India Packaged Jaggery Market Size, Share, Trends and Forecast by Product Type, Form, Pack Type, Pack Size, Distribution Channel, and Region, 2026-2034

India Packaged Jaggery Market Summary:

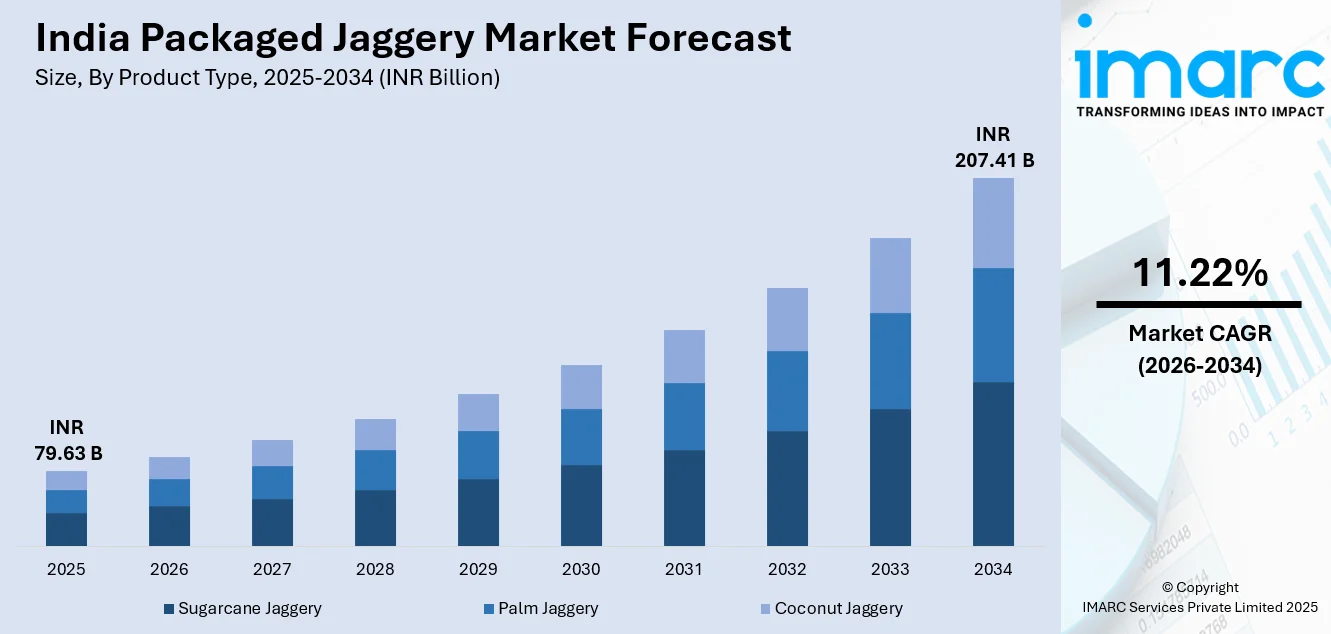

The India packaged jaggery market size was valued at INR 79.63 Billion in 2025 and is projected to reach INR 207.41 Billion by 2034, growing at a compound annual growth rate of 11.22% from 2026-2034.

The India packaged jaggery market is experiencing robust growth driven by increasing consumer awareness of natural sweeteners and their health benefits. Rising urbanization and evolving dietary preferences are accelerating demand for hygienic, conveniently packaged jaggery products. The expansion of modern retail channels and e-commerce platforms is enhancing product accessibility, while clean-label preferences and traditional culinary practices continue to bolster India packaged jaggery market share.

Key Takeaways and Insights:

- By Product Type: Sugarcane jaggery dominates the market with a share of 74% in 2025, owing to India's position as the world's largest sugarcane producer and the deep-rooted cultural preference for traditional gur in regional cuisines. Abundant raw material availability and established processing infrastructure further strengthen this segment's leadership.

- By Form: Powder/granules lead the market with a share of 45% in 2025. This dominance is driven by consumer preference for convenient, ready-to-use formats that dissolve easily in beverages and recipes, coupled with superior portioning control and extended shelf stability compared to traditional blocks.

- By Pack Type: Plastic pouches exhibit a clear dominance in the market with 58% share in 2025, reflecting their cost-effectiveness, lightweight nature, and moisture-resistant properties that preserve product freshness while offering convenient storage and handling for household consumers.

- By Pack Size: 500 gm represents the biggest segment with a market share of 40% in 2025, striking an optimal balance between affordability and quantity for typical household consumption patterns, enabling regular purchases without excessive storage requirements or product wastage.

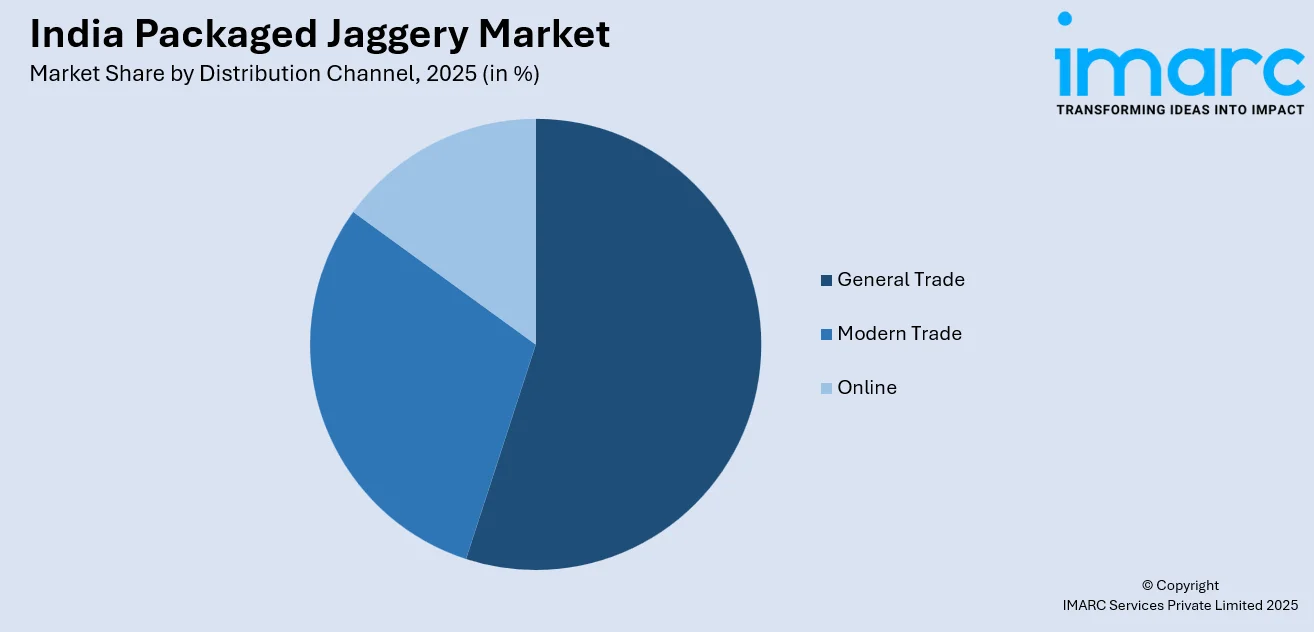

- By Distribution Channel: General trade dominates the market with a share of 49% in 2025, underpinned by India's extensive network of kirana stores and neighborhood retailers that maintain strong consumer relationships and offer accessible touchpoints across urban and rural markets.

- By Region: North India is the largest region with 30% share in 2025, driven by Uttar Pradesh's position as India's leading sugarcane producer and the region's strong cultural traditions of incorporating jaggery in daily culinary practices and festive preparations.

- Key Players: Key players drive the India packaged jaggery market by expanding organic product portfolios, investing in modern packaging technologies, and strengthening distribution networks. Their focus on quality certifications, sustainable sourcing practices, and e-commerce penetration accelerates consumer adoption and ensures consistent product availability across diverse market segments. Some of the key players operating in the market include 24 Mantra Organic, A.K.S. Trading Corporations, B&B Organics, Desi Village Agro Foods India (P) Ltd, Dhampur Green, Geographical Indications Tagged World Premium Products Pvt Ltd, Maple Leaf Project, Miltop Exports, Nutriplato, Organic India Pvt Ltd (Fab India), Organic Tattva (Mehrotra Consumer Products Pvt.), Patanjali Ayurveda Limited, Sriveda Sattva Private Limited, Truefarm, Two Brothers Organic Farms, and Vayam.

To get more information on this market Request Sample

The India packaged jaggery market is witnessing accelerated expansion as health-conscious consumers increasingly shift from refined sugar to natural, mineral-rich alternatives. The growing prevalence of lifestyle diseases including diabetes, cardiovascular conditions, and obesity has heightened awareness about the detrimental effects of processed sugars, positioning packaged jaggery as a nutritious substitute that retains essential micronutrients such as iron, calcium, potassium, and magnesium. According to the ICMR INDIAB study, India’s diabetes prevalence reached 10.1 Crore in 2023, driving significant consumer shifts toward natural sweetening alternatives. Urbanization and rising disposable incomes are driving demand for premium, hygienically packaged food products that align with modern consumption patterns. The implementation of stringent food safety standards by FSSAI for jaggery processing and labeling is enhancing product credibility and consumer trust. Additionally, the integration of jaggery into contemporary food and beverage applications beyond traditional uses is broadening market appeal.

India Packaged Jaggery Market Trends:

Rising Preference for Organic and Clean-Label Jaggery Products

Consumers are increasingly gravitating toward organic and clean-label jaggery variants that guarantee chemical-free production processes and transparent sourcing practices. This shift reflects broader wellness trends emphasizing minimally processed foods with traceable origins. Manufacturers are responding by obtaining organic certifications including India Organic and USDA Organic, enabling access to premium market segments. The emphasis on authentic, additive-free jaggery that preserves traditional nutritional profiles while meeting contemporary hygiene standards is reshaping product development strategies and India packaged jaggery market growth trajectories.

Expansion of E-Commerce and Direct-to-Consumer Distribution Channels

Digital retail platforms are transforming packaged jaggery distribution by connecting producers directly with health-conscious urban consumers seeking authentic, farm-sourced products. Online channels offer extensive product variety, detailed ingredient information, and convenient doorstep delivery that traditional retail cannot match. Quick commerce platforms and dedicated organic food websites are emerging as significant sales contributors, particularly among younger demographics. This digital transformation enables smaller producers to access national markets while allowing consumers to verify product authenticity through reviews and certifications.

Innovation in Product Formats and Functional Applications

The market is witnessing diversification beyond traditional blocks into user-friendly formats including powder, granules, cubes, and liquid variants that cater to varied culinary applications. Food manufacturers are increasingly incorporating jaggery as a natural sweetener in snacks, confectioneries, beverages, and health supplements, expanding its relevance in modern food systems. Value-added products featuring jaggery infused with spices, herbs, or functional ingredients are gaining traction among wellness-focused consumers. These innovations are broadening jaggery's appeal beyond traditional uses into contemporary dietary preferences.

Market Outlook 2026-2034:

The India packaged jaggery market is poised for sustained expansion through the forecast period, driven by favorable demographic trends, evolving consumer preferences, and supportive regulatory frameworks. Increasing health consciousness among consumers seeking alternatives to refined sugar will continue propelling demand for natural sweeteners. The market generated a revenue of INR 79.63 Billion in 2025 and is projected to reach a revenue of INR 207.41 Billion by 2034, growing at a compound annual growth rate of 11.22% from 2026-2034. The expansion of modern retail infrastructure, growing penetration of e-commerce channels, and rising export opportunities are expected to create significant growth avenues. Manufacturers focusing on product innovation, sustainable packaging solutions, and quality certifications will be well-positioned to capitalize on emerging opportunities in both domestic and international markets.

India Packaged Jaggery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Sugarcane Jaggery |

74% |

|

Form |

Powder/Granules |

45% |

|

Pack Type |

Plastic Pouches |

58% |

|

Pack Size |

500 gm |

40% |

|

Distribution Channel |

General Trade |

49% |

|

Region |

North India |

30% |

Product Type Insights:

- Sugarcane Jaggery

- Palm Jaggery

- Coconut Jaggery

Sugarcane jaggery dominates with a market share of 74% of the total India packaged jaggery market in 2025.

Sugarcane jaggery maintains overwhelming market dominance owing to India's status as the world's largest sugarcane producer, with key northern states contributing significantly to national output. The abundant availability of raw material combined with established processing infrastructure across major producing states ensures consistent supply and competitive pricing. Traditional manufacturing techniques passed through generations have created regional varieties with distinctive flavor profiles that command consumer loyalty. India's robust sugarcane cultivation provides a strong foundation for jaggery manufacturing operations nationwide.

The deep cultural integration of sugarcane jaggery in Indian culinary traditions, religious ceremonies, and Ayurvedic practices reinforces sustained demand across demographic segments. Consumers associate this variant with authenticity and nutritional completeness, as it retains the full spectrum of minerals present in sugarcane juice. The emergence of branded, organically certified sugarcane jaggery products is attracting health-conscious consumers willing to pay premium prices for quality assurance. Processing innovations that preserve nutritional content while extending shelf life are further strengthening the competitive position of sugarcane-derived products in organized retail channels.

Form Insights:

- Powder/Granules

- Block

- Liquid

Powder/granules leads with a share of 45% of the total India packaged jaggery market in 2025.

Powder and granulated jaggery formats are experiencing accelerated adoption driven by consumer preferences for convenience and versatility in modern culinary applications. These formats dissolve rapidly in beverages and recipes, enabling precise portioning and consistent sweetness levels that traditional blocks cannot easily achieve. Urban consumers particularly favor powdered variants for daily use in tea, coffee, and dessert preparations where ease of measurement enhances cooking efficiency. Leading manufacturers are expanding their organic jaggery portfolios by introducing resealable pouches specifically designed for metro consumers seeking premium quality combined with convenience.

The superior shelf stability of properly processed powder jaggery compared to traditional solid forms addresses storage concerns in humid climatic conditions prevalent across India. Modern packaging technologies incorporating moisture barriers extend product freshness, reducing wastage and enabling broader distribution reach. Food manufacturers increasingly prefer granulated formats for industrial applications in confectionery, bakery, and beverage production where consistent quality specifications are essential. The growing availability of powdered jaggery through e-commerce platforms with detailed nutritional information is expanding consumer awareness and driving segment growth.

Pack Type Insights:

- Plastic Pouches

- Jars

- Others

Plastic pouches exhibit a clear dominance with 58% share of the total India packaged jaggery market in 2025.

Plastic pouches maintain commanding market share owing to their cost-effectiveness, lightweight construction, and excellent moisture barrier properties essential for preserving jaggery quality. The flexibility of pouch packaging enables efficient space utilization during transportation and retail display while minimizing breakage risks associated with rigid containers. Manufacturers prefer pouches for their lower material costs and streamlined filling operations that enhance production efficiency. Consumer acceptance remains high due to the resealable features available in premium variants that maintain freshness between uses.

The evolution toward multi-layer laminated pouches incorporating advanced barrier films addresses concerns about moisture ingress and product deterioration during storage. Branded manufacturers leverage attractive pouch designs incorporating transparent windows to showcase product quality while communicating brand identity effectively. Growing environmental consciousness is driving innovation in sustainable packaging alternatives, with some producers introducing biodegradable pouch materials. The adaptability of pouch formats to various fill sizes allows manufacturers to cater to diverse consumer segments ranging from single-use sachets to family-sized packs, maximizing market penetration across urban and rural retail channels.

Pack Size Insights:

- 500 gm

- 1000 gm

- 250 gm

- Others

500 gm represents the leading segment with 40% share of the total India packaged jaggery market in 2025.

The 500 gm pack size optimally balances affordability with adequate quantity for typical Indian household consumption patterns spanning two to three weeks. This format enables regular purchase cycles without excessive upfront expenditure, aligning with prevalent budgeting practices among middle-income consumers. The manageable package dimensions facilitate convenient storage in home pantries without requiring specialized containers or refrigeration. Retailers favor this size for its reasonable price point that encourages impulse purchases while maintaining attractive margins.

The 500 gm format serves as an effective entry point for consumers transitioning from unpackaged traditional jaggery to branded alternatives. Manufacturers leverage this size for promotional activities and trial generation programs aimed at building brand loyalty. The standardization around this quantity simplifies inventory management across distribution channels from modern retail to neighborhood stores. Product freshness remains optimal within typical consumption periods, ensuring consistent quality experience that encourages repeat purchases and positive word-of-mouth recommendations. This pack size also aligns with gifting occasions and festive purchases where consumers seek appropriately sized, attractively packaged products for household use or sharing.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- General Trade

- Modern Trade

- Online

General trade dominates with a market share of 49% of the total India packaged jaggery market in 2025.

India's extensive network of traditional retail outlets including kirana stores, provision shops, and local grocers maintains dominant market position through unparalleled geographic reach and established consumer relationships. These neighborhood retailers offer convenient accessibility, credit facilities, and personalized service that modern formats cannot easily replicate in price-sensitive markets. The familiarity and trust built over generations position general trade as the preferred channel for routine household purchases including packaged jaggery. Strong wholesale distribution networks ensure consistent product availability even in smaller towns and semi-urban areas.

General trade retailers possess intimate knowledge of local consumer preferences, enabling them to stock product variants aligned with regional taste profiles and purchasing capacities. The lower operational overhead compared to organized retail allows competitive pricing that appeals to budget-conscious consumers. Manufacturers invest significantly in maintaining robust relationships with traditional channel partners through dedicated sales teams and promotional support. The resilience demonstrated by general trade during economic disruptions reinforces its strategic importance in comprehensive distribution strategies.

Regional Insights:

- North India

- West & Central India

- South India

- East India

North India leads with a share of 30% of the total India packaged jaggery market in 2025.

North India commands the largest regional market share anchored by Uttar Pradesh's dominant position in sugarcane cultivation and jaggery production infrastructure. The fertile Gangetic plains provide ideal growing conditions while extensive irrigation networks support year-round agricultural productivity. Muzaffarnagar in Uttar Pradesh hosts Asia's largest jaggery trading market, serving as a critical hub for price discovery and bulk transactions. Cultural traditions deeply embed jaggery consumption in regional cuisines, festive preparations, and religious offerings, sustaining consistent household demand throughout the year.

The concentration of production facilities in North India enables efficient supply chains with reduced logistics costs that support competitive retail pricing. State government initiatives promoting sugarcane cultivation and jaggery manufacturing modernization strengthen the regional ecosystem. Growing consumer preference for branded, hygienically packaged products in urban centers like Delhi and Lucknow is driving premiumization trends. The proximity between production clusters and large consumption markets facilitates rapid distribution of fresh products, enhancing quality perceptions and consumer satisfaction across the region.

Market Dynamics:

Growth Drivers:

Why is the India Packaged Jaggery Market Growing?

Increasing Health Consciousness and Shift Toward Natural Sweeteners

The rising prevalence of lifestyle diseases including diabetes, obesity, and cardiovascular conditions is fundamentally reshaping consumer attitudes toward sweetener choices across India. Growing awareness about the detrimental health effects of excessive refined sugar consumption is driving significant behavioral shifts toward natural alternatives that offer nutritional benefits alongside sweetening functionality. Jaggery's rich mineral profile comprising iron, calcium, potassium, and magnesium positions it favorably among health-conscious consumers seeking functional food ingredients. The Ayurvedic heritage associating jaggery with digestive health, immunity enhancement, and blood purification resonates strongly with consumers embracing traditional wellness practices. Healthcare professionals and nutritionists increasingly recommend jaggery as a preferable sweetening option for individuals managing blood sugar levels or seeking to reduce processed food intake. This evolving dietary consciousness spans demographic segments, with younger consumers particularly receptive to natural food messaging through digital health platforms.

Expansion of Modern Retail Infrastructure and E-Commerce Platforms

India's rapidly evolving retail landscape is creating unprecedented opportunities for packaged jaggery manufacturers to reach broader consumer segments through organized distribution channels. The proliferation of supermarkets, hypermarkets, and specialty organic stores provides dedicated shelf space that elevates packaged jaggery from commodity status to premium product positioning. Modern retail environments enable effective brand communication, product sampling, and consumer education that traditional channels cannot easily facilitate. The exponential growth of e-commerce platforms and quick commerce services has democratized access to premium jaggery products for consumers regardless of geographic location. Online channels offer extensive product variety with detailed nutritional information and customer reviews that support informed purchasing decisions.

Regulatory Support and Food Safety Standardization

Government regulatory frameworks establishing quality standards for packaged jaggery are strengthening consumer confidence and industry professionalism across the market. The Food Safety and Standards Authority of India has implemented comprehensive guidelines addressing moisture content, ash levels, permitted ingredients, and labeling requirements that enhance product safety and transparency. These standards differentiate quality manufacturers from unorganized producers who may utilize adulterants or substandard processing methods. The emphasis on traceability and certification enables premium positioning for compliant products while protecting consumers from adulterated alternatives prevalent in unorganized markets.

Market Restraints:

What Challenges the India Packaged Jaggery Market is Facing?

Quality Consistency and Adulteration Concerns

The packaged jaggery market faces significant challenges related to maintaining consistent product quality and combating adulteration practices that undermine consumer trust. Unscrupulous producers may introduce adulterants including refined sugar, chemical bleaching agents, or artificial colorants to reduce costs or enhance visual appeal. These practices compromise the nutritional integrity that distinguishes authentic jaggery from processed alternatives. Variations in raw material quality, processing conditions, and storage handling create inconsistencies that affect taste, texture, and shelf stability. Establishing effective quality control mechanisms across fragmented supply chains involving numerous small-scale producers remains operationally complex.

Limited Shelf Life and Storage Challenges

Jaggery's inherent moisture sensitivity creates preservation challenges that complicate distribution logistics and retail management across India's diverse climatic conditions. High humidity environments prevalent in coastal and monsoon-affected regions accelerate product degradation, causing hardening, discoloration, or fungal development. Traditional packaging solutions may inadequately protect against moisture ingress during extended storage or transportation periods. Cold chain infrastructure limitations restrict geographic reach for premium jaggery variants requiring controlled temperature conditions. These preservation constraints concentrate market opportunities in regions with favorable storage conditions while limiting penetration in challenging environments.

Competition from Alternative Sweeteners and Refined Sugar

Packaged jaggery faces intense competition from refined sugar, artificial sweeteners, and emerging natural alternatives that offer distinct functional or economic advantages. Refined sugar maintains significant price advantages from large-scale industrial production and established distribution infrastructure. Artificial sweeteners appeal to calorie-conscious consumers seeking zero-calorie options despite growing concerns about long-term health implications. Newer alternatives including stevia, monk fruit, and date sugar are capturing attention among health-focused consumers exploring diverse natural sweetener options. Effectively communicating jaggery's unique nutritional benefits requires sustained marketing investments to differentiate against well-funded competing categories.

Competitive Landscape:

The India packaged jaggery market exhibits a fragmented competitive structure comprising established FMCG conglomerates, dedicated organic food companies, and numerous regional manufacturers serving local consumer preferences. Major players are differentiating through product innovation, organic certifications, sustainable packaging initiatives, and omnichannel distribution strategies. Companies are increasingly investing in backward integration with farmer networks to ensure raw material quality while supporting sustainable agricultural practices. Strategic partnerships with e-commerce platforms and quick commerce services are expanding market reach, particularly among urban consumer segments. Brand building through digital marketing, influencer collaborations, and health-focused messaging is intensifying as companies compete for consumer mindshare. Quality certifications including FSSAI licensing, organic accreditation, and international food safety standards serve as critical competitive differentiators in premium market segments.

Some of the key players include:

- 24 Mantra Organic

- A.K.S. Trading Corporations

- B&B Organics

- Desi Village Agro Foods India (P) Ltd

- Dhampur Green

- Geographical Indications Tagged World Premium Products Pvt Ltd

- Maple Leaf Project

- Miltop Exports

- Nutriplato

- Organic India Pvt Ltd (Fab India)

- Organic Tattva (Mehrotra Consumer Products Pvt.)

- Patanjali Ayurveda Limited

- Sriveda Sattva Private Limited

- Truefarm

- Two Brothers Organic Farms

- Vayam

India Packaged Jaggery MarketReport Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Billion, ‘000 Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sugarcane Jaggery, Palm Jaggery, Coconut Jaggery |

| Forms Covered | Powder/Granules, Block, Liquid |

| Pack Types Covered | Plastic Pouches, Jars, Others |

| Pack Sizes Covered | 500 gm, 1000 gm, 250 gm, Others |

| Distribution Channels Covered | General Trade, Modern Trade, Online |

| Region Covered | North India, West & Central India, South India, East India |

| Companies Covered | 24 Mantra Organic, A.K.S. Trading Corporations, B&B Organics, Desi Village Agro Foods India (P) Ltd, Dhampur Green, Geographical Indications Tagged World Premium Products Pvt Ltd, Maple Leaf Project, Miltop Exports, Nutriplato, Organic India Pvt Ltd (Fab India), Organic Tattva (Mehrotra Consumer Products Pvt.), Patanjali Ayurveda Limited, Sriveda Sattva Private Limited, Truefarm, Two Brothers Organic Farms, Vayam. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India packaged jaggery market size was valued at INR 79.63 Billion in 2025.

The India packaged jaggery market is expected to grow at a compound annual growth rate of 11.22% from 2026-2034 to reach INR 207.41 Billion by 2034.

Sugarcane jaggery dominated the market with a share of 74%, driven by India's position as the world's largest sugarcane producer and deep-rooted cultural preferences for traditional gur in regional cuisines and festive preparations.

Key factors driving the India packaged jaggery market include increasing health consciousness, shift toward natural sweeteners, expansion of modern retail and e-commerce channels, regulatory support strengthening food safety standards, and growing consumer preference for organic products.

Major challenges include quality consistency concerns and adulteration practices, limited shelf life in humid storage conditions, competition from refined sugar and alternative sweeteners, fragmented supply chains affecting standardization, and consumer education requirements regarding product differentiation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)