India Outdoor Advertising Market Size, Share, Trends and Forecast by Type, Segment, and Region, 2025-2033

India Outdoor Advertising Market Overview:

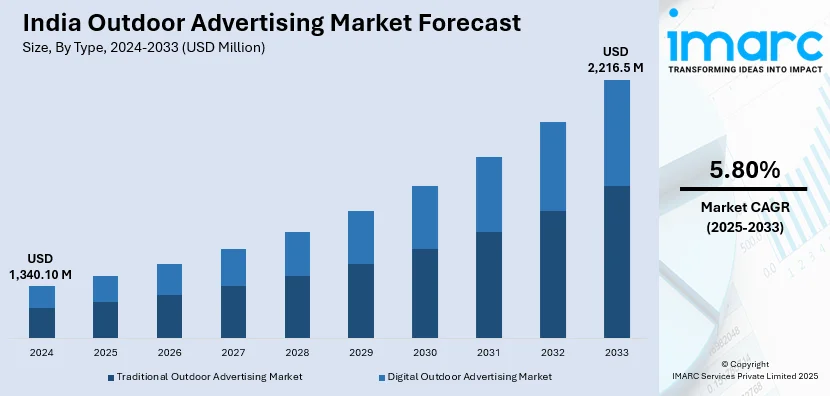

The India outdoor advertising market size reached USD 1,340.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,216.5 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is driven by rapid urbanization, increasing digitalization, and the growing adoption of transit advertising. Technological advancements including digital billboards and programmatic platforms enhance audience targeting and engagement. Rising consumer mobility, coupled with cost-effective ad solutions, further fuels the India outdoor advertising market share, making outdoor advertising a key medium for brand visibility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,340.10 Million |

| Market Forecast in 2033 | USD 2,216.5 Million |

| Market Growth Rate 2025-2033 | 5.80% |

India Outdoor Advertising Market Trends:

Digital Transformation in Outdoor Advertising

The significant shift towards digitalization is majorly driving the India outdoor advertising market growth. Traditional static billboards are increasingly being replaced by digital screens, offering dynamic and interactive content. This trend is driven by advancements in technology, such as high-resolution LED displays and programmatic advertising platforms, which allow advertisers to update content in real-time and target specific audiences more effectively. Cities such as Mumbai, Delhi, and Bangalore are witnessing a rise in digital out-of-home (DOOH) advertising, as brands seek to capture the attention of tech-savvy consumers. Additionally, the integration of data analytics and AI enables advertisers to measure campaign performance more accurately, optimizing their strategies for better ROI. On 28th January 2025, Godrej Enterprises Group announced plans to invest INR 1,200 Crore (approximately USD 146.34 Million) over the next three years in digital transformation and artificial intelligence initiatives for enhancing customer experience across its log of business sectors. This includes investments in AI-powered personalization, advanced data analytics, and an organization-wide reskilling initiative that will deliver 600,000 hours of training to employees. This strategy formation comes as a reaction to the growing demand for digital solutions in India, most notably impacting markets such as those for advertising sectors driven by AI-embedded customer interaction and automation. Moreover, the growing adoption of digital outdoor advertising is also fueled by its ability to deliver personalized and engaging experiences, making it a preferred choice for brands looking to stand out in a competitive market.

To get more information on this market, Request Sample

Integration of Outdoor Advertising with Mobile Technology

The rise of smartphone usage in India is transforming outdoor advertising by enabling seamless integration between physical ads and mobile devices, creating a positive India outdoor advertising market outlook. Brands are incorporating QR codes, NFC tags, and augmented reality (AR) features into outdoor campaigns, allowing consumers to interact with ads using their smartphones. This trend enhances engagement by bridging the gap between offline and online experiences. For instance, users can scan a QR code on a billboard to access exclusive content, discounts, or product information. With large smartphone users in India, this trend is gaining momentum, as it provides measurable insights into campaign effectiveness and drives higher consumer participation. A report indicates that 84% of smartphone users in India examine their devices within 15 minutes of rising, dedicating 31% of their waking hours to smartphone usage. The duration of time spent on smartphones has increased significantly, rising from 2 hours in 2010 to 4.9 hours in 2023, with an average of 80 checks per day. Furthermore, the synergy between outdoor advertising and mobile technology is reshaping how brands connect with their audiences, making campaigns more interactive and impactful.

India Outdoor Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and segment.

Type Insights:

- Traditional Outdoor Advertising Market

- Digital Outdoor Advertising Market

The report has provided a detailed breakup and analysis of the market based on the type. This includes traditional outdoor advertising market and digital outdoor advertising market.

Segment Insights:

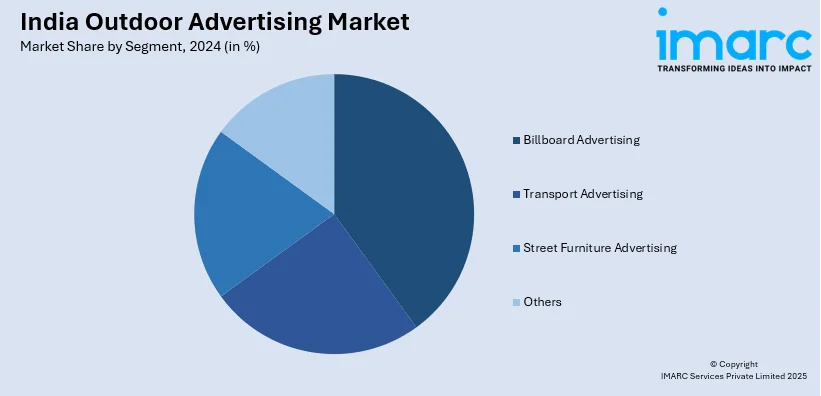

- Billboard Advertising

- Transport Advertising

- Street Furniture Advertising

- Others

A detailed breakup and analysis of the market based on the segment have also been provided in the report. This includes billboard advertising, transport advertising, street furniture advertising, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Outdoor Advertising Market News:

- January 09, 2025: Platinum Outdoor launched an AI-powered, real-time, interactive digital billboard at Juhu Beach as part of a campaign with Aditya Birla Sun Life Insurance. This initiative, which is part of a campaign called #BoodheHokeKyaBanoge, allows users to upload their selfies and view AI-generated representations of their future selves. This groundbreaking approach sets a new standard in outdoor advertising by combining AI capabilities with digital billboard technology, transforming audience interaction within the DOOH sector.

- October 24, 2024: Devangi Outdoor Advertising placed dual 30×40 feet digital LED boards at Chembur ROB Amar Mahal flyover facing the high volume of traffic coming towards Ghatkopar, Mulund, and Dadar. It claimed its digital out-of-home (DOOH) billboards would provide brands with dynamic real-time content updates scrolling in both directions, ensuring brands achieve optimal visibility along one of Mumbai's most heavily trafficked routes. This new installation further cements Devangi Outdoor's place in the highly competitive outdoor advertising industry of Mumbai.

India Outdoor Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Traditional Outdoor Advertising Market, Digital Outdoor Advertising Market |

| Segments Covered | Billboard Advertising, Transport Advertising, Street Furniture Advertising, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India outdoor advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India outdoor advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India outdoor advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The outdoor advertising market in India was valued at USD 1,340.10 Million in 2024.

The India outdoor advertising market is projected to exhibit a CAGR of 5.80% during 2025-2033, reaching a value of USD 2,216.5 Million by 2033.

Key factors driving the India outdoor advertising market include increased digital media integration and growing infrastructure development. Additionally, the shift toward experiential marketing and outdoor campaigns' effectiveness in reaching a broad audience contributes significantly to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)