India Packaged Atta Market Size, Share, Trends and Forecast by Product Type, Pack Type, Pack Size, Distribution Channel, and State, 2025-2033

Market Overview:

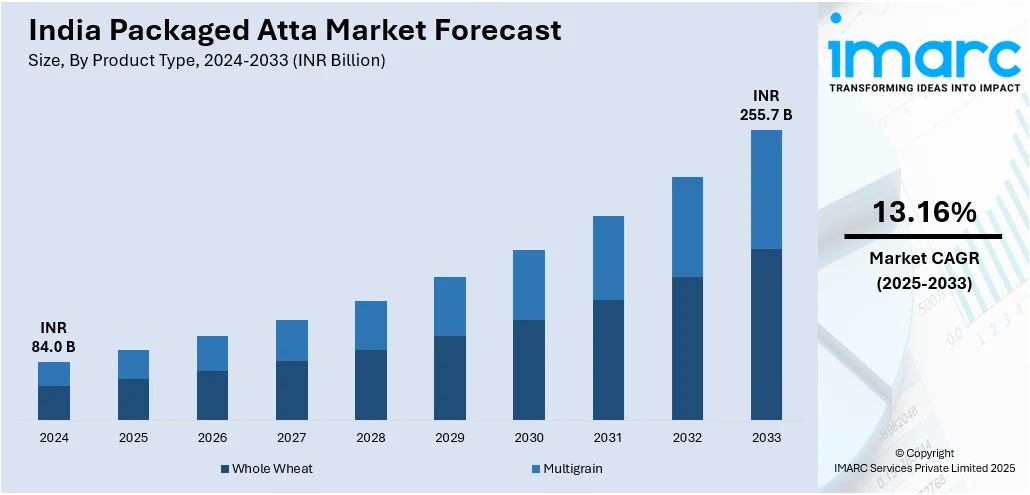

The India packaged atta (wheat flour) market size reached INR 84.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 255.7 Billion by 2033, exhibiting a growth rate (CAGR) of 13.16% during 2025-2033. An enhanced focus on hygiene and sanitation, the rising need for convenience and elimination of manual grinding and sifting of wheat grains and changing consumer lifestyles represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 84.0 Billion |

|

Market Forecast in 2033

|

INR 255.7 Billion |

| Market Growth Rate 2025-2033 | 13.16% |

An Enhanced Focus on Hygiene and Sanitation is Augmenting the Market Growth

The packaged atta (wheat flour) market in India has been experiencing continuous growth. An enhanced focus on hygiene and sanitation currently represents one of the primary drivers resulting in the increasing sales of packaged atta. Packaging of atta safeguards the product from external contaminants and prevents any tampering or exposure to unfavorable environmental conditions. In addition to this, the sealed packaging ensures that the atta remains fresh, clean, and intact until it is opened by the end user. The rising concerns regarding food contamination, along with an enhanced emphasis on quality assurance in packaged atta, serves the growing consumer demand for safe and reliable food products.

To get more information on this market, Request Sample

Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

What is Packaged Atta?

Packaged atta refers to finely ground commercial wheat flour with a uniform texture that is packaged and sold in sealed bags or containers for consumer use. Packaged atta brands typically provide flour enriched with nutrients, such as iron and folic acid while ensuring consistent quality and texture for optimal baking and cooking outcomes. In addition to this, majority of the packaged atta brands provide nutritional information on their packaging, thereby enabling consumers make informed choices based on their dietary needs. Also, the packaging of atta helps to extend the shelf life by protecting it from moisture and external contaminants and offers convenience for handling and storage. It is commonly used in the formulation of various wheat-based products such as chapatis, bread, and pastries.

COVID-19 Impact:

The COVID-19 pandemic outbreak has caused a severe problem in the packaged atta industry and imposed unprecedented challenges in India. It led to a significant increase in demand for packaged goods, propelled by the growing concerns regarding safety and hygiene. The consumers rushed to stock up on essential items, including packaged atta, due to the fear of potential product unavailability during the lockdown. The sudden rise in demand resulted in the trend of bulk buying and hoarding of staple food items and caused severe supply shortages in the market. The increasing preference for packaged atta was also influenced by the shift in shopping patterns toward supermarkets and online platforms predominantly dealing in packaged items, even in semi-urban and rural areas of India. However, as the COVID-19 cases came toward a decline, the supply chain and market supply were increased and the balance has been restored, and the market is anticipated to face steady growth opportunities in future.

India Packaged Atta Market Trends:

The market in India is primarily driven by the rising need for convenience and elimination of manual grinding and sifting of wheat grains. In line with this, rapid urbanization across the country, along with changing consumer lifestyles, is resulting in an augmented demand for convenience food products, which, in turn, is fueling the market. Moreover, considerable rise in concerns regarding adulteration and contamination in unbranded or unregulated products is resulting in the higher uptake of packaged atta. In addition to this, the implementation of rigorous quality control processes during production and packaging to market it as a safer and more reliable option is providing an impetus to the market. Also, the rising need for staples with longer shelf life facilitating reduced food spoilage and wastage is further propelling the demand for packaged atta. Furthermore, the rapid expansion of organized retail in the country, such as supermarkets, hypermarkets, and online grocery platforms, is resulting in a higher product uptake.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India packaged atta market, along with forecasts at the regional levels from 2025-2033. Our report has categorized the market based on product type, pack type, pack size and distribution channel.

Product Type Insights:

- Whole Wheat

- Multigrain

The report has provided a detailed breakup and analysis of the packaged atta market based on the product type. This includes whole wheat and multigrain. According to the report, whole wheat represented the largest segment due to the presence of higher nutritional content compared to refined wheat flour. In addition, the growing consumer demand for natural and authentic food products that are less processed and closer to their original form is impacting the market positively.

Pack Type Insights:

- Pouches

- Woven Bags

A detailed breakup and analysis of the packaged atta market based on the pack type has also been provided in the report. This includes pouches and woven bags. According to the report, pouches accounted for the largest market share due to their enhanced convenience and portability, thereby making them a popular choice for consumers. Moreover, pouches help in extending the shelf life of atta by providing a protective barrier against moisture and air.

Pack Size Insights:

- 10 KG

- 5 KG

- 1 KG

- Others

A detailed breakup and analysis of the packaged atta market based on the pack size has also been provided in the report. This includes 10 KG, 5 KG, 1 KG, and others. According to the report, 10 KG accounted for the largest market share on account of the pack size enabling consumers to purchase atta in bulk at a relatively lower price per kilogram as compared to smaller packaging sizes. In addition, a greater size reduces the frequency of purchasing and enhances convenience in households with multiple members.

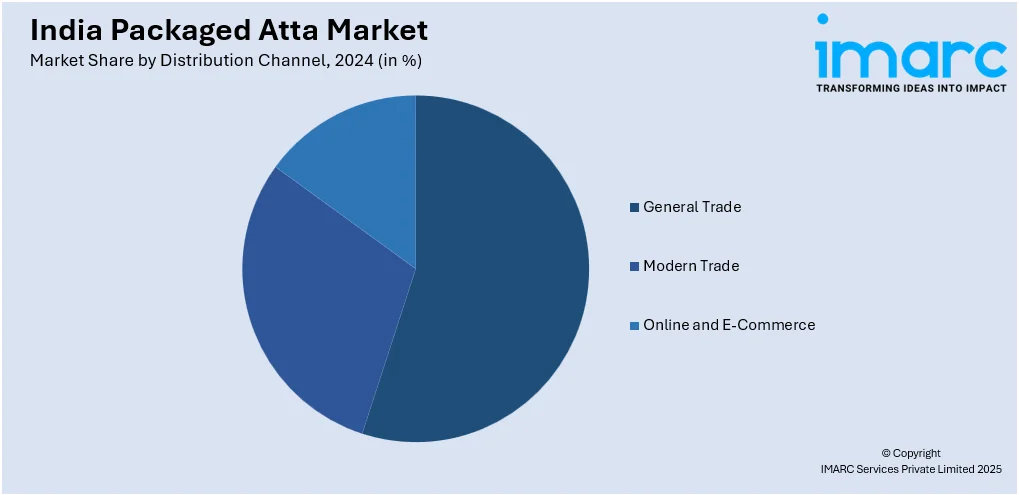

Distribution Channel Insights:

- General Trade

- Convenience Stores

- Kirana Stores

- Modern Trade

- Supermarkets

- Hypermarkets

- Specialty Stores

- Online and E-Commerce

A detailed breakup and analysis of the packaged atta market based on the distribution channel has also been provided in the report. This includes general trade(Convenience Stores, Kirana Stores ), modern trade (supermarkets, hypermarkets and specialty stores), and Online and E-Commerce. According to the report, general trade accounted for the largest market share on account of the general trade segment serving a broad consumer base across various regions and socio-economic strata. Apart from this, the general trade segment comprises local retailers with an extensive distribution network across both urban and rural areas, even to remote areas, which is propelling the segment growth.

State Insights:

- Maharashtra

- Andhra Pradesh

- Karnataka

- Telangana

- Goa

- Others

The report has also provided a comprehensive analysis of all the major states, which include Maharashtra, Andhra Pradesh, Karnataka, Telangana, Goa, and Others. According to the report, Maharashtra was the largest market for packaged atta. Some of the factors driving the packaged atta market in Maharashtra included the rising health consciousness among the masses, an enhanced focus on hygiene and sanitation, the wide availability of packaged atta from e-commerce brands and distribution channels, and the growing demand for premium atta variants.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India packaged atta market. Some of the companies covered in the report include:

- Adani Wilmer Ltd

- Ahaar Consumer Products Pvt. Ltd

- Anand Milk Union Ltd (AMUL)

- Cargill India Pvt. Ltd.

- Delhi Flour Mills Co Ltd

- General Mills, Inc.

- Hindustan Unilever Ltd

- ITC Ltd

- J.J. Foods Private Limited

- Kovilpatti Lakshmi Roller Flour Mills Limited

- Parakh Agro Industries Ltd.

- Patanjali Ayurved Ltd.

Please note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion |

| Product Types Covered | Whole Wheat, Multigrain |

| Pack Types Covered | Pouches, Woven Bags |

| Pack Sizes Covered | 10 Kg, 5 Kg, 1 Kg, Others |

| Distribution Channels Covered |

|

| States Covered | Maharashtra, Andhra Pradesh, Karnataka, Telangana, Goa, Others |

| Companies Covered | Adani Wilmer Ltd, Ahaar Consumer Products Pvt. Ltd, Anand Milk Union Ltd (AMUL), Cargill India Pvt. Ltd., Delhi Flour Mills Co Ltd, General Mills, Inc., Hindustan Unilever Ltd, ITC Ltd, J.J. Foods Private Limited, Kovilpatti Lakshmi Roller Flour Mills Limited, Parakh Agro Industries Ltd., Patanjali Ayurved Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India packaged atta market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India packaged atta market?

- What is the impact of each driver, restraint, and opportunity on the India packaged atta market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the India packaged atta market?

- What is the breakup of the market based on the pack type?

- Which is the most attractive pack type in the India packaged atta market?

- What is the breakup of the market based on the pack size?

- Which is the most attractive pack size in the India packaged atta market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the India packaged atta market?

- What is the competitive structure of the India packaged atta market?

- Who are the key players/companies in the India packaged atta market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India packaged atta market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India packaged atta market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India packaged atta industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)