India Overhead Cranes Market Size, Share, Trends, and Forecast by Type, Lifting Capacity, End Use, and Region, 2025-2033

India Overhead Cranes Market Overview:

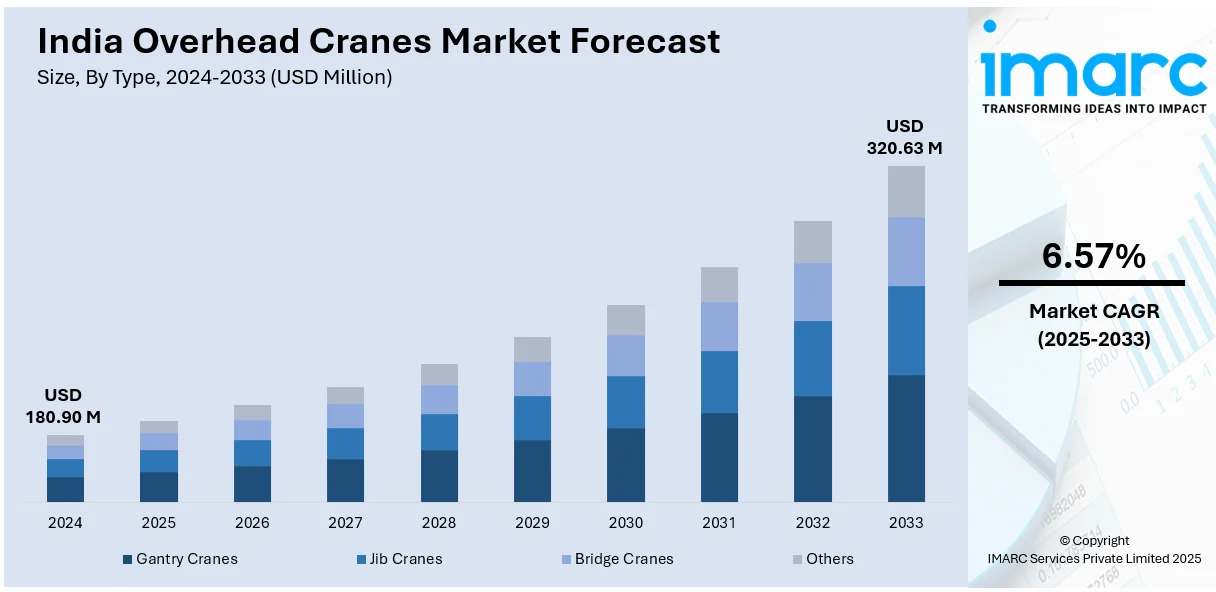

The India overhead cranes market size reached USD 180.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 320.63 Million by 2033, exhibiting a growth rate (CAGR) of 6.57% during 2025-2033. The market is expanding due to rising infrastructure projects, automation in manufacturing, and an increased demand from steel, automotive, and logistics sectors. Key trends include smart cranes, IoT integration, and higher load capacities for improved efficiency and safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 180.90 Million |

| Market Forecast in 2033 | USD 320.63 Million |

| Market Growth Rate 2025-2033 | 6.57% |

India Overhead Cranes Market Trends:

Increasing Adoption of Smart and Automated Overhead Cranes

The India overhead cranes market is witnessing a shift toward smart and automated crane solutions as industries prioritize operational efficiency and workplace safety. Automation techniques, enveloping IoT-based sensors, real-time monitoring systems, and predictive maintenance solutions, are becoming integral to modern overhead crane systems. For instance, as per industry reports, the deployment of real-time monitoring systems significantly lowers accidents risk by around 20%. In parallel, Godrej & Boyce, a major India-based company, deployed electric overhead cranes in their production processes, leading to a 30% minimization in both emissions and energy consumption in comparison to conventional models. Moreover, these advancements allow for remote operation, load monitoring, and failure prediction, reducing downtime and optimizing productivity. Sectors such as manufacturing, warehousing, logistics, and steel production are driving demand for these intelligent lifting solutions. The integration of AI-powered control systems enables precise movement and minimizes human intervention, enhancing safety standards. Additionally, regulatory emphasis on workplace safety and load-handling efficiency is accelerating the adoption of such technologies. Major market players are focusing on technological partnerships and R&D investments to develop smart cranes that align with India's growing industrial automation landscape. This trend is expected to reshape material handling operations across key industries in the coming years.

To get more information on this market, Request Sample

Rising Demand from Infrastructure and Construction Sectors

India's rapid infrastructure development and increasing construction activities are fueling the demand for overhead cranes in large-scale projects. For instance, as per industry reports, in 2024, construction segment across India proliferated by 7.8%, influenced by investments from both private and public industries. In addition to this, in September 2024, the government initiated the construction work for several ventures in Gujarat, encompassing housing, road, or railways, with a total value of USD 962.5 Million. Moreover, the government’s emphasis on initiatives such as Make in India, Smart Cities Mission, and Bharatmala Project is accelerating investments in urban infrastructure, roads, bridges, and industrial zones. These projects require heavy-duty lifting equipment to handle large loads efficiently, making overhead cranes essential in steel plants, cement production, and prefabrication units. Additionally, the expansion of metro rail projects, airports, and commercial real estate is driving significant demand for overhead cranes with higher load capacities, improved precision, and enhanced safety features. Market players are focusing on manufacturing customized solutions to meet project-specific requirements. The shift toward higher-capacity cranes with energy-efficient systems is another key development in this space. With continued government spending on infrastructure, the demand for overhead cranes is anticipated to grow steadily in the foreseeable future.

India Overhead Cranes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, lifting capacity, and end use.

Type Insights:

- Gantry Cranes

- Jib Cranes

- Bridge Cranes

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes gantry cranes, jib cranes, bridge cranes, and others.

Lifting Capacity Insights:

- Up to 5 Ton

- 6-10 Ton

- 11-50 Ton

- More Than 50 Ton

A detailed breakup and analysis of the market based on the lifting capacity have also been provided in the report. This includes up to 5 ton, 6-10 tone, 11-50 ton, and more than 50 ton.

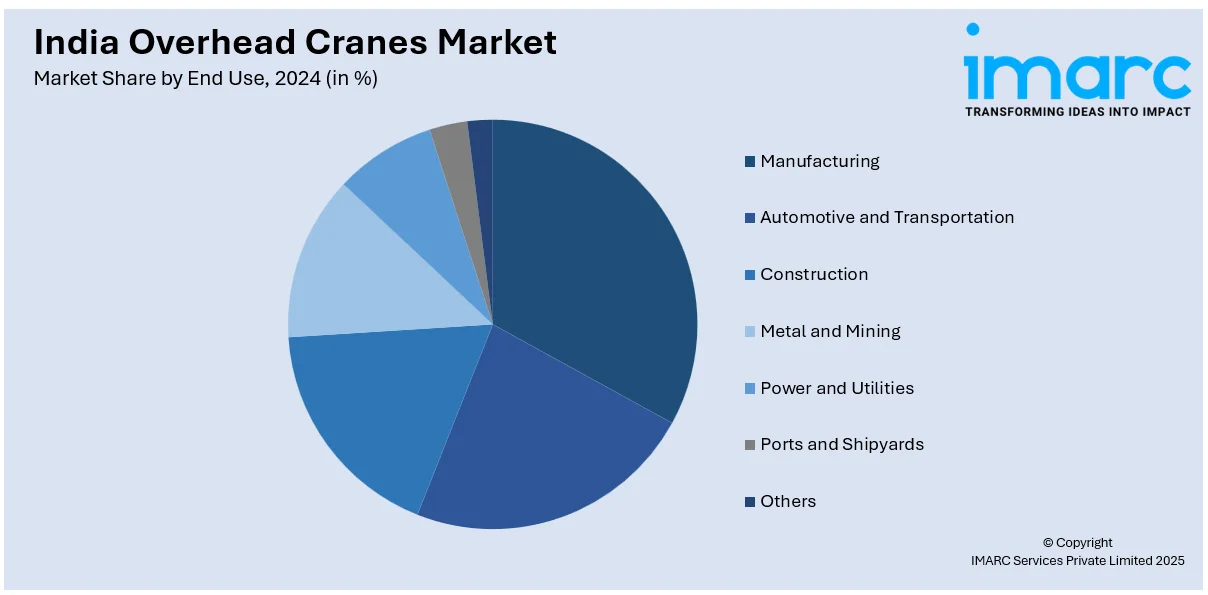

End Use Insights:

- Manufacturing

- Automotive and Transportation

- Construction

- Metal and Mining

- Power and Utilities

- Ports and Shipyards

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes manufacturing, automotive and transportation, construction, metal and mining, power and utilities, ports and shipyards, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Overhead Cranes Market News:

- In August 2024, Kito Crosby, a lifting equipment producer with having notable presence in India under the name Kito India, announced acquisition of Eepos, a major overhead crane systems manufacturer.

- In November 2024, India's crane rental and heavy lift segment witnessed a key development with the launch of HEFT Cranes International, a strategic alliance among Shethia Erectors & Material Handlers, Amrik Singh & Sons Crane Services, and Barkat Cranes & Equipment. The initiative targets to elevate industry norms, drive infrastructure advancements, and provide extensive lifting solutions.

India Overhead Cranes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gantry Cranes, Jib Cranes, Bridge Cranes, Others |

| Lifting Capacities Covered | Up to 5 Ton, 6-10 Ton, 11-50 Ton, More Than 50 Ton |

| End Uses Covered | Manufacturing, Automotive and Transportation, Construction, Metal and Mining, Power and Utilities, Ports and Shipyards, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India overhead cranes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India overhead cranes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India overhead cranes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The overhead cranes market in India was valued at USD 180.90 Million in 2024.

The India overhead cranes market is projected to exhibit a CAGR of 6.57% during 2025-2033, reaching a value of USD 320.63 Million by 2033.

The market is driven by growth in steel, automotive, and construction sectors. Expansion of industrial facilities and warehousing needs increases demand. Companies are prioritizing safety, efficiency, and automation. Government-supported infrastructure projects also contribute to market expansion. Manufacturers are replacing outdated lifting systems, and larger production sites are adopting modern cranes to handle heavy materials with speed and consistency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)