India Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2025-2033

India Pallet Market Size and Share:

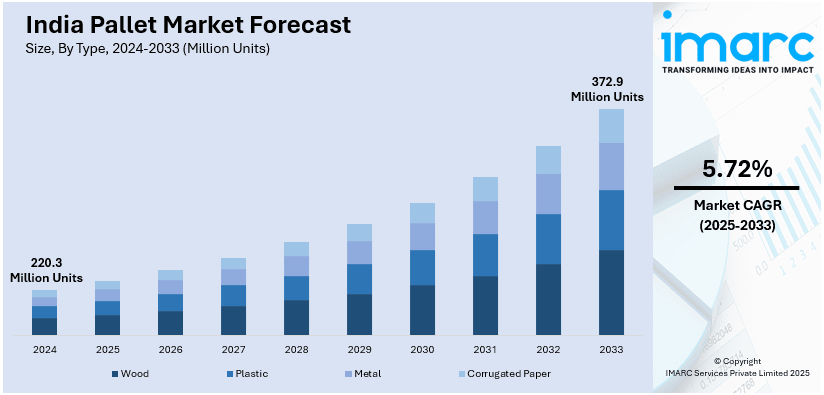

The India pallet market size was valued at 220.3 Million Units in 2024. Looking forward, IMARC Group estimates the market to reach 372.9 Million Units by 2033, exhibiting a CAGR of 5.72% during 2025-2033. West and Central India currently dominates the market, holding a significant market share of 35.0% in 2024. The market is driven by rapid industrialization, expanding e-commerce, and increasing demand for efficient logistics, warehousing, and cold chain infrastructure, which require durable, standardized pallet solutions. In addition to this, the implementation of government initiatives such as Make in India, growth in FMCG and pharmaceutical sectors, rising export activities, shift toward sustainability are some of the major factors augmenting India pallet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

220.3 Million Units |

|

Market Forecast in 2033

|

372.9 Million Units |

| Market Growth Rate 2025-2033 | 5.72% |

The market is primarily driven by rapid urbanization and industrialization which is leading to the expansion of manufacturing facilities, which rely heavily on pallets for material handling and inventory management. As per industry reports, the e-commerce sector in India is expected to reach USD 550 Billion by 2035, which is significantly shaping the demand for logistics and supply chain infrastructure, including pallets. The rapid growth of e-commerce and organized retail is creating an urgent need for standardized, efficient, and scalable logistics solutions to handle the increased volume of goods being transported across various channels. Moreover, the government's Make in India initiative and infrastructure development projects are encouraging domestic production and export activities, further necessitating reliable transportation and storage solutions. Besides this, the growth of cold chain logistics, particularly in the pharmaceutical and food industries, is highlighting the importance of hygienic and temperature-resistant pallets.

To get more information on this market, Request Sample

In addition to this, increased investments in warehouse automation and smart logistics systems are fostering demand for pallets compatible with conveyor belts and robotic systems. Also, major India pallet market companies are investing in new technologies like RFID integration and pallet monitoring to improve supply chain visibility and operational effectiveness. Furthermore, the implementation of stringent hygiene and safety regulations is promoting the use of composite pallets, which offer advantages over traditional wooden options. According to industry reports, India, currently ranked 38th on the World Bank Logistics Performance Index (LPI), aims to be among the top 25 nations by 2030. The nation's logistics market is anticipated to grow to USD 484.43 Billion by 2029, at an annual growth rate of 8.8%. This development will significantly impact the pallet market. The expansion of the logistics sector, driven by infrastructure improvements, better connectivity, and increased demand for efficient supply chain solutions, will create a surge in the need for pallets. As logistics operations become more streamlined and sophisticated, pallets will play a critical role in enabling efficient storage, handling, and transportation across various industries, further fueling the demand for standardized, durable, and cost-effective pallets.

India Pallet Market Trends:

Increasing Industrial Production in India

The rapid expansion of India's industrial sector is significantly contributing to the market expansion. As industries such as manufacturing, automotive, and textiles increase production, the demand for pallets for the storage and transportation of goods also rises. According to an industry report, India's industrial production grew by 5.0% year-on-year in January 2025, up from 3.5% in December 2024. The index has averaged 4.4% year-on-year growth from April 2006 to January 2025. As industries continue to ramp up production and improve logistics processes, the requirement for durable and efficient pallets to handle raw materials, components, and finished products is expected to increase. Moreover, the government's focus on initiatives like "Make in India" is further increasing domestic manufacturing, leading to a surge in the need for reliable pallet solutions, This, in turn, is supporting the India pallet market growth. Additionally, industries are increasingly focusing on automation, where pallets play a crucial role in streamlining material handling systems. With industrial output expected to continue its upward trajectory, the need for durable, cost-effective pallets will remain high, thereby positively impacting market expansion.

Growth of Pharmaceutical and Chemical Industries

The pharmaceutical and chemical industries in India are undergoing rapid growth, which directly impacts the demand for pallets. As India continues to emerge as a global leader in pharmaceutical manufacturing and chemical exports, the need for pallets to store and transport bulk raw materials, finished goods, and sensitive products grows significantly. As per an industry report, the chemical sector contributed 9.2% to India's manufacturing GVA in FY 2021-22 and recorded a CAGR of 8.3% from FY 2016-17 to FY 2021-22, reflecting steady growth at current prices. This consistent growth in the chemical industry is driving the demand for durable pallets, particularly for the safe handling of bulk chemicals and pharmaceuticals, which require precise storage and transportation conditions. Moreover, the rise in exports of chemicals and pharmaceuticals further propels the demand for standardized, durable pallets, which is creating a positive India pallet market outlook. The increase in regulatory compliance, which mandates efficient storage and transportation practices, is also driving the adoption of pallets across these sectors. This trend is poised to continue as the pharmaceutical and chemical industries expand in both domestic and international markets.

Rising Construction and Housing Activities

The ongoing boom in construction and housing activities across India is another critical factor driving the demand for pallets. According to industry reports, around 19,700 luxury housing units were sold in 2024, indicating a growing demand for residential spaces. Moreover, the government's push for foreign direct investment (FDI) has further fueled this growth, with 100% FDI permitted in township projects. Under Budget 2024–25, the PM Awas Yojana Urban 2.0 initiative targets to provide housing for one crore urban poor and middle-class families with an investment of INR 10 Lakh Crore (USD 120.16 Billion). These large-scale housing projects necessitate the efficient movement of construction materials, from cement to steel and bricks, driving the demand for pallets. The expansion of the construction industry contributing to the pallet requirement is one of the significant Indian pallet market trends. Furthermore, with the increase in large-scale projects, such as smart cities and industrial corridors, the logistics requirements have intensified, further strengthening the pallet market. The demand for pallets in the construction industry is expected to grow in line with these developments, driven by the need for cost-effective, durable, and easy-to-handle storage solutions.

India Pallet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India pallet market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, application, and structural design.

Analysis by Type:

- Wood

- Plastic

- Metal

- Corrugated Paper

Wood leads the market with around 71.2% of market share in 2024. Wood is known for its strength, affordability, and extensive supply. Wooden pallets are used extensively in several industries, such as logistics, retail, agriculture, and manufacturing, for transporting materials. Wood is flexible enough to be easily customized in terms of size, strength, and design to suit the differing requirements of different industries. Furthermore, wood is a renewable material, which makes it an eco-friendly option over other materials. The strong demand for wooden pallets in India is fueled by the nation's strong export and manufacturing sectors, where pallets play a key role in effective cargo handling. Furthermore, wood's ease of repair and reuse contributes to its sustainability and long-term worth, enabling a circular economy. Overall, this segment is a building block in the Indian pallet market, reconciling affordability, utility, and environmental concerns.

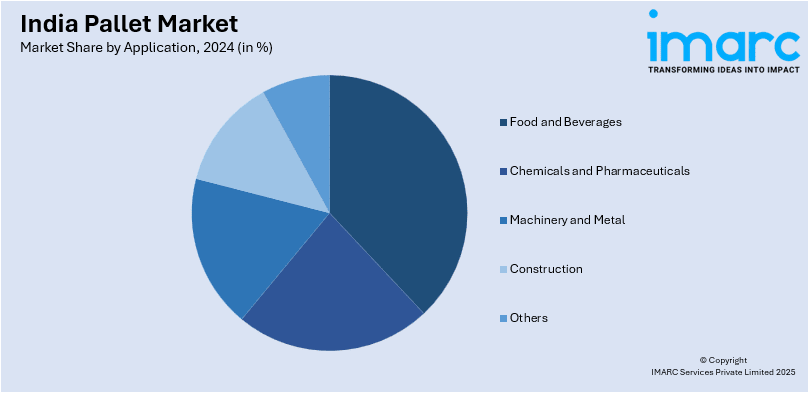

Analysis by Application:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

Food and beverages lead the market with around 35.8% of market share in 2024 driven by the increased demand for efficient and safe shipping of perishables. Plastic and wooden pallets are used extensively in this sector for product storage and movement of such products as grains, dairy, processed food, and beverages, which makes sure that products arrive at their destinations in the best possible shape. Pallets provide protection, stackability, and handling ease, which are important to preserve the integrity of food and beverage products during transportation and storage. As India's food processing and export business industries are expanding, the demand for dependable pallet solutions is skyrocketing. Further, the food and beverages sector's strict hygiene norms require high-grade, easy-to-clean pallets in order to avoid any contamination. While the sector will continue to grow, the use of pallets within food and beverages will be indispensable, catering to logistics efficiency, adherence to safety standards, and seamless supply chain operations

Analysis by Structural Design:

- Block

- Stringer

- Others

Block leads the market with around 49.7% of market share in 2024. The block style is popular as it is not only strong but also long-lasting and stable and, therefore, preferred for use in heavy-duty operations. A solid, compact structure with many openings makes the block design. This type can be picked up using forklifts from either side, which enhances efficiency while handling. This type of design is most useful in businesses involving the shipping of heavy or large items like automobile components, chemicals, and equipment. Furthermore, block pallets have superior wear and tear resistance and load capacity, promoting long-lasting use and cost-effective replacement. Block pallets' flexibility of customizability, adjustable sizes, and layout are major factors that increase their usage in different sectors. With India's emerging manufacturing and export industries, the demand for block pallets is expected to increase as the market needs efficient, cost-effective, and reliable solutions for storage and logistics.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

In 2024, West and Central India accounted for the largest market share of over 35.0%. The region's industrial strength and favorable location support the market growth. These regions are home to major industrial cities, such as Gujarat, Maharashtra, Madhya Pradesh, and Rajasthan that are imperative for manufacturing, warehousing, and logistics. Western India, with its highly developed ports of Mumbai and Jawaharlal Nehru Port, is a prime export gateway. This increases the demand for pallets to ensure efficient handling of cargo. Central India, which is agriculturally and manufacturing-rich, also plays an important role in the pallet market, especially in the movement of agricultural produce and industrial products. The requirement for pallets in these areas is supported by automotive, retail, and food and beverages industry growth. With their access to raw materials and manufacturing facilities, both regions are vital for the production, supply, and distribution of pallets, ensuring a strong presence in the national market.

Competitive Landscape:

The competitive landscape of the market is characterized by a combination of domestic and regional producers, offering a variety of products to meet the diverse requirements of many industries, including logistics, manufacturing, and retail. The market is driven by the widespread use of wooden pallets, valued for their convenience and versatility in bulk transportation and storage. Additionally, other products, such as metal and plastic pallets, are gaining popularity, particularly in those industries with higher durability and carrying capacity demands, such as the pharmaceutical and automotive industries. As per the India pallet market forecast, growing concerns for sustainability is likely to generate a high demand for green pallet solutions, thus encouraging manufacturers to find alternatives to traditional materials. Regional differences also have a role in evolving market dynamics, with the demand varying according to local industrial requirements, infrastructure, and weather conditions. Further, technological developments in manufacturing are fostering competition by enabling product quality to be enhanced, cost decreases, and efficiency in operations throughout the industry.

The report provides a comprehensive analysis of the competitive landscape in the India pallet market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Godrej Consumer Products launched its first vertical storage warehouse in Bhiwandi, Maharashtra. Spanning 2.84 lakh sq. ft. with over 3,200 pallet positions and G+6 racking, the high-density facility reportedly featured AI-ML monitoring and could handle over 60,000 cases daily under Project Parivartan.

- February 2025: CocoPallet and Super Pack launched a coconut husk pallet factory in Tiptur, Karnataka. Aiming to produce 10 lakh pallets by 2028, the initiative offered a sustainable alternative to wood, using termite-proof, resin-free coconut husk to reduce deforestation and repurpose agricultural waste.

- January 2025: LEAP India acquired CHEP India Private Limited, strengthening its pallet pooling and sustainable supply chain services. With over 11 million assets and 33 warehouses, the merger enhanced LEAP’s reach across FMCG, automotive, retail, and e-commerce sectors.

- October 2024: IFCO unveiled Nestor, a 14kg ultralight, nestable plastic pallet designed for fresh food logistics. It supported up to 1,000kg, enabled stacking of 1,386 empty pallets per truck, reduced transport legs by 62%, and integrated BLE, GPS, and QR tech for smart tracking.

- September 2024: Indicold launched a rack-clad ASRS frozen facility in Ahmedabad, housing over 7,000 pallets. The company also announced plans to expand to 12 lakh pallets in 2025.

India Pallet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pallet market from 2019-2033.

- The India pallet market research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pallet market in India was valued at 220.3 Million Units in 2024.

The growth of the India pallet market is driven by increasing demand from sectors like e-commerce, manufacturing, and logistics, as well as the expansion of cold chain infrastructure. Moreover, the growing adoption of pallets for efficient storage, transportation, and inventory management, coupled with urbanization and industrial development, further fuels market growth.

The pallet market in India is projected to exhibit a CAGR of 5.72% during 2025-2033, reaching a value of 372.9 Million Units by 2033.

Wood holds the largest share in India pallet type due to its cost-effectiveness, durability, and ease of availability. Wood pallets also offer strength and versatility, making them ideal for various industries. The widespread use of wooden pallets in transportation and logistics contributes to their dominant market position.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)