India Organic Spices Market Size, Share, Trends and Forecast by Product, Form, Distribution Channel and Region, 2026-2034

India Organic Spices Market Overview:

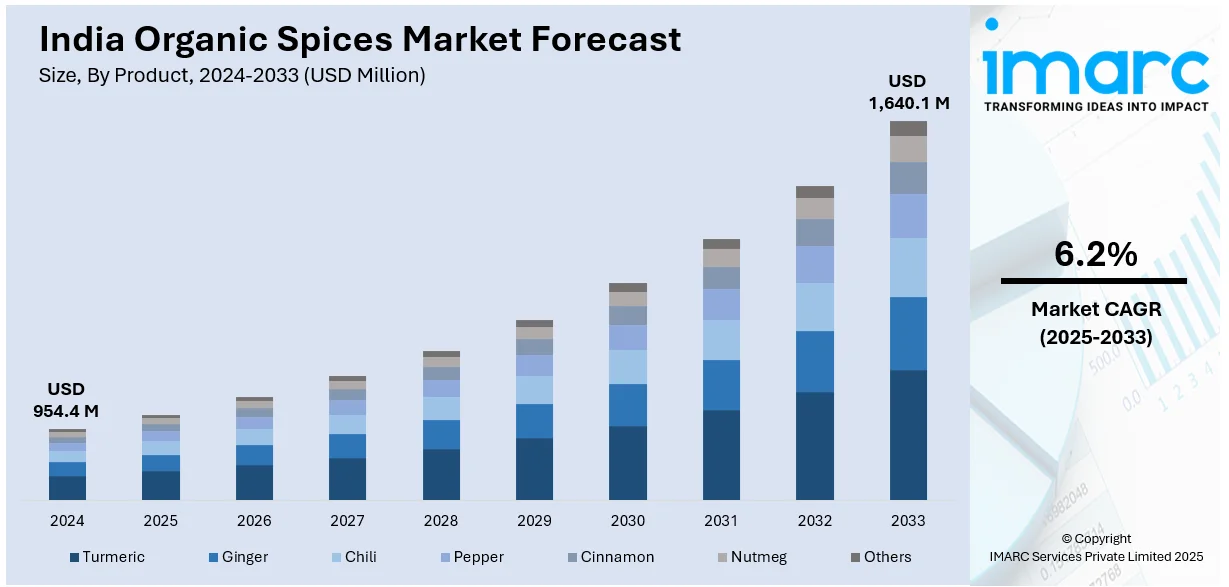

The India organic spices market size reached USD 954.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,640.1 Million by 2034, exhibiting a growth rate (CAGR) of 6.2% during 2026-2034. Rising health consciousness and dietary shifts are driving the demand for organic spices in India, with consumers preferring chemical-free and natural options. Sustainability and ethical sourcing are further strengthening the market growth, as brands are adopting responsible practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 954.4 Million |

| Market Forecast in 2034 | USD 1,640.1 Million |

| Market Growth Rate 2026-2034 | 6.2% |

India Organic Spices Market Trends:

Rising Health Consciousness and Dietary Shifts

The growing emphasis on health and wellness is boosting the need for organic spices in India. Consumers are recognizing the connection between their diet and long-term health, resulting in a preference for natural, chemical-free components. Organic spices, devoid of artificial additives and pesticides, resonate with this movement towards mindful eating. The increasing trend of immunity-enhancing diets, detox programs, and anti-inflammatory foods is further supporting this trend. Organic spices are viewed as potent and beneficial, making them a favored option for home cooking and health-oriented meal preparation. Moreover, shifts in diet like veganism and plant-based eating are catalyzing the demand for organic spices, as consumers favor natural flavors and nutrient-rich components. With increasing concerns about food safety, especially related to pesticide residues in conventional spices, more health-conscious consumers are turning to organic alternatives. Leading companies are responding to this demand by introducing certified products to gain consumer trust and drive sales. In 2023, VAHDAM India introduced a selection of organic spices, featuring certified organic varieties like turmeric powder, black pepper powder, cinnamon powder, ginger powder, whole cloves, cumin powder, and onion powder. These spices were obtained from the best organic farms in India and were devoid of pesticides, contaminants, and toxins. The firm highlighted the freshness, cleanliness, and nutritional benefits of these organic spices.

To get more information on this market, Request Sample

Growing Awareness of Sustainable and Ethical Sourcing

The demand for organic spices in India is being fueled by consumer preference for sustainable practices and responsible sourcing. Individuals are becoming more aware about the social and environmental impact of their food selections, motivating brands to implement sustainable sourcing methods. Organic spice farming enhances biodiversity, improves soil health, and decreases water pollution, supporting environmental sustainability objectives. Concerns about ethical practices related to fair pay and enhanced living standards for farmers bolster market growth, as organic farming typically provides better wages and working environments. Certifications such as Fair Trade and Rainforest Alliance enhance consumer confidence, resulting in increased demand for ethically sourced spices. Food producers and sellers are integrating sustainability assertions into their marketing approaches, addressing consumer demands for responsible supply chains. This change extends beyond premium markets and is also impacting mainstream buying trends, bolstering long-term expansion for the organic spices sector in India. In line with this trend, in 2023, Tulua launched a new line of aromatic spices, including certified organic options like coriander powder, Lakadong turmeric powder, guntur chilli powder, and cumin seed. The brand emphasized quality, sustainability, and ethical sourcing, with plans to make all its spices organic within three months.

India Organic Spices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product, form, and distribution channel.

Product Insights:

- Turmeric

- Ginger

- Chili

- Pepper

- Cinnamon

- Nutmeg

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes turmeric, ginger, chili, pepper, cinnamon, nutmeg, and others.

Form Insights:

- Powder

- Whole

- Chopped/Crushed

The report has provided a detailed breakup and analysis of the market based on the form. This includes powder, whole, and chopped/crushed.

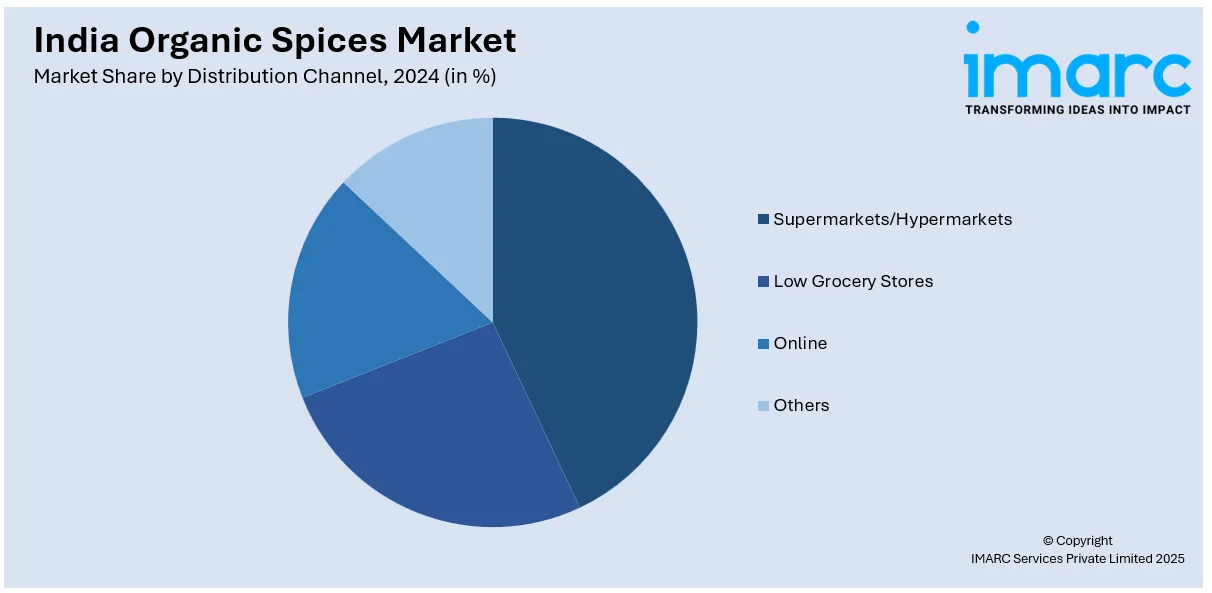

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Local Grocery Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, local grocery stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Organic Spices Market News:

- In January 2025, Rapid Organic launched its Organic Cumin Tea (Jaivik Jeera Chai) at the Silver Jubilee Foundation Day celebration of the National Research Centre on Seed Spices in Ajmer, Rajasthan. The tea, made from organic cumin, is promoted for its digestive and detoxifying benefits.

- In May 2024, Amul announced the launch of its high-protein "super milk," containing 35 grams of protein per glass, which was set to hit shelves soon. The company was also introducing organic spices, which were expected to be available in the market in the last week of May.

India Organic Spices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Turmeric, Ginger, Chili, Pepper, Cinnamon, Nutmeg, Others |

| Forms Covered | Powder, Whole, Chopped/ Crushed |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Local Grocery Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India organic spices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India organic spices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India organic spices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic spices market in India was valued at USD 954.4 Million in 2024.

The India organic spices market is projected to exhibit a CAGR of 6.2% during 2025-2033, reaching a value of USD 1,640.1 Million by 2033.

A surge in health-conscious eating and preference for pesticide-free produce is fueling demand. Rising awareness about food safety and purity boosts organic spice adoption. Additionally, expanding distribution through modern retail and e-commerce and support from government initiatives are further accelerating the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)