India Outdoor LED Display Market Size, Share, Trends and Forecast by Screen Size, Mode of Sales, Application, and Region, 2025-2033

India Outdoor LED Display Market Overview:

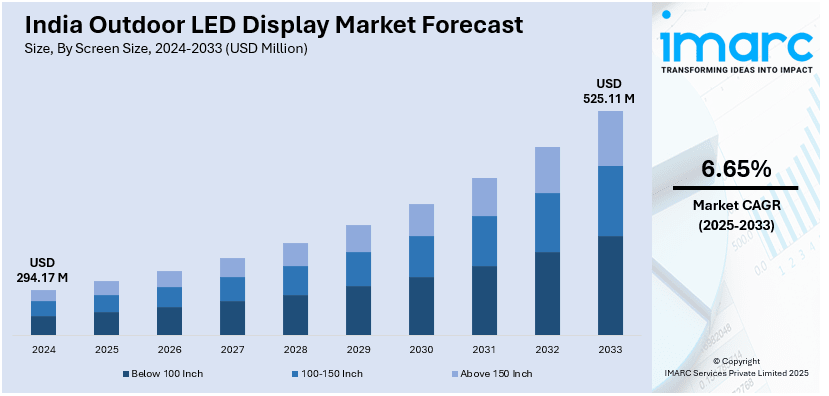

The India outdoor LED display market size reached USD 294.17 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 525.11 Million by 2033, exhibiting a growth rate (CAGR) of 6.65% during 2025-2033. The market in India is driven by rising demand for high-resolution and interactive screens in advertising and public spaces. The implementation of government smart city initiatives, digital out-of-home (DOOH) advertising growth, declining LED costs, and energy-efficient technologies, rapid urbanization, and increasing digitization further augments the India outdoor LED display market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 294.17 Million |

| Market Forecast in 2033 | USD 525.11 Million |

| Market Growth Rate (2025-2033) | 6.65% |

India Outdoor LED Display Market Trends:

Rising Demand for High-Resolution and Interactive LED Displays

The increasing demand for high-resolution and interactive displays, driven by advancements in technology and changing consumer expectations are positively impacting the India outdoor LED display market outlook. Businesses and advertisers are increasingly adopting ultra-HD and 4K LED screens to deliver crisp, vibrant visuals that capture audience attention. A research report from the IMARC Group indicates that the market size for displays in India was valued at USD 5,602 Million in 2024. It is projected to grow to USD 8,403 Million by 2033, reflecting a compound annual growth rate (CAGR) of 4.6% from 2025 to 2033. Moreover, interactive LED screens with touch and gesture controls are progressively incorporated into retail, hospitality, and public venues, enhancing customer engagement. These displays are quickly being launched at shopping centers, transportation terminals, and sports arenas in Mumbai, Delhi, and Bangalore. This is further driven by the increasing popularity of digital out-of-home (DOOH) advertising, as brands seek eye-catching and interactive ways to engage with consumers. With the prices of LED panels dropping as well as their energy efficiency improving, high-resolution and interactive displays are becoming widely available, thereby contributing to the growth of the market.

To get more information on this market, Request Sample

Government Initiatives Increasing Smart City LED Deployments

Government-led smart city projects are significantly propelling the India outdoor LED display market growth. Under the initiative of India's Smart Cities Mission, more than 8000 projects worth INR 1.6 lakh Crore (approximately USD 522.24 Million) are being executed across 100 cities, among which 90% of projects have been completed. High-impact initiatives such as the rollout of 5.2 Million solar and LED streetlights and the installation of 83,000+ CCTV cameras that are upgrading urban infrastructure. The expansion of the mission provides critical opportunities for the outdoor LED display market in India, propelling the advent of smart city projects and improving public safety. Furthermore, municipalities are replacing traditional billboards with energy-efficient LED screens to reduce power consumption and enhance visibility. The push for digital infrastructure in cities such as Pune, Ahmedabad, and Hyderabad are creating lucrative opportunities for LED display manufacturers and solution providers. Additionally, initiatives including "Digital India" are encouraging the adoption of digital signage in public spaces, further driving market expansion. As smart city projects accelerate, the demand for durable, weather-resistant outdoor LED displays is expected to rise, shaping the future of India’s urban digital landscape.

India Outdoor LED Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on screen size, mode of sales, and application.

Screen Size Insights:

- Below 100 Inch

- 100-150 Inch

- Above 150 Inch

The report has provided a detailed breakup and analysis of the market based on the screen size. This includes below 100 inch, 100-150 inch, and above 150 inch.

Mode of Sales Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the mode of sales have also been provided in the report. This includes online and offline.

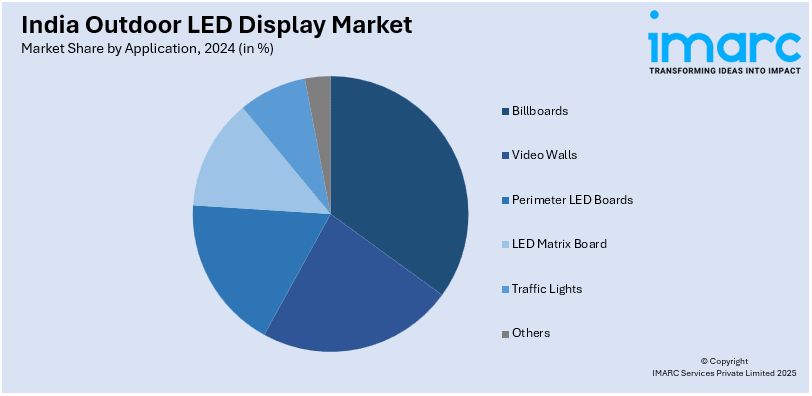

Application Insights:

- Billboards

- Video Walls

- Perimeter LED Boards

- LED Matrix Board

- Traffic Lights

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes billboards, video walls, perimeter LED boards, LED matrix board, traffic lights, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Outdoor LED Display Market News:

- January 09, 2025: Platinum Outdoor launched an AI-powered, real-time, interactive digital billboard at Juhu Beach as part of a campaign with Aditya Birla Sun Life Insurance. This initiative, which is part of a campaign called #BoodheHokeKyaBanoge, allows users to upload their selfies and view AI-generated representations of their future selves. This groundbreaking approach sets a new standard in outdoor advertising by combining AI capabilities with digital billboard technology, transforming audience interaction within the DOOH sector.

- October 24, 2024: Devangi Outdoor Advertising placed dual 30×40 feet digital LED boards at Chembur ROB Amar Mahal flyover facing the high volume of traffic coming towards Ghatkopar, Mulund, and Dadar. It claimed its digital out-of-home (DOOH) billboards would provide brands with dynamic real-time content updates scrolling in both directions, ensuring brands achieve optimal visibility along one of Mumbai's most heavily trafficked routes. This new installation further cements Devangi Outdoor's place in the highly competitive outdoor advertising industry of Mumbai.

India Outdoor LED Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Screen Sizes Covered | Below 100 Inch, 100-150 Inch, Above 150 Inch |

| Modes of Sales Covered | Online, Offline |

| Applications Covered | Billboards, Video Walls, Perimeter LED Boards, LED Matrix Board, Traffic Lights, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India outdoor LED display market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India outdoor LED display market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India outdoor LED display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The outdoor led display market in India was valued at USD 294.17 Million in 2024.

The India outdoor led display market is projected to exhibit a (CAGR) of 6.65% during 2025-2033, reaching a value of USD 525.11 Million by 2033.

The major growth drivers are increasing use of digital advertising, smart city projects, and high visibility in public and commercial areas. Improved energy efficiency, extended lifespan, and weather resistance make LED screens the best choice for outdoors. Transportation, retail, and political advertising demand also fuel market momentum, with weakening LED panel prices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)