India Optical Character Recognition (OCR) Market Size, Share, Trends, and Forecast by Type, Mode of Operation, Vertical, and Region, 2025-2033

India Optical Character Recognition (OCR) Market Overview:

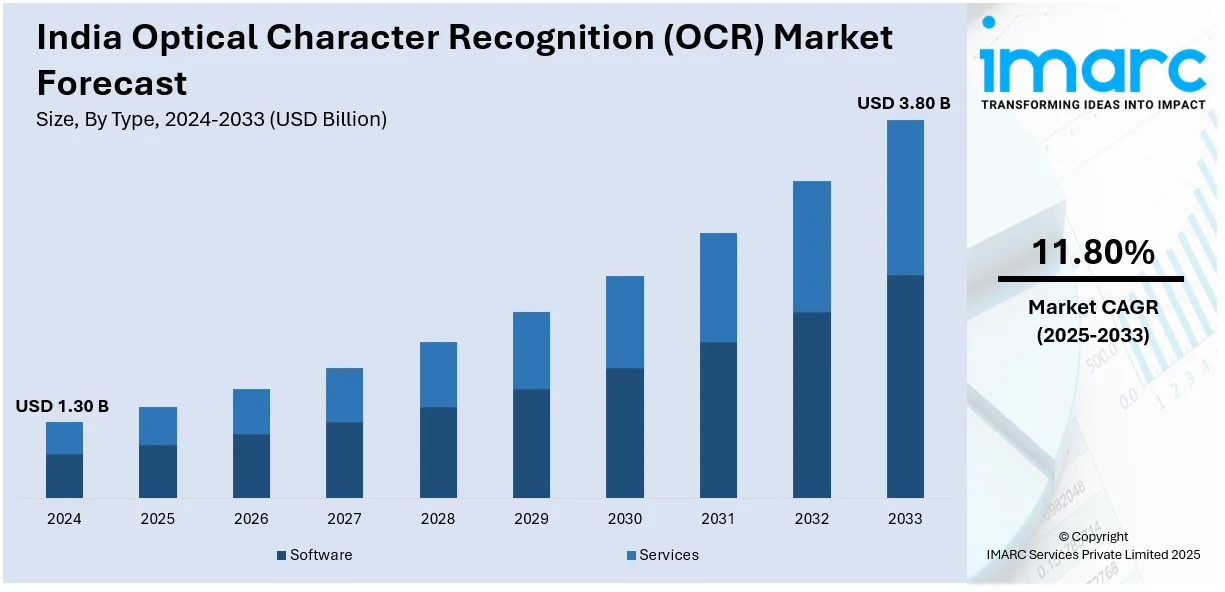

The India optical character recognition (OCR) market size reached USD 1.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.80 Billion by 2033, exhibiting a growth rate (CAGR) of 11.80% during 2025-2033. The market is growing rapidly, driven by the widespread adoption across industries like banking, healthcare, and logistics. OCR technology enhances data accuracy, efficiency, and document automation. Additionally, the market benefits from advancements in AI and machine learning, improving the accuracy and scalability of OCR solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.30 Billion |

| Market Forecast in 2033 | USD 3.80 Billion |

| Market Growth Rate 2025-2033 | 11.80% |

India Optical Character Recognition (OCR) Market Trends:

Rising Adoption of AI-Powered OCR Solutions

The India optical character recognition (OCR) market is witnessing the widespread adoption of artificial intelligence (AI) and machine learning (ML)-powered OCR solutions. Traditional OCR systems rely on rule-based algorithms, which struggle with complex handwriting, varying fonts, and low-quality scans. AI-enhanced OCR technologies leverage deep learning models to improve text recognition accuracy, even for unstructured or handwritten content. For instance, at MLDS 2025, Johnson & Johnson revealed how innovation and cost constraints led to a scalable OCR tool, achieving 85% handwritten text accuracy and outperforming third-party APIs internally. Additionally, industries such as banking, insurance, healthcare, and retail are integrating AI-based OCR to automate data extraction, enhance document processing efficiency, and reduce human intervention. In banking and financial services, AI-powered OCR facilitates real-time Know Your Customer (KYC) verification by extracting information from Aadhaar cards, PAN cards, and other identity documents. Similarly, in the logistics and e-commerce sectors, automated invoice processing and inventory management benefit from AI-driven OCR. The increasing availability of cloud-based OCR solutions further accelerates market adoption, enabling businesses to scale their document processing capabilities without extensive infrastructure investment. Furthermore, as companies seek higher accuracy, faster processing, and seamless integration with existing enterprise applications, AI-powered OCR solutions are expected to drive significant growth in the Indian market.

To get more information on this market, Request Sample

Expanding Use of OCR in Government and Digital Initiatives

The Indian government’s push toward digitization is a key factor driving OCR adoption. Various initiatives such as Digital India, e-Governance programs, and smart city projects require advanced OCR solutions to convert physical records into searchable and structured digital formats. Government agencies are increasingly deploying OCR to digitize land records, tax documents, and legal paperwork, improving accessibility and transparency in public administration. Additionally, the use of OCR in Aadhaar-based authentication and e-KYC processes has further accelerated adoption across sectors like banking, telecommunications, and public welfare services. The integration of OCR with Natural Language Processing (NLP) is also gaining traction, enabling the recognition of regional languages, which is crucial in a linguistically diverse country like India. Moreover, startups and technology firms are developing multilingual OCR solutions to cater to local language requirements, supporting financial inclusion and digital literacy initiatives. For instance, in January 2025, MeitY announced the utilization of BHASHINI, a Digital India initiative, to enhance multilingual communication in 11 Indian languages, ensuring seamless accessibility and information sharing for all participants at this significant event. Furthermore, with the increasing emphasis on paperless workflows, automation, and compliance, OCR is becoming a vital tool for government bodies and enterprises alike. The market is expected to witness continued expansion as public and private sectors invest in advanced document digitization technologies to streamline operations and improve service delivery.

India Optical Character Recognition (OCR) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, mode of operation, and vertical.

Type Insights:

- Software

- Desktop-based OCR

- Mobile-based OCR

- Cloud-based OCR

- Others

- Services

- Consulting

- Outsourcing

- Implementation and Integration

The report has provided a detailed breakup and analysis of the market based on the type. This includes software (desktop-based OCR, mobile-based OCR, cloud-based OCR, and others) and services (consulting, outsourcing, and implementation and integration).

Mode of Operation Insights:

- B2B

- B2C

A detailed breakup and analysis of the market based on the mode of operation have also been provided in the report. This includes B2B and B2C.

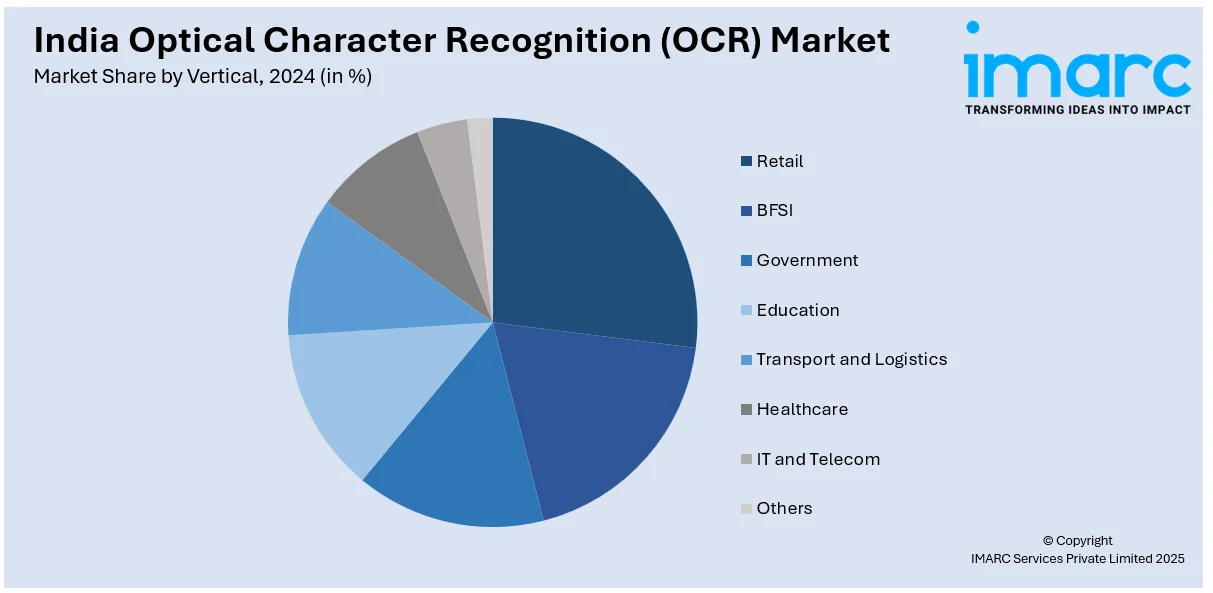

Vertical Insights:

- Retail

- BFSI

- Government

- Education

- Transport and Logistics

- Healthcare

- IT and Telecom

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes retail, BFSI, government, education, transport and logistics, healthcare, IT and telecom, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Optical Character Recognition (OCR) Market News:

- In October 2024, G2 awarded Nanonets 12+ badges in its Fall 2024 Report, recognizing it as a global OCR market leader. This achievement highlights Nanonets' commitment to advanced AI automation, delivering cutting-edge OCR solutions that enhance business efficiency and streamline operations across multiple regions and industries, driving impactful results for customers.

India Optical Character Recognition (OCR) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Mode of Operations Covered | B2B, B2C |

| Verticals Covered | Retail, BFSI, Government, Education, Transport and Logistics, Healthcare, IT and Telecom, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India optical character recognition (OCR) market performed so far and how will it perform in the coming years?

- What is the breakup of the India optical character recognition (OCR) market on the basis of type?

- What is the breakup of the India optical character recognition (OCR) market on the basis of mode of operation?

- What is the breakup of the India optical character recognition (OCR) market on the basis of vertical?

- What is the breakup of the India optical character recognition (OCR) market on the basis of region?

- What are the various stages in the value chain of the India optical character recognition (OCR) market?

- What are the key driving factors and challenges in the India optical character recognition (OCR) market?

- What is the structure of the India optical character recognition (OCR) market and who are the key players?

- What is the degree of competition in the India optical character recognition (OCR) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India optical character recognition (OCR) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India optical character recognition (OCR) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India optical character recognition (OCR) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)