India Petroleum Coke Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Petroleum Coke Market Overview:

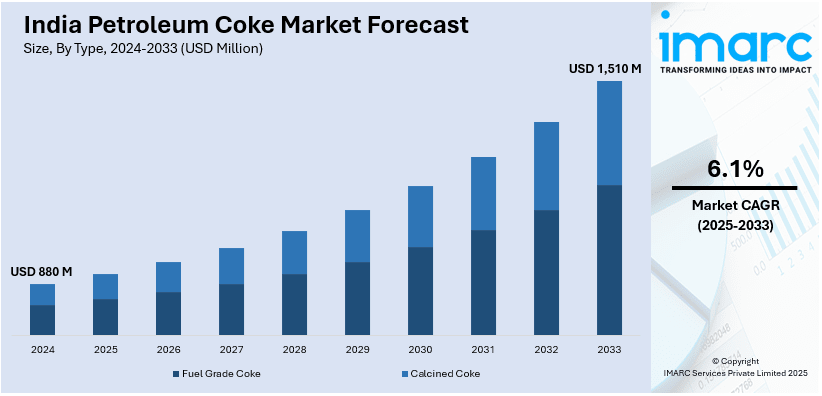

The India petroleum coke market size reached USD 880 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,510 Million by 2033, exhibiting a growth rate (CAGR) of 6.1% during 2025-2033. The market is witnessing significant growth, driven by an increasing demand for petroleum coke in cement and power generation industries and rising environmental regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 880 Million |

| Market Forecast in 2033 | USD 1,510 Million |

| Market Growth Rate (2025-2033) | 6.1% |

India Petroleum Coke Market Trends:

Increasing Demand for Petroleum Coke in Cement and Power Generation Industries

The Indian petroleum coke market is witnessing significant demand growth from the cement and power generation industries. Petroleum coke, known for its high calorific value and cost-effectiveness compared to traditional fuels, is increasingly being used as an alternative to coal. The cement sector, one of the largest consumers of petroleum coke in India, relies on it for clinker production due to its lower ash content and ability to provide consistent energy output. For instance, as of January 2025, India has 19 PSU refineries, 3 private-sector refineries, and 1 joint venture refinery, with the country's refining capacity reaching 256.816 MMTPA in April 2024. Similarly, power plants are shifting towards petroleum coke as an economical fuel source amid rising coal prices and supply constraints. Government policies promoting domestic energy security and reducing dependency on imported coal further contribute to this trend. However, environmental concerns regarding high sulfur emissions from petroleum coke combustion are prompting regulatory interventions. The introduction of stricter emission norms has led to increased investments in flue gas desulfurization (FGD) systems and cleaner combustion technologies. Companies in the sector are adapting to these changes by exploring desulfurization processes and alternative uses for petroleum coke, such as gasification for hydrogen production. As industries continue to prioritize cost-efficient energy sources, the demand for petroleum coke in cement and power generation is expected to remain strong in the coming years.

To get more information on this market, Request Sample

Rising Environmental Regulations

The Indian petroleum coke market is experiencing regulatory shifts due to increasing environmental concerns over air pollution and carbon emissions. Petroleum coke, particularly high-sulfur variants, contributes to significant sulfur dioxide (SO₂) emissions when burned, prompting stricter emission control measures by the government. In recent years, authorities have imposed limitations on the use of high-sulfur petroleum coke in certain industrial applications, restricting its usage in sensitive Indias with high pollution levels. The Supreme Court of India has played a crucial role in regulating petroleum coke imports and domestic consumption, particularly in the National Capital India (NCR) and other high-pollution zones. For instance, in March 2024, DGFT announced amending the import policy for Raw Petroleum Coke (RPC) and Calcined Petroleum Coke (CPC), allowing 1.9 million MTs of RPC for CPC manufacturing and 0.5 million MTs of CPC for the aluminum industry in FY 2024-25, with future adjustments based on domestic needs and usage restrictions. Industrial users are required to comply with sulfur emission standards and adopt pollution control technologies, such as scrubbers and FGD systems, to mitigate environmental impact. These regulatory challenges have driven market players to explore alternative fuel sources and invest in desulfurization technologies. Additionally, the push for sustainable energy solutions is encouraging research into the gasification of petroleum coke to produce cleaner fuels like syngas and hydrogen. As environmental policies tighten, market participants must navigate evolving regulations while balancing operational efficiency and compliance with sustainability standards.

India Petroleum Coke Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application

Type Insights:

- Fuel Grade Coke

- Calcined Coke

The report has provided a detailed breakup and analysis of the market based on the type. This includes fuel grade coke and calcined coke.

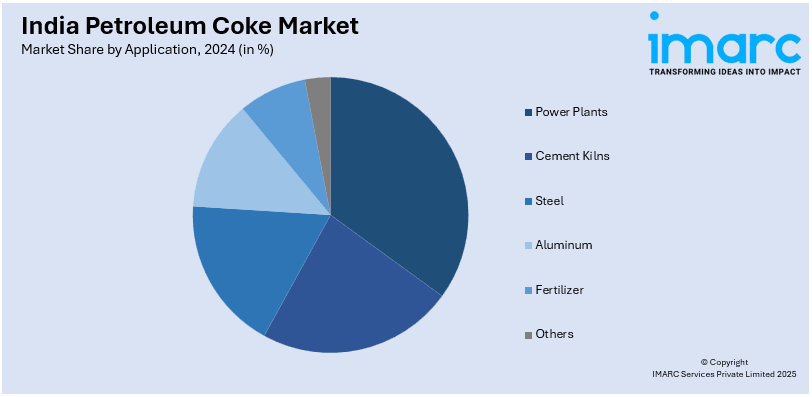

Application Insights:

- Power Plants

- Cement Kilns

- Steel

- Aluminum

- Fertilizer

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power plants, cement kilns, steel, aluminum, fertilizer, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Petroleum Coke Market News:

- In December 2024, India’s Bharat Petroleum Corp (BPCL) announced its plans to expand refining capacity from 35.3 million tpy to 45 million tpy by 2028. BPCL will increase its Kochi refinery to 18 million tpy, Mumbai refinery to 16 million tpy, and Bina refinery to 11.3 million tpy by May 2028.

India Petroleum Coke Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fuel Grade Coke, Calcined Coke |

| Applications Covered | Power Plants, Cement Kilns, Steel, Aluminum, Fertilizer, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Speciality Store, Online, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India petroleum coke market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India petroleum coke market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India petroleum coke industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The petroleum coke market in India was valued at USD 880 Million in 2024.

The India petroleum coke market is projected to exhibit a CAGR of 6.1% during 2025-2033, reaching a value of USD 1,510 Million by 2033.

Key factors driving the India petroleum coke market include rising demand from the aluminum, cement, and power industries, increased industrial innovation, and growing infrastructure development. Additionally, the shift towards cost-effective and high-calorific value fuels, along with favorable government policies supporting energy diversification, further contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)