India Optical Interconnect Market Size, Share, Trends and Forecast by Product Type, Interconnect Level, Fiber Mode, Application, End Use Industry, and Region, 2025-2033

India Optical Interconnect Market Size and Share:

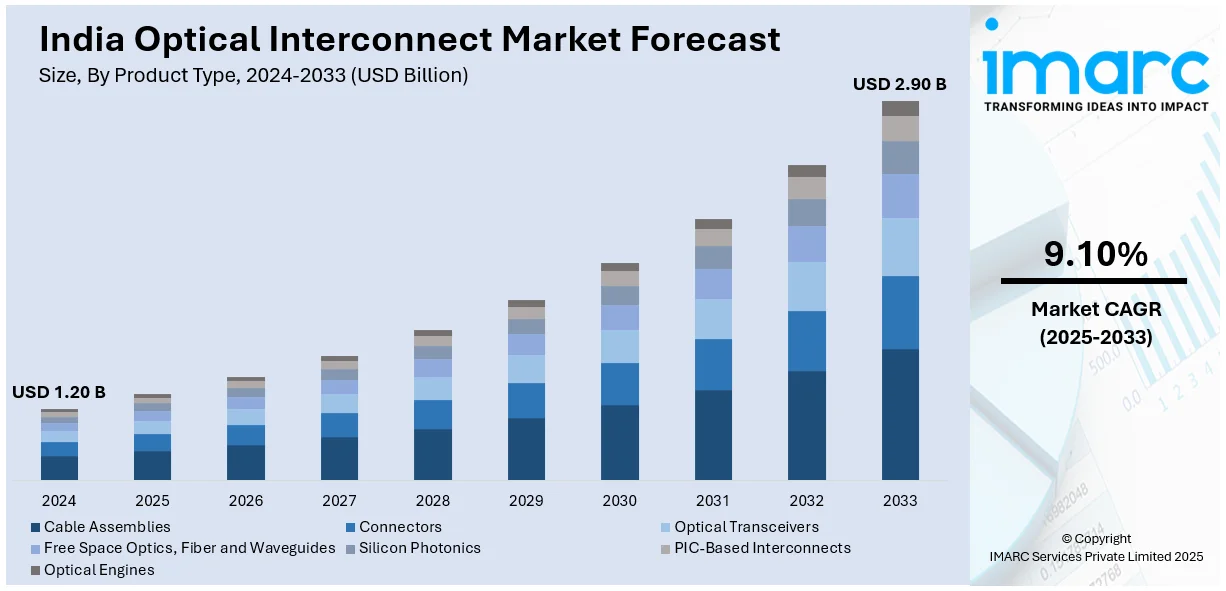

The India optical interconnect market size reached USD 1.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.90 Billion by 2033, exhibiting a growth rate (CAGR) of 9.10% during 2025-2033. The India optical interconnect market is driven by large-scale digital infrastructure projects like BharatNet, rapid expansion of hyperscale data centers, increasing adoption of AI-driven applications, government initiatives promoting semiconductor manufacturing, and rising demand for high-speed connectivity solutions in sectors such as telecom, healthcare, finance, and industrial automation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.20 Billion |

| Market Forecast in 2033 | USD 2.90 Billion |

| Market Growth Rate 2025-2033 | 9.10% |

India Optical Interconnect Market Trends:

Expansion of Digital Infrastructure through Initiatives like BharatNet

India's pledge to the development of its digital infrastructure can be seen in the ambitious BharatNet program. BharatNet has the goal of establishing high-speed broadband connectivity to all 250,000 Gram Panchayats of the nation, thus narrowing the urban-rural digital gap. Phase-I of BharatNet was completed as of July 2021, bringing 150,000 Gram Panchayats online with the installation of about 509,000 kilometers of Optical Fibre Cable (OFC). To extend this initiative, a Public-Private Partnership (PPP) tender valued at INR 29,500 crore was invited in 2021 to link the remaining Gram Panchayats, with completion by 2023. Effective roll-out of BharatNet not only enhances access to the internet but also spurs demand for optical interconnect solutions. The widespread deployment of OFC in this project requires high-end interconnect technologies for hassle-free data transfer over long distances. This, in turn, generates a strong market for optical components, connectors, and ancillary infrastructure, propelling the optical interconnect market in India.

To get more information on this market, Request Sample

Growth in Semiconductor Manufacturing and Investments

India's semiconductor industry is on a progressive path, with estimates putting it at USD 103.4 billion by 2030, backing its over USD 400 billion electronics industry. During the fiscal year 2024-25, the semiconductor industry was worth USD 52 billion and is likely to grow at a CAGR of 13% up to 2030. The main drivers of this development are consumer electronic devices, IT hardware, and industrial applications, which account for nearly 70% of the industry's revenue. The expansion of semiconductor production is directly related to the need for optical interconnects. Semiconductor fabrication facilities (fabs) and associated facilities need dependable, high-speed data transmission systems, which are enabled through optical interconnect technologies. With India emerging as a semiconductor manufacturing hub, the demand for advanced optical interconnect infrastructure is crucial, thus pushing the development in this field. Overall, combined initiatives to fortify digital infrastructure by way of ventures such as BharatNet and the new emerging semiconductor production scene are significant drivers of India's optical interconnect market expansion. These interventions serve not just to expand interconnectivity as well as progress through technology, but also drive a large body of opportunities in the optical interconnect sector.

India Optical Interconnect Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, interconnect level, fiber mode, application, and end use industry.

Product Type Insights:

- Cable Assemblies

- Indoor Cable Assemblies

- Outdoor Cable Assemblies

- Active Optical Cables

- Multi-Source Agreement

- QSFP

- CXP

- CFP

- CDFP

- Connectors

- LC Connectors

- SC Connectors

- ST Connectors

- MPO/MTP Connectors

- Optical Transceivers

- Free Space Optics, Fiber and Waveguides

- Silicon Photonics

- PIC-Based Interconnects

- Optical Engines

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cable assemblies (indoor cable assemblies, outdoor cable assemblies, active optical cables, multi-source agreement (QSFP, CXP, CFP, CDFP)), connectors (LC connectors, SC connectors, ST connectors, MPO/TP connectors), optical transceivers, free space optics, fiber and waveguides, silicon photonics, PIC-based interconnects, and optical engines.

Interconnect Level Insights:

- Chip- and Board-Level Interconnect

- Board-To-Board and Rack-Level Optical Interconnect

- Metro and Long Haul Optical Interconnect

A detailed breakup and analysis of the market based on the interconnect level have also been provided in the report. This includes chip-and board-level interconnect, board-to-board and rack-level optical interconnect, and metro and long-haul optical interconnect.

Fiber Mode Insights:

- Multi-Mode Fiber

- Step Index Multi-Mode Fiber

- Graded Index Multi-Mode Fiber

- Single-Mode Fiber

A detailed breakup and analysis of the market based on the fiber mode have also been provided in the report. This includes multi-mode fiber (step index multi-mode fiber and graded index multi-mode fiber) and single-mode fiber.

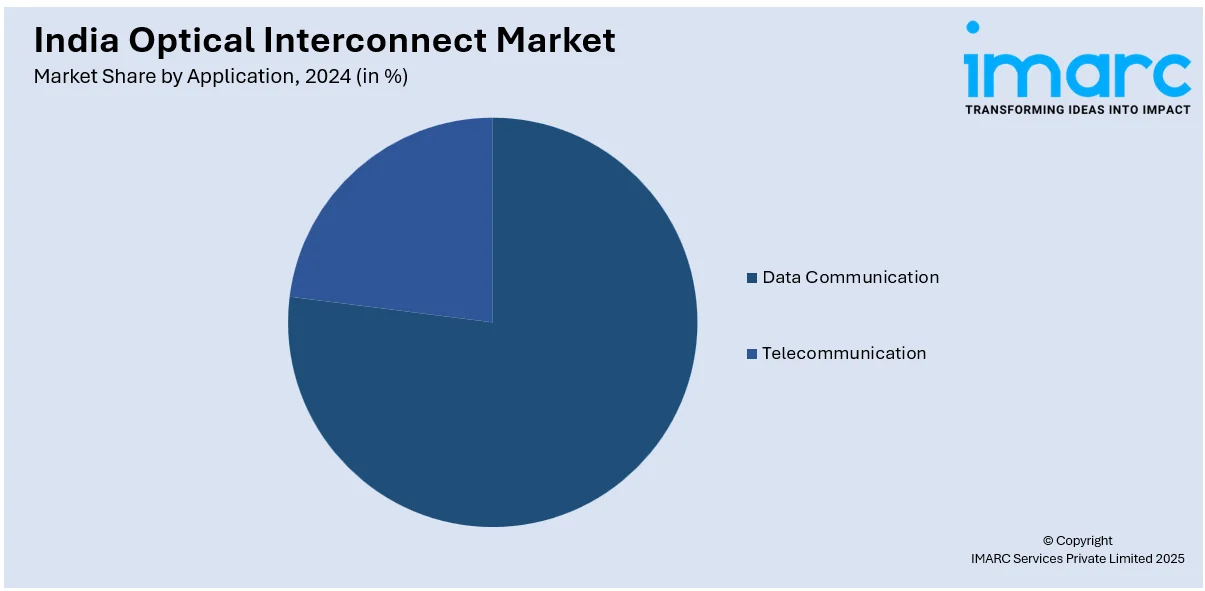

Application Insights:

- Data Communication

- Data Center

- High-Performance Computing (HPC)

- Telecommunication

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes data communication (data center and high-performance computing (HPC)) and telecommunication.

End Use Industry Insights:

- Military and Aerospace

- Consumer Electronics

- Automotive

- Chemicals

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes military and aerospace, consumer electronics, automotive, chemicals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Optical Interconnect Market News:

- February 2025: STMicroelectronics is unveiling its next generation of proprietary technologies for higher-performing optical interconnect in data centers and AI clusters. This advancement enhances data transmission efficiency, benefiting India's expanding data center industry. The integration of such technologies supports the country's digital infrastructure development, driving development in the optical interconnect market.

- October 2024: Sterlite Technologies ventured into AI-enabled data centers with the launch of optical cable and interconnect offerings at India Mobile Congress 2024. The expansion comes with India's escalating demand for fast data transmission, boosting the market for optical interconnects. Growing usage of AI and cloud services in India is also fueling the necessity for next-generation optical connectivity solutions.

India Optical Interconnect Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Interconnect Levels Covered | Chip- and Board-Level Interconnect, Board-To-Board and Rack-Level Optical Interconnect, Metro and Long Haul Optical Interconnect |

| Fiber Modes Covered |

|

| Applications Covered |

|

| End Use Industries Covered | Military and Aerospace, Consumer Electronics, Automotive, Chemicals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India optical interconnect market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India optical interconnect market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India optical interconnect industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The optical interconnect market in India was valued at USD 1.20 Billion in 2024.

The India optical interconnect market is projected to exhibit a CAGR of 9.10% during 2025-2033, reaching a value of USD 2.90 Billion by 2033.

Rising need for high-speed data transmission, increasing adoption of cloud services, expanding data centers, and government initiatives are driving the optical interconnect market in India. The growing internet penetration, 5G rollout, and need for better network infrastructure are also contributing, with enterprises upgrading to handle increasing bandwidth and latency requirements across urban and rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)