India Pet Food Market Size, Share, Trends and Forecast by Pet Type, Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2026-2034

India Pet Food Market Summary:

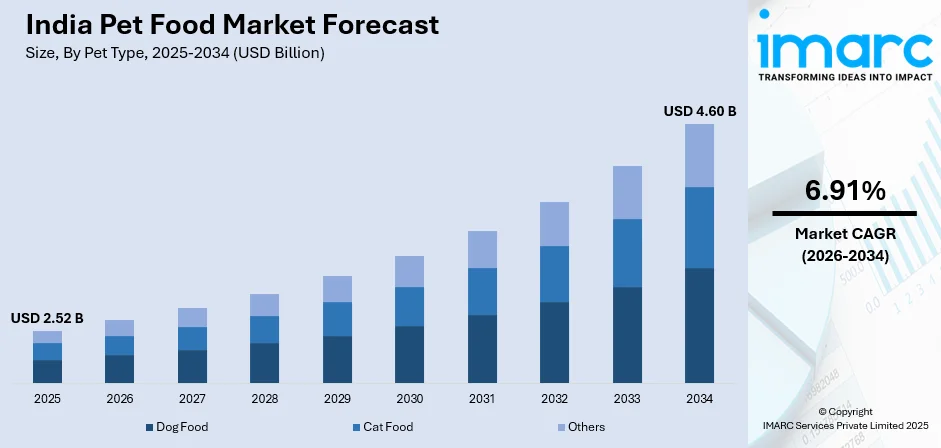

The India pet food market size was valued at USD 2.52 Billion in 2025 and is projected to reach USD 4.60 Billion by 2034, growing at a compound annual growth rate of 6.91% from 2026-2034.

The India pet food market is growing steadily, supported by rising urban pet adoption and increasing awareness of pet health and nutrition. Higher disposable incomes allow pet owners to spend more on premium and specialized food products. Expanding online and offline retail channels are improving accessibility, while pet humanization is driving demand for functional, organic, and value-added nutrition, ensuring sustained market growth during the forecast period across key consumer segments.

Key Takeaways and Insights:

- By Pet Type: Dog food dominates the market with a share of 85.6% in 2025, driven by the high prevalence of dog ownership across Indian households and established feeding routines that favor commercial nutrition options.

- By Product Type: Dry pet food leads the market with a share of 89.6% in 2025, attributed to its convenience, affordability, extended shelf life, and wide availability across various retail channels.

- By Pricing Type: Mass products represent the largest segment with a market share of 70% in 2025, reflecting price-conscious consumer preferences and the accessibility requirements of a developing pet food market.

- By Ingredient Type: Animal derived ingredients dominate with a share of 80% in 2025, owing to their high protein content, palatability, and alignment with natural dietary requirements of companion animals.

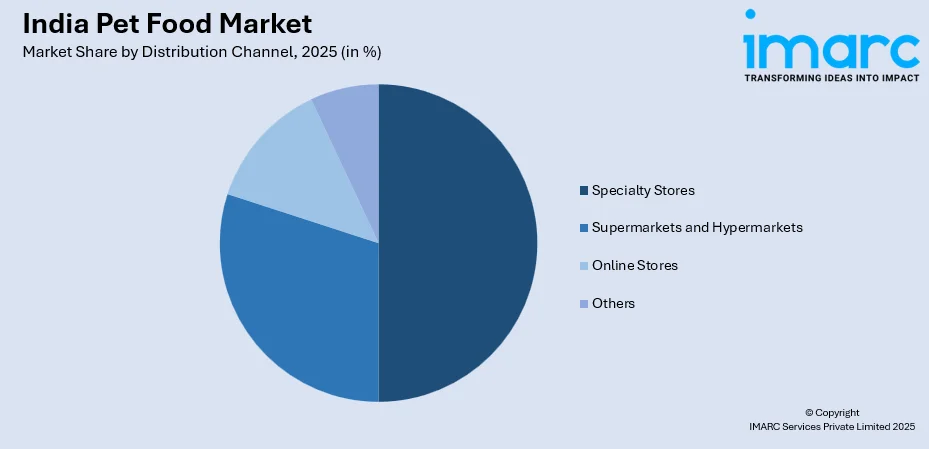

- By Distribution Channel: Specialty stores lead the market with a share of 50% in 2025, supported by expert guidance, extensive product variety, and trusted positioning as dedicated destinations for pet nutrition needs.

- By Region: North India represents the largest segment with a market share of 35% in 2025, benefiting from high disposable incomes, elevated pet adoption rates, and robust organized retail infrastructure in major urban centers.

- Key Players: Market participants emphasize premium and functional product innovation, nutrition-focused formulations, and quality standards. Strategies include expanding e-commerce and retail distribution, strengthening partnerships, targeted health-based marketing, and investing in manufacturing capabilities to enhance competitiveness and long-term growth.

To get more information on this market Request Sample

Pet food encompasses commercially manufactured food products specifically formulated to provide complete and balanced nutrition for domesticated animals including dogs, cats, and other companion pets. These products are available in various forms including dry kibble, wet canned food, semi-moist formulations, and treats, each designed to meet specific nutritional requirements across different life stages and health conditions. In 2025 Reliance Consumer Products Ltd. launched “Waggies,” a new pet food brand in India aimed at delivering science-backed nutrition at affordable prices, marking a strategic push by a major FMCG player into the expanding pet care segment. India represents one of the fastest-growing pet food markets globally, driven by increasing urbanization, changing lifestyle patterns, and the cultural shift toward treating pets as family members. The market benefits from expanding retail infrastructure, growing e-commerce penetration, and rising consumer awareness about the importance of scientifically formulated pet nutrition over traditional homemade diets.

India Pet Food Market Trends:

Rising Pet Humanization and Premium Nutrition Demand

The India pet food market is evolving rapidly due to growing pet humanization, with owners treating pets as family members requiring high-quality nutrition. In May 2025, global FMCG giant Nestlé S.A. acquired a minority stake in Indian pet food company Drools, helping the Bengaluru-based brand achieve unicorn status and underscoring rising investor confidence in premium, science-based pet nutrition offerings in India. This shift is boosting demand for premium, science-backed products targeting digestive health, coat care, and weight management. Urban consumers are especially willing to invest in specialized diets aligned with human wellness trends, encouraging innovation in functional ingredients, grain-free recipes, and life-stage-specific nutrition.

Rapid Expansion of E-Commerce and Digital Retail Channels

E-commerce growth is transforming pet food distribution in India by improving access to premium and global brands across tier-one, tier-two, and tier-three cities. According to a 2025 Unicommerce report, India’s online pet care segment, including pet food, saw online sales surge by about 95% year-on-year in FY25, highlighting how digital channels are rapidly expanding reach beyond major metros into smaller towns. Online platforms offer convenience, subscriptions, transparent product information, and competitive pricing, appealing to busy consumers. Digital channels also help brands expand reach, engage directly with customers, deliver personalized recommendations, and build loyalty through targeted marketing and flexible purchasing options.

Growing Emphasis on Natural and Sustainable Pet Food Options

Rising environmental awareness and health consciousness are shaping pet food choices, increasing demand for natural, organic, and sustainably sourced products. In 2024, Indian television actor Palak Jain launched Paws for Greens, India’s first vegan dog food brand, offering cruelty‑free, plant‑based nutrition aimed at eco‑conscious pet parents, signaling how ethical considerations are influencing product innovation in the market. Consumers increasingly value clean-label formulations aligned with ethical and eco-friendly lifestyles. In response, manufacturers are launching products with plant-based proteins, recyclable packaging, and minimal artificial additives. These innovations are creating new niches and influencing long-term development of India’s pet nutrition landscape.

Market Outlook 2026-2034:

The India pet food market is positioned for sustained expansion throughout the forecast period, underpinned by favorable demographic trends, rising pet adoption rates, and evolving consumer attitudes toward pet care and nutrition. The growing number of households with pets, attributed to changing lifestyles and urbanization, creates substantial demand for reliable and convenient feeding solutions. Government initiatives supporting domestic manufacturing, improving retail infrastructure, and expanding e-commerce accessibility are expected to further accelerate market development across urban and emerging markets. The market generated a revenue of USD 2.52 Billion in 2025 and is projected to reach a revenue of USD 4.60 Billion by 2034, growing at a compound annual growth rate of 6.91% from 2026-2034.

India Pet Food Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Pet Type | Dog Food | 85.6% |

| Product Type | Dry Pet Food | 89.6% |

| Pricing Type | Mass Products | 70% |

| Ingredient Type | Animal Derived | 80% |

| Distribution Channel | Specialty Stores | 50% |

| Region | North India | 35% |

Pet Type Insights:

- Dog Food

- Cat Food

- Others

The dog food dominates with a market share of 85.6% of the total India pet food market in 2025.

Dog food maintains its commanding position in the India pet food market driven by the high prevalence of dog ownership across Indian households and the established cultural preference for dogs as companion animals. In late 2025, Reliance Consumer Products Ltd. entered the Indian pet food space with the launch of its Waggies dog food brand, offering science‑led, affordable nutrition and intensifying competition among established and emerging players. Urban households particularly demonstrate growing preference for commercially formulated dog food products that offer convenience, nutritional completeness, and consistency compared to traditional homemade diets. The segment benefits from stable demand patterns supported by established feeding routines and owner familiarity with commercial nutrition options across various life stages.

The expanding range of specialized dog food formulations addressing breed-specific requirements, health conditions, and activity levels continues to drive segment growth and premiumization trends. Manufacturers are introducing innovative products including grain-free options, limited ingredient diets, and functional formulations targeting joint health, dental care, and digestive wellness. The rising awareness among pet owners regarding the importance of balanced nutrition, combined with veterinary recommendations favoring commercial diets, reinforces the segment's dominant market position.

Product Type Insights:

- Dry Pet Food

- Wet and Canned Pet Food

- Snacks and Treats

The dry pet food leads with a share of 89.6% of the total India pet food market in 2025.

Dry pet food dominates the India market owing to its convenience, affordability, and wide availability across various retail channels that make it particularly suited to the requirements of Indian consumers. In April 2025, Godrej Pet Care launched Godrej Ninja, a dry dog food brand supporting gut health and immunity, marking its entry into India’s pet food market with a Rs. 500 crore plan. The product category's extended shelf life and easy storage characteristics are especially valuable for urban households where space and time constraints influence purchasing decisions. Unlike wet food alternatives, dry pet food does not require refrigeration, reducing waste and simplifying maintenance while enabling easier portion control for weight management.

The dry pet food segment benefits from cost-effective distribution models that enable mass market penetration and competitive pricing accessible to price-conscious consumers. Available in diverse formulations tailored to different breeds, life stages, and specific dietary needs, dry food caters to varied consumer preferences while manufacturers continuously enhance appeal through fortification with essential vitamins, minerals, and functional ingredients. Domestic manufacturing scale improvements are steadily reducing retail prices, making premium nutrition increasingly accessible to mid-income households.

Pricing Type Insights:

- Mass Products

- Premium Products

The mass products dominates with a market share of 70% of the total India pet food market in 2025.

Mass-market pet food products maintain their leading position in India driven by price-conscious consumer preferences and the accessibility requirements characteristic of a developing pet food market transitioning from traditional homemade diets. These products offer nutritionally adequate formulations at affordable price points that enable first-time pet food buyers to adopt commercial feeding practices without significant financial commitment. The segment serves as an entry point for market expansion, introducing pet owners to the convenience and consistency of manufactured pet nutrition.

The mass products segment benefits from extensive distribution through diverse retail channels including neighborhood stores, supermarkets, and online platforms that ensure widespread availability across urban and semi-urban markets. Domestic manufacturers play a significant role in this segment by leveraging local production capabilities to offer competitive pricing while maintaining acceptable quality standards. The segment continues to expand as rising pet adoption rates among middle-income households create sustained demand for value-oriented nutrition solutions.

Ingredient Type Insights:

- Animal Derived

- Plant Derived

The animal derived leads with a share of 80% of the total India pet food market in 2025.

Animal derived ingredients dominate the India pet food market owing to their high protein content, superior palatability, and alignment with the natural dietary requirements of companion animals, particularly dogs and cats. These ingredients including chicken, lamb, fish, and meat by-products provide essential amino acids, vitamins, and minerals that support optimal pet health, muscle development, and energy requirements. In September 2024, Growel Group launched Carniwel, a pet food brand with fresh proteins and superfood ingredients, targeting premium nutrition for India’s expanding pet market. Consumer preference for protein-rich formulations that mirror natural carnivorous diets reinforces the segment's market leadership.

The animal derived ingredient segment benefits from established supply chains and manufacturing processes that ensure consistent quality and nutritional profiles across product ranges. Manufacturers leverage various protein sources to create diverse formulations addressing specific health requirements and taste preferences, while premium products increasingly feature single-source proteins for pets with dietary sensitivities. The segment maintains its dominant position despite growing interest in plant-based alternatives, as the majority of pet owners prioritize traditional protein sources for perceived nutritional superiority.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The specialty stores dominates with a market share of 50% of the total India pet food market in 2025.

Specialty pet stores maintain their dominant position in the India pet food distribution landscape through their comprehensive product offerings, expert customer guidance, and trusted positioning as dedicated destinations for pet nutrition and care requirements. These specialized outlets offer extensive variety across multiple brands, formulations, and price points, enabling consumers to make informed purchasing decisions with professional assistance from knowledgeable staff. The physical retail experience provided by specialty stores remains particularly valued for products requiring proper selection based on pet characteristics and health conditions.

The specialty store channel benefits from the ability to offer complementary products and services including grooming supplies, accessories, and veterinary consultations that create comprehensive pet care destinations. These retailers increasingly adopt omnichannel approaches integrating physical presence with digital capabilities to serve evolving consumer preferences while maintaining the personalized service advantages that differentiate them from mass retail alternatives. The channel continues to expand through new store openings in emerging urban centers and tier-two cities.

Regional Insights:

- South India

- North India

- West and Central India

- East India

North India exhibits a clear dominance with a 35% share of the total India pet food market in 2025.

North India leads the pet food market supported by rising disposable incomes, elevated pet adoption rates, and robust organized retail infrastructure concentrated in major urban centers including Delhi, Chandigarh, and Jaipur. The region demonstrates strong demand for branded pet food products driven by higher consumer awareness about pet nutrition and the availability of veterinary services that recommend commercial diets. A well-developed network of specialty pet shops and organized retail outlets enhances accessibility to diverse product ranges across premium and mass market segments.

The North India market benefits from the concentration of affluent urban households that treat pets as family members and willingly invest in quality nutrition products. The region's cosmopolitan consumer base demonstrates receptivity to international brands and innovative product offerings, creating favorable conditions for premiumization trends. Continued expansion of e-commerce infrastructure and specialty retail presence in emerging cities across the region is expected to sustain market leadership throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the India Pet Food Market Growing?

Rising Pet Adoption and Evolving Household Dynamics

India's pet food market is experiencing substantial growth driven by increasing pet adoption rates, particularly in urban households where changing lifestyle patterns create favorable conditions for companion animal ownership. In December 2025, Mankind Pharma expanded its pet nutrition portfolio with the launch of PetStar Delight, entering the cat food segment following its PetStar dog food range, strategically targeting growing demand for specialized pet nutrition in India. The trend toward nuclear family structures combined with apartment living in metropolitan areas has accelerated demand for pets as companions, particularly among young professionals and families seeking emotional connection. This demographic shift directly translates into growing need for reliable, convenient, and nutritionally adequate feeding solutions that commercial pet food products provide.

Expanding Retail Infrastructure and E-Commerce Penetration

The extensive accessibility of pet food through structured retail and online platforms is fundamentally transforming purchasing behaviors across India. The India e-commerce market size reached USD 107.7 Billion in 2024, and IMARC Group expects it to reach USD 650.4 Billion by 2033, reflecting the rapid digital adoption that is enabling pet food brands to reach consumers more efficiently. Consumers who previously depended on neighborhood stores with limited options can now access diverse branded products through supermarkets, pet specialty stores, and veterinary clinics. Online shopping platforms are accelerating this transformation by providing home delivery, attractive pricing, subscription options, and detailed product information that appeal particularly to convenience-oriented urban consumers while enabling market access in previously underserved locations.

Growing Awareness of Pet Health and Nutrition

Rising consumer awareness about the importance of balanced, scientifically formulated pet nutrition is driving the transition from traditional homemade diets to commercial pet food products. Veterinary endorsements and professional recommendations increasingly favor manufactured foods that provide complete and consistent nutritional profiles tailored to specific life stages and health requirements. This educational shift, combined with greater access to pet care information through digital channels and veterinary services, is creating informed consumers who prioritize quality nutrition as an essential component of responsible pet ownership.

Market Restraints:

What Challenges the India Pet Food Market is Facing?

Prevalence of Traditional Homemade Feeding Practices

The deeply rooted cultural preference for homemade pet food remains a significant barrier to commercial pet food adoption across India. Many pet owners, particularly in semi-urban and rural areas, continue to feed pets household food scraps or home-prepared meals, viewing commercial products as unnecessary expenses. This traditional mindset limits market penetration potential and requires sustained consumer education efforts to demonstrate the nutritional advantages and long-term health benefits of commercially formulated pet diets.

Price Sensitivity and Affordability Concerns

Price sensitivity among Indian consumers presents ongoing challenges for pet food market expansion, particularly in the premium segment where products command significantly higher prices than mass-market alternatives. Many potential consumers perceive commercial pet food as expensive compared to home-prepared options, limiting adoption rates among price-conscious households. This affordability barrier constrains market growth and necessitates strategic pricing approaches that balance quality with accessibility.

Limited Awareness in Emerging Markets and Rural Areas

The pet food market faces awareness gaps in smaller cities and rural areas where exposure to commercial pet nutrition concepts remains limited. Distribution challenges and inadequate retail infrastructure in these regions further compound accessibility issues, restricting market expansion beyond established urban centers. The absence of veterinary services and pet care information sources in underserved areas perpetuates reliance on traditional feeding practices and delays market development.

Competitive Landscape:

The India pet food market exhibits a consolidated competitive structure dominated by established international players alongside emerging domestic manufacturers competing across diverse market segments. Leading multinational corporations leverage strong brand recognition, extensive distribution networks, and substantial marketing investments to maintain premium market positions. Domestic companies compete effectively in the mass-market segment through local manufacturing capabilities, competitive pricing, and products tailored to Indian consumer preferences. Strategic initiatives including product innovation, digital marketing investments, distribution expansion, and partnerships with veterinary professionals characterize competitive dynamics as players seek to capture growing market opportunities.

Recent Developments:

- In September 2024, Hyderabad-based Growel Group entered India’s pet food market with Carniwel, offering dog and cat food now stocked in 4,000+ outlets across 200 cities. The company said it plans to begin export expansion soon, tapping rising demand for premium pet nutrition.

India Pet Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Pet Types Covered | Dog Food, Cat Food, Others |

| Product Types Covered | Dry Pet Food, Wet and Canned Pet Food, Snacks and Treats |

| Pricing Types Covered | Mass Products, Premium Products |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | South India, North India, West and Central, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India pet food market size was valued at USD 2.52 Billion in 2025.

The India pet food market is expected to grow at a compound annual growth rate of 6.91% from 2026-2034 to reach USD 4.60 Billion by 2034.

Dog food dominated the market with a share of 85.6%, driven by the high prevalence of dog ownership across Indian households and well-established feeding routines that favor commercially prepared pet food products.

Key factors driving the India pet food market include rising pet adoption rates in urban households, growing awareness about pet health and nutrition, increasing disposable incomes, expanding e-commerce and retail infrastructure, pet humanization trends, and veterinary endorsements favoring commercial pet diets.

Major challenges include the prevalence of traditional homemade feeding practices, price sensitivity among consumers, limited awareness in rural and semi-urban areas, inadequate retail infrastructure in emerging markets, and the need for sustained consumer education about commercial pet nutrition benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)