India Packaging Machinery Market Size, Share, Trends and Forecast by Machine Type, Technology, End Use, and Region, 2025-2033

Market Overview:

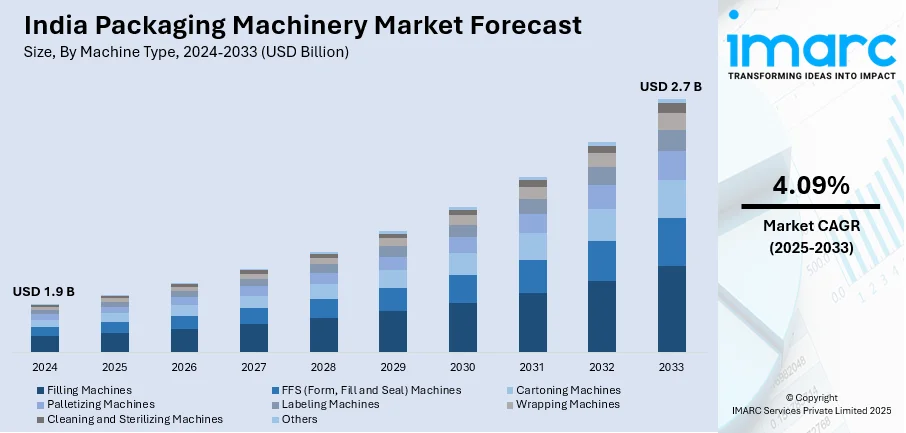

The india packaging machinery market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.09% during 2025-2033. The increasing demand for packaging machinery that incorporates automation features, such as robotics, sensors, and connectivity to improve efficiency, reduce costs, and enhance overall production capabilities, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.9 Billion |

|

Market Forecast in 2033

|

USD 2.7 Billion |

| Market Growth Rate 2025-2033 | 4.09% |

Packaging machinery refers to a diverse range of automated equipment designed to streamline the process of packing products for distribution, sale, or storage. These machines play a crucial role in various industries, such as food and beverage, pharmaceuticals, and manufacturing, by efficiently and consistently packaging goods in a timely manner. Packaging machinery encompasses a wide array of equipment, including fillers, sealers, labelers, and conveyors, each serving a specific function in the packaging process. The primary goals of packaging machinery are to enhance efficiency, reduce labor costs, ensure product integrity, and meet industry regulations. Advancements in technology have led to the development of sophisticated packaging machinery that can handle diverse packaging materials, sizes, and shapes, contributing to improved productivity and the overall quality of packaged goods. In summary, packaging machinery is an integral component of modern industrial processes, playing a pivotal role in optimizing the packaging and distribution of products across various sectors.

To get more information on this market, Request Sample

India Packaging Machinery Market Trends:

The packaging machinery market in India is driven by a confluence of factors that collectively shape its trajectory. Primarily, the rising demand for automation across industries has been a pivotal driver as manufacturers increasingly recognize the efficiency gains and cost-effectiveness associated with automated packaging processes. Moreover, the growing emphasis on sustainable and eco-friendly packaging solutions has spurred innovation in packaging machinery. Consequently, manufacturers are investing in machinery that facilitates the use of recyclable materials and reduces overall environmental impact. Furthermore, the burgeoning e-commerce sector has emerged as a significant driving force, necessitating advanced packaging machinery to handle the diverse packaging requirements of online retail. Additionally, advancements in technology, such as the integration of artificial intelligence and machine learning in packaging machinery, are catalyzing market growth. These technological enhancements not only enhance the speed and precision of packaging processes but also contribute to predictive maintenance, minimizing downtime, and optimizing overall operational efficiency. In conclusion, the packaging machinery market in India is propelled by a dynamic interplay of automation trends, sustainability imperatives, e-commerce dynamics, and technological innovations.

India Packaging Machinery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on machine type, technology, and end use.

Machine Type Insights:

- Filling Machines

- FFS (Form, Fill and Seal) Machines

- Cartoning Machines

- Palletizing Machines

- Labeling Machines

- Wrapping Machines

- Cleaning and Sterilizing Machines

- Others

The report has provided a detailed breakup and analysis of the market based on the machine type. This includes filling machines, FFS (form, fill and seal) machines, cartoning machines, palletizing machines, labeling machines, wrapping machines, cleaning and sterilizing machines, and others.

Technology Insights:

- General Packaging

- Modified Atmosphere Packaging

- Vacuum Packaging

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes general packaging, modified atmosphere packaging, and vacuum packaging.

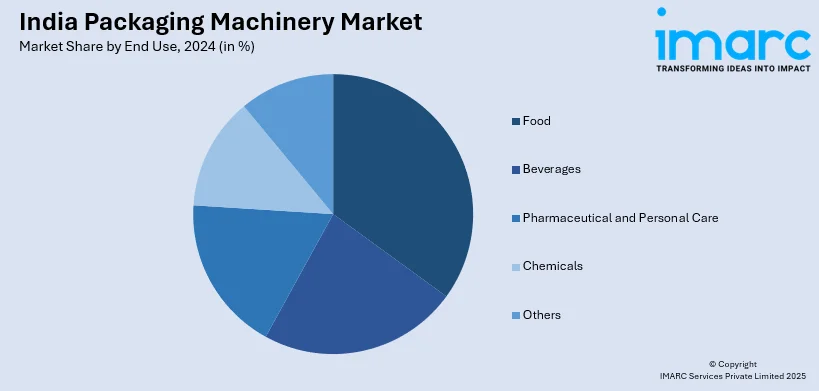

End Use Insights:

- Food

- Beverages

- Pharmaceutical and Personal Care

- Chemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes food, beverages, pharmaceutical and personal care, chemicals, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Packaging Machinery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Machine Types Covered | Filling Machines, FFS (Form, Fill and Seal) Machines, Cartoning Machines, Palletizing Machines, Labeling Machines, Wrapping Machines, Cleaning and Sterilizing Machines, Others |

| Technologies Covered | General Packaging, Modified Atmosphere Packaging, Vacuum Packaging |

| End Uses Covered | Food, Beverages, Pharmaceutical and Personal Care, Chemicals, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India packaging machinery market performed so far and how will it perform in the coming years?

- What is the breakup of the India packaging machinery market on the basis of machine type?

- What is the breakup of the India packaging machinery market on the basis of technology?

- What is the breakup of the India packaging machinery market on the basis of end use?

- What are the various stages in the value chain of the India packaging machinery market?

- What are the key driving factors and challenges in India packaging machinery?

- What is the structure of the India packaging machinery market and who are the key players?

- What is the degree of competition in the India packaging machinery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India packaging machinery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India packaging machinery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India packaging machinery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)