India Personal Hygiene Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

India Personal Hygiene Market Overview:

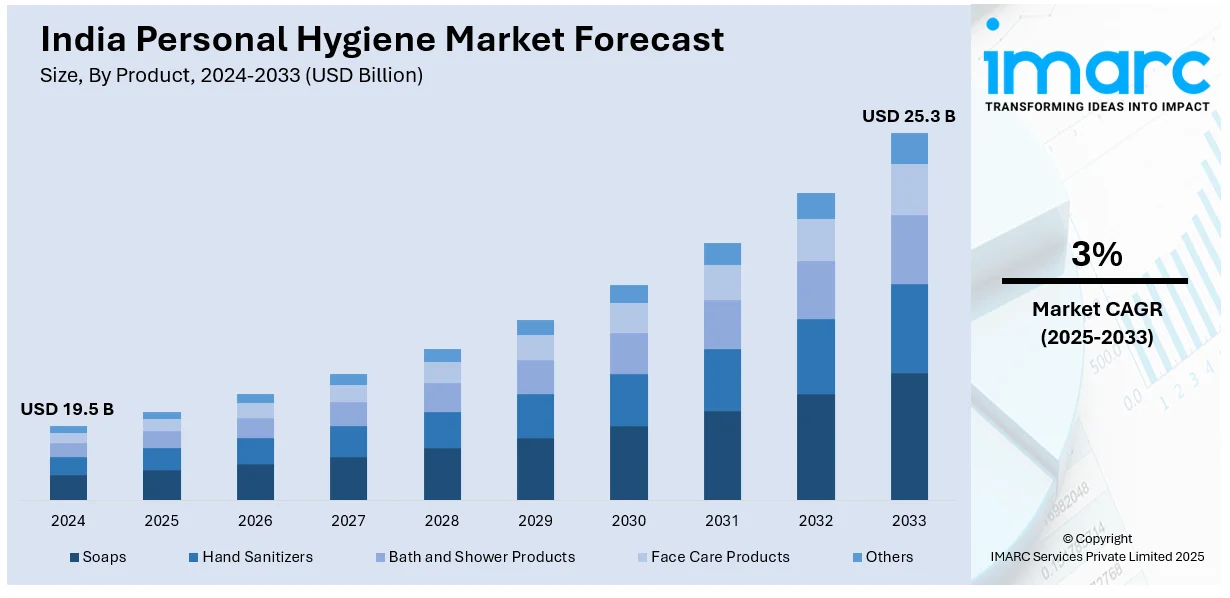

The India personal hygiene market size reached USD 19.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 25.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3% during 2025-2033. The market is witnessing significant growth, driven by the escalating demand for premium and organic hygiene products and expansion of male grooming and personal hygiene segment. Increasing disposable income and consumer purchasing power are other key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 25.3 Billion |

| Market Growth Rate (2025-2033) | 3% |

India Personal Hygiene Market Trends:

Rising Demand for Premium and Organic Hygiene Products

India's personal hygiene market is witnessing a surge in demand for premium and organic hygiene products, driven by increasing consumer awareness, higher disposable income, and a preference for chemical-free, eco-friendly alternatives. Consumers, particularly in urban and semi-urban areas, are shifting toward products with natural ingredients, biodegradable materials, and dermatologically tested formulations. Leading brands are responding by launching organic and herbal variants in categories such as sanitary napkins, baby wipes, deodorants, and intimate hygiene products. For instance, in March 2025, as per World Economic Forum, about 64% of menstruating women in India use sanitary napkins, while 34% rely on unsafe alternatives. A rural movement is breaking taboos, promoting menstrual hygiene, and transforming young girls' lives. E-commerce platforms and direct-to-consumer (DTC) brands are capitalizing on this trend by offering customized hygiene solutions, subscription-based deliveries, and sustainable packaging. Global players and local startups are increasingly focusing on plant-based antibacterial solutions, toxin-free formulations, and cruelty-free certifications to differentiate their products. Government initiatives promoting menstrual hygiene awareness and sustainability regulations are further influencing product innovation. Mergers and acquisitions in the organic personal care segment indicate strong investor interest in this evolving market. As consumers continue prioritizing health-conscious and eco-friendly choices, companies investing in research, sustainable sourcing, and innovative product formulations will gain a competitive edge in India’s rapidly growing personal hygiene sector. The trend is expected to accelerate, particularly among millennials and Gen Z consumers, shaping the future of hygiene products in India.

To get more information on this market, Request Sample

Expansion of Male Grooming and Personal Hygiene Segment

The male grooming and personal hygiene segment in India is experiencing significant expansion, fueled by changing lifestyle patterns, increasing disposable income, and growing influence of digital media. Traditionally, personal hygiene products were largely marketed toward women, but rising awareness among men regarding self-care and grooming has driven demand for male-centric hygiene solutions. Major brands are launching male-specific body washes, deodorants, intimate hygiene products, and skincare solutions. For instance, in February 2025, Dove Men+Care announced the launch of new Body and Face Scrubs, combining exfoliation, cleansing, and moisturizing in one step, offering an efficient, personalized self-care solution designed for men's skin. The popularity of beard care products, facial cleansers, and hygiene essentials such as antibacterial wipes and grooming kits is further driving growth. Startups and established FMCG companies are leveraging celebrity endorsements, digital marketing, and social media influencers to target the younger demographic. E-commerce platforms and quick commerce services have played a key role in expanding accessibility and driving sales growth. The rise of customized grooming subscriptions and male-focused DTC brands indicates a sustained market shift. Additionally, increased emphasis on workplace hygiene, fitness, and wellness trends is further boosting demand for hygiene essentials tailored for men. As urban and semi-urban consumers adopt comprehensive personal care routines, companies investing in product innovation, specialized formulations, and targeted marketing strategies will gain a competitive edge in this evolving market segment.

India Personal Hygiene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Soaps

- Hand Sanitizers

- Bath and Shower Products

- Face Care Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes soaps, hand sanitizers, bath and shower products, face care products, and others.

Gender Insights:

- Unisex

- Male

- Female

A detailed breakup and analysis of the market based on gender have also been provided in the report. This includes unisex, male, and female.

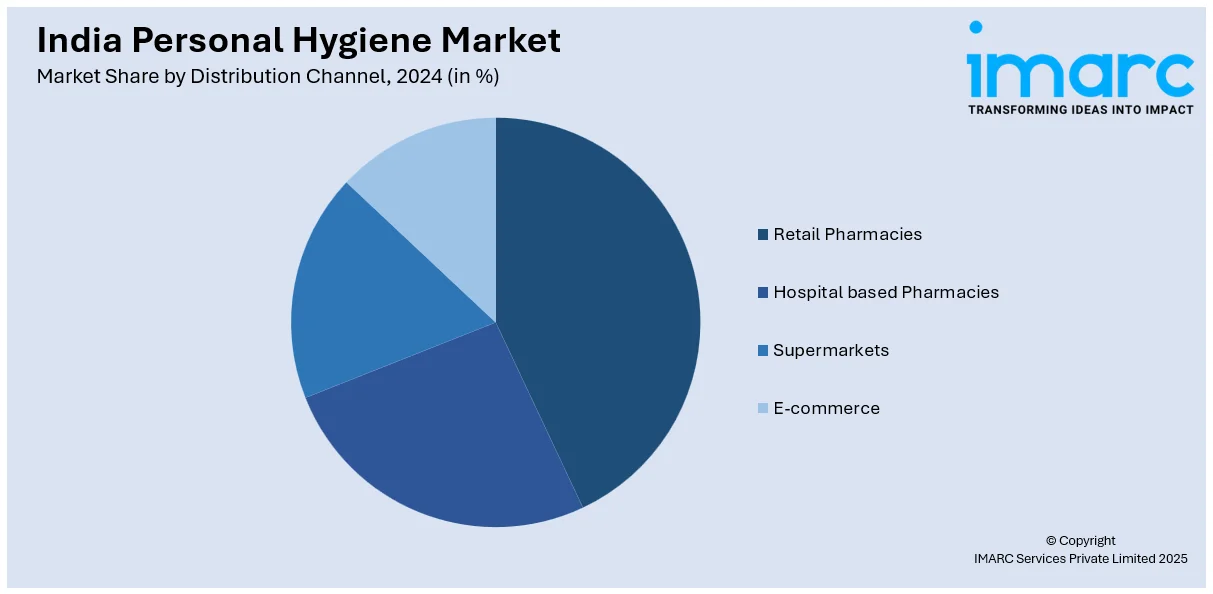

Distribution Channel Insights:

- Retail Pharmacies

- Hospital based Pharmacies

- Supermarkets

- E-commerce

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies, hospital based pharmacies, supermarkets, and e-commerce.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Personal Hygiene Market News:

- In January 2025, Nobel Hygiene, a leading diaper and maternity pad manufacturer, is in talks to raise ₹150-200 crore in funding, led by Neo Asset Management’s investment arm, sources told Mint. The Bengaluru-based company seeks capital to expand operations and strengthen its position in India’s growing personal hygiene market.

- In March 2024, The Organic World (TOW), India’s leading organic grocery retailer, expands its personal care and hygiene line with six new sustainable categories. Addressing rising demand for eco-friendly self-care, TOW aims to transform India’s hygiene market with innovative, natural solutions that promote conscious consumerism and environmentally responsible daily routines.

India Personal Hygiene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Soaps, Hand Sanitizers, Bath and Shower Products, Face Care Products, Others |

| Genders Covered | Unisex, Male, Female |

| Distribution Channels Covered | Retail Pharmacies, Hospital based Pharmacies, Supermarkets, E-commerce |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India personal hygiene market performed so far and how will it perform in the coming years?

- What is the breakup of the India personal hygiene market on the basis of product?

- What is the breakup of the India personal hygiene market on the basis of gender?

- What is the breakup of the India personal hygiene market on the basis of distribution channel?

- What is the breakup of the India personal hygiene market on the basis of region?

- What are the various stages in the value chain of the India personal hygiene market?

- What are the key driving factors and challenges in the India personal hygiene?

- What is the structure of the India personal hygiene market and who are the key players?

- What is the degree of competition in the India personal hygiene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India personal hygiene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India personal hygiene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India personal hygiene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)