India Paper Bags Market Size, Share, Trends and Forecast by Product Type, Material Type, Thickness, Distribution Channel, End Use Industry, and Region, 2026-2034

India Paper Bags Market Summary:

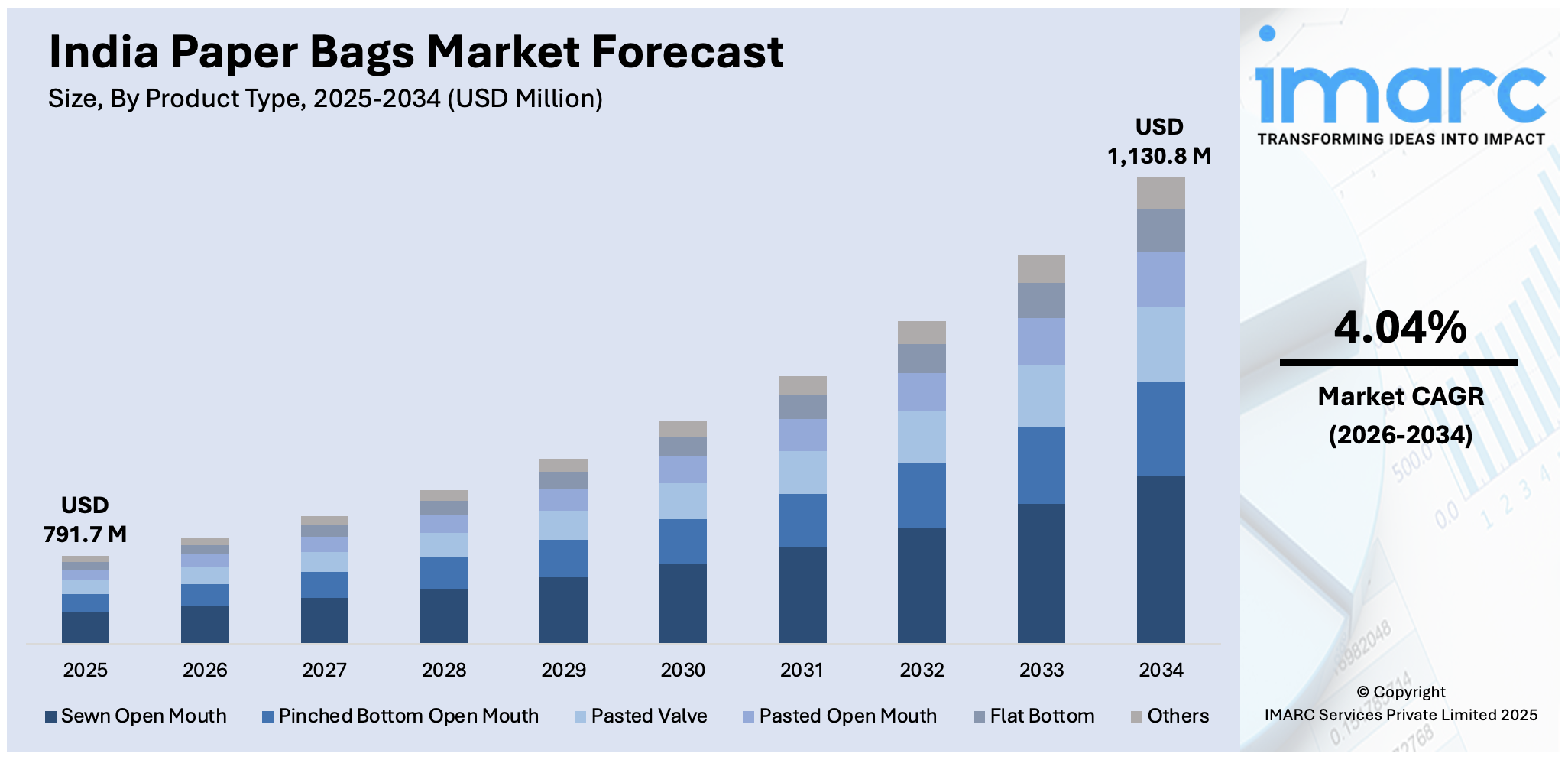

The India paper bags market size was valued at USD 791.65 Million in 2025 and is projected to reach USD 1,130.84 Million by 2034, growing at a compound annual growth rate of 4.04% from 2026-2034.

The India paper bags market is gaining substantial momentum as environmental awareness intensifies and government regulations mandate the phaseout of single-use plastics across the nation. The market expansion is supported by growing retail and organized trade sectors, expanding e-commerce operations, and rising consumer preference for sustainable packaging alternatives. Innovations in paper bag manufacturing, including enhanced durability and moisture-resistant coatings, are enabling broader applications across diverse end use industries. The transition toward eco-friendly packaging solutions among food service operators, quick-commerce platforms, and luxury retail segments is reshaping India paper bags market share.

Key Takeaways and Insights:

- By Product Type: Pasted open mouth dominates the market with a share of 25% in 2025, because of its numerous uses in the retail, industrial, and food packaging industries. The easy-fill design and cost-effective production make it preferable for high-volume manufacturing.

- By Material Type: Brown kraft leads the market with a share of 68% in 2025. This dominance is driven by superior strength, durability, biodegradability, and cost-effectiveness compared to white kraft variants, making it ideal for heavy-duty packaging applications.

- By Thickness: 2 ply represents the biggest segment with a market share of 33% in 2025, reflecting optimal balance between durability and cost efficiency for medium-weight products across food and beverage, retail, and pharmaceutical applications.

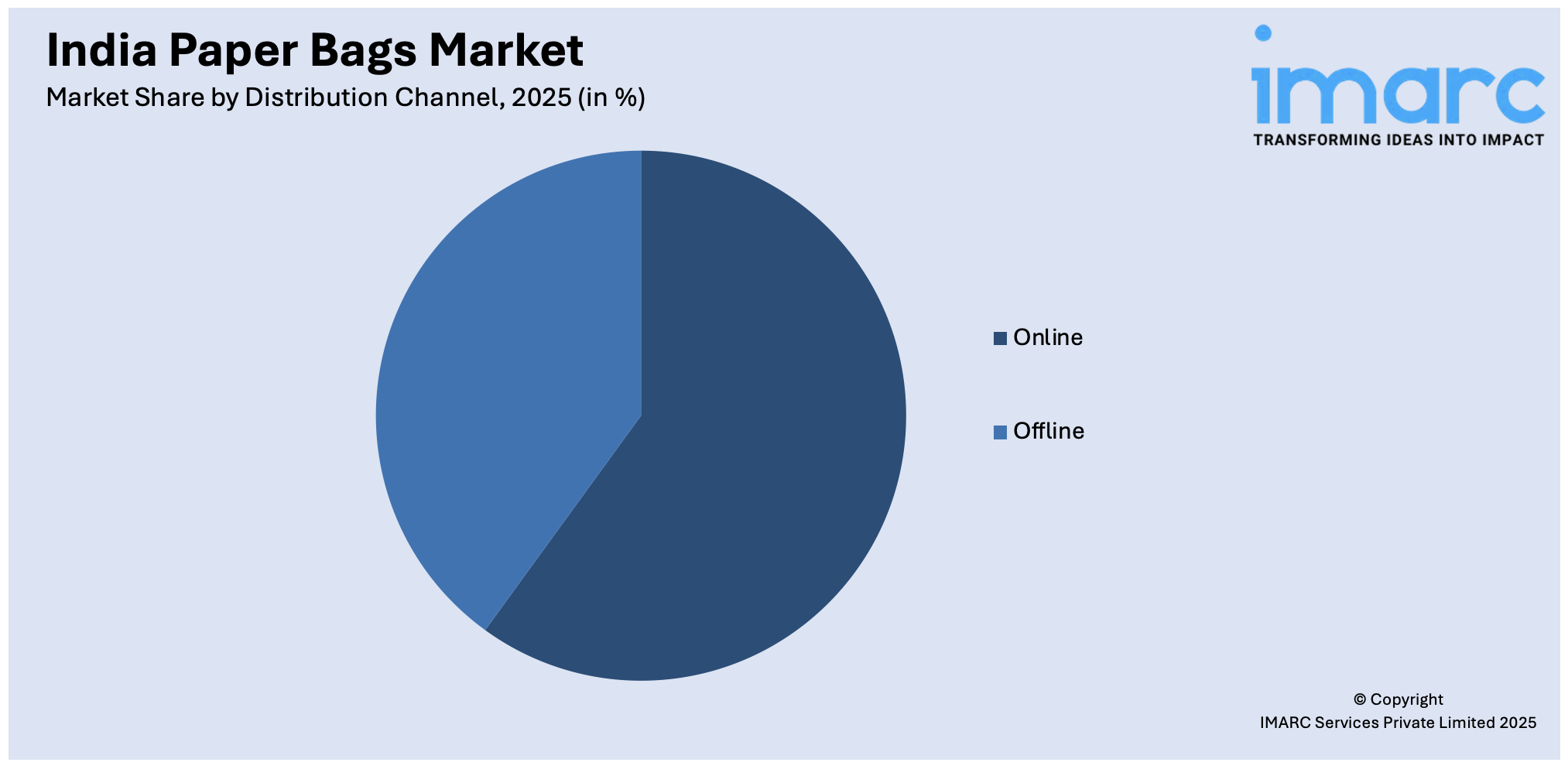

- By Distribution Channel: Offline exhibits a clear dominance in the market with 82% share in 2025, driven by the extensive network of brick-and-mortar retail outlets, supermarkets, and traditional trade establishments requiring immediate packaging solutions.

- By End Use Industry: Food and beverages dominate the market with a share of 45% in 2025, due to strict food safety regulations, expanding quick-service restaurant chains, and rising customer demand for environmentally friendly food packaging options.

- By Region: North India is the largest region with 30% share in 2025, driven by high concentration of manufacturing units, dense urban population centers in Delhi NCR, and robust retail infrastructure supporting paper bag adoption.

- Key Players: Key players drive the India paper bags market by expanding manufacturing capacities, investing in advanced production technologies, and developing innovative moisture-resistant and customizable packaging solutions. Their strategic partnerships with retail chains and e-commerce platforms accelerate adoption across diverse consumer segments.

To get more information on this market Request Sample

The India paper bags market is witnessing transformative growth as sustainability becomes central to packaging strategies across industries. Government initiatives targeting single-use plastic elimination have created a favorable regulatory environment, necessitating urgent alternatives. The market benefits from expanding organized retail networks, proliferating quick-commerce platforms, and growing consumer environmental consciousness. In January 2024, ITC Foods introduced its Sunfeast Farmlite Digestive family pack in 800-gram format using 100% paper-based outer packaging, marking a significant industry shift toward sustainable solutions. Manufacturers are investing in advanced machinery capable of producing high-quality bags at scale, while innovations in barrier coatings enable applications in moisture-sensitive food packaging. The convergence of regulatory pressure, consumer demand, and corporate sustainability commitments positions India paper bags market growth for sustained expansion through the forecast period.

India Paper Bags Market Trends:

Accelerated Adoption Driven by Single-Use Plastic Regulations

The nationwide ban on single-use plastics implemented under the Plastic Waste Management Rules is fundamentally reshaping packaging choices across industries. Businesses are transitioning to paper-based alternatives to ensure regulatory compliance and avoid penalties. State-level enforcement drives and border checkpoints monitoring banned plastic items have intensified the shift toward sustainable packaging. Retailers, restaurants, and food service operators are increasingly adopting branded paper bags that serve dual purposes of compliance and marketing, creating sustained demand growth.

Integration of Advanced Manufacturing Technologies

Paper bag manufacturers are presently continuously engaged in deploying sophisticated automation and servo-controlled machinery to enhance production efficiency and quality consistency. Modern equipment enables rapid size changeovers and higher output rates while maintaining precise folding and sealing standards. These technological upgrades support customization capabilities including multi-color printing, embossing, and handle attachment options. Investment in digital printing technologies allows for short-run customized orders catering to brand-specific requirements of retail clients and e-commerce operators.

Expansion of Eco-Conscious Consumer Preferences

Growing environmental awareness among Indian consumers is currently driving preference for biodegradable and recyclable packaging solutions. Urban consumers increasingly associate paper bag usage with brand sustainability credentials, influencing purchasing decisions. Luxury retail segments and premium food brands leverage aesthetically designed paper bags as brand differentiators. The rising middle-class population with higher disposable incomes demonstrates willingness to pay premium prices for products utilizing eco-friendly packaging, thereby supporting India paper bags market growth.

Market Outlook 2026-2034:

The India paper bags market is poised for sustained expansion throughout the forecast period, underpinned by strengthening regulatory frameworks, expanding retail infrastructure, and evolving consumer preferences toward sustainable packaging. The market generated a revenue of USD 791.65 Million in 2025 and is projected to reach a revenue of USD 1,130.84 Million by 2034, growing at a compound annual growth rate of 4.04% from 2026-2034. The proliferation of quick-commerce platforms and organized retail chains across tier-two and tier-three cities is creating new demand centers. Manufacturers are expanding production capacities and establishing regional facilities to optimize logistics and serve local markets efficiently. Ongoing innovation in moisture-resistant coatings and grease-proof paper technologies is enabling penetration into previously underserved food packaging applications, while export opportunities are emerging as global demand for sustainable packaging intensifies.

India Paper Bags Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Pasted Open Mouth |

25% |

|

Material Type |

Brown Kraft |

68% |

|

Thickness |

2 Ply |

33% |

|

Distribution Channel |

Offline |

82% |

|

End Use Industry |

Food and Beverages |

45% |

|

Region |

North India |

30% |

Product Type Insights:

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Pasted Valve

- Pasted Open Mouth

- Flat Bottom

- Others

Pasted open mouth dominates with a market share of 25% of the total India paper bags market in 2025.

The pasted open mouth segment maintains market leadership due to its exceptional versatility across diverse packaging applications. This product type features an open top that facilitates easy filling operations, making it particularly suitable for automated packaging lines in food processing and retail environments. The adhesive-sealed bottom construction provides reliable strength for carrying medium to heavy-weight contents while enabling efficient stacking during storage and transportation. Manufacturers prefer this format for its cost-effective production process and adaptability to various size requirements.

The segment benefits from expanding applications in quick-service restaurants, bakeries, and retail shopping bags where rapid filling and presentation are essential. Advanced manufacturing equipment featuring servo-controlled systems enables high-speed production with minimal changeover time between different bag sizes. Manufacturers continue investing in automation technologies to meet growing demand while maintaining consistent quality. The growing preference among brand owners for customizable printed designs featuring logos, brand messaging, and aesthetic finishes further strengthens segment demand across premium retail and food service sectors.

Material Type Insights:

- Brown Kraft

- White Kraft

Brown kraft leads with a share of 68% of the total India paper bags market in 2025.

Brown kraft paper bags command the majority market share owing to their superior mechanical strength, cost efficiency, and enhanced sustainability credentials. The unbleached kraft production process retains natural lignin content, delivering exceptional tear resistance and durability suitable for heavy-duty packaging requirements. Brown kraft bags are particularly favored in industrial, construction, and food service applications where functional performance takes precedence over aesthetic considerations. The material's natural appearance also resonates with environmentally conscious consumers seeking authentic eco-friendly packaging.

The brown kraft segment benefits from favorable raw material economics as the unbleached manufacturing process requires less chemical treatment and energy consumption compared to bleached alternatives. Southern states like Tamil Nadu and Karnataka house a significant concentration of manufacturing units due to robust pulpwood availability, supporting competitive pricing structures. The proximity to raw material sources enables cost-efficient production and optimized supply chains. Indian manufacturers are actively investing in enhanced strength grades and advanced barrier coatings to expand brown kraft applications into moisture-sensitive food packaging segments.

Thickness Insights:

- 1 Ply

- 2 Ply

- 3 Ply

- > 3 Ply

2 ply exhibits a clear dominance with a 33% share of the total India paper bags market in 2025.

2 ply thickness segment captures the largest market share by delivering optimal balance between structural integrity and manufacturing cost efficiency. This configuration provides sufficient strength for carrying medium-weight items commonly encountered in retail shopping, food service, and pharmaceutical packaging applications. The double-layer construction offers enhanced puncture resistance and load-bearing capacity compared to single-ply alternatives while maintaining competitive pricing that supports mass-market adoption across diverse end use industries. The reinforced structure ensures reliable performance during handling and transportation without excessive material consumption.

2 ply segment benefits from versatile applicability across multiple market verticals, including grocery retail, quick-service restaurants, and departmental stores. Manufacturers optimize 2 ply production for high-volume orders from organized retail chains and food service aggregators requiring consistent quality at competitive unit costs. The thickness specification meets standard durability requirements while enabling efficient material utilization throughout the production process. This balance between performance and economy positions the segment favorably for continued growth as businesses seek packaging solutions that satisfy both functional needs and budget constraints across expanding retail and food service networks.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline represents the leading segment with 82% share of the total India paper bags market in 2025.

The offline distribution channel maintains overwhelming market dominance driven by the extensive network of traditional retail establishments, supermarkets, and direct business-to-business procurement relationships. Physical retail outlets require immediate packaging availability, favoring established distribution networks with regional warehousing capabilities. The offline channel facilitates bulk procurement negotiations, customization discussions, and quality verification essential for large-volume buyers including organized retail chains and hospitality sector operators. Face-to-face interactions enable detailed specification discussions and sample evaluations that strengthen long-term business partnerships.

The segment strength reflects India's retail landscape where brick-and-mortar establishments continue commanding significant consumer footfall despite e-commerce growth. Domestic paper production increasingly relies on recovered paper and recycled fiber, supporting robust offline supply chains throughout the country. Direct manufacturer-retailer relationships enable efficient order fulfillment and responsive customization services tailored to specific branding requirements. The offline channel also serves wholesale markets and packaging material distributors who subsequently supply small-scale retailers, food vendors, and local businesses requiring paper bags. This multi-tiered distribution structure ensures comprehensive market coverage across urban and semi-urban areas.

End Use Industry Insights:

- Food and Beverages

- Pharmaceutical

- Retail

- Construction

- Chemicals

- Others

Food and beverages dominate with a market share of 45% of the total India paper bags market in 2025.

The food and beverages segment commands the largest market share driven by stringent food safety regulations, expanding quick-service restaurant networks, and growing consumer preference for hygienic, sustainable packaging. Paper bags offer natural grease resistance and breathability essential for bakery products, snacks, and takeaway meals. The segment benefits from rising health consciousness among consumers associating paper packaging with product freshness and safety. Quick-commerce platforms delivering food within short timeframes increasingly mandate paper-based packaging compliant with sustainability standards. The proliferation of cloud kitchens and delivery-focused food businesses further amplifies packaging requirements.

The segment growth accelerates as major food brands transition toward sustainable packaging solutions aligned with corporate environmental commitments. Urban consumers increasingly utilize rapid commerce platforms for food purchases, driving demand for functional paper-based packaging solutions. Innovations including leak-proof paper containers, insulated wraps, and compostable trays help food service operators meet both functionality and sustainability requirements effectively. The recurring high-frequency nature of food delivery orders positions this segment as a powerful volume driver for paper bag manufacturers seeking stable demand streams across metropolitan and emerging urban markets.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India holds the largest share of 30% of the total India paper bags market in 2025.

North India leads market consumption driven by the dense concentration of manufacturing units, robust retail infrastructure, and high urbanization levels across the Delhi National Capital Region and adjoining states. The region houses major metropolitan centers with extensive organized retail presence, quick-service restaurant chains, and e-commerce fulfillment operations generating substantial paper bag demand. Strong regulatory enforcement of single-use plastic bans by the National Green Tribunal in Delhi NCR has accelerated substitution toward paper-based packaging alternatives across commercial establishments. The concentration of corporate headquarters, hospitality chains, and premium retail outlets in the region creates sustained demand for customized branded paper bags serving marketing and packaging purposes simultaneously.

The region benefits from well-developed transportation networks facilitating efficient raw material procurement and finished goods distribution throughout northern territories. Proximity to major consumer markets enables manufacturers to maintain responsive supply chains meeting fluctuating demand patterns. Educational institutions, government offices, and corporate campuses implementing sustainability initiatives further contribute to regional paper bag adoption. The presence of established packaging material distributors and wholesale markets supports comprehensive coverage across organized retail and traditional trade channels throughout North India.

Market Dynamics:

Growth Drivers:

Why is the India Paper Bags Market Growing?

Stringent Government Regulations Phasing Out Single-Use Plastics

The Government of India has implemented comprehensive regulatory measures targeting elimination of single-use plastics, creating a favorable policy environment for paper bag adoption. The Plastic Waste Management Amendment Rules mandate prohibition of identified single-use plastic items and require plastic carry bags to meet minimum thickness standards, effectively eliminating thin plastic bags from circulation. State-level enforcement through special task forces conducts regular inspections at manufacturing units, retail establishments, and border checkpoints to prevent distribution of banned items. The National Green Tribunal has imposed bans on non-biodegradable plastic bags in major metropolitan regions, while state-owned institutions have eliminated single-use plastics from their operations. Municipal authorities conduct periodic drives confiscating banned plastic items from commercial establishments and imposing penalties on violators. These regulatory pressures compel businesses across food service, retail, and industrial sectors to transition toward compliant paper-based packaging alternatives, driving sustained market growth. The progressive strengthening of enforcement mechanisms ensures continued momentum toward plastic substitution across diverse industry verticals throughout the country.

Rapid Expansion of E-Commerce and Quick-Commerce Platforms

The exponential growth of online retail and quick-commerce platforms is generating unprecedented demand for sustainable packaging solutions throughout India. Online shopping penetration continues expanding across metropolitan and emerging urban centers, representing substantial growth in packaging material requirements annually. Quick-commerce operators promising rapid delivery timeframes are increasingly adopting paper-based packaging that combines tamper-evidence, moisture resistance, and sustainability credentials appealing to environmentally conscious consumers. Large e-commerce platforms have implemented automated packing lines standardizing package dimensions while prioritizing recyclable materials to meet corporate sustainability commitments and regulatory compliance requirements. The penetration of quick-commerce into tier-two and tier-three cities is creating new demand centers for paper bags as local retailers and restaurants join aggregator platforms seeking broader market reach. Food delivery services particularly favor kraft paper bags that provide grease resistance and maintain product temperature during transit operations. The competitive landscape among delivery platforms drives continuous improvement in packaging quality and sustainability standards, benefiting paper bag manufacturers serving this rapidly expanding segment.

Rising Consumer Preference for Sustainable and Eco-Friendly Packaging

Increasing environmental consciousness among Indian consumers is fundamentally reshaping packaging preferences across demographic segments and geographic regions throughout the country. Urban consumers increasingly associate brand sustainability credentials with packaging material choices, influencing purchase decisions particularly in food, fashion, and personal care categories where packaging visibility remains high. The growing middle-class population with higher disposable incomes demonstrates willingness to support brands utilizing eco-friendly packaging solutions even at premium price points reflecting environmental values. Younger consumer demographics exhibit particularly strong preferences for sustainable packaging, driving brands to adopt paper-based alternatives for customer retention and acquisition purposes. Luxury retail brands leverage premium paper bag designs featuring custom printing, embossing, and decorative handles as brand differentiators enhancing customer experience and perceived product value. Social media amplification of sustainability initiatives encourages businesses to showcase eco-friendly packaging choices as marketing advantages. The alignment of consumer preferences with corporate sustainability goals accelerates paper bag adoption across organized retail, hospitality, and food service sectors seeking to strengthen brand positioning among environmentally aware customer segments.

Market Restraints:

What Challenges the India Paper Bags Market is Facing?

Raw Material Price Volatility and Supply Chain Constraints

The India paper bags market faces significant challenges from fluctuating kraft paper prices and inconsistent raw material availability affecting manufacturing operations. Kraft paper costs demonstrate considerable volatility on a quarterly basis, impacting manufacturer profitability and pricing stability throughout the value chain. India relies substantially on seaborne recovered fiber imports, exposing the industry to freight disruptions and international price fluctuations beyond domestic control. Limited domestic waste paper collection infrastructure constrains recycled material availability, while wood fiber shortages persist due to restrictions on industrial plantations limiting raw material sourcing options.

Higher Production Costs Compared to Plastic Alternatives

Paper bags require higher manufacturing costs compared to conventional plastic bags, creating adoption barriers particularly among price-sensitive small-scale retailers and vendors operating on thin margins. The production process involves more extensive raw material processing, energy consumption, and quality control requirements increasing per-unit expenses. Small-scale manufacturers operating in rural manufacturing clusters face infrastructure limitations affecting production efficiency and cost competitiveness. Limited economies of scale among fragmented producers restrict cost optimization opportunities, maintaining price premiums that slow transition from cheaper plastic alternatives in price-conscious market segments.

Moisture Sensitivity and Limited Weather Resistance

Inherent moisture sensitivity of paper materials limits application range in humid climates and for liquid or wet product packaging requiring water-resistant solutions. Paper bags require protective storage conditions and careful handling during monsoon seasons prevalent across India for extended periods annually. While barrier coating technologies are advancing rapidly, treated paper bags command premium prices restricting adoption in cost-sensitive applications where functionality requirements conflict with budget constraints. The functional limitations compared to waterproof plastic alternatives constrain market penetration in certain food service and industrial packaging segments requiring enhanced durability.

Competitive Landscape:

The India paper bags market exhibits a fragmented competitive structure with numerous domestic manufacturers serving regional markets alongside established players expanding nationwide presence. Competition intensifies as companies invest in manufacturing capacity expansion, advanced production technologies, and product innovation to capture growing demand. Market participants differentiate through customization capabilities, sustainable sourcing certifications, and strategic partnerships with retail chains and e-commerce platforms. The industry experiences consolidation trends as larger players acquire regional manufacturers to expand geographic coverage and production capacity. Companies focus on developing barrier-coated variants, reinforced handles, and premium printing finishes to serve diverse end-user requirements. Strategic investments in digital printing technologies enable short-run customization catering to brand-specific packaging needs.

India Paper Bags Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Sewn Open Mouth, Pinched Bottom Open Mouth, Pasted Valve, Pasted Open Mouth, Flat Bottom, Others |

| Material Types Covered | Brown Kraft, White Kraft |

| Thickness Covered | 1 Ply, 2 Ply, 3 Ply, > 3 Ply |

| Distribution Channels Covered | Online, Offline |

| End Use Industries Covered | Food and Beverages, Pharmaceutical, Retail, Construction, Chemicals, Others |

| Region Covered | North India, West and Central India, South India, East India, |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India paper bags market size was valued at USD 791.65 Million in 2025.

The India paper bags market is expected to grow at a compound annual growth rate of 4.04% from 2026-2034 to reach USD 1,130.84 Million by 2034.

Pasted open mouth dominated the market with a share of 25%, owing to its versatile application across food packaging, retail shopping, and industrial sectors with easy-fill design and cost-effective production.

Key factors driving the India paper bags market include stringent government regulations banning single-use plastics, rapid e-commerce and quick-commerce expansion, rising consumer preference for sustainable packaging, and growing retail sector development.

Major challenges include raw material price volatility with kraft paper costs fluctuating quarterly, limited domestic raw material availability, higher production costs compared to plastic alternatives, infrastructure constraints, and moisture sensitivity limiting certain applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)