India Peanut Butter Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

India Peanut Butter Market Size and Share:

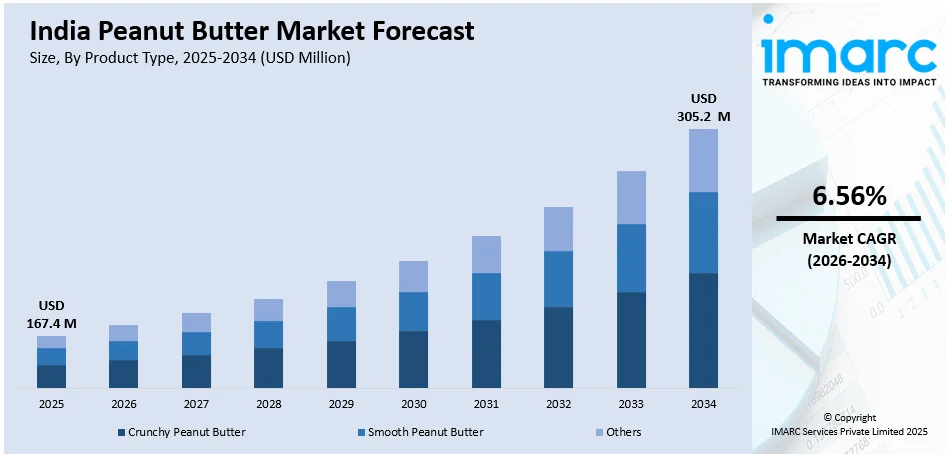

The India peanut butter market size was valued at USD 167.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 305.2 Million by 2034, exhibiting a CAGR of 6.56% from 2026-2034. The India peanut butter market share is increasing due to the changing dietary habits, awareness about peanuts in terms of nutrition, newer trends in food processing, and peanut-based products in the pipelines of new food processors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 167.4 Million |

| Market Forecast in 2034 | USD 305.2 Million |

| Market Growth Rate (2026-2034) | 6.56% |

The market is growing due to the growing health consciousness among consumers. As consumers become increasingly conscious about their health, they are looking at food products with higher protein content, healthy fats, and essential vitamins. Peanut butter has emerged as a preferred food choice due to these reasons. The popularity of plant-based diets and demand for alternatives to dairy and meat-based sources of protein have also fueled the increasing trend for peanut butter. It is something that can be used as a breakfast spread, mixed into smoothies, or even a base for cooking. Rising fitness and gym culture across the globe has positioned peanut butter as a staple in the diet of any fitness enthusiast. Aggressive promotion campaigns by Indian and global companies that have enhanced the health benefits related to peanut butter, popularizing it for both urban and rural markets, have further accelerated this trend.

To get more information on this market Request Sample

Organized retail and e-commerce platforms is boosting the India peanut butter market growth to a massive extent. With the emergence of digital platforms, consumers can now obtain more access to more premium and more locally manufactured types of peanut butter. According to the Indian Brand Equity Foundation (IBEF), the Indian e-commerce industry is projected to reach US$ 325 Billion by 2030, which increases the chances for the Indian types of peanut butter to be provided across the rest of the globe. The single-serve sachet and eco-friendly containers meet the expectations of the on-the-go busy consumers and environmentally friendly buyers. The introduction of peanut butter-flavored and fortified options, such as organic and sugar-free, has further increased the appeal of the product across different demographics. India is a very strong producer of peanuts and has a large reserve of these raw materials. Manufacturers in India can maintain cost-effectiveness while catering to the growing demand in other markets. It is such a synergy of healthy trends, new marketing, and ever-expanding channels that propels this market forward.

India Peanut Butter Market Trends:

Rise of plant-based diets

Peanut butter stands to be a healthy source of plant-based protein and healthy fats. Hence, vegan customers use peanut butter in place of other dairy-based spreads and protein sources. With this opportunity, manufacturers are introducing peanut butter products with vegan certification for the growing population. The market for peanut butter is also propelled by growing trend of seeking alternatives to the consumption of animal products for health, environmental, and ethical reasons. This trend is more pronounced in urban areas, where there is a high awareness about the plant-based lifestyle, and such products are more accessible.

Increased consumption of peanut butter in different culinary preparations

Peanut butter is increasingly used in different culinary applications beyond its traditional use as a spread. It is added to baked goods, smoothies, protein bars, and savory dishes, which appeal to a wide range of consumers. The flavor and the texture of peanut butter would allow food service places such as cafes and bakeries to offer appealing menu items including peanut butter cookies, peanut butter milkshakes, and sauces. This demand correlates with increasing need for convenient yet flexible ingredients with flavors that also add nutritional value. Growth in India's food services also escalates the India peanut butter demand. As per the IMARC Group, the India foodservice market size reached USD 51.0 Billion in 2024 and is expected to grow to USD 123.5 Billion by 2033. Restaurants and catering services have been influenced to use peanut butter as a central ingredient in different cuisines due to this growth, which in turn has increased the demand for it. Another reason for adopting this fusion is that peanut butter has been a staple in meals that have some roots in Asian and African cooking.

Growing packaged food and beverage industries

In recent years, India's packaged food and beverage industries have increased dramatically. Since there has been an upsurge in changing lifestyle preferences with an increasingly preferred ready-to-eat or packaged food consumption, consumers move toward ready-made foods and packaged consumables. Peanut butter fits into the nutritious and versatile category. It is increasingly represented in packaged snack bars, spreads, and breakfast kits destined for the busy lives of urban consumers. The strong growth of the packaged food industry itself adds to the India peanut butter market trend. As per the USDA, the packaged food and beverages industry in India is expected to grow significantly to reach a size of $46.3 Billion by 2028. Thus, there exists a substantial scope for development opportunities for manufacturers in peanut butter production, which enticed them into diverse product penetration within the marketplace. The reason being, the increasingly greater concern for a clean label and the health of packaged food boosted companies to think ahead and initiate new organic protein-rich and fat-low variants for peanut butter.

India Peanut Butter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India peanut butter market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Crunchy Peanut Butter

- Smooth Peanut Butter

- Others

Crunchy peanut butter contains parts of peanuts, making it crunchier and more textured. It is mainly liked by those who enjoy a spread that has a more robust texture. The texture of smoothened peanut butter is creamier and silkier with very finely ground peanuts, making it an all-around spread for multiple recipes and a perfect spread for bread, toast, or use in baked goods. Both kinds of peanut butter are often used as ingredients in sauces, smoothies, and other snack foods. The preference of each consumer for a type of peanut butter depends on texture preference, ease of use, and the intended application. IBEF states that, according to UBS, India will emerge as the third-largest consumer market by 2026, meaning the demand for food items like peanut butter will increase significantly as the country's consumer base expands and diversifies. Even though smooth peanut butter is used and incorporated in a much more significant number of recipes, crunchy peanut butter is in demand by consumers who want to have a better, more textured paste.

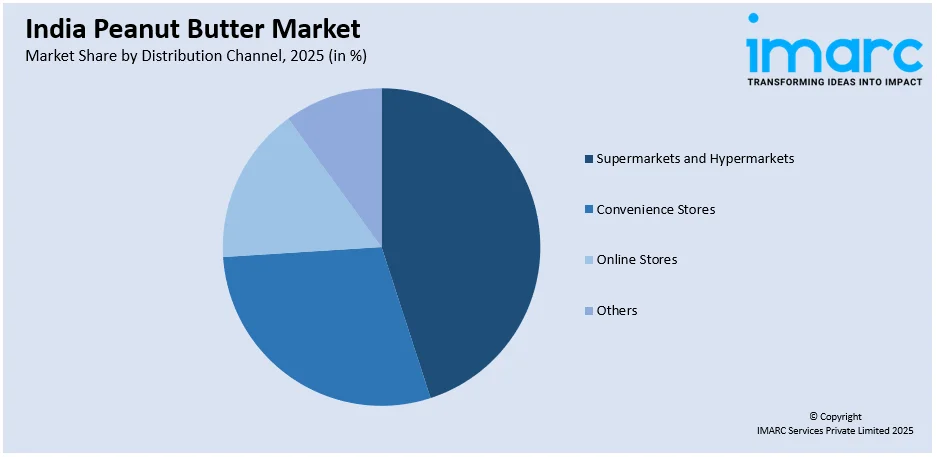

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets remain a significant channel for the distribution of peanut butter as they offer extensive varieties in big quantities. Normally, these outlets also provide the convenience of physical shopping, allowing customers to compare different brands and options. The growth in urbanization of India is leading to the increase of supermarkets, mainly in rapidly growing urban centers, where consumers are preferring to shop at organized retail outlets due to convenience. Convenience stores are meant for on-the-go consumers who want products quickly and easily, like single-serve or small-sized jars of peanut butter. This channel has been popular with urban customers and impulse purchasing. The popularity of the online store has risen even more due to the facility of home delivery by e-commerce sites and the assortment of peanut butter brands and products available for viewing on the website. Online shopping brings convenience that normally comes with improved deals and discounts, making this a favorite option for the majority of customers.

Regional Analysis:

- South India

- East India

- West and Central India

- North India

South India constitutes a significant portion of the peanut butter market. Consumers are health conscious and increasingly becoming aware about the importance of nutritious eating. This has been fueled by rapid urbanization in cities such as Bengaluru, Chennai, and Hyderabad, thereby increasing the demand for peanut butter as an easy, healthy snack. Apart from that, IBEF states that the ready-to-eat market in India will grow nearly 45% in the next five years from 2024, which also raises demand for peanut butter and similar other easy, ready-to-consume food items. In East India, particularly in West Bengal, Odisha, and Assam, there is also more demand as this product is slowly being promoted for health benefits. The growing middle class and increasing urban population are also driving up demand. West and Central India, including Maharashtra, Gujarat, and Madhya Pradesh, have emerged as significant markets due to the rising disposable income of consumers and increased availability of peanut butter through retail outlets. Finally, North India, particularly Delhi, Punjab, and Haryana have been steadily growing in peanut butter consumption, led by the rising demand for ready-to-eat, nutritious snack options. The region's diversified culinary preferences and the trend of including Western foods in daily diets have contributed to the growth of the market.

Competitive Landscape:

Market players in the Indian peanut butter industry are getting more focused on innovative expansion strategies to derive their benefits through growing demand for healthier and easier food options. Changing consumer preferences to healthier choices drives the product category, which differentiates into organic, low-sugar, and fortified peanut butter as brands look to target health-conscious customers. Companies are also diversifying their product lines with innovative flavors and pack formats to address various consumer requirements, such as single-serve packs and family packs. Companies are also addressing environmental concerns through sustainable packaging solutions. With the increasing adoption of e-commerce, many brands are establishing their online presence through collaboration with online marketplaces and standalone websites, by leveraging the comfort of home delivery and a much wider reach. This digital transformation also enables brands to access a wider consumer base, both urban and rural populations. These efforts are providing a positive India peanut butter market outlook.

The report provides a comprehensive analysis of the competitive landscape in the India peanut market with detailed profiles of all major companies.

Latest News and Developments:

- On December 2024: Nutty Village introduced two new flavors of peanut butter, such as coffee and barbeque, in memory of US President Jimmy Carter, known as the "champion of peanut farming." It acknowledged his dedication to agriculture and sustainable development in launching the same flavors that had been on offer so far.

- On September 2024: Gujarat-based D2C health food brand Alpino raised $1.2 million in its initial funding round. The company, famous for peanut butter and many other peanut-based products, will use these funds to strengthen its offline presence as well as product innovation.

- On January 1, 2025: Boyo launched 20 more retail outlets. It promised that in 180 days it will launch as many as 100 retail stores across the city. Being a company manufacturing peanut butter and trail mix products, they saw their online sales record an increment of 1000% for FY 2023.

- On June 2025, Mensa Brands, through its FMCG brand MyFitness, expanded peanut butter, and the same was progressing to ARR Rs 1000 crore in three years. The firm had got an ARR of Rs 300 crore with peanut butter. The company plans to foray into breakfast cereals, protein bars, and supplements.

India Peanut Butter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Crunchy Peanut Butter, Smooth Peanut Butter, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | South India, East India, West and Central India, North India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India peanut butter market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India peanut butter market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India peanut butter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India peanut butter market was valued at USD 167.4 Million in 2025.

IMARC estimates the India peanut butter market to exhibit a CAGR of 6.56% during 2026-2034.

The market is driven by changing dietary habits, awareness about peanuts in terms of nutrition, newer trends in food processing, and peanut-based products in the pipelines of new food processors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)