India Orthopedic Implants Market Size, Share, Trends and Forecast by Product, Type, Biomaterial, End User, and Region, 2025-2033

Market Overview:

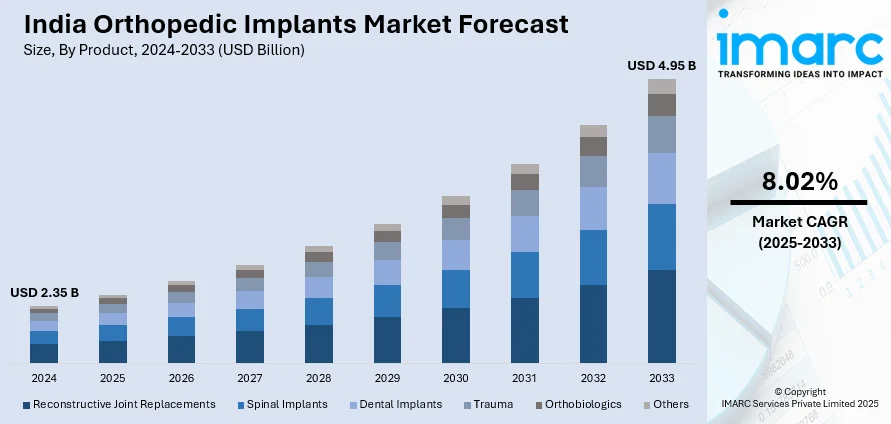

India orthopedic implants market size reached USD 2.35 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.95 Billion by 2033, exhibiting a growth rate (CAGR) of 8.02% during 2025-2033. The growing advancements in medical technology, the rising awareness about orthopedic solutions, and an emphasis on improving healthcare infrastructure represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.35 Billion |

|

Market Forecast in 2033

|

USD 4.95 Billion |

| Market Growth Rate 2025-2033 | 8.02% |

Orthopedic implants are specialized medical devices meticulously crafted to address musculoskeletal conditions and injuries. These implants are characterized by essential attributes such as biocompatibility, durability, and a seamless integration with the human body. Typically crafted from materials like titanium, stainless steel, or medical-grade polymers, these implants ensure enduring stability within the body over the long term. Diverse in design, orthopedic implants encompass joint replacements such as hip and knee prostheses, as well as plates, screws, and rods tailored for fracture fixation. Additionally, spinal implants are employed to address spinal disorders. The fundamental purpose of these implants is to restore mobility, alleviate pain, and enhance the overall quality of life for individuals grappling with orthopedic conditions, fractures, or degenerative joint diseases.

To get more information on this market, Request Sample

India Orthopedic Implants Market Trends:

The India orthopedic implants market stands as a crucial sector within the country's healthcare industry, catering to the diverse needs of individuals suffering from musculoskeletal conditions and injuries. Crafted with meticulous precision, orthopedic implants in India embody key characteristics such as biocompatibility, durability, and compatibility with the human body. Additionally, the India orthopedic implants market offers a wide array of designs tailored to address various musculoskeletal issues. Moreover, this includes joint replacements like hip and knee prostheses, as well as fixation devices such as plates, screws, and rods used for fracture management. Besides this, spinal implants contribute to the treatment of spinal disorders, showcasing the market's diversity in catering to different orthopedic needs. Furthermore, as the country experiences demographic shifts, including an aging population and an increased prevalence of orthopedic conditions, the demand for orthopedic implants is witnessing substantial growth. Apart from this, with an elevating focus on enhancing the quality of patient care, the market is poised for continued development, offering innovative solutions to individuals seeking orthopedic interventions for an improved and active lifestyle.

India Orthopedic Implants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, type, biomaterial, and end user.

Product Insights:

- Reconstructive Joint Replacements

- Knee Replacement Implants

- Hip Replacement Implants

- Extremities

- Spinal Implants

- Spinal Fusion Implants

- Vertebral Compression Fracture (VCF) Devices

- Motion Preservation Devices/Non-Fusion Devices

- Dental Implants

- Root Form Dental Implants

- Plate Form Dental Implants

- Trauma

- Orthobiologics

- Demineralized Bone Matrix (DBM)

- Allograft

- Bone Morphogenetic Protein (BMP)

- Viscosupplementation Products

- Synthetic Bone Substitutes

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes reconstructive joint replacements (knee replacement implants, hip replacement implants, and extremities), spinal implants (spinal fusion implants, vertebral compression fracture (VCF) devices, and motion preservation devices/non-fusion devices), dental implants (root form dental Implants and plate form dental implants), trauma, orthobiologics (demineralized bone matrix (DBM), allograft, bone morphogenetic protein (BMP), viscosupplementation products, synthetic bone substitutes, and others), and others.

Type Insights:

- Knee

- Hip

- Wrist and Shoulder

- Dental

- Spine

- Ankle

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes knee, hip, wrist and shoulder, dental, spine, ankle, and others.

Biomaterial Insights:

- Metallic Biomaterials

- Stainless Steel

- Titanium alloy

- Cobalt alloy

- Others

- Ceramic Biomaterials

- Polymers Biomaterials

- Others

The report has provided a detailed breakup and analysis of the market based on the biomaterial. This includes metallic biomaterials (stainless steel, titanium alloy, cobalt alloy, and others), ceramic biomaterials, polymers biomaterials, and others.

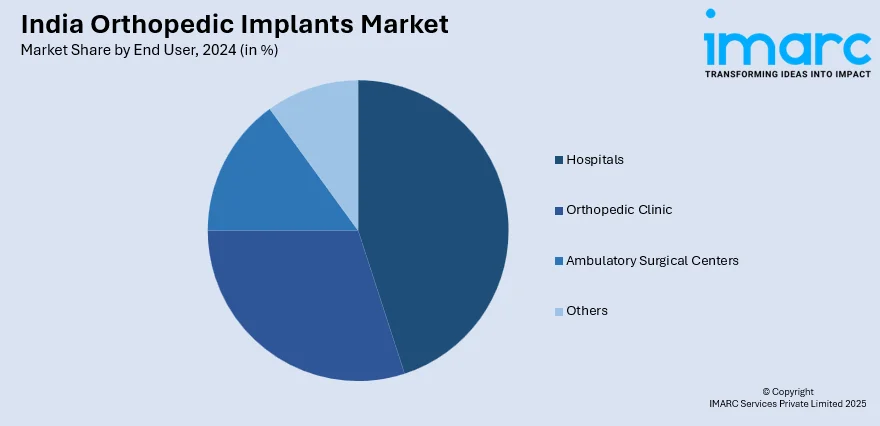

End User Insights:

- Hospitals

- Orthopedic Clinic

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, orthopedic clinic, ambulatory surgical centers, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Orthopedic Implants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Types Covered | Knee, Hip, Wrist and Shoulder, Dental, Spine, Ankle, Others |

| Biomaterials Covered |

|

| End Users Covered | Hospitals, Orthopedic Clinic, Ambulatory Surgical Centers, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India orthopedic implants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India orthopedic implants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India orthopedic implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India orthopedic implants market size reached USD 2.35 Billion in 2024.

The India orthopedic implants market is expected to grow at a CAGR of 8.02% during 2025-2033, reaching USD 4.95 Billion by 2033.

The market growth is driven by advancements in medical technology, rising awareness about orthopedic solutions, increasing prevalence of musculoskeletal disorders, demographic shifts including an aging population, and improvements in healthcare infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)