India Pharmaceutical Market Size, Share, Trends and Forecast by Type, Nature, and Region, 2026-2034

India Pharmaceutical Market Summary:

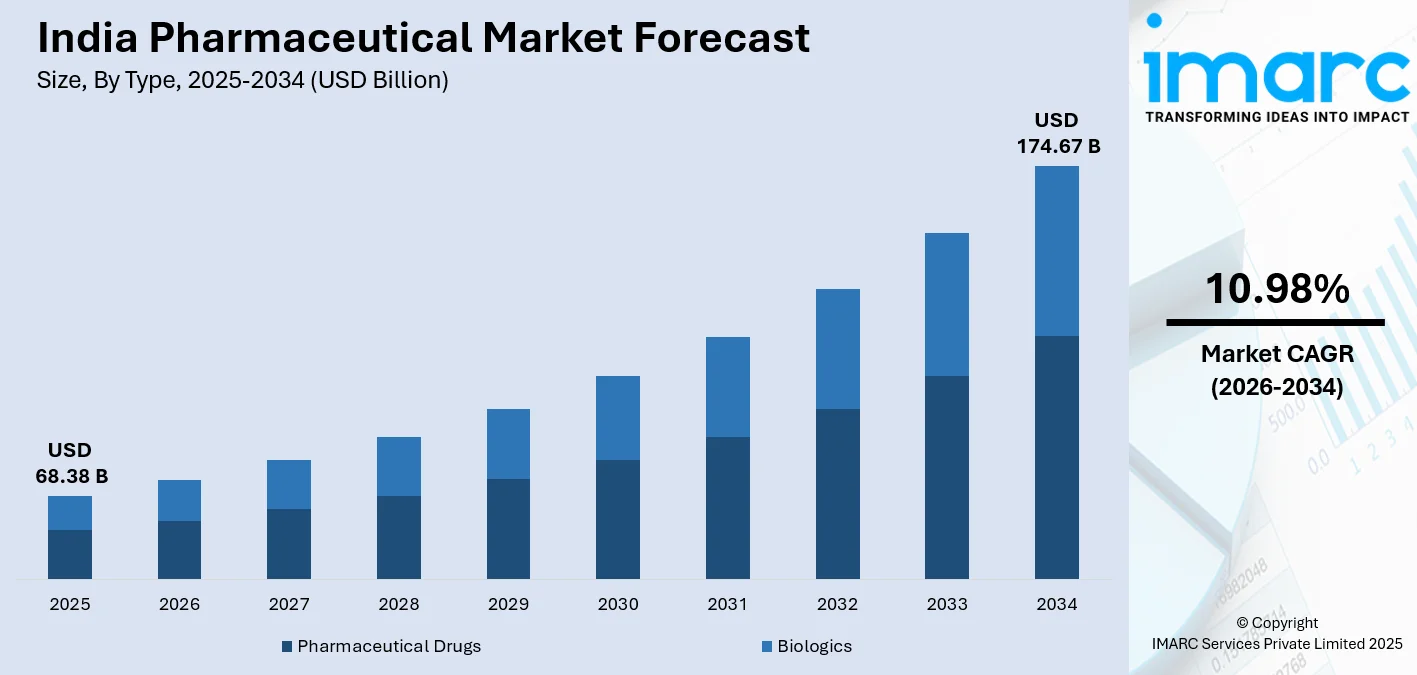

The India pharmaceutical market size was valued at USD 68.38 Billion in 2025 and is projected to reach USD 174.67 Billion by 2034, growing at a compound annual growth rate of 10.98% from 2026-2034.

India's pharmaceutical market stands as a cornerstone of the global healthcare supply chain, recognized worldwide as the "Pharmacy of the World." The market benefits from a robust manufacturing ecosystem, a skilled workforce, and cost-efficient production capabilities that enable affordable medicine delivery both domestically and internationally. The sector is propelled by rising healthcare awareness, expanding health insurance coverage, and the government's strong commitment to strengthening domestic pharmaceutical production through supportive policy frameworks and infrastructure development initiatives.

Key Takeaways and Insights:

- By Type: Pharmaceutical drugs dominate the market with a share of 81% in 2025, driven by the rising prevalence of chronic and acute disorders, enhanced healthcare infrastructure, and strong government initiatives promoting domestic drug manufacturing and innovation.

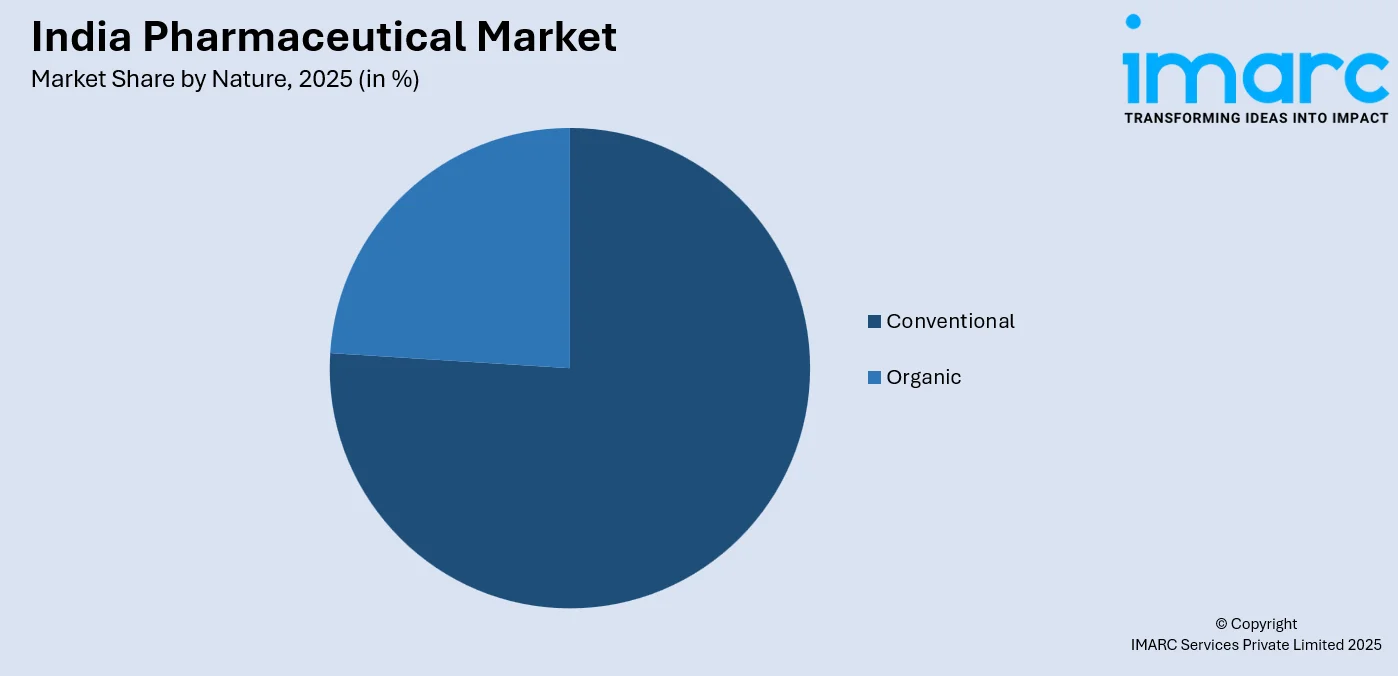

- By Nature: Conventional leads the market with a share of 76% in 2025, owing to established manufacturing processes, widespread physician familiarity, cost advantages, and the extensive distribution network supporting traditional pharmaceutical formulations.

- By Region: North India represents the largest segment with a market share of 30% in 2025, attributed to the concentration of major pharmaceutical manufacturing hubs, well-developed healthcare facilities, higher population density, and strong distribution networks across key states.

- Key Players: The India pharmaceutical market exhibits a moderately fragmented competitive landscape, with leading domestic manufacturers competing alongside multinational corporations. Some of major players operating in the market include, Abbott India Limited, Aurobindo Pharma Limited, Biocon Limited, Cadila Pharmaceuticals, Cipla Limited, Divi's Laboratories Limited, Dr. Reddy’s Laboratories Ltd, GSK plc, Lupin Limited, Mankind Pharma Limited, Novartis India (Novartis AG), Pfizer Inc, Procter & Gamble Health Limited, Sun Pharmaceutical Industries Ltd, and Torrent Pharmaceuticals Ltd.

To get more information on this market Request Sample

The India pharmaceutical market is experiencing robust expansion driven by multiple converging factors that underscore its strategic importance in global healthcare. The country's position as the world's largest producer of generic medicines continues to strengthen, supported by government initiatives such as the Production-Linked Incentive scheme encouraging domestic manufacturing of active pharmaceutical ingredients and finished formulations. Recently, in January 2026, the Delhi High Court authorized Zydus Lifesciences to manufacture and sell a biosimilar version of Bristol Myers Squibb’s cancer drug Nivolumab, enabling broader access to this advanced treatment in India and marking a milestone in the country’s biosimilar landscape. Rising healthcare expenditure, expanding middle-class population, and increasing health insurance penetration are creating sustained demand across therapeutic categories. The sector benefits from skilled scientists and technical professionals enabling continuous innovation. Furthermore, the growing burden of chronic diseases is driving consumption of specialty pharmaceuticals and advanced treatment solutions.

India Pharmaceutical Market Trends:

Growing Focus on Biosimilars and Biologics Development

The India pharmaceutical market is witnessing a significant shift toward biosimilars and biologics as manufacturers leverage their generics expertise to develop complex biological therapies. For example, Biocon Ltd’s biosimilars arm, Biocon Biologics, recently announced it will expand its oncology portfolio with three new biosimilar cancer therapies, including versions of Trastuzumab, Nivolumab, and Pembrolizumab, highlighting Indian firms’ growing role in advanced biologics development. Pharmaceutical companies are increasingly investing in research and development capabilities to produce monoclonal antibodies, therapeutic proteins, and advanced biological treatments. This transition reflects the growing demand for targeted therapies and personalized medicine approaches that offer improved efficacy for chronic and life-threatening conditions.

Expansion of Digital Health Integration and E-Pharmacy Platforms

Digital transformation is reshaping the pharmaceutical distribution landscape in India, with e-pharmacy platforms gaining rapid traction among urban and semi-urban consumers. For instance, Indian e‑pharmacy and telehealth platform Truemeds secured a major funding boost of approximately $85 million in a Series C round led by Accel and Peak XV Partners in 2025, underscoring strong investor confidence in digitally enabled medicine access and telehealth services. The integration of technology across the pharmaceutical value chain is enabling improved supply chain visibility, enhanced patient engagement, and streamlined medication management. Telemedicine adoption and digital prescription systems are creating new pathways for medication access while supporting adherence monitoring and health outcome tracking.

Increasing Emphasis on Self-Reliance in Active Pharmaceutical Ingredients

The pharmaceutical sector is experiencing a strategic realignment toward domestic production of active pharmaceutical ingredients and key starting materials to reduce import dependency. For example, under India’s Production Linked Incentive Scheme for Bulk Drugs and related initiatives, manufacturing capacity has now been created for 26 critical APIs, key starting materials (KSMs), and drug intermediates in the country, resulting in avoided imports worth over ₹1,807 crore as of late 2025, according to the government’s reply in Parliament. Government-supported bulk drug parks and manufacturing clusters are attracting substantial investments from both domestic and international players seeking to establish integrated production facilities. This self-reliance initiative is strengthening supply chain resilience while creating opportunities for backward integration across the pharmaceutical manufacturing ecosystem.

Market Outlook 2026-2034:

The India pharmaceutical market bears a highly promising outlook with robust growth momentum fueled by favorable demographic shift patterns, sound policy support, and steadily growing healthcare infrastructure development across India. The industry is well placed to harness increasing domestic demands alongside mounting export demands for highly regulated markets across the globe. Aggressive investments will be made in research and development competencies, manufacturing upgrades, technology adoption, and human resources development expected to improve industry competencies substantially over the next few years. The market generated a revenue of USD 68.38 Billion in 2025 and is projected to reach a revenue of USD 174.67 Billion by 2034, growing at a compound annual growth rate of 10.98% from 2026-2034.

India Pharmaceutical Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Pharmaceutical Drugs | 81% |

| Nature | Conventional | 76% |

| Region | North India | 30% |

Type Insights:

- Pharmaceutical Drugs

- Cardiovascular Drugs

- Dermatology Drugs

- Gastrointestinal Drugs

- Genito-Urinary Drugs

- Hematology Drugs

- Anti-Infective Drugs

- Metabolic Disorder Drugs

- Musculoskeletal Disorder Drugs

- Central Nervous System Drugs

- Oncology Drugs

- Ophthalmology Drugs

- Respiratory Diseases Drugs

- Biologics

- Monoclonal Antibodies (MAbS)

- Therapeutic Proteins

- Vaccines

The pharmaceutical drugs dominate with a market share of 81% of the total India pharmaceutical market in 2025.

The pharmaceutical drugs segment maintains its leading position in the India pharmaceutical market, serving as the foundation of healthcare delivery across the country. This segment encompasses a diverse portfolio of therapeutic categories addressing both acute and chronic health conditions prevalent among the Indian population. For example, Alembic Pharmaceuticals posted a 20.4% rise in second‑quarter profit in October 2025, driven by strong demand for its generic drugs in both domestic and export markets, highlighting robust performance within the core drug segment. The dominance of pharmaceutical drugs is reinforced by their established efficacy profiles, widespread physician adoption, and extensive availability through retail pharmacy networks spanning urban and rural areas.

Growth in this segment is actively propelled by rising healthcare awareness among the general population, increasing diagnosis rates for previously undetected medical conditions, and expanding healthcare access through comprehensive government health programs and welfare initiatives. The segment significantly benefits from continuous formulation innovations, substantially enhanced manufacturing capabilities, and robust regulatory frameworks that ensure stringent product quality and safety standards supporting both strong domestic consumption and rapidly growing international export opportunities.

Nature Insights:

Access the comprehensive market breakdown Request Sample

- Organic

- Conventional

The conventional leads with a share of 76% of the total India pharmaceutical market in 2025.

The conventional pharmaceutical segment commands the largest share of the India pharmaceutical market, reflecting the established nature of traditional drug manufacturing and distribution systems. This segment benefits from well-optimized production processes, economies of scale in manufacturing, and comprehensive regulatory pathways that facilitate efficient product approvals and market access. Conventional pharmaceuticals remain the backbone of affordable healthcare delivery, offering cost-effective treatment solutions for a broad spectrum of medical conditions.

The segment's sustained market leadership is strongly supported by extensive infrastructure investments, skilled workforce availability, and robust distribution networks that ensure comprehensive medication accessibility across diverse geographic regions throughout the country. Leading pharmaceutical manufacturers continue to actively enhance conventional drug portfolios through advanced formulation improvements, extended-release technologies, and innovative combination therapies that significantly improve patient convenience and long-term treatment adherence while maintaining highly competitive pricing structures in the domestic market.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 30% share of the total India pharmaceutical market in 2025.

The region of North India has developed as a prominent market for the pharmaceutical sector owing to the presence of a considerable number of people in this region. In addition to this, it has a well-developed infrastructure for the production of pharmaceuticals. The presence of prominent distributing points for the pharmaceutical market, a well-developed network of retail pharmacies, and efficient connectivity have escalated the development of the pharmaceutical market in this region. The expenditure patterns of the people belonging to the Indian healthcare sector are inclined towards preventive measures.

The pharmaceutical market in this region receives an increased boost in terms of growth, thanks to initiatives by the governments to ensure improved health care delivery to their populations via comprehensive health care initiatives and health care insurance programs. The established manufacturing clusters in some of this region’s states, including Himachal Pradesh, Uttarakhand, among others, play an important role in promoting this sector in this region, with many large pharmaceutical manufacturers showing significant interest to invest in these hubs.

Market Dynamics:

Growth Drivers:

Why is the India Pharmaceutical Market Growing?

Rising Burden of Chronic Diseases and Lifestyle Disorders

The India pharmaceutical market is experiencing significant growth impetus from the escalating prevalence of chronic diseases including diabetes, cardiovascular conditions, respiratory ailments, and cancer. Changing lifestyle patterns characterized by sedentary behavior, dietary modifications, and urbanization are contributing to rising incidence rates of non-communicable diseases across demographic segments. According to recent industry data, chronic therapies such as cardiac and antidiabetic medicines continue to lead volume and value growth in the Indian pharma market, with major companies like Sun Pharma, Dr. Reddy’s, and Cipla reporting strong performance in these categories in 2025, reflecting sustained demand for long‑term treatment solutions. This epidemiological transition is creating sustained demand for therapeutic interventions spanning prevention, treatment, and disease management categories. Healthcare providers are witnessing increasing patient volumes requiring long-term medication regimens that drive recurring pharmaceutical consumption.

Government Support Through Policy Initiatives and Healthcare Programs

Government commitment to strengthening domestic pharmaceutical manufacturing and expanding healthcare access is providing substantial growth impetus to the India pharmaceutical market. Strategic policy frameworks including Production-Linked Incentive schemes are attracting investments in active pharmaceutical ingredient production, formulation manufacturing, and research and development infrastructure. For example, in May 2025 the Union Government invited fresh applications under the PLI scheme for bulk drugs, focusing on 11 key active pharmaceutical ingredients, key starting materials, and drug intermediates to further expand domestic API production and reduce import dependence, signalling continued policy support for local manufacturing expansion. Healthcare programs such as Ayushman Bharat are expanding insurance coverage to economically disadvantaged population segments, thereby enhancing medication affordability and accessibility. Regulatory reforms aimed at streamlining drug approval processes and strengthening quality standards are improving market efficiency while supporting international competitiveness.

Expanding Healthcare Infrastructure and Accessibility

The expansion of healthcare infrastructure across India is creating new growth opportunities for the pharmaceutical market by improving medication accessibility and treatment coverage. Investments in hospital networks, primary healthcare centers, and diagnostic facilities are enhancing disease detection rates and treatment initiation, thereby driving pharmaceutical consumption. For example, Torrent Group, better known for its pharmaceutical business, has announced plans to build a 500‑plus‑bed multispecialty hospital in Ahmedabad with an investment of over ₹750 crore, reflecting how pharma companies are directly participating in broader healthcare delivery infrastructure. The proliferation of retail pharmacy outlets, including organized pharmacy chains and e-pharmacy platforms, is improving last-mile medication delivery across urban and rural areas. Healthcare workforce development through medical education expansion and skill enhancement programs is strengthening prescription generation capacity and clinical care quality.

Market Restraints:

What Challenges the India Pharmaceutical Market is Facing?

Price Control Regulations and Margin Pressures

The India pharmaceutical market faces challenges from regulatory price controls imposed on essential medicines through the National List of Essential Medicines framework. These price ceiling mechanisms, while ensuring medication affordability for consumers, constrain revenue growth potential and limit profitability margins for pharmaceutical manufacturers. Companies must navigate pricing constraints while managing rising input costs, quality compliance investments, and research expenditures.

Dependence on Imported Active Pharmaceutical Ingredients

The pharmaceutical industry continues to be fraught with supply chain vulnerabilities emanating from an over-reliance on imported active pharmaceutical ingredients and key starting materials from exogenous sources. Manufacturing under such dependence poses risks stemming from currency fluctuations, the threat of supply disruptions, and geopolitics that could unpredictably put continuity and cost structures in jeopardy. Pursuing active pharmaceutical ingredient production within the country is ongoing but needs consistent investments and will take time for actual independence.

Regulatory Compliance and Quality Assurance Requirements

Stringent regulatory requirements from domestic and international regulatory authorities pose ongoing challenges for pharmaceutical manufacturers in maintaining compliance standards. Companies must invest substantially in quality management systems, facility upgrades, and documentation processes to meet evolving regulatory expectations. Regulatory observations and compliance issues can result in operational disruptions, market access restrictions, and reputational impacts that affect business performance.

Competitive Landscape:

The Indian pharmaceutical industry is found to have a moderately fragmented level of competition, including prominent domestic players, MNCs, and new entrants specializing in specific therapy areas and geography. Degree of competition is largely influenced by parameters such as product portfolio diversity, production capacities, distribution network, research and development strength, and regulatory compliance record. The key players are also taking steps to expand through capacity augmentation, geographic extension, new therapeutic area development, and foraying into international markets. Competition level also incorporates a mix of generics competition based on pricing, and differentiated positioning and development by key players through increased investments on branding, medical and patient engagement. Formulation and process development strength, particularly on quality parameters, is turning out to be a new area for differentiation.

Some of the key players include:

- Abbott India Limited

- Aurobindo Pharma Limited

- Biocon Limited

- Cadila Pharmaceuticals

- Cipla Limited

- Divi's Laboratories Limited

- Dr. Reddy’s Laboratories Ltd

- GSK plc

- Lupin Limited

- Mankind Pharma Limited

- Novartis India (Novartis AG)

- Pfizer Inc

- Procter & Gamble Health Limited

- Sun Pharmaceutical Industries Ltd

- Torrent Pharmaceuticals Ltd

Recent Developments:

- In December 2025, Danish pharma giant Novo Nordisk has officially launched Ozempic, a once‑weekly injectable for type‑2 diabetes, in India, offering tailored pricing for patients with doses available in pre‑filled pens. The move expands treatment options in the country’s growing diabetes market.

India Pharmaceutical Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Natures Covered | Organic, Conventional |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Abbott India Limited, Aurobindo Pharma Limited, Biocon Limited, Cadila Pharmaceuticals, Cipla Limited, Divi's Laboratories Limited, Dr. Reddy’s Laboratories Ltd, GSK plc, Lupin Limited, Mankind Pharma Limited, Novartis India (Novartis AG), Pfizer Inc, Procter & Gamble Health Limited, Sun Pharmaceutical Industries Ltd, Torrent Pharmaceuticals Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India pharmaceutical market size was valued at USD 68.38 Billion in 2025.

The India pharmaceutical market is expected to grow at a compound annual growth rate of 10.98% from 2026-2034 to reach USD 174.67 Billion by 2034.

The pharmaceutical drugs dominated the market with a share of 81%, driven by rising healthcare awareness, increasing prevalence of chronic diseases, expanded healthcare infrastructure, and strong government support for domestic pharmaceutical manufacturing.

Key factors driving the India pharmaceutical market include the rising burden of chronic diseases, government support through Production-Linked Incentive schemes and healthcare programs, expanding healthcare infrastructure, growing middle-class population, and increasing health insurance penetration.

Major challenges include price control regulations affecting profitability margins, dependence on imported active pharmaceutical ingredients creating supply chain vulnerabilities, stringent regulatory compliance requirements, intense market competition, and currency fluctuation risks impacting export competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)