India Pediatric Nutritional Supplements Market Size, Share, Trends and Forecast by Product Type, Formulation, Age Group, Distribution Channel, and Region, 2025-2033

India Pediatric Nutritional Supplements Market Overview:

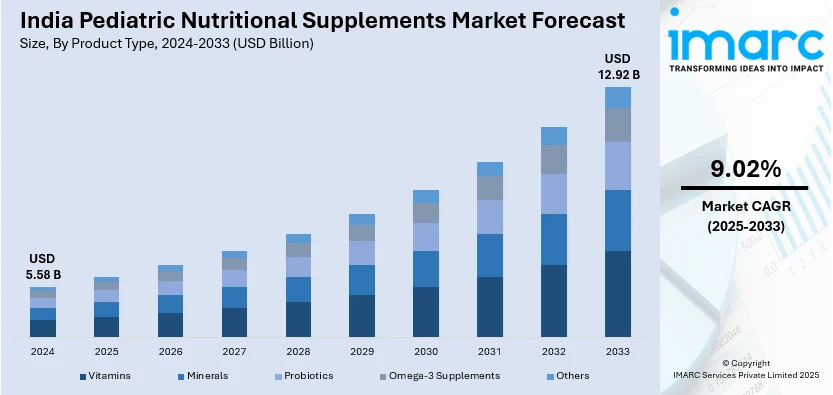

The India pediatric nutritional supplements market size reached USD 5.58 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.92 Billion by 2033, exhibiting a growth rate (CAGR) of 9.02% during 2025-2033. The market is driven by rising parental health awareness, increasing demand for immunity-enhancing products post-pandemic, and a shift toward plant-based and organic supplements. Growing cases of micronutrient deficiencies, child-friendly supplement formats, and e-commerce are augmenting the India pediatric nutritional supplements market share. Government initiatives promoting child nutrition and stricter regulations on synthetic ingredients also contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.58 Billion |

| Market Forecast in 2033 | USD 12.92 Billion |

| Market Growth Rate 2025-2033 | 9.02% |

India Pediatric Nutritional Supplements Market Trends:

Rising Demand for Plant-Based and Organic Pediatric Supplements

The growing preference for plant-based and organic products, driven by increasing health consciousness among parents, is favoring the India pediatric nutritional supplements market growth. Concerns over synthetic additives, artificial flavors, and chemical preservatives have led to a shift toward natural and clean-label supplements. Brands are introducing plant-based vitamins, herbal immunity enhancers, and organic protein powders tailored for children. The demand is further fueled by rising cases of food allergies, digestive sensitivities, and autoimmune conditions, prompting parents to seek safer alternatives. Food allergies in Indian children are common and estimated to be 2-8%, with allergens such as milk, egg, fish, and peanuts widely documented in Indian children. The rising demand for nutraceuticals targeting children's immune and food sensitivities also underscores these growing concerns in India. Furthermore, government programs that advocate for organic farming and impose stricter regulations on synthetic components are motivating manufacturers to develop innovative Ayurvedic and herbal products. The rise of e-commerce platforms and specialized health stores is enhancing the accessibility of these items, thereby facilitating market growth. With increasing awareness, it is anticipated that plant-based and organic supplements for children will capture a substantial portion of the market.

To get more information on this market, Request Sample

Increasing Focus on Immunity-Enhancing Pediatric Supplements Post-Pandemic

The COVID-19 pandemic has significantly influenced parental priorities, leading to a rise in demand for immunity-enhancing pediatric supplements in India. With rising awareness of infectious diseases, parents are proactively seeking supplements enriched with vitamin C, zinc, elderberry, and probiotics to strengthen their children's immune systems. Pediatricians and nutritionists are also recommending preventive healthcare through dietary supplements, which further creates a positive India pediatric nutritional supplements market outlook. Companies are launching child-friendly formats such as gummies, chewable tablets, and flavored syrups to enhance compliance among young consumers. Additionally, aggressive marketing campaigns emphasizing immunity support and scientific endorsements are improving consumer trust. The market is also benefiting from the increasing prevalence of micronutrient deficiencies in children, pushing parents toward fortified supplements. A study conducted in July 2024 showed that 52.59% of all Indian children below five years of age are malnourished and are suffering from serious aspects of malnourishment, including stunting, wasting, and being underweight. The high rates of micronutrient deficiencies play a significant role in this issue, further intensified by factors such as maternal health and socioeconomic conditions. This highlights the growing requirement for pediatric nutritional supplements in India to address these common deficiencies and improve health outcomes in children. As health consciousness continues to rise post-pandemic, immunity-focused pediatric nutrition products are expected to remain a key growth driver in the Indian market.

India Pediatric Nutritional Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, formulation, age group, and distribution channel.

Product Type Insights:

- Vitamins

- Minerals

- Probiotics

- Omega-3 Supplements

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamins, minerals, probiotics, omega-3 supplements, and others.

Formulation Insights:

- Tablets

- Capsules

- Powders

- Liquids

- Gummies

A detailed breakup and analysis of the market based on the formulation have also been provided in the report. This includes tablets, capsules, powders, liquids, and gummies.

Age Group Insights:

- Infants (0-2 years)

- Children (3-12 years)

- Adolescents (13-18 years)

The report has provided a detailed breakup and analysis of the market based on the age group. This includes infants (0-2 years), children (3-12 years), and adolescents (13-18 years).

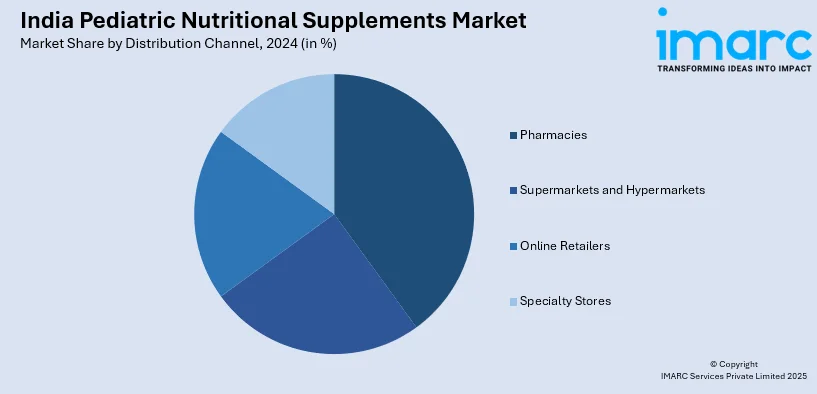

Distribution Channel Insights:

- Pharmacies

- Supermarkets and Hypermarkets

- Online Retailers

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes pharmacies, supermarkets and hypermarkets, online retailers, and specialty stores.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pediatric Nutritional Supplements Market News:

- July 17, 2024: Quaker announced the results of the latest campaign: 'Bowl of Growth', taking the initiative to fight malnutrition in India. It has provided 1,000 malnourished children in Pune with a millet-based ‘panjiri’ recipe, supplemented with 18 minerals and vitamins, through a specialized pediatric nutritional supplement program. Proving an astounding 89% improvement in the growth of children and a 95.6% increase in appetite, the program will now be expanded to Mumbai to help another 4,000 children. This move highlights India's exploding demand for nutritional supplements among children, the most vulnerable segment of its health landscape.

- On November 14, 2024, Gritzo, a children's brand under HealthKart, launched the "Nahi Chalega" digital campaign to challenge the conventional "one-size-fits-all" approach in children's health food drinks. The campaign emphasizes the importance of personalized nutrition, showcasing Gritzo's SuperMilk range, which offers customized formulations tailored to individual children's needs based on age, gender, and specific health goals. This initiative underscores Gritzo's commitment to providing tailored nutritional solutions that support optimal child development.

India Pediatric Nutritional Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamins, Minerals, Probiotics, Omega-3 Supplements, Others |

| Formulations Covered | Tablets, Capsules, Powders, Liquids, Gummies |

| Age Groups Covered | Infants (0-2 years), Children (3-12 years), Adolescents (13-18 years) |

| Distribution Channels Covered | Pharmacies, Supermarkets and Hypermarkets, Online Retailers, Specialty Stores |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pediatric nutritional supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the India pediatric nutritional supplements market on the basis of product type?

- What is the breakup of the India pediatric nutritional supplements market on the basis of formulation?

- What is the breakup of the India pediatric nutritional supplements market on the basis of age group?

- What is the breakup of the India pediatric nutritional supplements market on the basis of distribution channel?

- What is the breakup of the India pediatric nutritional supplements market on the basis of region?

- What are the various stages in the value chain of the India pediatric nutritional supplements market?

- What are the key driving factors and challenges in the India pediatric nutritional supplements market?

- What is the structure of the India pediatric nutritional supplements market and who are the key players?

- What is the degree of competition in the India pediatric nutritional supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pediatric nutritional supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pediatric nutritional supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pediatric nutritional supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)