India Palm Oil Market Size, Share, Trends and Forecast by Packaging Type, Packaging Material, Pack Size, Domestic Manufacturing/Imports, Application, Distribution Channel, and Region, 2026-2034

India Palm Oil Market Summary:

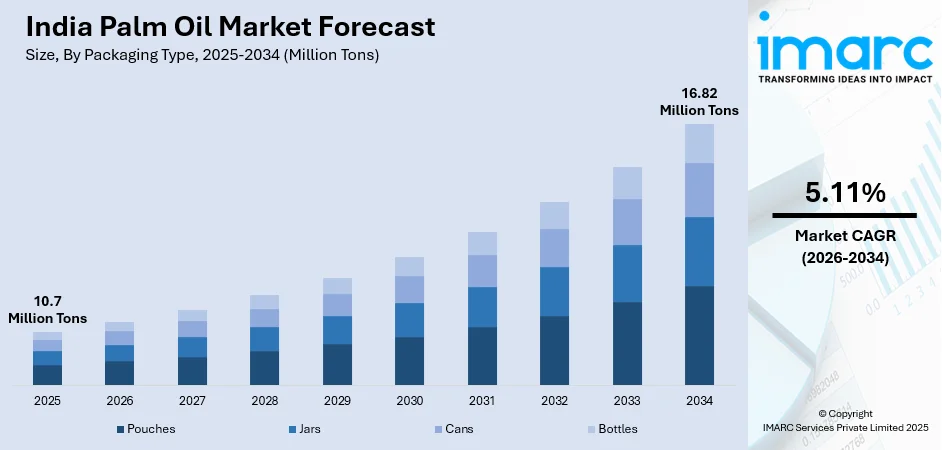

The India palm oil market size reached 10.7 Million Tons in 2025 and is projected to reach 16.82 Million Tons by 2034, growing at a compound annual growth rate of 5.11% from 2026-2034.

The India palm oil market growth is primarily driven by the rising population and increasing urbanization, which are driving the demand for affordable cooking oils across households and food service establishments. The expanding food processing industry, the growing preference for packaged foods, and government initiatives to boost domestic oil palm cultivation are collectively reshaping the edible oil landscape and creating substantial opportunities for market participants across the value chain.

Key Takeaways and Insights:

- By Packaging Type: Pouches dominates the market with a share of 41% in 2025, driven by their cost-effectiveness, convenience for daily household use, and widespread availability across retail channels.

- By Packaging Material: Plastic leads the market with a share of 49% in 2025, due to its durability, lightweight properties, and suitability for various pack sizes preferred by Indian consumers.

- By Pack Size: 1 litres-5 litres represent the largest segment with a market share of 31% in 2025, reflecting user preference for medium-sized packaging that balances affordability with storage convenience.

- By Domestic Manufacturing/Imports: Domestic manufacturing dominates the market with a share of 67% in 2025, supported by government initiatives to expand oil palm cultivation and reduce import dependence.

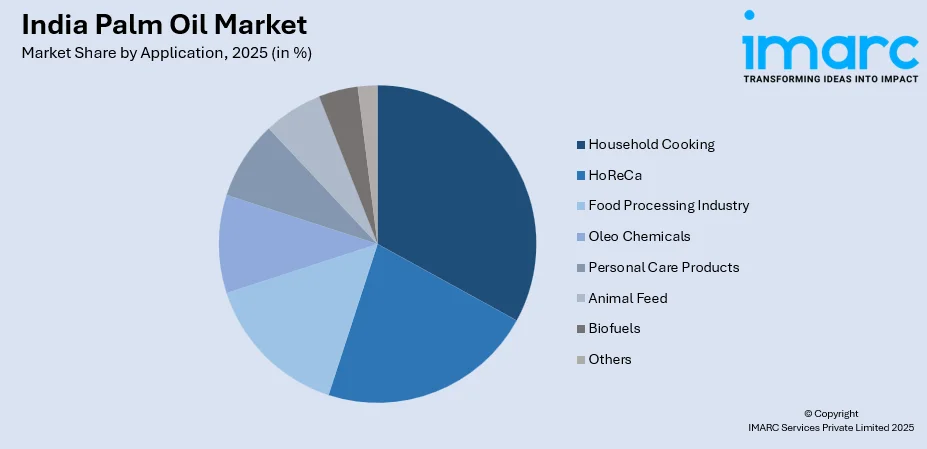

- By Application: Household cooking leads the market with a share of 49% in 2025, owing to palm oil's affordability and widespread acceptance as a primary cooking medium across Indian households.

- By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 43% in 2025, benefiting from organized retail expansion, product variety, and competitive pricing strategies.

- By Region: North India dominates the market with a share of 30% in 2025, driven by high population density, rising urbanization, and strong presence of organized retail infrastructure.

- Key Players: The India palm oil market exhibits moderate competitive intensity, with established processors and agribusiness companies competing alongside regional manufacturers across price segments and distribution channels. Some of the key players operating in the market include 3F Industries Ltd., AWL Agri Business Ltd, Emami Agrotech Ltd., Gokul Group, K. S. Oils Limited, Oil Palm India Ltd., and Patanjali Foods Ltd.

To get more information on this market Request Sample

The India palm oil market is driven by rising domestic consumption, supply security concerns, and government initiatives aimed at reducing import dependence. The growing demand from the food processing, personal care, and biofuel sectors continues to increase palm oil usage due to its cost efficiency and versatility. Policy support under national oilseed and edible oil missions is encouraging domestic cultivation and processing capacity expansion. By November 2025, around 2.50 lakh hectares had been newly covered, bringing total oil palm cultivation in India to 6.20 lakh hectares. This expansion has directly supported output growth, with crude palm oil production increasing from 1.91 lakh tons in 2014–15 to 3.80 lakh tons in 2024–25. Rising yields, improved planting material, and better farmer incentives are strengthening supply prospects. In addition, population growth and higher consumption of packaged foods are sustaining the demand, positioning palm oil as a strategically important commodity within India’s edible oils market.

India Palm Oil Market Trends:

Government Support for Domestic Oil Palm Cultivation

Policy initiatives aimed at reducing edible oil import dependence are supporting the growth of domestic palm oil production. Government programs encourage oil palm cultivation through financial incentives, improved planting material, and infrastructure support. Expansion of cultivated area and improved yields are strengthening local supply and stabilizing availability. In 2024, the Ministry of Agriculture announced the successful planting of over 17 lakh oil palm saplings across 15 states under the National Mission for Edible Oils – Oil Palm. The Mega Oil Palm Plantation Drive, launched on July 15, 2024, aimed to reduce India’s edible oil import dependence while benefiting over 10,000 farmers. These measures contribute to long term market growth by reducing reliance on imports and supporting rural agricultural development.

Industry Commitment to Sustainable Palm Oil Practices

Industry stakeholders are recognizing the importance of responsible sourcing, environmental protection, and long-term viability of cultivation practices. This awareness is leading to a higher number collaborative initiatives that aim to balance production growth with ecological and social responsibility. For example, in October 2024, IDH launched the India Sustainable Palm Oil Manifesto, which was endorsed by major players including Godrej Agrovet and Patanjali Foods. The manifesto advocated for responsible sourcing, increased support for smallholders, and enhanced consumer awareness about sustainable palm oil. This initiative reflects broader industry alignment toward sustainable palm oil sourcing while supporting the market growth.

Expansion of Domestic Processing Infrastructure

The growing number of investments in domestic processing infrastructure is influencing the India palm oil market by strengthening local value chains and improving supply efficiency. In 2025, Patanjali Foods announced plans to establish an oil palm mill in Mizoram’s Lawngtlai district, with completion targeted within one year. The facility sourced oil palm from farmers across multiple districts, supporting regional cultivation and farmer participation. This investment enhanced processing capacity closer to production areas, reduced transportation costs, and improved raw material utilization. Such developments increase domestic crude palm oil output, support rural income generation, and reinforce long term market growth by reducing dependence on imported edible oils.

Market Outlook 2026-2034:

The India palm oil market demonstrates growth potential over the forecast period, supported by sustained demand from the food processing industry and changing consumer consumption patterns. Palm oil remains a preferred edible oil due to its cost efficiency, versatility, and wide application across packaged foods and commercial cooking. The market size was estimated at 10.7 Million Tons in 2025 and is expected to reach 16.82 Million Tons by 2034, reflecting a compound annual growth rate of 5.11% over the forecast period 2026-2034. Population growth, urbanization, and rising processed food consumption are expected to further support the market growth.

India Palm Oil Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Packaging Type |

Pouches |

41% |

|

Packaging Material |

Plastic |

49% |

|

Pack Size |

1 Litres-5 Litres |

31% |

|

Domestic Manufacturing/Imports |

Domestic Manufacturing |

67% |

|

Application |

Household Cooking |

49% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

43% |

|

Region |

North India |

30% |

Packaging Type Insights:

- Pouches

- Jars

- Cans

- Bottles

Pouches dominates with a market share of 41% of the total India palm oil market in 2025.

Pouches represent the largest segment owing to their cost effectiveness, lightweight structure, and convenience in handling and transportation. They reduce packaging material usage and logistics costs, making them suitable for large scale distribution across retail and wholesale channels.

Their dominance is further supported by ease of storage, flexibility in pack sizes, and the growing acceptance among price sensitive users. Pouches also offer better space efficiency for retailers and support higher sales volumes in both urban and rural markets.

Packaging Material Insights:

- Metal

- Plastic

- Paper

- Others

Plastic leads with a market share of 49% of the total India palm oil market in 2025.

Plastic accounts for the majority of the market share because of its durability, low cost, and strong resistance to leakage. It ensures product safety during transportation and storage while maintaining oil quality across diverse distribution environments.

Its widespread use is also driven by flexibility in packaging formats, including bottles and pouches, and ease of handling for individuals and retailers. Established plastic packaging infrastructure supports large scale production and efficient nationwide distribution.

Pack Size Insights:

- Less than 1 Litres

- 1 Litres

- 1 Litres-5 Litres

- 5 Litres-10 Litres

- 10 Litres and Above

1 litres-5 litres exhibit a clear dominance with a 31% share of the total India palm oil market in 2025.

1 litre to 5 litres dominates the market due to their suitability for regular household consumption. These sizes balance affordability and convenience, meeting the needs of families seeking manageable quantities for daily cooking requirements.

Their dominance is further supported by widespread availability across retail formats and compatibility with monthly purchasing habits. This pack size range appeals to both urban and rural consumers, supporting consistent sales volumes and repeat purchases.

Domestic Manufacturing/Imports Insights:

- Domestic Manufacturing

- Imports

Domestic manufacturing dominates with a market share of 67% of the total India palm oil market in 2025.

Domestic manufacturing leads the market owing to the increasing policy focus on reducing import dependence and strengthening domestic edible oil production. Government initiatives supporting oil palm cultivation and local processing are improving supply reliability and production capacity.

This dominance is further supported by rising investment in domestic refining infrastructure and farmer incentives. For instance, in 2024, India’s inaugural oil palm processing facility started functioning in Arunachal Pradesh, part of the National Mission for Edible Oils - Oil Palm (NMEO-OP). This factory contributed to India's initiative to lessen reliance on edible oil imports and enhance domestic production.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household Cooking

- HoReCa

- Food Processing Industry

- Oleo Chemicals

- Personal Care Products

- Animal Feed

- Biofuels

- Others

Household cooking leads with a market share of 49% of the total India palm oil market in 2025.

Household cooking holds the biggest market share attributed to its affordability, high smoke point, and versatility in everyday cooking. According to the Asian Palm Oil Alliance in 2024, India consumes 24–25 million tons of edible oil annually, of which palm oil accounts for about 9 million tons.

Its dominance is further reinforced by widespread availability, stable pricing, and long shelf life. Palm oil’s neutral taste and ability to withstand repeated heating make it a preferred choice for cost conscious households in both urban and rural areas.

Distribution Channel Insights:

- Direct/Institutional Sales

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 43% share of the total India palm oil market in 2025.

Supermarkets and hypermarkets represent the largest segment, supported by their wide product assortment, consistent availability, and competitive pricing. These outlets attract high footfall and enable buyers to compare brands, pack sizes, and prices in one location.

Their dominance is further influenced by strong supply chain networks, promotional activities, and private label offerings. Supermarkets and hypermarkets also provide better visibility for packaged edible oils, supporting higher sales volumes across urban and semi urban markets.

Regional Insights:

- North India

- West and Central India

- East India

- South India

North India dominates with a market share of 30% of the total India palm oil market in 2025.

North India leads the market, driven by its large population base, high household consumption, and widespread use of palm oil in daily cooking and food preparation. Strong urbanization and dense retail networks support consistent demand across major states in the region.

The region also benefits from strong distribution infrastructure and a well-established food processing and hospitality base. Rising consumption through packaged foods, roadside eateries, and institutional catering supports palm oil demand. As per the IMARC Group, by 2033, India’s packaged food market is projected to reach USD 224.8 Billion, reinforcing sustained regional consumption trends.

Market Dynamics:

Growth Drivers:

Why is the India Palm Oil Market Growing?

Regulatory Enforcement and Data Transparency

Market transparency and regulatory discipline are becoming increasingly important drivers shaping India’s palm oil ecosystem. Stronger reporting requirements improve visibility across production, processing, and distribution stages, enabling better policy calibration and market oversight. This regulatory focus is distinct from cultivation initiatives and targets systemic efficiency. In October 2025, the Government of India announced inspections to enforce new edible oil reporting norms, requiring manufacturers and processors to submit monthly production data. Such measures strengthen compliance, reduce information asymmetry, and support more predictable market functioning across the palm oil value chain.

Strategic Collaborations

Strategic partnerships between industry associations and global sustainability bodies are supporting structured growth of the palm oil sector in India. These collaborations focus on awareness creation, research support, and policy advocacy aligned with national self-sufficiency goals. Such partnerships help improve governance standards and production practices. For instance, in 2024, RSPO and IVPA signed an MOU to promote sustainable palm oil practices in India, focusing on awareness, research, and policy advocacy. This collaboration aimed to support India's palm oil self-sufficiency goals under the National Mission on Edible Oils (NMEO-OP). This collaboration underscores efforts to position India as a responsible and reliable palm oil producer.

Strengthening Farmer Support and Oil Palm Cultivation Ecosystems

The expansion of structured farmer support systems is playing a key role in bolstering the growth of the India palm oil market by improving productivity and supply sustainability. In 2024, Godrej Agrovet inaugurated its first Samadhan Centre in Thanjavur, Tamil Nadu, offering oil palm farmers integrated access to agronomic guidance, tools, and support services. The initiative focused on enhancing yields, promoting sustainable farming practices, and improving farmer incomes. Godrej Agrovet’s plan to establish 50 such centers by 2027, highlights increasing private sector participation in strengthening the oil palm value chain. These efforts support expansion of cultivated area, improve farm level efficiency, and contribute to higher domestic crude palm oil output, reinforcing long term supply growth and reducing reliance on imports.

Market Restraints:

What Challenges the India Palm Oil Market is Facing?

High Import Dependency and Price Volatility

India's substantial reliance on palm oil imports creates vulnerability to international price fluctuations and supply disruptions from major producing countries. With Indonesia and Malaysia accounting for majority of India's palm oil imports, geopolitical developments, trade policy changes, and production variations in these countries directly impact domestic prices and availability, creating uncertainty for processors and end-users.

Environmental and Sustainability Concerns

The growing environmental concerns related to palm oil cultivation, including deforestation and biodiversity loss, are influencing consumer perceptions and sourcing strategies. Domestic expansion initiatives face closer scrutiny, particularly in northeastern regions, where sensitive ecosystems require careful management. Balancing agricultural development with environmental protection remains a key challenge shaping long term market dynamics.

Competition from Alternative Edible Oils

Rising health consciousness among individuals is leading to a shift toward edible oils, including sunflower, soybean, and mustard oil, which are perceived as healthier. Increased availability of fortified and functional oils marketed as heart healthy alternatives is intensifying competition, which may constrain palm oil adoption among nutrition focused consumer groups.

Competitive Landscape:

The India palm oil market exhibits moderate competitive intensity characterized by the presence of established agribusiness conglomerates alongside regional processors competing across price segments and distribution channels. Market dynamics reflect strategic positioning, ranging from premium, quality-focused offerings emphasizing sustainable sourcing to value-oriented products targeting cost-conscious users. The competitive landscape is increasingly shaped by backward integration initiatives, sustainability certifications, distribution network expansion, and brand marketing effectiveness in addressing individual preferences. Strategic partnerships between processors and oil palm cultivators are strengthening supply chain resilience while government-supported cultivation programs are enabling new entrants and capacity expansion.

Some of the key players include:

- 3F Industries Ltd.

- AWL Agri Business Ltd

- Emami Agrotech Ltd.

- Gokul Group

- K. S. Oils Limited

- Oil Palm India Ltd.

- Patanjali Foods Ltd.

Recent Developments:

- July 2025: Arunachal Pradesh's Lohit district launched a mega oil palm plantation drive to boost local edible oil production and reduce reliance on imports. The initiative, part of the National Mission on Edible Oils – Oil Palm (NMEO-OP), aimed to promote self-reliance and provide economic benefits to farmers. It also included a buy-back policy and support for sustainable livelihoods.

- January 2025: Hindustan Unilever Limited (HUL) announced the acquisition of the palm undertaking from Vishwatej Oil Industries in Telangana. This move was part of HUL’s palm localization strategy to reduce reliance on imports and strengthen its supply chain for palm derivatives. The acquisition supported India’s National Mission on Edible Oils through infrastructure development and farmer outreach programs.

India Palm Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Packaging Types Covered | Pouches, Jars, Cans, Bottles |

| Packaging Materials Covered | Metal, Plastic, Paper, Others |

| Pack Sizes Covered | Less than 1 Litres, 1 Litres, 1 Litres-5 Litres, 5 Litres-10 Litres, 10 Litres and Above |

| Domestic Manufacturing/Imports Covered | Domestic Manufacturing, Imports |

| Applications Covered | Household Cooking, HoReCa, Food Processing Industry, Oleo Chemicals, Personal Care Products, Animal Feed, Biofuels, Others |

| Distribution Channels Covered | Direct/Institutional Sales, Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Region Covered | North India, West and Central India, East India, South India |

| Companies Covered | 3F Industries Ltd., AWL Agri Business Ltd, Emami Agrotech Ltd., Gokul Group, K. S. Oils Limited, Oil Palm India Ltd., Patanjali Foods Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India palm oil market reached a volume of 10.7 Million Tons in 2025.

The India palm oil market is expected to grow at a compound annual growth rate of 5.11% from 2026-2034 to reach 16.82 Million Tons by 2034.

Pouches lead the market with a share of 41% in 2025, owing to their cost-effectiveness, convenience for daily household use, and widespread availability across retail channels.

Key factors driving the India palm oil market include government initiatives to boost domestic oil palm cultivation through incentives, planting material, and infrastructure support. In 2024, the Ministry of Agriculture planted over 17 lakh oil palm saplings across 15 states under the National Mission, benefiting more than 10,000 farmers.

Major challenges include high import dependency and price volatility, environmental and sustainability concerns, competition from alternative edible oils, supply chain disruptions, and evolving consumer preferences toward perceived healthier oil alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)