India Pharmaceutical Contract Packaging Market Size, Share, Trends and Forecast by Industry, Type, Packaging, and Region, 2025-2033

India Pharmaceutical Contract Packaging Market Size and Share:

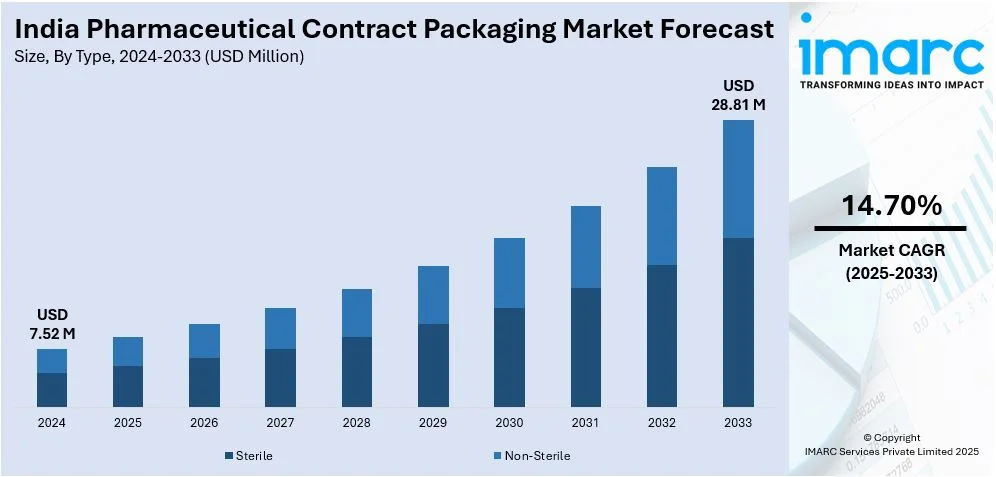

The India pharmaceutical contract packaging market size was valued at USD 7.52 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.81 Million by 2033, exhibiting a CAGR of 14.70% from 2025-2033. The Indian pharmaceutical contract packaging market share is expanding, driven by rising innovations such as automation, robotics, and digital technologies, increasing demand for biopharmaceuticals and specialty medicines, and heightened digital transformation of retail channels and the increased adoption of online platforms for pharmaceutical sales, packaging solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.52 Million |

|

Market Forecast in 2033

|

USD 28.81 Million |

| Market Growth Rate (2025-2033) | 14.70% |

The Indian pharmaceuticals contract packaging industry has witnessed notable growth owing to the growing healthcare industry. Outsourcing is becoming the main trend in the Indian pharmaceutical sector. Pharmaceutical firms are continuously seeking outside vendors for domestic and international standard packaging solutions. Outsourcing has numerous benefits such as cost reduction, lower capital outlays, and enabling firms to concentrate on their core competencies like research or marketing. Additionally, the increasing popularity of e-commerce websites and the demand for pharmaceutical products in the nation is motivating drug firms to implement flexible and scalable packaging systems.

To get more information on this market, Request Sample

The pharmaceutical contract packaging sector in India has experienced remarkable technological progress. Pharmaceutical items are becoming more functional and aesthetically pleasing due to technological developments in materials, technology, and design. The need for eco-friendly packaging, tamper-proof sealing, and child-resistant packaging has grown as patient safety concerns have grown. Additionally, manufacturing processes have been improved by the use of automation and robotics in packaging lines, increasing accuracy, speed, and efficiency. Additionally, especially in sterile settings, automated technologies guarantee higher standards of hygiene and lessen human mistake. Traceability, anti-counterfeiting measures, and stock management are being improved by digital printing technologies and intelligent packaging solutions, such as radio frequency identification (RFID)-enabled and intelligent labels, which are becoming more popular in the Indian market.

India Pharmaceutical Contract Packaging Market Trends:

Technological Advancements in Packaging Solutions

Technology developments in packaging solutions are leading the India market. In the last few years, automation, robotics, and digital technologies have revolutionized the pharma packaging industry in a drastic way. Apart from that, the majority of major Indian pharma giants installed automatic packaging lines along with cutting-edge packaging material for enhancing the amount of efficiency and quality while packing. For example, the technology in smart packaging solutions such as RFID packaging, offers better tracking of products, anti-counterfeit capabilities, and inventory management, which is especially crucial for the domestic as well as international marketplaces. In 2025, Marks Print, an Indore-based tags and labels supplier, has achieved a significant milestone by introducing its cutting-edge RFID tags and labels. These new technologies are offered to various industries, including textiles, pharmaceuticals, personal care, and the automobile sector.

Growing Demand for Biopharmaceuticals and Specialty Medicines

The increasing demand for biopharmaceuticals and specialty medicines is contributing to the India pharmaceutical contract packaging market growth. Biopharmaceuticals, including biologics, biosimilars, and monoclonal antibodies, have special packaging solutions owing to the complexity and sensitivity of such products. Such products are required to have controlled temperature conditions like refrigerated or cryogenic packaging for stability and potency maintenance. The increasing incidence of chronic conditions like cancer, autoimmune disorders, and diabetes is likely to fuel demand for such advanced drugs, and in turn, has prompted pharma manufacturers to depend on professional contract packagers who possess the ability to process these fragile drugs. As there is more demand for biologics, Indian contract packagers are developing capabilities to process temperature-sensitive packaging. The IMARC Group forecasts that the Indian biologics industry will likely become USD 24.6 Billion in 2033.

Expansion of E-commerce and Online Pharmaceutical Sales

The rise of e-commerce and online pharmaceutical sales is another factor driving the India pharmaceutical contract packaging market demand. As retail channels undergo digital transformation and the use of online platforms for pharmaceutical sales rises, packaging solutions must be refined for direct-to-consumer (D2C) distribution. E-commerce platforms are experiencing considerable expansion, and pharmaceutical firms are modifying their packaging approaches to address the demands of online sales. This encompasses packaging that is sturdier, safer, and capable of enduring extended transportation periods. Moreover, the rise in e-commerce demands has resulted in a greater requirement for packaging that is both easy to use and adheres to regulations concerning labeling and product details. In 2025, Amazon Pharmacy is improving medication access across India by connecting customers with licensed vendors through its online platform. Clients are able to buy prescription drugs, over-the-counter medications, medical equipment, and supplements, with home delivery services available in all serviceable pin codes. Same-day delivery can be accessed in 23 locations, covering urban regions and Tier 2 cities. This transition to e-commerce-based pharmaceutical sales is anticipated to keep driving the need for specialized packaging solutions.

India Pharmaceutical Contract Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India pharmaceutical contract packaging market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on industry, type, and packaging.

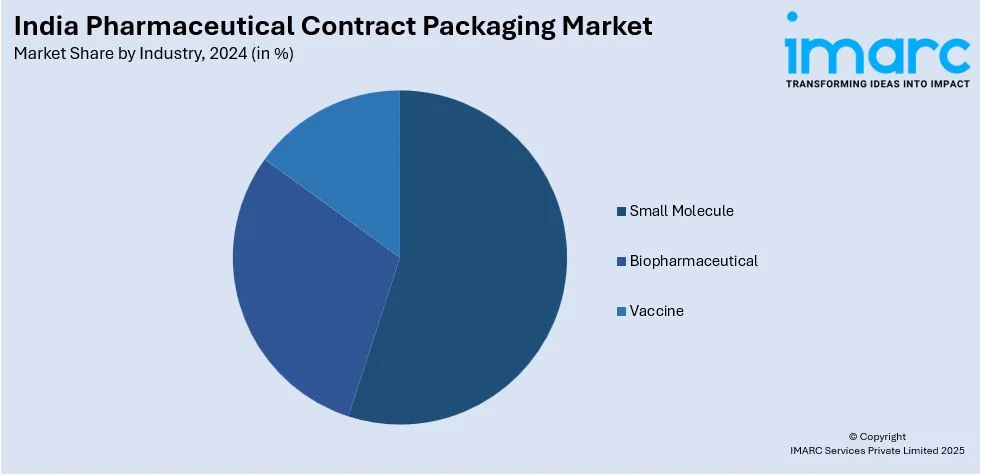

Analysis by Industry:

- Small Molecule

- Biopharmaceutical

- Vaccine

Small molecules account for the largest portion. Due to the extensive usage of both traditional pharmaceutical pharmaceuticals and generic versions, small molecules constitute one of the most established and sizable segments of the industry. Low-molecular-weight substances used in a variety of treatments, such as cancer medicines and antibiotics, are commonly referred to as small molecules. Strict regulatory requirements must be met by small molecule packaging solutions in order to guarantee product stability and safety, resulting in a positive pharmaceutical contract packaging market outlook. Packaging for injectables, topical drugs, capsules, and tablets falls under this category; these products are frequently seen in blister packs, bottles, and vials. India is a global leader in the development of generic drugs, which has increased demand for small molecule packaging in the nation. The contract packaging industry for small molecules is expected to grow as the generics market expands and pharmaceutical companies look for high-quality, reasonably priced packaging that conforms to international regulatory standards.

Analysis by Type:

- Sterile

- Non-Sterile

Sterile packaging stands as the biggest and most important part of the pharmaceutical contract packaging market. It is vital for products that need strict controls against contamination. People use this type of packaging for products that must stay free from microbes, like shots, biologics, and medical tools. It keeps the contents safe during shipping and storage, which is vital for items sensitive to their surroundings. The growth in this area comes from more people needing injectable drugs, vaccines, and other products given through needles. With advancements in sterilization technologies and packaging materials, sterile packaging has become more efficient, meeting regulatory standards set by global health authorities. As more surgeries happen, biologics are made and the need for ways to control temperature during shipping rises. On top of that, people are more worried about keeping patients safe and making sure drugs work well in clean environments. This has led to a higher demand for sterile packaging solutions.

Analysis by Packaging:

- Plastic Bottles

- Caps and Closures

- Blister Packs

- Prefilled Syringes

- Parenteral Vials and Ampoules

- Others

Plastic bottles are the largest market segment due to their strength, flexibility, and affordability. Plastic bottles are widely used for packaging oral drugs, including liquids, syrups, suspensions, and other over-the-counter products. The extensive use of plastic bottles is due to their ability to be molded into various shapes and sizes, which offers flexibility in packaging design. Plastic bottles also provide excellent protection against environmental factors such as humidity and air, helping to maintain the quality of the content. Increased demand for liquid dosage forms within the pharmaceutical industry, as well as advances in plastic materials like polyethylene terephthalate (PET) and high-density polyethylene (HDPE), have driven the growth of this market. Further, plastic bottles are lightweight, making them affordable to produce and transport.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

South India has become an important area for the pharmaceutical contract packaging sector, owing to its robust pharmaceutical manufacturing base, talent, and higher production standards. Tamil Nadu, Karnataka, Telangana, and Andhra Pradesh are the states that contain multiple pharmaceutical facilities, contract packaging facilities, and R&D centers. In addition, South India is aided by increasing awareness of sustainable packaging practices since the region experiences higher consumer demand for green alternatives. As the pharmaceutical industry in South India expands with domestic demand and international exports, the need for customized packaging services such as sterile and non-sterile packaging will increase significantly. As reported in a news article on Pharmabiz.com, Karnataka and Bengaluru are also emerging as key pharmaceutical and biotechnology manufacturing and process engineering hubs, establishing themselves as key global market players. As part of this endeavor, Bengaluru will also see the hosting of the PharmaTech and Lab Tech Expo 2025, a majestic three-day exhibition from January 8 to 10, 2025, at the Bengaluru International Exhibition Centre (BIEC).

Competitive Landscape:

A key method is to invest in technological innovations. Top contract packaging companies are incorporating automation and robotics into their manufacturing processes to enhance efficiency, minimize errors, and decrease labor expenses. Automated packaging systems, designed for rapid production and accurate packaging, are especially advantageous for managing significant quantities of products, including generics and over-the-counter (OTC) drugs. For example, in 2023, the Navi Mumbai-based manufacturer of automated machines and complete lines serving the pharmaceutical industry has modified its case-packing configuration. Moreover, the use of digital printing technologies is increasingly prevalent, enabling more adaptable and economical options for labeling and product personalization. Packaging manufacturers are also utilizing technologies such as RFID, serialization, and tamper-evident characteristics to meet the increasing need for secure and compliant packaging options, especially for biologics, vaccines, and high-value drugs.

The report provides a comprehensive analysis of the competitive landscape in the India pharmaceutical contract packaging market with detailed profiles of all major companies.

Latest News and Developments:

- January 2023: Berry Global Group announced its plans to start manufacturing at its new production facility and healthcare center of excellence in Bangalore, India ahead of summer this year. The fresh greenfield expansion initiative will offer packaging solutions for products in the inhalation, nasal, ophthalmic, dispensing, and self-injection sectors.

- October 2024: Uhlmann India celebrated the opening of its new office by organizing an in-house event with industry leaders, partners, and customers, showcasing progress in blister packaging technology and localization initiatives.

- December 2024: ACG launched ADAPT X feeder at CpHI & PMEC 2024 in Delhi. Created to manage intricate and unconventional tablet forms, the ADAPT X feeder provides versatility for various packaging requirements. Designed for large-scale production, the feeder reaches speeds of 13.2 m/min on rotary sealing or 60 cycles per minute on intermittent systems. It additionally provides tool-free changeovers and accurate product positioning, which aids in reducing downtime and enhancing output on pharmaceutical packaging lines.

- December 2023: Berry Global showcased its commitment to providing innovative, patient-focused packaging, dispensing solutions, and drug delivery devices for India and the South Asia area at this year's CPHI India exhibition.

India Pharmaceutical Contract Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Industries Covered | Small Molecule, Biopharmaceutical, Vaccine |

| Types Covered | Sterile, Non-Sterile |

| Packagings Covered | Plastic Bottles, Caps and Closures, Blister Packs, Prefilled Syringes, Parenteral Vials and Ampoules, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pharmaceutical contract packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India pharmaceutical contract packaging market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pharmaceutical contract packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India pharmaceutical contract packaging market was valued at USD 7.52 Million in 2024.

The growth of the India pharmaceutical contract packaging market is driven by technological advancements in automation, robotics, and digital solutions, the increasing demand for biopharmaceuticals and specialty medicines, and the rapid expansion of e-commerce platforms for pharmaceutical sales.

The India Pharmaceutical Contract Packaging market is projected to exhibit a CAGR of 14.70% during 2025-2033, reaching a value of USD 28.81 Million by 2033.

The small molecule segment accounted for the largest share in the India pharmaceutical contract packaging market, driven by the widespread use of generics and traditional pharmaceutical products, such as antibiotics, cancer therapies, and other treatments in tablet, capsule, and injectable forms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)