India Personal Loan Market Size, Share, Trends, and Forecast by Provider, Tenure, Interest Rate, and Region, 2025-2033

India Personal Loan Market Overview:

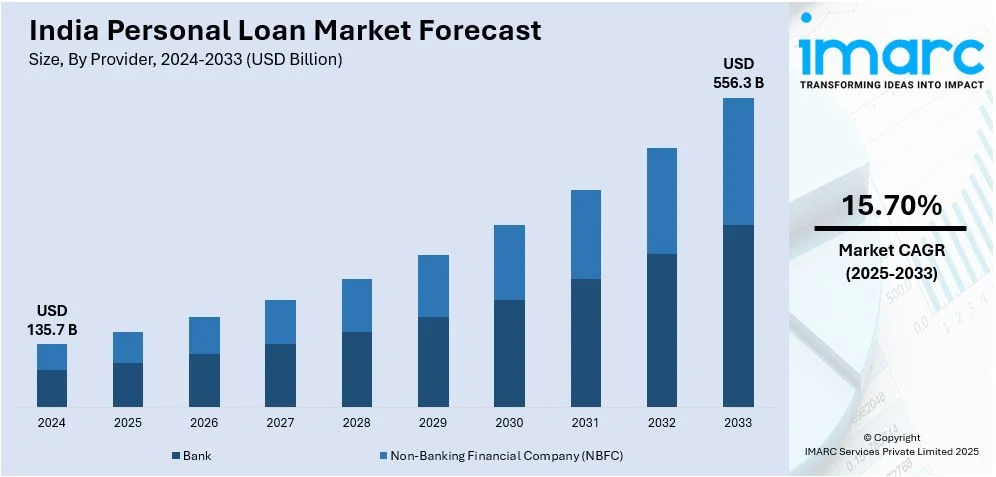

The India personal loan market size reached USD 135.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 556.3 Billion by 2033, exhibiting a growth rate (CAGR) of 15.70% during 2025-2033. The market is witnessing significant growth, driven by the growth of digital lending platforms and the rising demand for small-ticket and small-term loans.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 135.7 Billion |

| Market Forecast in 2033 | USD 556.3 Billion |

| Market Growth Rate 2025-2033 | 15.70% |

India Personal Loan Market Trends:

Growth of Digital Lending Platforms

With the use of technology-based lending platforms, there is a major upturn of the personal loan market in India. Fintech companies are growing with AI and machine learning rapidly integrating into pathways for loan approval and disbursement. Digital-first lenders, such as NBFCs and fintech startups, generally employ alternate credit scoring models to judge potential borrowers thereby facilitating quicker entry to the credit. For instance, in March 2025, the State Bank of India now offers online loans against mutual funds via Internet Banking and YONO App, providing a 100% digital, paperless, and 24x7 accessible service for customer convenience. The widespread adoption of mobile banking and digital payment infrastructure, driven by the Unified Payments Interface (UPI), has further accelerated the shift toward digital lending. Borrowers can now complete loan applications, receive approvals, and access funds within minutes, reducing dependency on traditional banks. Additionally, regulatory frameworks, such as the Reserve Bank of India’s (RBI) digital lending guidelines are ensuring transparency and consumer protection in the sector. This trend is particularly prominent among younger consumers and first-time borrowers who prefer digital channels over conventional banking methods. With increasing smartphone penetration and improved digital literacy, the demand for instant, paperless personal loans is expected to rise, reinforcing digital lending’s role in India’s evolving credit landscape.

To get more information on this market, Request Sample

Rising Demand for Small-Ticket and Short-Term Loans

The demand for small-ticket, short-term personal loans is increasing in India, driven by changing consumer spending patterns and evolving financial needs. Individuals, particularly from middle- and lower-income segments, are seeking instant access to smaller loan amounts to meet urgent expenses such as medical emergencies, education fees, and short-term liquidity gaps. For instance, in December 2024, Hero FinCorp offered personal loans up to ₹5 lakh for medical, wedding, education, home repairs, and travel needs, with instant approval, low fees, competitive rates, and flexible repayment through a simple application process. Fintech lenders and NBFCs are capitalizing on this demand by offering micro-personal loans with flexible repayment structures and minimal documentation. Unlike traditional banks, which primarily focus on larger loan amounts, these digital lenders cater to underserved segments by utilizing alternative credit scoring mechanisms, including transaction history, bill payments, and employment data. The rise of buy now, pay later (BNPL) services and embedded financing solutions has further fueled this trend, allowing borrowers to access short-term credit with seamless repayment options. With increasing financial inclusion and regulatory support, the segment is poised for further growth. The ability to access quick, collateral-free credit without stringent eligibility criteria makes small-ticket loans an attractive option, particularly in semi-urban and rural areas where formal credit penetration remains limited. As affordability and convenience continue to drive borrower preferences, this segment is expected to expand significantly.

India Personal Loan Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on provider, tenure, and interest rate.

Provider Insights:

- Bank

- Non-Banking Financial Company (NBFC)

The report has provided a detailed breakup and analysis of the market based on the provider. This includes bank and non-banking financial company (NBFC).

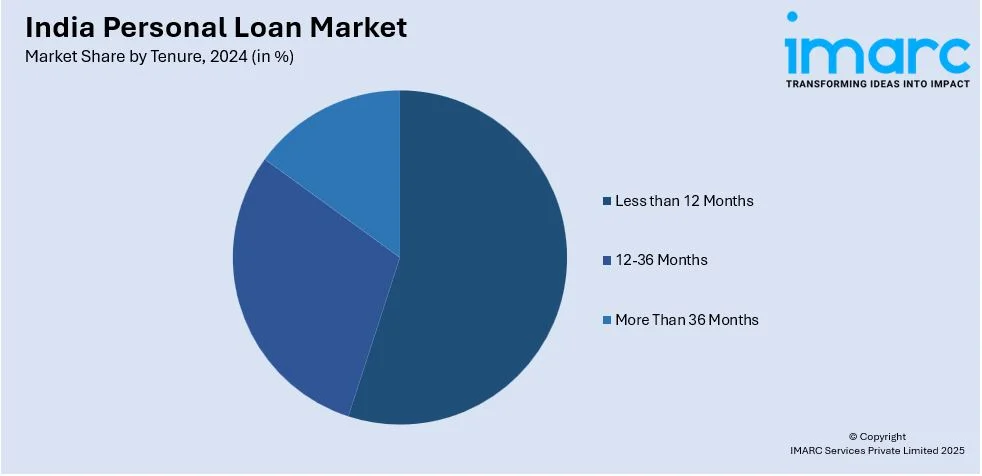

Tenure Insights:

- Less than 12 Months

- 12-36 Months

- More Than 36 Months

A detailed breakup and analysis of the market based on the tenure have also been provided in the report. This includes Less than 12 months, 12-36 months, and more than 36 months.

Interest Rate Insights:

- 10%-15%

- 16%-20%

- Above 20%

A detailed breakup and analysis of the market based on the interest rate have also been provided in the report. This includes 10%-15%, 16%-20%, and above 20%.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Personal Loan Market News:

- In January 2025, Bharti Airtel announced partnership with Bajaj Finance to offer financial products via its app and stores, expanding access to Airtel’s 375 million customers. Currently piloting two products, the offerings will expand to four by March, including gold loans, business loans, EMI cards, and personal loans, strengthening Bajaj Finance’s market reach.

- In September 2024, FinDoc Finvest, the non-banking financial company division of FinDoc Financial Services, ventures into India's digital lending sector by offering short-term personal loans. Its platform provides immediate approvals, fast disbursements, and a paperless approach, facilitating smooth online applications through the website or mobile app, making credit easier to access and more affordable for marginalized individuals nationwide.

India Personal Loan Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Bank, Non-Banking Financial Company (NBFC) |

| Tenures Covered | Less than 12 Months, 12-36 Months, More Than 36 Months |

| Interest Rates Covered | 10%-15%, 16%-20%, Above 20%. |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India personal loan market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India personal loan market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India personal loan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The personal loan market in India was valued at USD 135.7 Billion in 2024.

The India personal loan market is projected to exhibit a CAGR of 15.70% during 2025-2033, reaching a value of USD 556.3 Billion by 2033.

The India personal loan market is shaped by increasing disposable incomes and a growing middle class, rapid digital transformation, including fintech and online lending platforms, improved credit infrastructure like credit bureaus, and flexible, unsecured loan offerings that attract young, urban borrowers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)