India Personal Care Ingredients Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Personal Care Ingredients Market Overview:

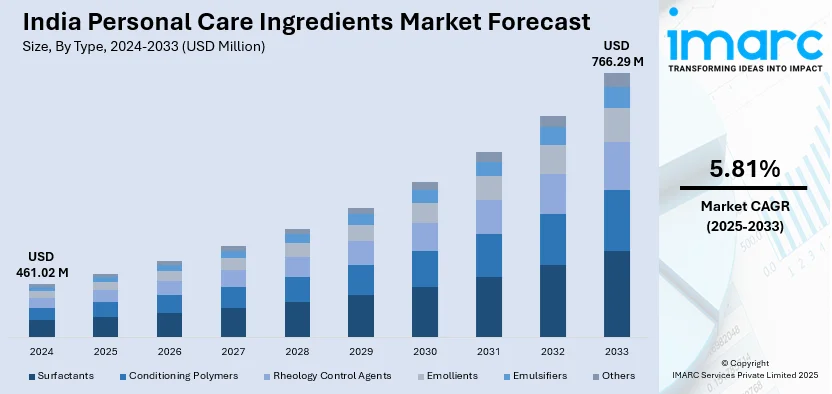

The India personal care ingredients market size reached USD 461.02 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 766.29 Million by 2033, exhibiting a growth rate (CAGR) of 5.81% during 2025-2033. The market is driven by the rising consumer demand for organic and natural products, the increasing disposable incomes, and the growing awareness regarding skincare and hygiene among consumers. Besides this, the expansion of the beauty and wellness sector, advancements in ingredient formulations, and government support for the domestic cosmetics sector are further bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 461.02 Million |

| Market Forecast in 2033 | USD 766.29 Million |

| Market Growth Rate 2025-2033 | 5.81% |

India Personal Care Ingredients Market Trends:

Rising Demand for Natural and Organic Ingredients

The shifting consumer preferences towards clean beauty and natural formulations are significantly boosting the demand for organic personal care ingredients in India. This shift is driven by increasing awareness towards skincare benefits, concerns over synthetic chemicals, and regulatory support for eco-friendly products. The organic personal care market in India is projected to grow rapidly in the near-term, with Ayurvedic and plant-based ingredients like neem, aloe vera, turmeric, and sandalwood gaining widespread popularity. A 2024 Euromonitor survey revealed that 71% of Indian consumers prefer skincare products formulated with organic and plant-derived ingredients. The industry is also growing as a result of favorable government programs, such as the Ministry of AYUSH's promotion of herbal formulations and the expansion of natural product lines by well-known companies like Himalaya, Biotique, and Forest Essentials. Businesses are repurposing their products with botanical extracts, essential oils, and biodegradable surfactants as customers turn away from parabens, sulfates, and artificial perfumes. India's transition to a cleaner and more sustainable personal care sector is being strengthened by manufacturers' adoption of eco-certifications and green chemistry principles in response to the growing demand for ingredients that are ethically and sustainably sourced.

To get more information on this market, Request Sample

Growing Adoption of Advanced Active Ingredients in Skincare

The Indian skincare market is witnessing a dynamic shift towards high-performance active ingredients, with peptides, ceramides, hyaluronic acid, and niacinamide gaining prominence. Consumers are prioritizing anti-aging, hydration, and skin-brightening solutions, fueling demand for advanced formulations. The luxury cosmetics segment in India reached USD 4.90 billion in 2024 and is projected to grow at a CAGR of 3.40%, reaching USD 6.90 billion by 2033, as consumers increasingly invest in clinically proven, science-backed skincare. The popularity of dermatologist-recommended ingredients, such as retinol and vitamin C, is also rising, driven by rising consumer awareness and influencer-led education. Additionally, AI-powered skincare brands like Minimalist and Dot & Key are leveraging technology to create personalized formulations tailored to individual skin concerns, further boosting demand for specialized ingredients. This shift has encouraged major players like BASF, Ashland, and Croda to invest in biotech-based and encapsulated actives for enhanced efficacy. Indian companies are also expanding their ingredient portfolios to cater to evolving consumer preferences, reinforcing the market’s focus on innovation, efficacy, and personalization in skincare solutions.

India Personal Care Ingredients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Surfactants

- Conditioning Polymers

- Rheology Control Agents

- Emollients

- Emulsifiers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes surfactants, conditioning polymers, rheology control agents, emollients, emulsifiers, and others.

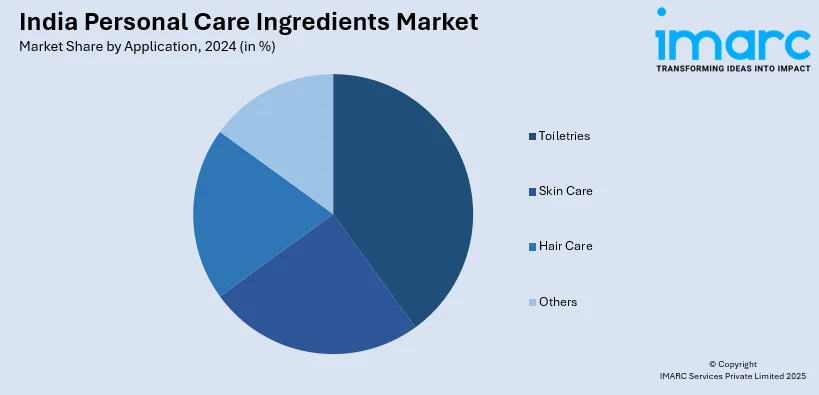

Application Insights:

- Toiletries

- Skin Care

- Hair Care

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes toiletries, skin care, hair care, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Personal Care Ingredients Market News:

- October 2024: Skin Beyond Borders (SkinBB) has introduced LabelLooker 1.0, India's first AI-powered ingredient scanning tool for skincare. The platform, which is part of the Skincare Metaverse, combines AI technology and clinical expertise to create a unique synergy between consumers, physicians, and industry partners. LabelLooker 1.0 is based on Ingredipedia, a proprietary personal care ingredient database.

- February 2024: Evonik introduced Vecollage™ Fortify L, a vegan collagen for beauty and personal care that mimics skin collagen. This novel solution takes advantage of Evonik's biotechnology expertise to fulfill the growing need for vegan collagen in anti-aging and moisturizing cream applications. Vecollage™ Fortify L was created in collaboration with Modern Meadow Inc., a firm focused on fermentation-based protein production.

India Personal Care Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Surfactants, Conditioning Polymers, Rheology Control Agents, Emollients, Emulsifiers, Others |

| Applications Covered | Toiletries, Skin Care, Hair Care, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India personal care ingredients market performed so far and how will it perform in the coming years?

- What is the breakup of the India personal care ingredients market on the basis of type?

- What is the breakup of the India personal care ingredients market on the basis of application?

- What are the various stages in the value chain of the India personal care ingredients market?

- What are the key driving factors and challenges in the India personal care ingredients market?

- What is the structure of the India personal care ingredients market and who are the key players?

- What is the degree of competition in the India personal care ingredients market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India personal care ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India personal care ingredients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India personal care ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)