India Orthopedic Devices Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

India Orthopedic Devices Market Size and Share:

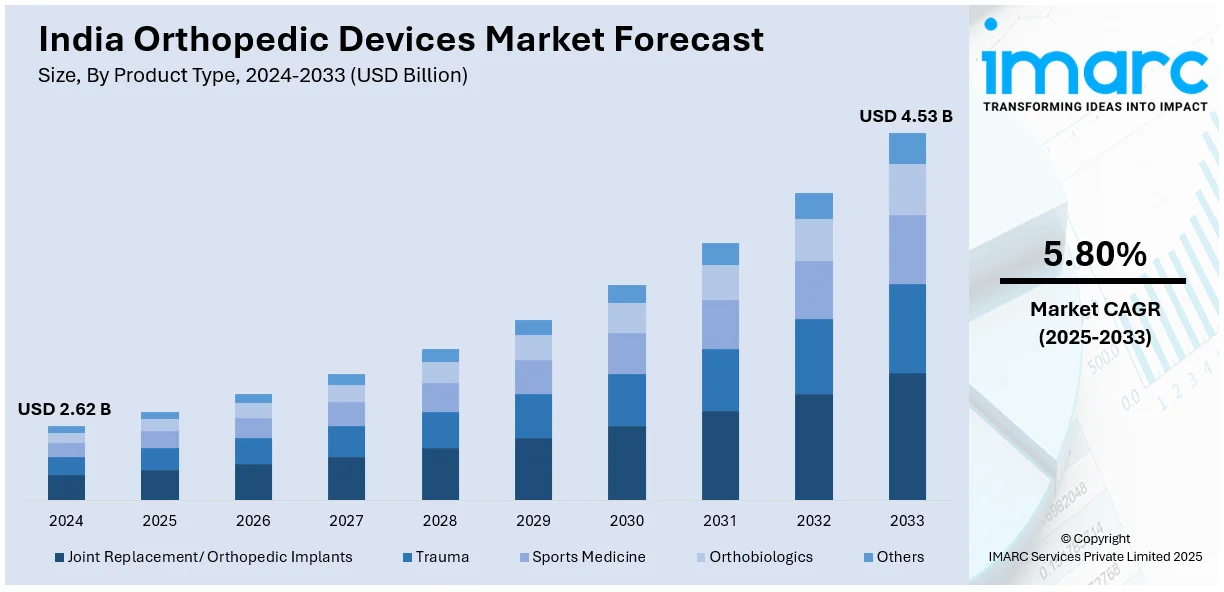

The India orthopedic devices market size was valued at USD 2.62 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.53 Billion by 2033, exhibiting a CAGR of 5.80% from 2025-2033. The market is driven by increasing musculoskeletal disorders, a growing population, higher sports injuries, and developing healthcare infrastructure. The market is led by South India because of highly developed hospitals, medical tourism, and technology-led innovations such as robotic-assisted surgeries and 3D-printed implants. Increasing insurance cover and government efforts also drive market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.62 Billion |

| Market Forecast in 2033 | USD 4.53 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

The growing incidence of road accidents and occupational injuries in India is contributing heavily to the demand for orthopedic devices. Rapid industrialization and urbanization have accelerated trauma-induced fractures and musculoskeletal disorders, which demand advanced fixation devices and orthopedic implants. Furthermore, a shift in lifestyle, such as decreased physical activity and increased screen time, has caused a boost in posture-induced spinal conditions, making room for correctional spinal implants and rehabilitation devices. For example, in January 2024, Stryker Corporation diversified its portfolio in India with the Tritanium spinal implant system aimed at improving spinal fusion procedures and patient outcomes. Further, the growth in telemedicine and remote consultations is also accelerating accessibility to orthopedic treatment, especially in rural regions where there is a scarcity of specialists. Advances in regenerative medicine like stem cell therapy and cartilage regeneration technologies are also driving the India orthopedic devices market growth through the availability of alternatives to conventional joint replacement surgery. Rising popularity of the culture of fitness, particularly among youth, is fueling the demand for orthopedic supports, bracing, and injury prevention devices, broadening the reach of non-surgical orthopedic products in India.

To get more information on this market, Request Sample

The growth of outpatient orthopedic surgery and ambulatory surgical centers is another major force that is driving the market. Thanks to improvements in anesthesia and pain management, more orthopedic surgeries like arthroscopic and minimally invasive (MI) procedures are today being conducted in outpatient facilities, lowering healthcare expenses and improving patient convenience. The growing integration of wearable orthopedic technology like intelligent braces and posture-correcting devices is improving real-time tracking and personalized rehabilitation. India’s growing middle class increased disposable income, and amplifying emphasis on health and well-being is fueling demand for high-end orthopedic implants and customized treatment solutions. The government's encouragement of medical research and clinical trials is also promoting innovation in materials for implants, resulting in next-generation orthopedic products with enhanced longevity and biocompatibility. According to the reports, the Union Budget 2024 introduces a reduction in custom duty on polyethylene for orthopedic implants and special-grade steel for medical implants, lowering production costs. Additionally, the Production Linked Incentive (PLI) scheme supports domestic manufacturing, fostering innovation in orthopedic and other medical devices. Furthermore, as surgery techniques, rehabilitation equipment, and patient-focused treatments continue to develop, India's orthopedic device market will continue to expand in the foreseeable future.

India Orthopedic Devices Market Trends:

Advancements in Orthopedic Technologies

Orthopedic technologies are evolving at a fast pace, increasing accuracy, efficiency, and patient results. Robotic-assisted procedures are transforming operations by enhancing precision and minimizing recovery time. AI-based implant design allows for personalized, patient-specific solutions, maximizing fit and function. 3D printing is revolutionizing orthopedic treatment by creating customized implants and prosthetics, providing better integration with natural bone structures. Biodegradable and Osseo-conductive materials are enhancing bone regeneration and minimizing complications. Smart implants and wearable technology increasingly offer real-time tracking of the healing process so that informed post-surgery care can be provided. For instance, in December 2023, Sancheti Hospital unveiled OrthoAI, India's first orthopedic generative AI tool, allowing surgeons to tap into huge medical literature and the wisdom of experts for better decision making in challenging cases. These technologies, combined with local manufacturing advancements, are also increasing access to high-quality orthopedic treatment while reducing costs. With digital health solutions increasingly on the rise, orthopedic treatment is increasingly being personalized, redefining the musculoskeletal therapy of the future.

Growing Incidence of Bone Disorders and Injuries

The prevalence of bone injuries and disorders is increasing all over the world due to a growing population of older people, changes in lifestyle, and higher physical activity. Osteoporosis, arthritis, and fractures are increasingly becoming common, especially among elderly and inactive people. Road accidents and high-impact sports are also leading to an increase in bone injuries, necessitating sophisticated orthopedic procedures. Urbanization and dietary inadequacies are causing diminished bone strength, added to vulnerability to fractures and joint degeneration. Stress exerted on bones and joints due to obesity is also adding fuel to musculoskeletal diseases. With increasing knowledge and improvements in medical technology, early detection and targeted treatment opportunities, such as minimally invasive procedures and regenerative medicine, are better managing disorders of the bone, enhancing the outcome for patients. According to the sources, in July 2024, Indian researchers developed OsseoCraft, the world’s first 3D bone graft printer, enabling customized, cost-effective, and osseo-conductive implants that enhance bone regeneration, reduce surgical time, and improve patient-specific treatment outcomes.

Rising Demand for Joint Replacement Surgeries

The need for joint replacement procedures is increasing as a result of an aging population, growing prevalence of arthritis, and lifestyle-associated joint degeneration. Osteoarthritis and rheumatoid arthritis are two of the most common reasons for the need for knee, hip, and shoulder replacements. Sedentary lifestyles, obesity, and athletic injuries are also causing joint deterioration at earlier ages, necessitating early surgical treatments. Advances in orthopedic technology, including robotic-assisted procedures, implant designs powered by artificial intelligence, and 3D-printed prosthetics, are refining surgical accuracy and patient recovery. Enhanced healthcare accessibility and affordability, increasing knowledge of joint replacement advantages, are driving market growth. With personalized and minimally invasive surgical procedures on the rise, joint replacement operations are becoming safer, more efficient, and universally accepted.

India Orthopedic Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India orthopedic devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and end user.

Analysis by Product Type:

- Joint Replacement/ Orthopedic Implants

- Lower Extremity Implants

- Knee Implants

- Hip Implants

- Foot & Ankle Implants

- Spinal Implants

- Upper Extremity Implants

- Elbow Implants

- Hand & Wrist Implants

- Shoulder Implants

- Lower Extremity Implants

- Trauma

- Implants

- Accessories (Plates, Screws, Nails, Pins, Wires)

- Instruments

- Sports Medicine

- Body Reconstruction & Repair

- Accessories

- Body Monitoring & Evaluation

- Body Support & Recovery

- Orthobiologics

- Viscosupplementation

- Demineralized Bone Matrix

- Synthetic Bone Substitutes

- Bone Morphogenetic Protein (BMP)

- Stem Cell Therapy

- Allograft

- Others

In 2024, joint replacement and orthopedic implants covered 46.5% of India's orthopedic devices market, depicting the increasing requirement for advanced musculoskeletal interventions. The contributing factors are aging population, accelerate in osteoarthritis cases, and elevated sports injuries. Developments like 3D-printed implants and patient-specific joint replacements are improving long-term results and refining surgical accuracy. The rising affordability of orthopedic treatments, combined with technological improvements in minimally invasive procedures, is inducing more patients to seek early intervention. Additionally, partnerships between local manufacturers and international medical technology companies are broadening the access to high-quality implants in India. The introduction of bioresorbable and smart implants, with AI-based monitoring, is also transforming the industry. With developing healthcare infrastructure and heightening awareness regarding mobility-improving treatments, demand for orthopedic implants is likely to grow further, making this segment a market leader in India's medical devices sector.

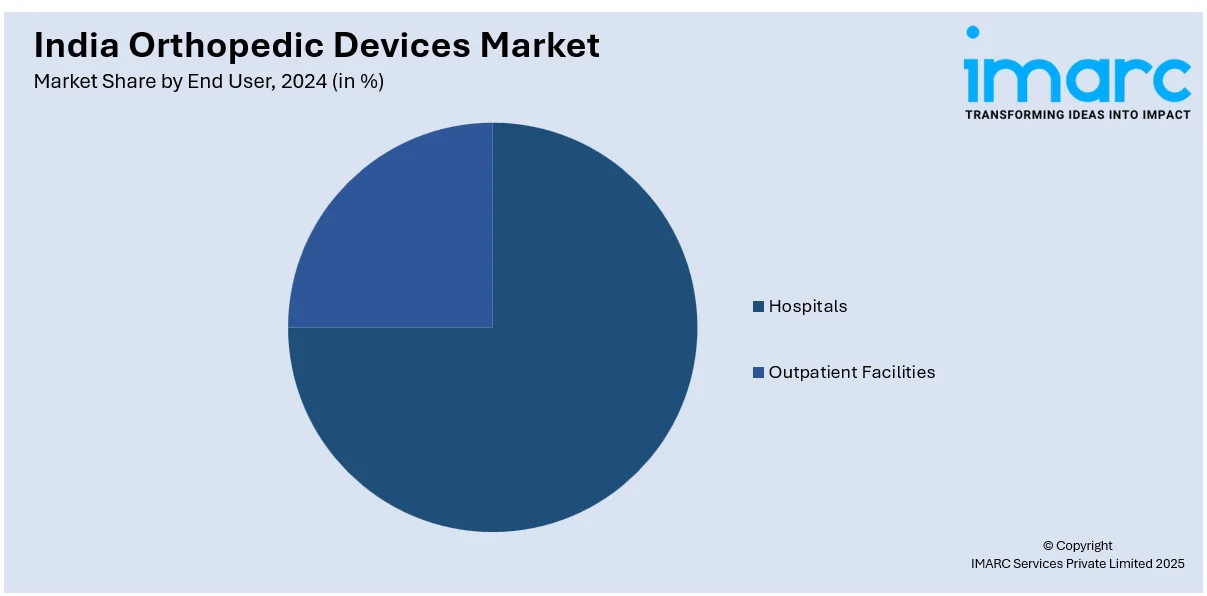

Analysis by End User:

- Hospitals

- Outpatient Facilities

Hospitals were the key end-users of orthopedic devices in India, commanding a massive 57.5% India orthopedic devices market share in 2024. The demand for hospital-based orthopedic procedures is fueled by improvements in surgical technology, availability of expert specialists, and improved post-operative care. Major hospitals are now embracing robotic-assisted joint replacement surgeries, with increased precision and shorter recovery periods. The incorporation of digital health solutions, such as AI-based diagnostic equipment and telemedicine patient monitoring, is also streamlining treatment outcomes. Government efforts to upgrade healthcare facilities, especially under the Ayushman Bharat program, have amplified the availability of high-end orthopedic treatments in urban and semi-urban settings. Additionally, hospitals are spending on specialized orthopedic units with state-of-the-art rehabilitation facilities. As patients become highly confident about surgical procedures and hospital-based orthopedic departments spur in size, this segment is anticipated to continue dominating the Indian market for orthopedic devices.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

South India became the dominant regional market for orthopedic devices in 2024 due to its well-developed healthcare infrastructure, high density of multispecialty hospitals, and rising uptake of innovative treatments. Metropolitan cities, such as Chennai, Bangalore, and Hyderabad have become primary centers for orthopedic surgeries, drawing domestic and international patients. The presence of world-class medical institutions and research centers has helped drive the widespread adoption of robotic-assisted surgeries and 3D-printed implants. In addition, growth in the market is also being driven by medical tourism, with South India emerging as a destination of choice for joint replacement operations because of affordable but high-quality treatment. The growth in the geriatric population coupled with growth in lifestyle-related orthopedic conditions has also increased demand. Healthcare programs conducted by the state and private investment are consolidating orthopedic facilities, thus facilitating greater accessibility to advanced interventions. As South India keeps on raising the bar for orthopedic innovations, its market leadership will continue to mount.

Key Regional Takeaways:

North India Orthopedic Devices Market Analysis

North India is one of the major contributors to the orthopedic devices market in the country, spurred by its advanced healthcare infrastructure and high patient base. Advanced medical institutions and multispecialty hospitals in metropolitan cities such as Delhi, Chandigarh, and Jaipur have boosted demand for joint replacements, trauma implants, and spinal devices. A rising geriatric population, along with growing instances of arthritis and osteoporosis, is driving growth further. Government schemes, such as Ayushman Bharat, are enhancing rural access to orthopedic interventions, whereas private hospitals are investing in robotic procedures and AI-based diagnostics. Medical tourism is also increasing, with overseas patients opting for value-for-money, high-quality orthopedic surgeries, in North Indian facilities. Stimulating healthcare expenditure and awareness about addressing orthopedic ailments at an early stage ensure that the region is on track for sustained market growth and technological innovation in orthopedic care.

West and Central India Orthopedic Devices Market Analysis

The market for orthopedic devices in West and Central India is experiencing consistent growth, as more cases of musculoskeletal disorders, the aging population, and advancements in medical technology are on the rise. Although South India is leading the market share at present, the western and central markets are experiencing growing demand as a result of upgraded healthcare infrastructure, improving awareness, and the incorporation of advanced orthopedic solutions. Increasing use of robotic-assisted procedures and AI-based implant designs is improving accuracy and efficiency, rendering orthopedic surgeries more successful. Local manufacturing opportunities are also enhancing accessibility and affordability, leading to the adoption of advanced medical devices across a broad base. Government efforts aimed at healthcare growth are additionally driving the market expansion. Yet regional inequalities in infrastructure and concerns about affordability are continuing issues that need focused efforts for inclusive growth. With healthcare professionals more and more adopting digital health solutions and patient-specific implants, West and Central India are on the threshold of some major developments in orthopedic treatments and surgical outcomes.

South India Orthopedic Devices Market Analysis

South India dominates the orthopedic devices market in the country, thanks to its robust healthcare system, top-notch hospitals, and burgeoning medical tourism. Urban centers such as Chennai, Bangalore, and Hyderabad are major centers for advanced orthopedic care, such as robotic joint replacement surgeries and minimally invasive spinal interventions. The zone is supported by a high density of research facilities and medical device companies, which encourage product innovation in orthopedic implants as well as rehabilitation solutions. Also, the rise in demand due to the growing cases of sports injuries and lifestyle-related orthopedic ailments is adding to the demand. Government-sponsored healthcare programs and private investment in super-specialty orthopedic hospitals are also adding to market fortification. The usage of AI-based diagnostics and 3D-printed implants is also gaining pace, driving South India as a forerunner in orthopedic innovation. With its growing healthcare infrastructure and skilled medical professionals, the region is set to continue its dominance in India's orthopedic devices market.

East India Orthopedic Devices Market Analysis

East India's orthopedic devices market is expanding progressively, fueled by enhanced access to healthcare and increased demand for orthopedic interventions. Large metropolitan areas such as Kolkata, Bhubaneswar, and Guwahati are experiencing notable investments in orthopedic infrastructure, with fresh specialty hospitals and medical colleges cropping up. Public efforts to reinforce healthcare in neglected areas are stimulating the availability of orthopedic care, especially in states of West Bengal and Odisha. Growing incidence of road accidents, factory injuries, and age-related orthopedic diseases is driving demand for trauma implants, prosthetics, and joint replacements. Also, partnerships among government and private healthcare organizations are enhancing surgical competence and technology usage. The region is also experiencing steady medical tourism growth, drawing patients from the neighboring countries. With further development of infrastructure, growing consciousness of orthopedic solutions, and growing private-sector investments, East India has a promising prospect of steady development in the market for orthopedic devices.

Competitive Landscape:

India's orthopedic devices market is experiencing cutthroat competition, driven by strategic acquisitions, product development, and mergers. One of the top Indian pharma companies has ventured into medical technology with the acquisition of a French lower-limb orthopedic implant manufacturer. Likewise, a local medical devices company has cemented its international reach with a joint venture agreement with a Japanese firm to establish advanced implant solutions. Hospitals are quickly embracing robot-assisted procedures and AI-enabled orthopedic products, delivering improved accuracy and recovery rates. South India is still a strong market leader in terms of well-established healthcare infrastructure and medical tourism development. Focused investments on intelligent implants and digital rehabilitation are also transforming the sector, and health tech financing is heavily investing in innovation. With local vendors increasing production volume and international giants entering the landscape, competition is growing. With rising demand for joint replacements, trauma devices, and minimally invasive surgeries (MIS), India's orthopedic device industry is ready to grow and evolve consistently.

The report provides a comprehensive analysis of the competitive landscape in the India orthopedic devices market with detailed profiles of all major companies, including:

- Aesculap (B. Braun)

- Enovis Corp

- Conmed Corp

- Smith & Nephew PLC

- DePuy Synthes (Johnson & Johnson)

- Stryker Corp

- Zimmer Biomet Holdings Inc

- Medtronic

- Integra LifeSciences

- CONMED Corporation

Latest News and Developments:

- In March 2025, Stryker has increased the size of its Global Technology Centre (SGTC) in India, boosting its R&D strength with state-of-the-art life cycle testing, prototyping, and microbiology development. The move reinforces India's position as a global center for medical innovation, enabling the creation of advanced healthcare solutions and furthering Stryker's dedication to quality and patient outcomes.

- In August 2024, Alkem MedTech signed a strategic partnership with Exactech to produce and distribute knee and hip replacement implants in India. This partnership enhances India's medical device sector, as per the government's initiative to promote local manufacturing. The alliance will improve orthopedic treatment with advanced joint replacement solutions.

India Orthopedic Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End Users Covered | Hospitals, Outpatient Facilities |

| Regions Covered | North India, West and India, South India, East India |

| Companies Covered | Aesculap (B. Braun), Enovis Corp, Conmed Corp, Smith & Nephew PLC, DePuy Synthes (Johnson & Johnson), Stryker Corp, Zimmer Biomet Holdings Inc, Medtronic, Integra LifeSciences, CONMED Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India orthopedic devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India orthopedic devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India orthopedic devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The orthopedic devices market in the India was valued at USD 2.62 Billion in 2024.

The India orthopedic devices market is expanding with rising road accidents, occupational injuries, and orthopedic conditions related to lifestyle. The upsurge in demand for minimally invasive procedures, increasing outpatient orthopedic treatment, and innovation in regenerative medicine, such as stem cell therapy, are also crucial drivers. Furthermore, amplified investment in wearable orthopedic technology improves monitoring and patient recovery.

The India orthopedic devices market is projected to exhibit a CAGR of 5.80% during 2025-2033, reaching a value of USD 4.53 Billion by 2033.

The orthopedic implants and joint replacement segment held the highest market share in the India orthopedic devices market. Increased prevalence of osteoarthritis, osteoporosis, and trauma injuries have fueled high demand for knee, hip, and extremity implants, as well as improved implant materials and minimally invasive surgical methods.

Some of the major players in the India orthopedic devices market include Aesculap (B. Braun), Enovis Corp, Conmed Corp, Smith & Nephew PLC, DePuy Synthes (Johnson & Johnson), Stryker Corp, Zimmer Biomet Holdings Inc, Medtronic, Integra LifeSciences, CONMED Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)