India Paper Chemicals Market Size, Share, Trends and Forecast by Type, Form, and Region, 2025-2033

India Paper Chemicals Market Overview:

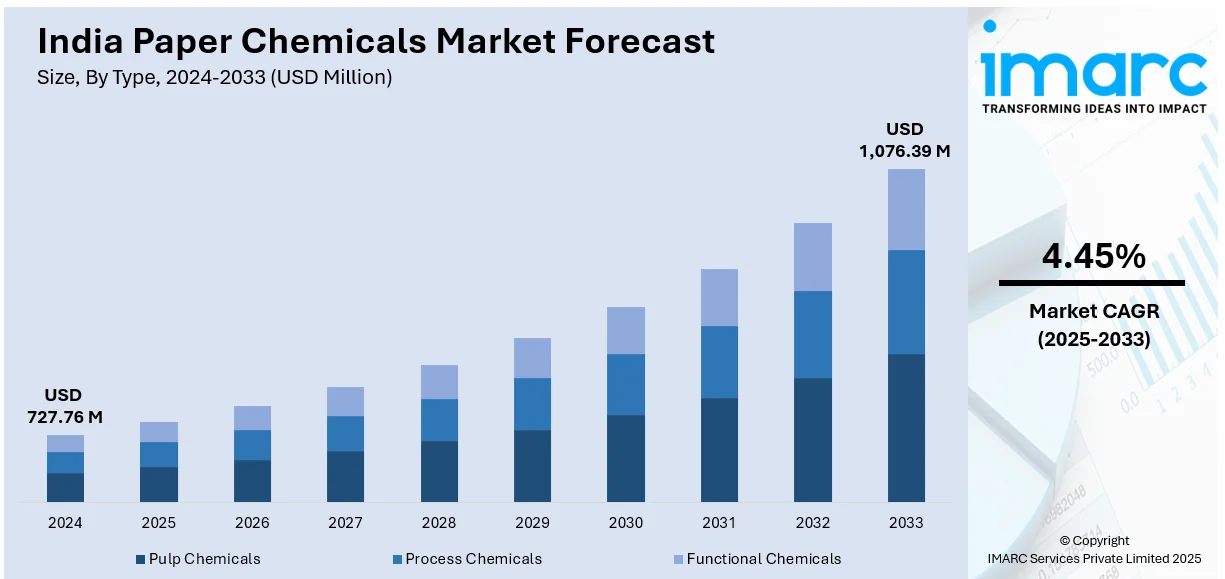

The India paper chemicals market size reached USD 727.76 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,076.39 Million by 2033, exhibiting a growth rate (CAGR) of 4.45% during 2025-2033. The market is expanding due to rising paper production, packaging demand, and eco-friendly chemical adoption. Growth is driven by increasing paper recycling, advancements in specialty chemicals, and government policies promoting sustainable manufacturing in the pulp and paper industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 727.76 Million |

| Market Forecast in 2033 | USD 1,076.39 Million |

| Market Growth Rate 2025-2033 | 4.45% |

India Paper Chemicals Market Trends:

Increasing Demand for Specialty Paper Chemicals

The India paper chemicals market is experiencing notable expansion mainly because of the heightening need for specialty paper chemicals, driven by expanding applications in packaging, printing, and hygiene products. With e-commerce and sustainable packaging gaining traction, manufacturers are increasingly adopting functional chemicals such as wet-strength resins, sizing agents, and retention aids to enhance paper performance. For instance, as per industry reports, in 2024, 8% of the retail sector across India is attributed to the e-commerce segment, with projections indicating this percent to increase to 14% by the year 2028. Moreover, the growing preference for high-quality, durable, and recyclable paper has further accelerated the use of surface treatment chemicals that improve printability and water resistance. Additionally, the increasing adoption of biodegradable and food-safe paper packaging in response to regulatory changes and environmental concerns is driving demand for eco-friendly chemical formulations. Technological advancements in chemical manufacturing, such as enzyme-based solutions and nanoparticle coatings, are also shaping product development. Market players are investing in research and innovation to create cost-effective, high-performance chemicals that enhance fiber bonding, reduce energy consumption, and minimize water usage in paper production processes.

To get more information on this market, Request Sample

Rising Focus on Sustainable and Environmentally Friendly Chemicals

Sustainability concerns and stringent environmental regulations are significantly influencing the India paper chemicals market. The transition towards chlorine-free bleaching agents, bio-based polymers, and low-emission defoamers is gaining momentum as the industry seeks to reduce its environmental footprint. Rising awareness about wastewater treatment and chemical recovery processes has led to the development of greener alternatives such as enzyme-based pulping chemicals and biodegradable retention aids. For instance, according to the Press Information Bureau, during January-December 2024, 12 initiatives for the development of 305 MLD sewage treatment capacity were approved by the government of India, with 750 completed during same period, highlighting amplifying emphasis on wastewater treatment across the country. Additionally, the implementation of stringent government policies, including the promotion of Extended Producer Responsibility (EPR) in paper packaging, is pushing manufacturers to adopt sustainable chemical solutions. The increasing shift towards recycled fiber in paper production has also fueled demand for advanced deinking and dispersant chemicals that enhance fiber recovery efficiency. Companies are actively making investments in research and development ventures to introduce water-efficient and energy-saving chemical solutions, aligning with global sustainability goals. The adoption of circular economy principles in paper manufacturing is expected to further drive innovation in eco-friendly paper chemicals.

India Paper Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and form.

Type Insights:

- Pulp Chemicals

- Process Chemicals

- Functional Chemicals

The report has provided a detailed breakup and analysis of the market based on the type. This includes pulp chemicals, process chemicals, and functional chemicals.

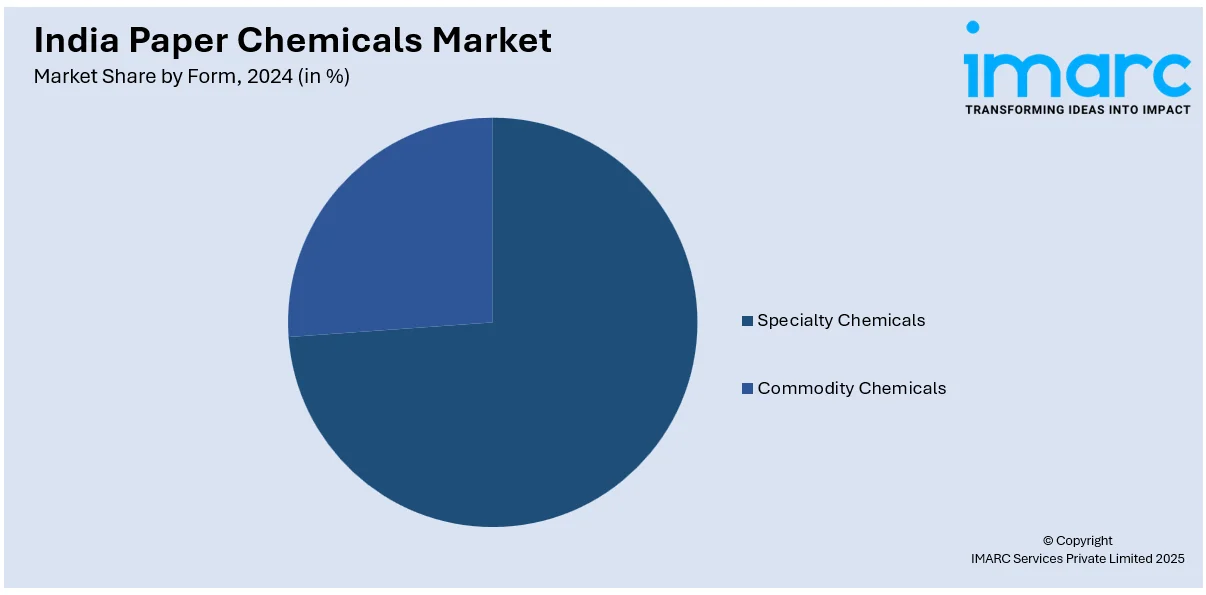

Form Insights:

- Specialty Chemicals

- Commodity Chemicals

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes specialty chemicals and commodity chemicals.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Paper Chemicals Market News:

- In June 2024, Solenis, a major specialty chemicals firm with significant presence across Indian market, announced collaboration with PhaBuilder Biotechnology Co to boost development of critical PHA-based technology for the paper packaging segment. The companies are targeting to cater to the heightening demand for sustainability across packaging sector.

India Paper Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pulp Chemicals, Process Chemicals, Functional Chemicals |

| Forms Covered | Specialty Chemicals, Commodity Chemicals |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India paper chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India paper chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India paper chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paper chemicals market in India was valued at USD 727.76 Million in 2024.

The India paper chemicals market is projected to exhibit a CAGR of 4.45% during 2025-2033, reaching a value of USD 1,076.39 Million by 2033.

The India paper chemicals market is fueled by the growing need for high-quality packaging and specialty papers, rising environmental regulations promoting eco-friendly chemicals, and technological advancements in paper processing. Growth in e-commerce, FMCG, and sustainable manufacturing practices further accelerates the market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)