India Organic Pasta Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

India Organic Pasta Market Overview:

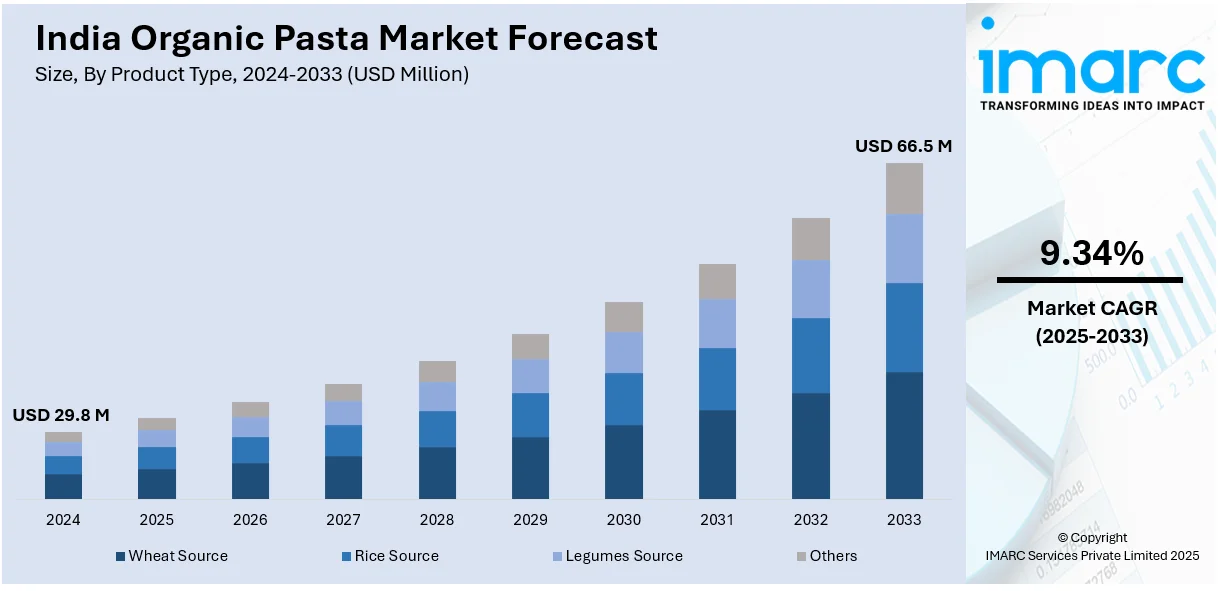

The India organic pasta market size reached USD 29.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 66.5 Million by 2033, exhibiting a growth rate (CAGR) of 9.34% during 2025-2033. The market is expanding due to the rising health consciousness among the masses and positive governmental policies and efforts encouraging sustainable agricultural practices. Moreover, the increasing number of retail channels are offering buyers a wide range of organic pastas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.8 Million |

| Market Forecast in 2033 | USD 66.5 Million |

| Market Growth Rate 2025-2033 | 9.34% |

India Organic Pasta Market Trends:

Expansion of Organic Farming and Government Support

India's organic farming industry is witnessing expansion, backed by positive governmental policies and efforts encouraging sustainable agricultural practices. For example, in 2025, Zydex Group and Krishi Jagran signed a memorandum of understanding (MoU) to promote organic farming in India under the initiative "Bharat Ka Jaivik Jagran." The partnership aims to transform Indian agriculture, focusing on soil health, sustainable practices, and increasing farmers' incomes. The goal is to make India fully organic by 2047, ensuring nutritious food for the world. Government-sponsored initiatives are encouraging farmers to embrace organic farming techniques, enhancing the supply of certified organic wheat, rice, and other ingredients utilized in pasta manufacturing. Regulatory assistance, such as the guidelines from the Food Safety and Standards Authority of India (FSSAI) for organic certification, is enhancing consumer confidence in organic pasta brands. The establishment of organic farming groups and upgraded supply chain systems are boosting raw material sourcing for producers. As more farmers transition to organic methods, the prices of organic ingredients are slowly stabilizing, narrowing the price gap between conventional and organic pasta. Growing export opportunities and heightened domestic demand are further boosting investments in organic food processing, promoting advancements in organic pasta recipes.

To get more information on this market, Request Sample

Rise of E-Commerce and Direct-to-Consumer (D2C) Sales

The swift expansion of e-commerce platforms and direct-to-consumer (D2C) sales is greatly propelling the organic pasta market in India. As per the India Brand Equity Foundation (IBEF), India's D2C market is projected to attain US$ 60 billion by FY27. Additionally, the e-commerce sector in India is expected to hit US$ 325 billion by 2030, showing substantial expansion. Digital marketplaces offer a range of organic pasta choices, providing consumers with convenient access to specialty food items that may be difficult to locate in local grocery shops. Online platforms enable brands to engage with health-conscious people in Tier I, II, and III cities, broadening the buyer reach. Subscription services and personalized recommendations are enhancing consumer engagement with organic pasta brands. The increasing use of digital payment methods and promotions for online purchases are prompting shoppers to consider premium organic products. Brands are leveraging social media marketing, collaborating with influencers, and using targeted advertisements to educate consumers about the benefits of organic pasta. Due to improvements in digital infrastructure and the growth of logistics networks, the online availability of organic food products, including pasta, is strengthening the market growth.

India Organic Pasta Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Wheat Source

- Rice Source

- Legumes Source

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wheat source, rice source, legumes source, and others.

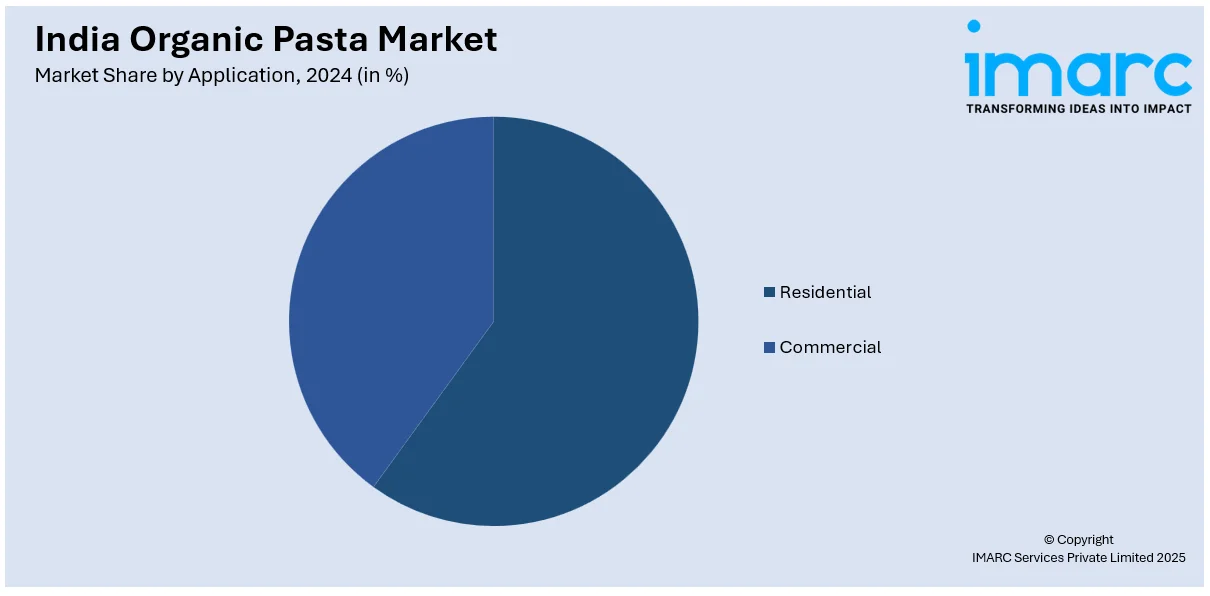

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Distribution Channel Insights:

- Offline Stores

- Online Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline stores and online stores.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Organic Pasta Market News:

- In September 2024, The Organic World (TOW) announced an expansion of its millet product range, increasing offerings from two categories to 11, including items like bread, pasta, and ready-to-cook (RTC) meals. This expansion aimed to boost millet sales from 4% to a double-digit percentage, making millet consumption more accessible and convenient for consumers.

India Organic Pasta Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wheat Source, Rice Source, Legumes Source, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Offline Stores, Online Stores |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India organic pasta market performed so far and how will it perform in the coming years?

- What is the breakup of the India organic pasta market on the basis of product type?

- What is the breakup of the India organic pasta market on the basis of application?

- What is the breakup of the India organic pasta market on the basis of distribution channel?

- What is the breakup of the India organic pasta market on the basis of region?

- What are the various stages in the value chain of the India organic pasta market?

- What are the key driving factors and challenges in the India organic pasta market?

- What is the structure of the India organic pasta market and who are the key players?

- What is the degree of competition in the India organic pasta market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India organic pasta market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India organic pasta market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India organic pasta industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)