India Organic Cotton Market Size, Share, Trends and Forecast by Type, Quality Type, Application, and Region, 2025-2033

India Organic Cotton Market Overview:

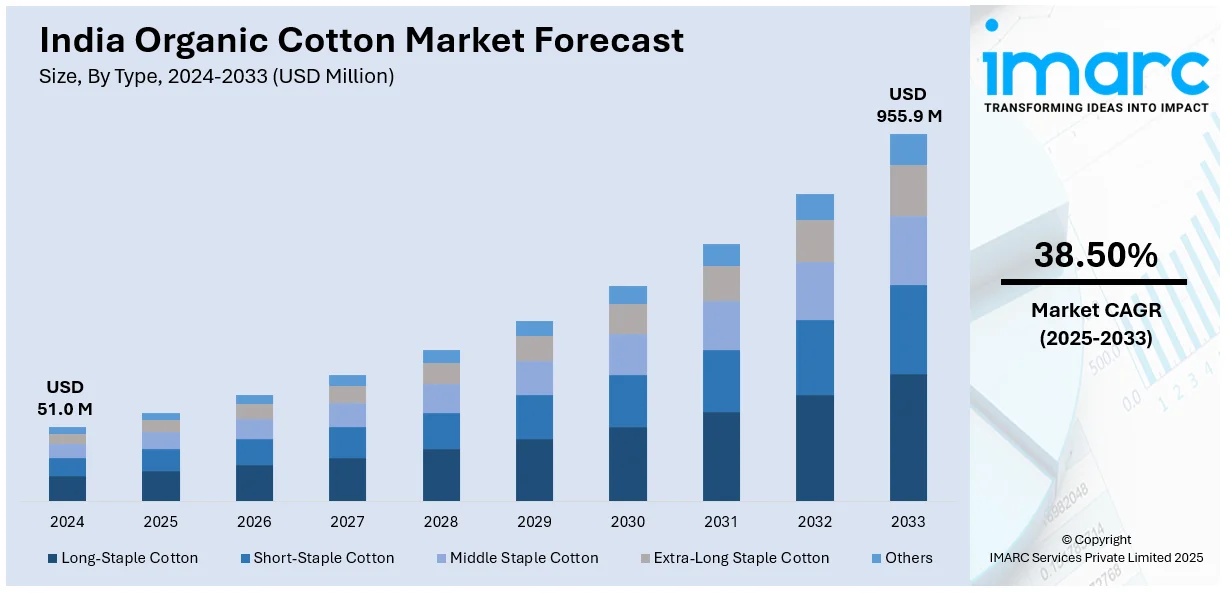

The India organic cotton market size reached USD 51.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 955.9 Million by 2033, exhibiting a growth rate (CAGR) of 38.50% during 2025-2033. The market is driven by rising consumer demand for sustainable textiles, government incentives promoting organic farming, and increasing global preference for eco-friendly apparel. Growing awareness of environmental concerns, reduced water usage in organic cultivation, and expanding export opportunities further support market growth, attracting investments from major textile brands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 51.0 Million |

| Market Forecast in 2033 | USD 955.9 Million |

| Market Growth Rate 2025-2033 | 38.50% |

India Organic Cotton Market Trends:

Rising Demand for Sustainable and Ethical Fashion

The increasing preference for eco-friendly clothing among Indian and global consumers is shaping the organic cotton market. Shoppers are increasingly aware of sustainability, with increased demand for clothing made of organic cotton that is not treated with synthetic pesticides and fertilizers. Large apparel brands and retailers are launching extended lines of organic cotton clothing to achieve sustainability goals and cater to ethically conscious consumers. Furthermore, e-commerce has offered direct access to clothing made of organic cotton, stimulating sales. Brands are also focusing on fair trade practices and transparency in sourcing, which further drives the market growth. With increasing awareness of sustainability, organic cotton is emerging as a central element of ethical fashion, driving adoption in different segments of the textile market.

To get more information on this market, Request Sample

Government Support and Organic Farming Initiatives

The Indian government is actively promoting organic cotton cultivation through subsidies, certification programs, and awareness campaigns. Policies like the Paramparagat Krishi Vikas Yojana (PKVY) provide financial and technical support to help farmers transition to organic farming. The Agricultural and Processed Food Products Export Development Authority (APEDA) oversees organic certification and export promotion, strengthening India’s global market position. As of March 31, 2023, India had 10.17 million hectares under organic certification, including 5.39 million hectares of cultivable land and 4.78 million hectares for wild harvest collection. State governments in cotton-producing regions offer incentives and support farmer cooperatives to enhance organic farming. These initiatives lower production costs, ensure compliance with international standards, and improve market competitiveness, driving the expansion of organic cotton domestically and internationally.

Expansion of Export Opportunities and Global Collaborations

India’s organic cotton exports are rising as global markets emphasize sustainable sourcing. Europe and North America are key drivers due to stringent environmental regulations and evolving consumer preferences. Leading international brands are collaborating with Indian organic cotton suppliers to ensure a stable supply of sustainable raw materials, fostering long-term commitments. Certification programs like the Global Organic Textile Standard (GOTS) and Organic Content Standard (OCS) enhance India’s reputation in global markets. Increased participation in sustainability initiatives, such as the Better Cotton Initiative (BCI), further strengthens India’s presence in the eco-friendly textile sector. Additionally, India's total cotton exports reached approximately 877 billion Indian rupees in the fiscal year 2023, highlighting the country’s dominance in the global cotton trade. With rising demand from global retailers and manufacturers, India’s organic cotton sector is set for sustained export expansion.

India Organic Cotton Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, quality type, and application.

Type Insights:

- Long-Staple Cotton

- Short-Staple Cotton

- Middle Staple Cotton

- Extra-Long Staple Cotton

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes long-staple cotton, short-staple cotton, middle staple cotton, extra-long staple cotton, and others.

Quality Type Insights:

- Supima/Pima

- Upland

- Giza

- Others

A detailed breakup and analysis of the market based on the quality type have also been provided in the report. This includes Supima/Pima, upland, Giza, and others.

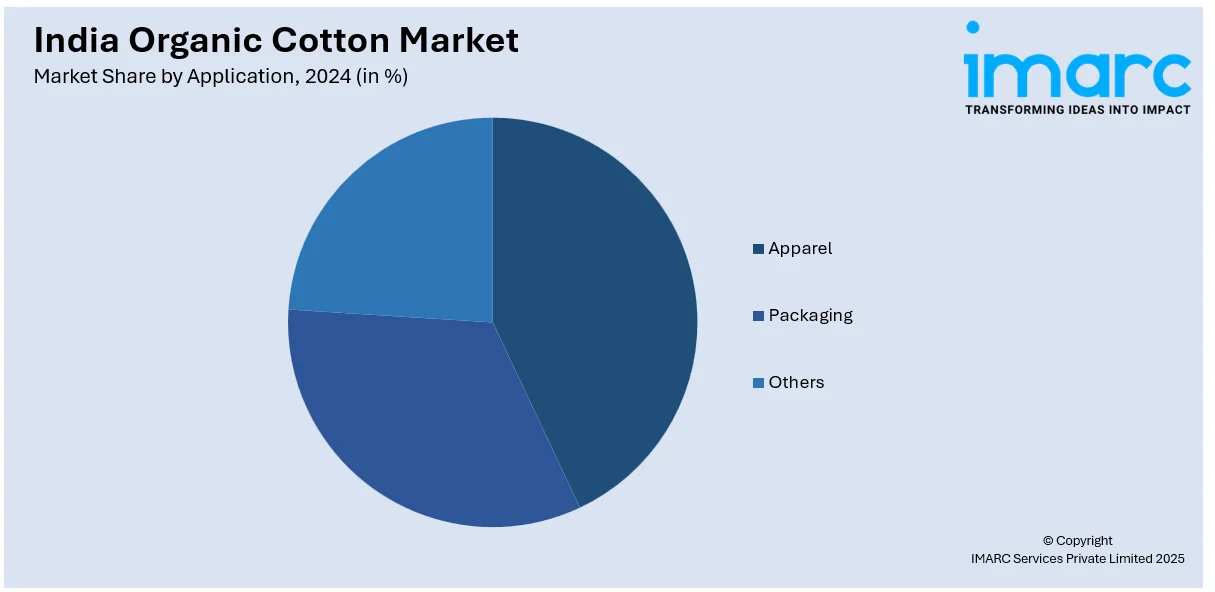

Application Insights:

- Apparel

- Packaging

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes apparel, packaging, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Organic Cotton Market News:

- In March 2024, Indo Count Industries Limited (ICIL) has partnered with GIZ India under Project AVANI to enhance organic cotton farming in Maharashtra’s Yavatmal district. Supported by Germany’s BMZ, this initiative promotes sustainable agriculture by reducing synthetic inputs and improving farmers’ livelihoods. GIZ will provide technical assistance, while ICIL ensures fair procurement. This collaboration strengthens India’s organic cotton supply chain, reinforcing ethical and eco-friendly practices in the textile industry.

India Organic Cotton Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Long-Staple Cotton, Short-Staple Cotton, Middle Staple Cotton, Extra-Long Staple Cotton, Others |

| Quality Types Covered | Supima/Pima, Upland, Giza, Others |

| Applications Covered | Apparel, Packaging, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India organic cotton market performed so far and how will it perform in the coming years?

- What is the breakup of the India organic cotton market on the basis of type?

- What is the breakup of the India organic cotton market on the basis of quality type?

- What is the breakup of the India organic cotton market on the basis of application?

- What is the breakup of the India organic cotton market on the basis of region?

- What are the various stages in the value chain of the India organic cotton market?

- What are the key driving factors and challenges in the India organic cotton?

- What is the structure of the India organic cotton market and who are the key players?

- What is the degree of competition in the India organic cotton market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India organic cotton market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India organic cotton market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India organic cotton industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)