India Paper Market Size, Share, Trends and Forecast by Raw Material, End Use, and Region, 2026-2034

India Paper Market Overview:

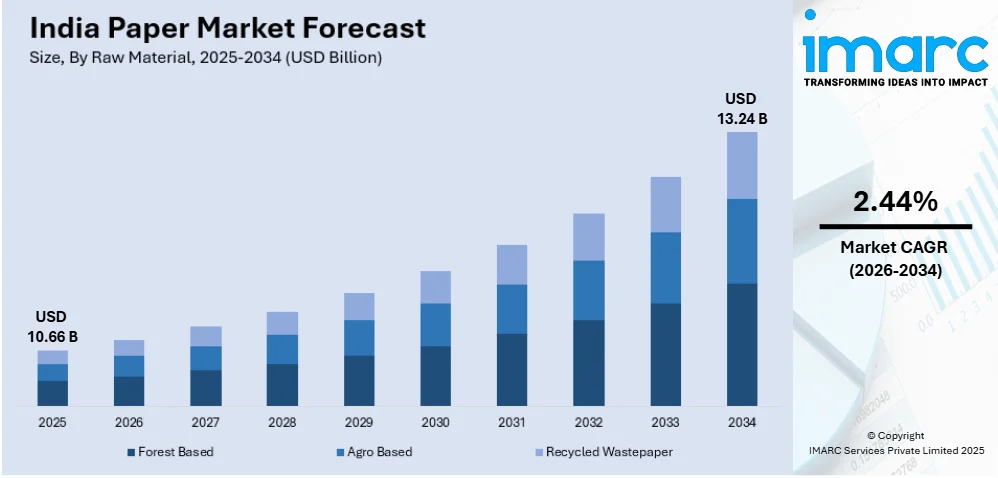

The India paper market size reached USD 10.66 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 13.24 Billion by 2034, exhibiting a growth rate (CAGR) of 2.44% during 2026-2034. The market is driven by increasing demand for packaging solutions, growth in e-commerce, and the expansion of the education sector. Rising urbanization, industrialization, and sustainable packaging preferences further boost growth. Government initiatives supporting waste paper recycling and growing export opportunities also contribute to the market's upward trajectory.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.66 Billion |

| Market Forecast in 2034 | USD 13.24 Billion |

| Market Growth Rate 2026-2034 | 2.44% |

India Paper Market Trends:

Expansion of Sustainable and Recycled Paper Products

The Indian paper industry is witnessing a surge in the production of sustainable and recycled paper products. Environmental concerns and stricter regulations on plastic packaging are driving the shift towards eco-friendly alternatives. Additionally, advancements in recycling technologies have improved the quality of recycled paper, making it a viable substitute for virgin paper. The government’s focus on promoting circular economy practices has further propelled this trend. For instance, in March 2025, the Indian Recovered Papers Traders Association (IRPTA) proposed a reduction in GST on waste paper in the upcoming Delhi budget. The meeting highlighted the importance of the waste paper recycling sector in supporting the livelihoods of underprivileged individuals. The association's role was further emphasized in waste management and suggested that their involvement could significantly reduce Delhi's garbage issues. The proposal aims to promote sustainable waste recycling and strengthen the circular economy in the paper industry. Large corporations and retailers are also opting for sustainable paper solutions for their packaging needs, which has increased the demand for biodegradable and recyclable paper products in the Indian market. Amcor, a global packaging leader, aims to achieve 30% recycled content across its portfolio by 2030 through strategic partnerships and investments. In FY24, it used 10% post-consumer recycled resins a year ahead of its 2025 target. The company invested USD 100 Million annually in R&D, supporting innovations like AmFiber Performance Paper and recycled packaging for food and healthcare.

To get more information on this market Request Sample

Growth in E-commerce and Demand for Packaging Paper

The exponential growth of the e-commerce sector has significantly increased the demand for paper-based packaging solutions. For instance, as per industry reports, India's paper market remains the world's fastest-growing, with packaging paper and paperboard consumption rising by 8.2% in 2024, reaching 15 million tonnes, which is 65% of the total 23 million tonnes. With more consumers shopping online, companies require durable and sustainable packaging materials to ensure the safe delivery of products. Corrugated boxes, paperboard cartons, and Kraft paper are widely used for this purpose. Additionally, increasing consumer preference for eco-friendly packaging has led companies to adopt recyclable paper materials. Innovations in lightweight and moisture-resistant paper packaging have further enhanced its application in e-commerce. As logistics and warehousing sectors expand, the demand for paper packaging is expected to grow, further cementing its role as a critical component in the supply chain.

Technological Advancements and Automation in Paper Manufacturing

Indian paper manufacturers are increasingly adopting advanced technologies and automation to enhance production efficiency and reduce operational costs. Modern paper mills are equipped with state-of-the-art machinery for automated pulp processing, paper formation, and quality control. Digital monitoring systems and predictive maintenance tools optimize operations and minimize downtime. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in the manufacturing process has enabled better resource management and waste reduction. The adoption of water-saving technologies and biomass energy utilization has also contributed to making production processes more sustainable. As companies strive for operational excellence, these technological advancements are becoming integral to the growth of the Indian paper industry. For instance, in May 2024, Line O Matic showcased four cutting-edge machines at Drupa 2024. The display featured a Fully Automatic Exercise Book Machine, an Inline Shrink-Wrapping Machine (Bolt RB104 Max+ SWM 100), a Folio Size Sheeter (APEX RS165), and an Automatic Binding Machine (Spiro B340 S). The company aims to demonstrate advancements in printing, packaging, and converting technology.

India Paper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on raw material and end use.

Raw Material Insights:

- Forest Based

- Agro Based

- Recycled Wastepaper

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes forest based, agro based, and recycled wastepaper.

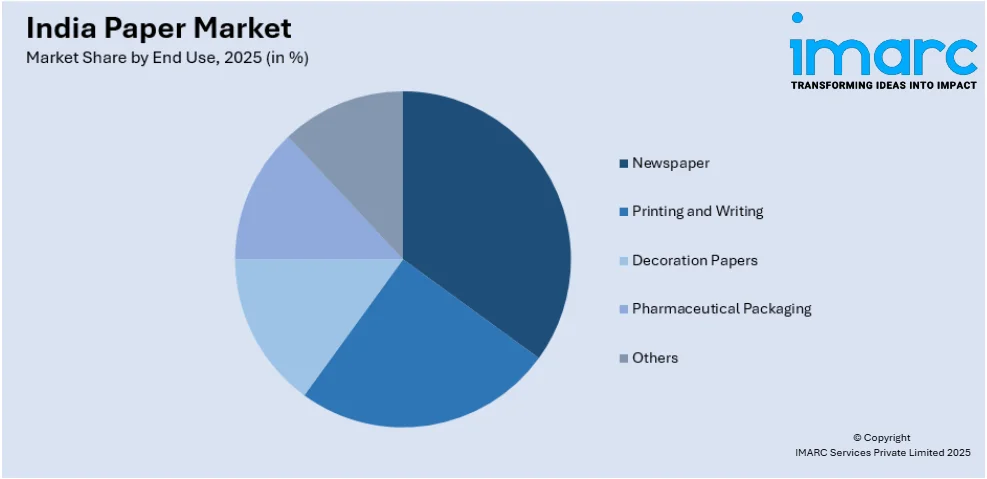

End Use Insights:

Access the Comprehensive Market Breakdown Request Sample

- Newspaper

- Printing and Writing

- Decoration Papers

- Pharmaceutical Packaging

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes newspaper, printing and writing, decoration papers, pharmaceutical packaging, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Paper Market News:

- In March 2025, TCPL Packaging inaugurated a new Greenfield facility in Chennai, strengthening its sustainable packaging presence in Southern India. The plant focuses on paperboard carton production, enhancing logistics and service efficiency. TCPL’s performance was driven by flexible and paperboard packaging, operational efficiency, and product innovation, positioning it for further growth.

- In May 2024, APRIL Group, a global pulp and paper producer, acquired a controlling stake in Origami, a leading Indian tissue products company. This marks APRIL’s entry into India’s growing tissue and personal hygiene market. Origami produces facial tissues, napkins, toilet rolls, and wipes. The acquisition supports APRIL’s strategy to expand in high-growth markets like India, leveraging its existing presence as a major pulp supplier.

- In May 2024, Andhra Paper Limited (APL) partnered with Valmet AB to install a ₹125 crore tissue paper production line at its Kadiyam facility, with a daily capacity of 129 tons. The expansion, part of a ₹270 crore capital expenditure, will produce various grades of tissue paper. This move aligns with growing demand driven by urbanization, hygiene initiatives like Swachh Bharat, and increased use in healthcare and hospitality sectors.

- In November 2024, Ashoka Rolls LLP introduced new-generation ceramic rollers with European technology, becoming the first company in India to do so. They also launched polyurethane (PU) rollers and composite rollers for paper mills. With facilities in Gujarat and Uttar Pradesh, the company manufactures rollers up to 2,000 mm diameter and 10,000 mm length. Their rollers offer wear resistance, chemical protection, and are tested in their own mill before market launch.

- In March 2025, Oji India Packaging Pvt Ltd, a subsidiary of Japan’s Oji Group, inaugurated its fifth manufacturing facility in India at Sri City, Andhra Pradesh. Spanning 43,000 square meters, the automated plant has an annual production capacity of 100 million square meters of corrugated packaging.

India Paper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Forest Based, Agro Based, Recycled Wastepaper |

| End Uses Covered | Newspaper, Printing and Writing, Decoration Papers, Pharmaceutical Packaging, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India paper market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India paper market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India paper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paper market in India was valued at USD 10.66 Billion in 2025.

The India paper market is projected to exhibit a CAGR of 2.44% during 2026-2034, reaching a value of USD 13.24 Billion by 2034.

The key factors driving India’s paper market include expanding literacy, boosting demand for educational print, surging packaging demand from e-commerce, FMCG, pharma, and healthcare, government bans on single-use plastics promoting sustainable paper use, rising household hygiene needs, and adoption of recycling and advanced paper technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)