India Pet Care Products Market Size, Share, Trends and Forecast by Pet Type, Type, and Region, 2026-2034

India Pet Care Products Market Overview:

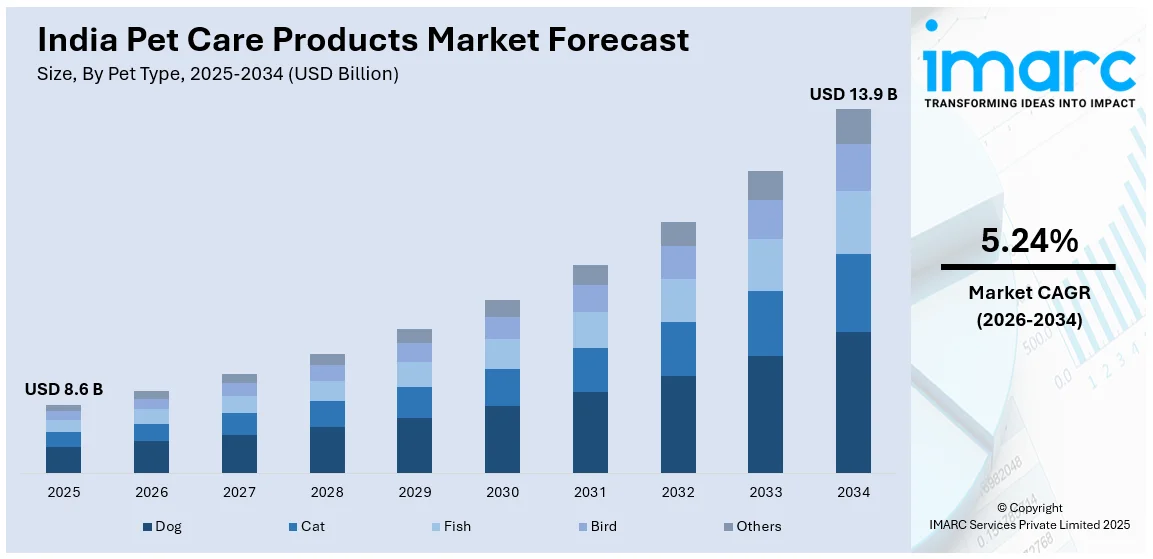

The India pet care products market size reached USD 8.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 13.9 Billion by 2034, exhibiting a growth rate (CAGR) of 5.24% during 2026-2034. The market is experiencing significant growth, driven by rising pet ownership, urbanization and higher disposable incomes premiumization and increasing demand for organic, eco-friendly and health-focused products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.6 Billion |

| Market Forecast in 2034 | USD 13.9 Billion |

| Market Growth Rate (2026-2034) | 5.24% |

India Pet Care Products Market Trends:

E-Commerce Growth

The Indian pet care market is witnessing a surge in online sales as digital platforms become a preferred shopping destination for pet owners. E-commerce giants like Amazon, Flipkart and pet-specific platforms such as Heads Up For Tails and Supertails are offering a wide range of pet food, grooming products, accessories and healthcare essentials. These developments are fueling a significant boost in the India pet care product market share. According to the data published by IBEF, India's e-commerce industry is set to reach US$ 325 billion by 2030 driven by a projected 17 billion shipments in seven years and US$ 14 billion GMV during the 2024 festive season. In FY23, GMV hit US$ 60 billion. The shift is driven by convenience, doorstep delivery, subscription models for recurring purchases and access to premium and international brands. Online retailers provide detailed product descriptions, expert recommendations and customer reviews helping buyers make informed decisions. The growing penetration of smartphones and digital payment options is further accelerating this trend. According to the data published by the Ministry of Finance, Digital payment transactions surged to 1,767 crore in September 2024 with a total value of ₹251 lakh crore. UPI continued to dominate, processing 1,504.17 crore transactions worth ₹20.64 lakh crore that month, up from 92 crore in FY 2017-18. UPI's overall growth was 129% CAGR accounting for 70% of digital transactions.Additionally, exclusive online discounts, bundled offers and personalized shopping experiences are attracting more consumers. As a result, the online pet care segment is expected to expand significantly contributing to the overall India pet care market growth.

To get more information on this market Request Sample

Rising Focus on Sustainability

Indian pet owners are increasingly prioritizing sustainability and ethical choices when purchasing pet care products. The demand for ecofriendly pet accessories, organic food and biodegradable waste disposal solutions is rising as consumers become more environmentally conscious. Brands are introducing sustainable pet bedding, toys made from recycled materials and biodegradable poop bags to reduce plastic waste. For instance, in November 2024, IndieGood announced its plans to revolutionize pet care with ecofriendly products made by Indian artisans. Addressing safety concerns over harmful materials the Ahmedabad-based brand offers sustainable pet accessories including plastic-free collars and orthopedic beds while promoting artisan empowerment and environmental awareness through public outreach initiatives.Cruelty-free grooming products such as sulfate-free shampoos and herbal flea treatments are gaining traction among pet owners who seek safer alternatives. Companies are also adopting ethical sourcing and sustainable packaging to appeal to eco conscious buyers. With the growing awareness about environmental impact, pet owners are willing to pay for premium products that align with their values. This trend is pushing brands to innovate and develop greener alternatives making sustainability a key factor in the evolving pet care market in India. These eco-driven approaches are creating a positive India pet care product market outlook as consumers are increasingly prioritizing ethical choices.

India Pet Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on pet type and type.

Pet Type Insights:

- Dog

- Cat

- Fish

- Bird

- Others

The report has provided a detailed breakup and analysis of the market based on the pet type. This includes dog, cat, fish, bird and others.

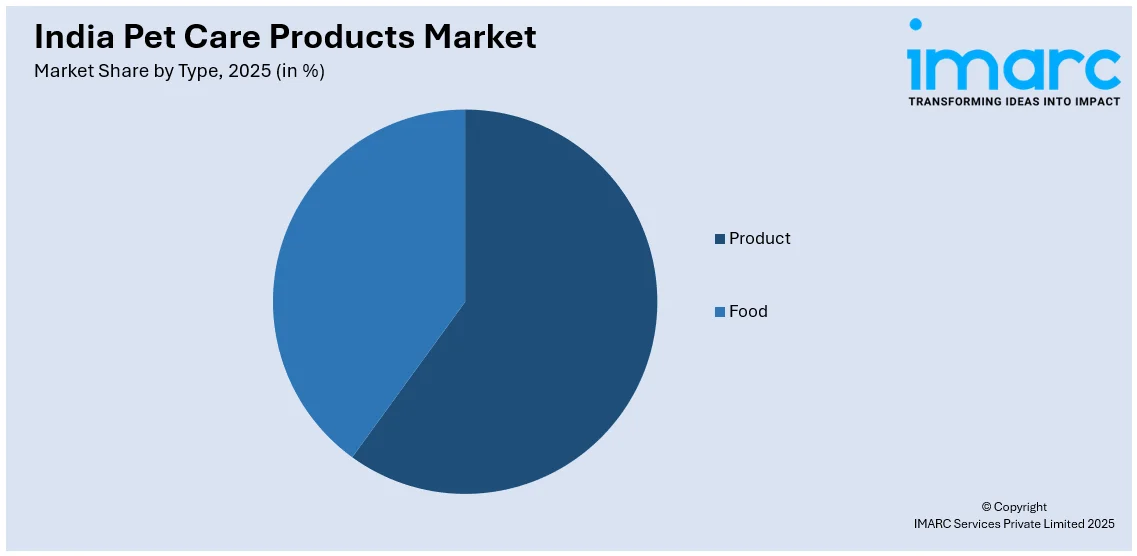

Type Insights:

Access the comprehensive market breakdown Request Sample

- Product

- Pet Litter

- Pet Grooming Products

- Fashion, Toys, and Accessories

- Food

- Dry Food

- Wet/Canned Food

- Treats/Snacks

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes product (pet litter, pet grooming products, fashion, toys, and accessories) and food (dry food, wet/canned food and treats/snacks).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pet Care Products Market News:

- In October 2024, Growel Group announced the launch of 'Carniwel,' a new brand targeting India's growing pet food market. Offering premium nutrition with unique vegetarian options, Carniwel aims to provide affordable, high-quality pet food for all demographics. With a focus on both meat-based and vegetarian products, the brand seeks to meet evolving pet owner needs.

- In August 2024, Godrej Consumer Products announced its plans to enter the Indian pet care market through its subsidiary, Godrej Pet Care, investing Rs 500 crore over five years. Targeting the Rs 5,000 crore sector, it's set to capitalize on low pet ownership and feeding trends, with manufacturing expected to start in FY26.

India Pet Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dog, Cat, Fish, Bird, Others |

| Types Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pet care products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pet care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pet care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pet care products market in India was valued at USD 8.6 Billion in 2025.

The India pet care products market is projected to exhibit a CAGR of 5.24% during 2026-2034, reaching a value of USD 13.9 Billion by 2034.

The India pet care products market is driven by increasing pet adoption, growing disposable incomes, rising awareness about pet health, and the shift towards premium pet products. Additionally, urbanization, a growing e-commerce sector, and rising demand for convenience and high-quality pet food further fuel the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)