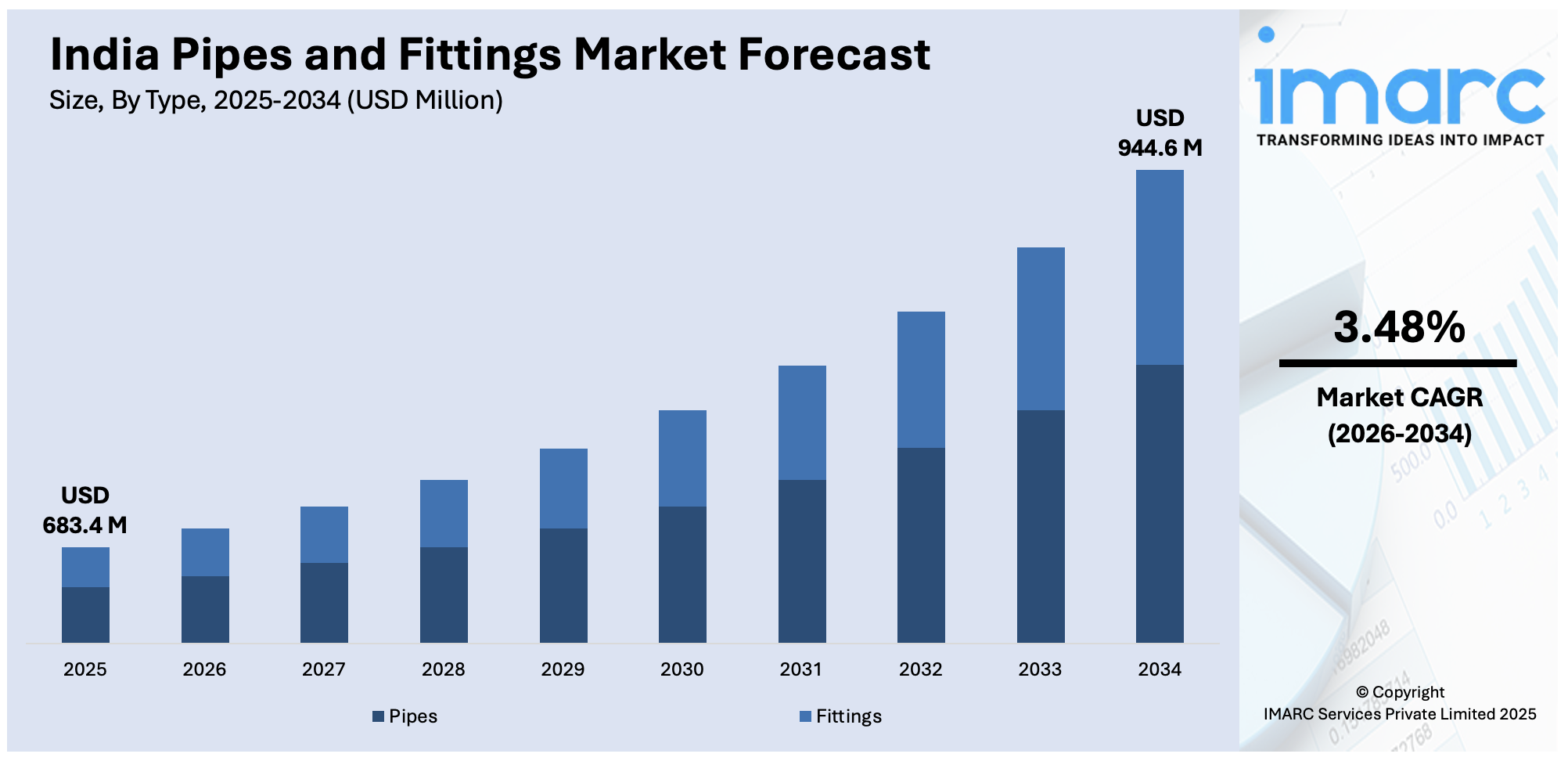

The India pipes and fittings market size reached USD 683.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 944.6 Million by 2034, exhibiting a growth rate (CAGR) of 3.48% during 2026-2034. The market is witnessing significant growth, driven by escalating demand for PVC and CPVC pipes in infrastructure development and growth of PEX and multilayer composite pipes in residential and commercial plumbing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 683.4 Million |

| Market Forecast in 2034 | USD 944.6 Million |

| Market Growth Rate 2026-2034 | 3.48% |

India Pipes and Fittings Market Trends:

Rising Demand for PVC and CPVC Pipes in Infrastructure Development

The India pipes and fittings market is growing at an impressive rate due to rising investments in infrastructure development. Initiatives like the Jal Jeevan Mission and Smart Cities Mission by the government are giving rise to the demand for pipeline solutions that are tough and reasonably priced. The trend is favoring polyvinyl chloride (PVC) and chlorinated polyvinyl chloride (CPVC) for their properties of corrosion resistance, lightweight, and long service life. The use of these materials is stronger in the sectors of water supply, sanitation, and residential where efficiency and durability are critical. For instance, in February 2025, Malpani Pipes announced the expansion of its product portfolio with new PVC pipes and enhanced production capacity, investing ₹3.8 crore in advanced machinery, adding 5,400 MTPA capacity across PVC, HDPE, and MDPE pipes to boost efficiency and growth. Additionally, urbanization and rapid industrial expansion are fueling the need for modern plumbing systems that can withstand varying pressure and temperature conditions. PVC and CPVC pipes are also gaining traction in chemical and industrial applications due to their superior chemical resistance and low maintenance requirements. Manufacturers are expanding their production capacities and investing in technological advancements to develop pipes with improved performance characteristics. The increasing focus on sustainability and recyclable materials is further encouraging the shift toward high-quality polymer-based pipes. With favorable government policies and a strong pipeline of infrastructure projects, the demand for PVC and CPVC pipes is expected to witness steady growth in the coming years.

To get more information on this market Request Sample

Growth of PEX and Multilayer Composite Pipes in Residential and Commercial Plumbing

The Indian pipes and fittings market is witnessing a growing preference for cross-linked polyethylene (PEX) and multilayer composite pipes in residential and commercial applications. These advanced piping solutions are gaining traction due to their flexibility, high-temperature resistance, and superior durability compared to traditional metal and plastic pipes. The shift is largely driven by the increasing adoption of modern plumbing systems in high-rise buildings, hotels, and commercial spaces, where efficiency and leak-proof installation are crucial. For instance, in March 2024, Prince Pipes and Fittings signed an Asset Purchase Agreement with Klaus Waren Fixtures for ₹55 crore, funding it through internal accruals in a two-phase acquisition to strengthen its piping solutions business. PEX pipes are particularly favored in hot and cold water distribution systems, as they offer enhanced resistance to scaling and corrosion. Multilayer composite pipes, which combine the benefits of metal and plastic, provide high strength and pressure resistance, making them ideal for both domestic and industrial applications. Additionally, their lightweight nature and ease of installation reduce labor costs and overall project timelines. The demand for these pipes is further supported by advancements in pipe joining technologies, such as push-fit and crimping systems, which simplify installation and minimize maintenance requirements. As consumer awareness regarding energy-efficient and long-lasting piping systems grows, the adoption of PEX and multilayer composite pipes is expected to accelerate, reshaping the Indian plumbing industry in the coming years.

India Pipes and Fittings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, technology, application, and vertical.

Type Insights:

- Pipes

- Plastic Pipes

- Metallic Pipes

- Others

- Fittings

- Elbow

- Reducer

- Tee Type

- Cross Type

- Coupling

- Unions

- Adaptors

- Valve

- Cap

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes pipes (plastic pipes, metallic pipes, and others) and Fittings (elbow, reducer, tee type, cross type, coupling, unions, adaptors, valve, cap, and others).

Technology Insights:

- Compression Molding

- Injection Molding

- Thermoforming

- Extrusion

- Electro Fusion

- Fabricated

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes compression molding, injection molding, thermoforming, extrusion, electro fusion, fabricated, and others.

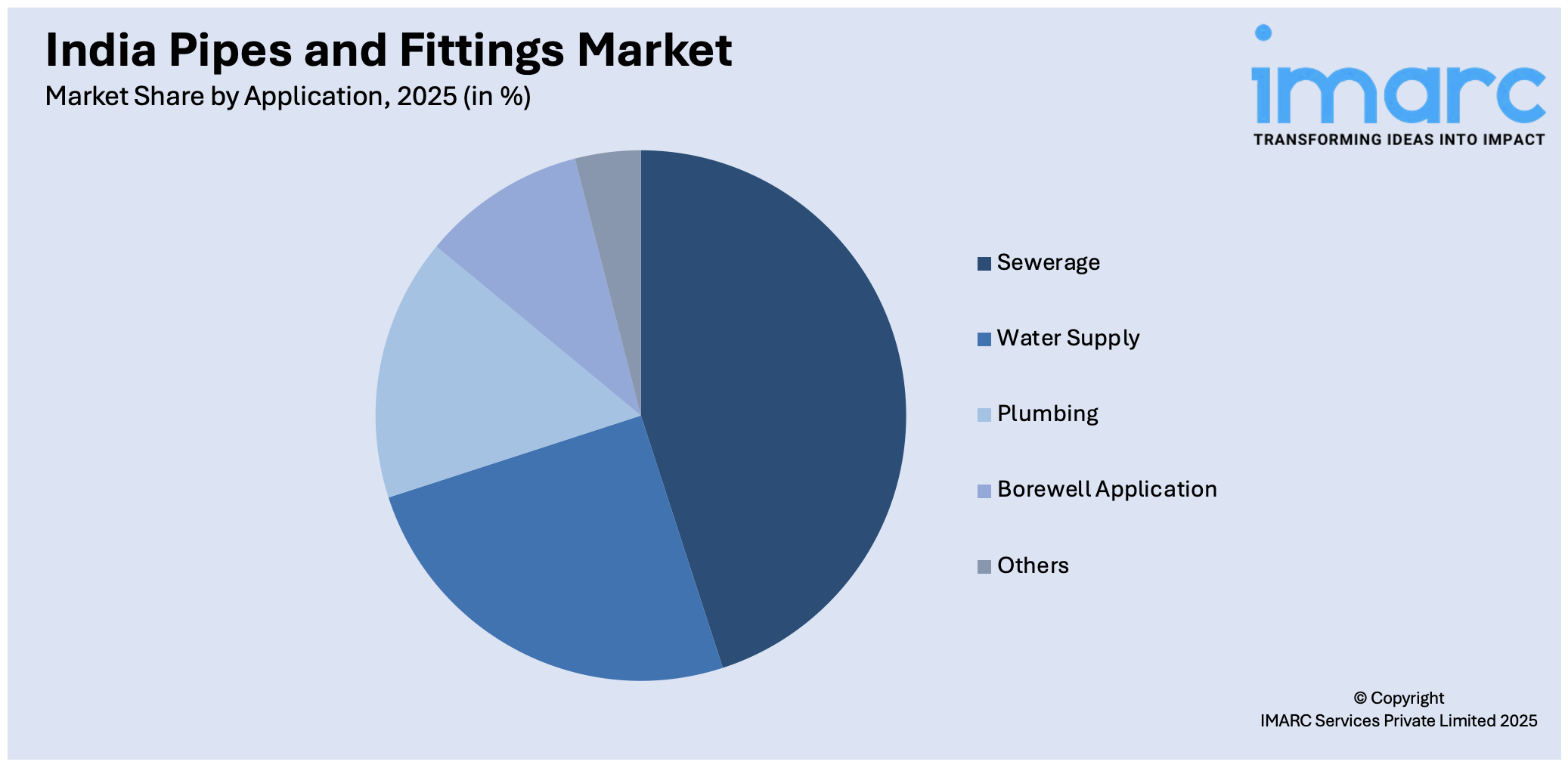

Application Insights:

Access the comprehensive market breakdown Request Sample

- Sewerage

- Water Supply

- Plumbing

- Borewell Application

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes sewerage, water supply, plumbing, borewell application, and others.

Vertical Insights:

- Chemical and Petrochemical

- Residential

- Commercial

- Transportation

- Municipal

- Food and Beverage

- Oil and Gas

- Power

- Process Instrumentation

- Semiconductor

- Irrigation

- HVAC

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes chemical and petrochemical, residential, commercial, transportation, municipal, food and beverage, oil and gas, power, process instrumentation, semiconductor, irrigation, HVAC, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pipes and fittings Market News:

- In October 2024, Jindal SAW reported a 32.5% increase in Q2 profit, reaching ₹5 billion ($59.5 million), driven by stable demand in Middle East and North Africa (MENA) markets and controlled expenses. The company manufactures steel pipes for energy, transportation, and water sectors, strengthening its market position.

India Pipes and fittings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Technologies Covered | Compression Molding, Injection Molding, Thermoforming, Extrusion, Electro Fusion, Fabricated, Others |

| Applications Covered | Sewerage, Water Supply, Plumbing, Borewell Application, Others |

| Verticals Covered | Chemical and Petrochemical, Residential, Commercial, Transportation, Municipal, Food and Beverage, Oil and Gas, Power, Process Instrumentation, Semiconductor, Irrigation, HVAC, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pipes and fittings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pipes and fittings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pipes and fittings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pipes and fittings market in the India was valued at USD 683.4 Million in 2025.

The India pipes and fittings market is projected to exhibit a CAGR of 3.48% during 2026-2034, reaching a value of USD 944.6 Million by 2034.

The market for pipes and fittings in India is prompted by rising urban infrastructure, needs for robust water supply systems, and increase in sanitation coverage under initiatives such as Swachh Bharat Mission. Development in construction, irrigation, and industrial activities, coupled with advancements in PVC (polyvinyl chloride) and HDPE (high-density polyethylene) materials, is fueling the market's long-term growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)