India Orthopedic Braces and Supports Market Size, Share, Trends and Forecast by Product, Type, Application, End User, and Region, 2026-2034

Market Overview:

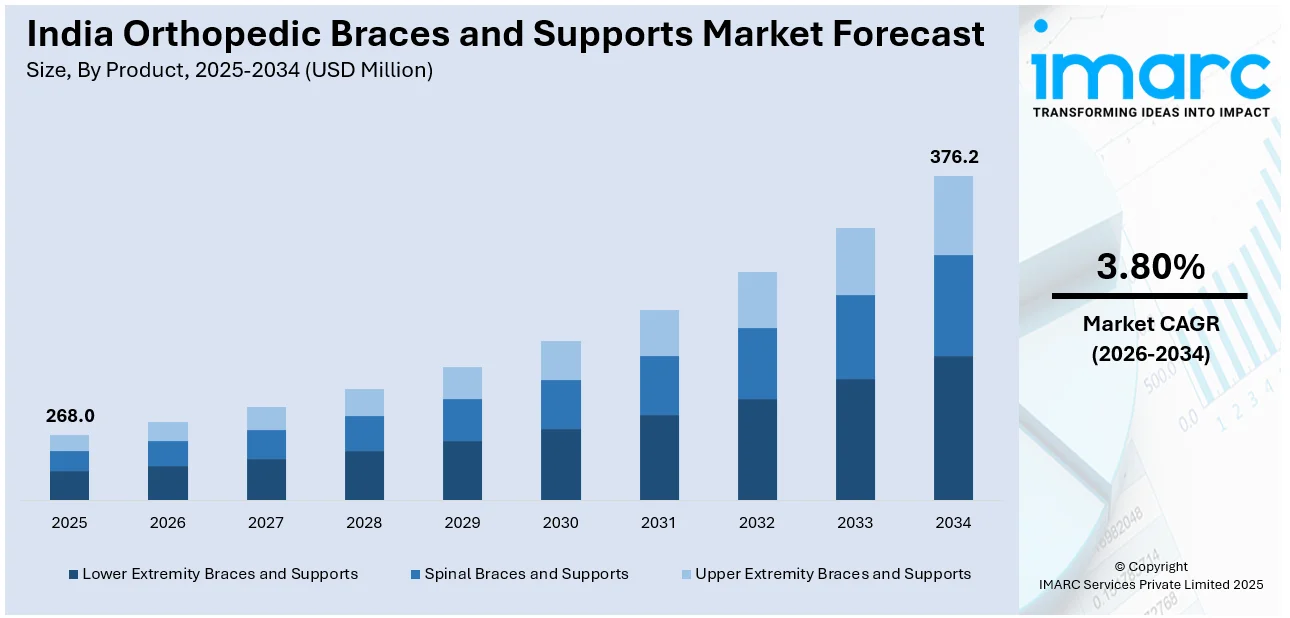

The India orthopedic braces and supports market size reached USD 268.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 376.2 Million by 2034, exhibiting a growth rate (CAGR) of 3.80% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 268.0 Million |

| Market Forecast in 2034 | USD 376.2 Million |

| Market Growth Rate (2026-2034) | 3.80% |

Orthopedic braces and supports refer to durable medical equipment used to alleviate chronic pain or temporary discomfort for patients recovering from a musculoskeletal disorder, road accident and sports injury. They facilitate the alignment, support, stabilization, and protection of body parts like muscles, joints, and bones. They are also extensively utilized in the healthcare industry to support the hips, foot, knee, ankle, and shoulder. In India, orthopedic braces and supports have gained immense popularity as they are utilized in specialized healthcare to rehabilitate and prevent injuries, along with providing post-operative and osteoarthritic care.

To get more information on this market Request Sample

The India orthopedic braces and supports market is primarily driven by the flourishing healthcare industry. The government is also implementing favorable initiatives to enhance the existing healthcare system across the country. Moreover, patients are opting for orthopedic braces and supports as they are less painful, assist in quick recovery and reduce the incidences of post-surgical complications compared to invasive treatments. Besides this, the rising awareness about the benefits of orthopedic braces and supports and the growing incidences of musculoskeletal disorders and injuries due to their sedentary lifestyles are also contributing to the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India orthopedic braces and supports market report, along with forecasts at the country and regional levels from 2026-2034. Our report has categorized the market based on product, type, application and end user.

Breakup by Product:

- Lower Extremity Braces and Supports

- Spinal Braces and Supports

- Upper Extremity Braces and Supports

Breakup by Type:

- Soft and Elastic Braces and Supports

- Hinged Braces and Supports

- Hard and Rigid Braces and Supports

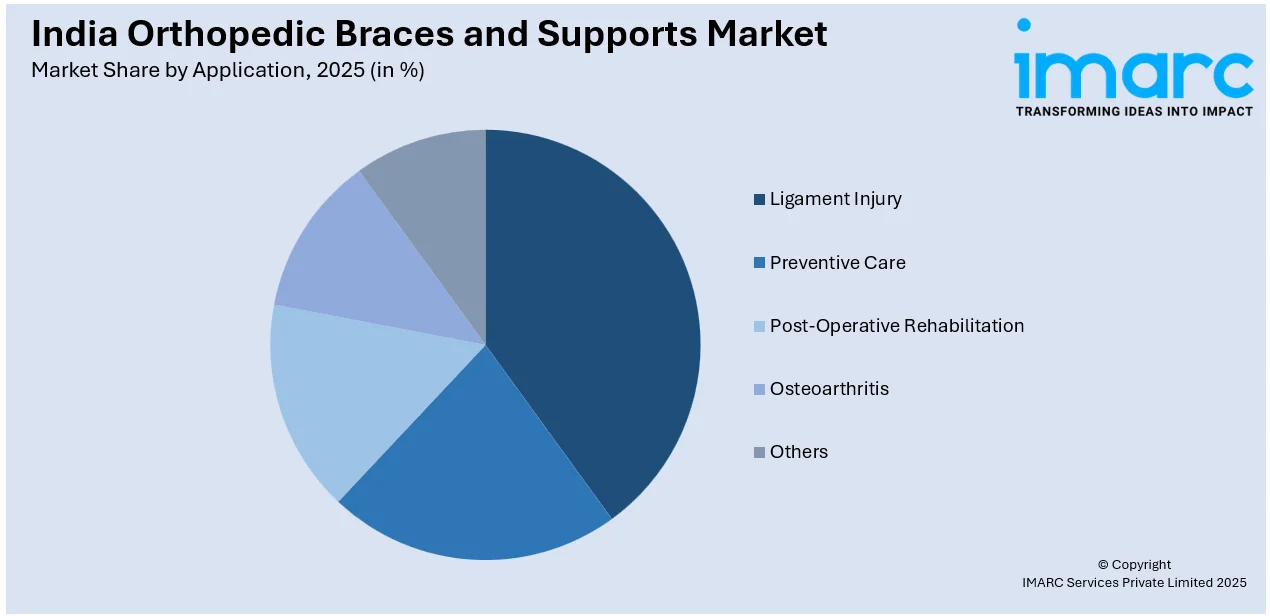

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Ligament Injury

- Preventive Care

- Post-Operative Rehabilitation

- Osteoarthritis

- Others

Breakup by End User:

- Orthopedic Clinics

- Hospitals and Surgical Centers

- Over-the-Counter (OTC) Platforms

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage | Product, Type, Application, End User, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the India orthopedic braces and supports market to exhibit a CAGR of 3.80% during 2026-2034.

The expanding geriatric population, who are more prone to numerous bone-related diseases such as spondylitis, arthritis, osteoporosis, etc., is currently driving the India orthopedic braces and supports market.

The sudden outbreak of the COVID-19 pandemic has led to the growing utilization of durable medical equipments, such as orthopedic braces and supports for providing post-operative and osteoarthritic care at home, to avoid elective hospital visits.

Based on the product, the India orthopedic braces and supports market has been divided into lower extremity braces and supports, spinal braces and supports, and upper extremity braces and supports. Currently, lower extremity braces and supports exhibit a clear dominance in the market.

Based on the type, the India orthopedic braces and supports market can be categorized into soft and elastic braces and supports, hinged braces and supports, and hard and rigid braces and supports. Among these, soft and elastic braces and supports currently hold the majority of the total market share.

Based on the application, the India orthopedic braces and supports market has been segmented into ligament injury, preventive care, post-operative rehabilitation, osteoarthritis, and others. Currently, ligament injury represents the largest market share.

Based on the end-user, the India orthopedic braces and supports market can be bifurcated into orthopedic clinics, hospitals and surgical centers, Over-the-Counter (OTC) platforms, and others. Among these, orthopedic clinics currently account for the majority of the total market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where North India currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)