India Particle Board Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2025-2033

India Particle Board Market Overview:

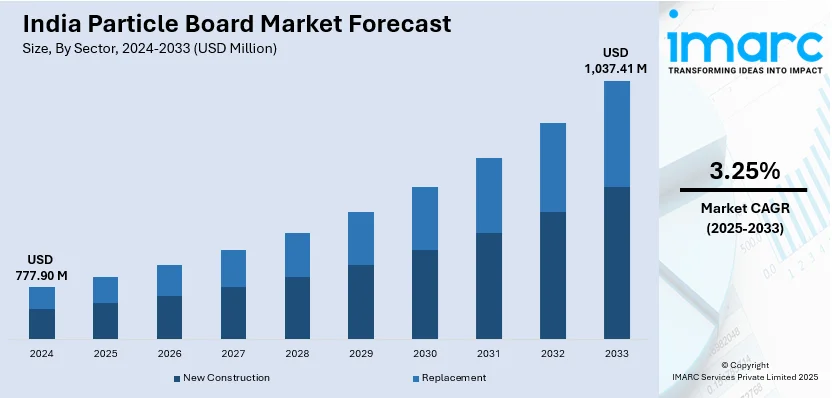

The India particle board market size reached USD 777.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,037.41 Million by 2033, exhibiting a growth rate (CAGR) of 3.25% during 2025-2033. The market is expanding due to rising demand in furniture, construction, and interior applications. Growth is driven by urbanization, affordability, sustainability trends, and increasing wood alternatives. Key players focus on durability, moisture resistance, and eco-friendly manufacturing to strengthen market presence.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 777.90 Million |

| Market Forecast in 2033 | USD 1,037.41 Million |

| Market Growth Rate 2025-2033 | 3.25% |

India Particle Board Market Trends:

Increasing Demand for Affordable and Sustainable Furniture Solutions

The India particle board segment is experiencing substantial growth, attributed to the magnifying need for cost-efficient and sustainable furniture solutions. With rapid urbanization and a growing middle-class population, there is an increasing preference for engineered wood products over solid wood due to their affordability and versatility. For instance, as per industry reports, urban population was anticipated to increase to 35% to 37% during 2024, with Tamil Nadu and Maharashtra being top two urbanized states respectively. 54% of the Tamil Nadu's population was found to be dwelling in urban zones. Moreover, particle boards are widely used in modular furniture, kitchen cabinets, and office spaces as a viable alternative to traditional plywood. Additionally, the emphasis on sustainability is driving manufacturers to use recycled wood and agricultural residues, aligning with government initiatives promoting eco-friendly materials. As the real estate and hospitality sectors expand, demand for lightweight and customizable furniture is further propelling market growth. Continuous advancements in particle board manufacturing, such as improved moisture resistance and fire retardancy, are enhancing product quality, making them more suitable for diverse applications. The accessibility to raw materials with low-cost and technological innovations is expected to sustain this trend.

To get more information on this market, Request Sample

Expansion of Domestic Production and Investment in Manufacturing Capacity

India’s particle board market is experiencing increased domestic production and investment in manufacturing infrastructure to meet growing demand. Leading domestic and international manufacturers are expanding their production capacities to cater to the rising consumption in the furniture, construction, and interior design sectors. Government initiatives such as “Make in India” and import restrictions on plywood and MDF have encouraged local manufacturers to strengthen their supply chains and reduce dependence on imports. Companies are investing in advanced machinery and automated production processes to improve efficiency and product quality while ensuring cost competitiveness. Additionally, rising awareness of deforestation and environmental regulations has resulted in an heightened focus on sustainable raw materials, including bagasse-based and agro-waste particle boards. For instance, in May 2024, the National Green Tribunal presented a notice to the Indian government associated with the 2.33 Million hectares of trees loss, highlighting growing scrutiny regarding the deforestation rate. The shift towards localized production is also reducing logistics costs and improving availability across regions, positioning India as a key manufacturing hub for particle board products in the Asia-Pacific market.

India Particle Board Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application and sector.

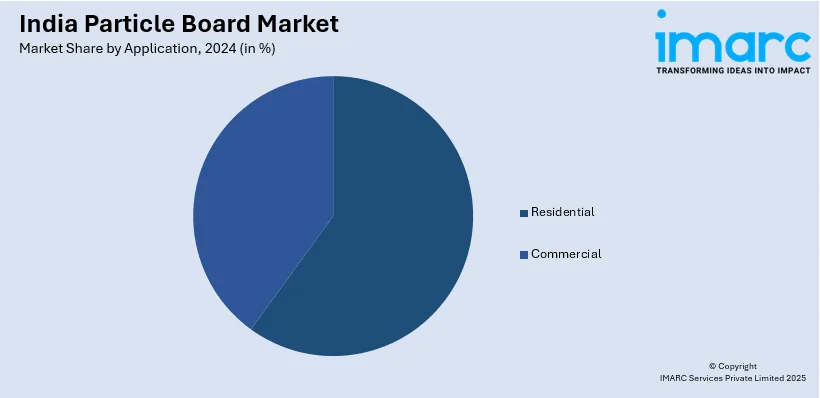

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Sector Insights:

- New Construction

- Replacement

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes new construction and replacement.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Particle Board Market News:

- In October 2024, CenturyPly announced plans to invest approximately USD 230 Million by the year 2025 to expand manufacturing capacity in key segments, including particle board. The company revealed that most of the investment will be directed toward Punjab, Andhra Pradesh, and Tamil Nadu.

- In October 2024, Magnus Plywood, an India-based company, signed an MoU with the Department of Industries to develop a new production facility in Kerala. This facility will produce crucial coach components for Vande Bharat train. In addition, two North India-based manufacturers of particle board are initiating operations same facility location.

India Particle Board Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Application Covered | Residential, Commercial |

| Sector Covered | New Construction, Replacement |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India particle board market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India particle board market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India particle board industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The particle board market in India was valued at USD 777.90 Million in 2024.

The India particle board market is projected to exhibit a CAGR of 3.25% during 2025-2033, reaching a value of USD 1,037.41 Million by 2033.

India’s particle board market is driven by growing demand for affordable and versatile furniture solutions, especially in residential, office, and hospitality spaces. Its lightweight, easy-to-use, and eco-friendly nature aligns with modern interior trends. Increasing focus on sustainable materials and innovations in manufacturing further support the market’s expansion across diverse applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)