India Ophthalmic Devices Market Size, Share, Trends and Forecast by Devices, End User, and Region, 2025-2033

India Ophthalmic Devices Market Size and Share:

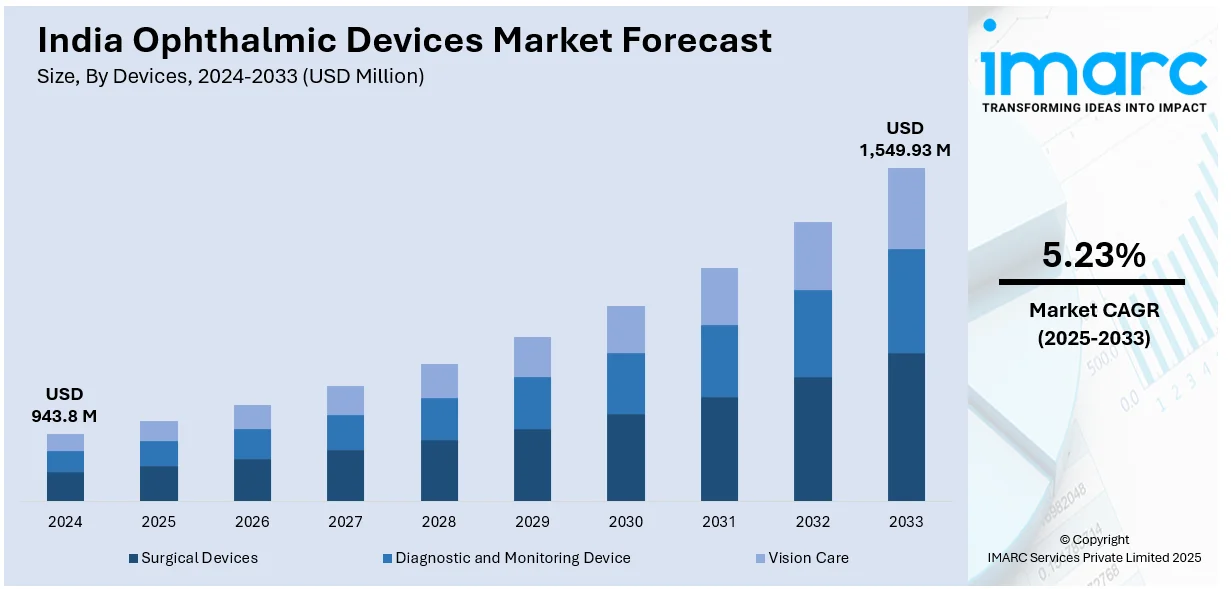

The India ophthalmic devices market size was valued at USD 943.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,549.93 Million by 2033, exhibiting a CAGR of 5.23% from 2025-2033. North India currently dominates the market in 2024. The rising demand for precision eye care, increasing in age-related vision issues, tech-driven diagnostic advancements, improving access to eye care in rural areas, growth in medical tourism, and higher awareness about vision health are some of the major factors augmenting India ophthalmic devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 943.8 Million |

| Market Forecast in 2033 | USD 1,549.93 Million |

| Market Growth Rate 2025-2033 | 5.23% |

The market is experiencing significant expansion due to the rising incidence of age-related eye conditions such as macular degeneration, glaucoma, and cataracts. According to an industry report, approximately 14.25% of older adults in India have cataracts. The increasing prevalence of cataracts is fueling the need for advanced diagnostic and surgical equipment. Additionally, rising awareness regarding preventive eye care among urban populations is encouraging routine eye examinations, thereby propelling the adoption of devices such as fundus cameras and optical coherence tomography. Moreover, government-led programs such as the National Programme for Control of Blindness (NPCB) are promoting early diagnosis and subsidized treatment, particularly in rural and underserved areas. Furthermore, continual technological advancements, including AI-powered screening systems, portable diagnostic tools, and femtosecond lasers, are transforming clinical efficiency and surgical precision.

To get more information on this market, Request Sample

Additionally, the growing middle-class population with inflating disposable income is increasing the demand for elective procedures, including LASIK and cataract surgeries with premium intraocular lenses. In line with this, the expansion of private eye care chains and multispecialty hospitals is broadening access to high-quality ophthalmic services, which is providing an impetus to India ophthalmic devices market growth. Besides this, favorable medical tourism policies and cost-effective procedures are positioning India as a preferred destination for international patients seeking advanced ophthalmic treatments. According to an industry report, more than 101 Million people in India have been diagnosed with diabetes mellitus (DM), creating a growing public health concern. An estimated 12.5% of these people have diabetic retinopathy (DR), which translates to around 12 Million people, and an additional 4 Million have vision-threatening diabetic retinopathy (VTDR). This is further driving the need for devices that support early detection and monitoring of diabetic retinopathy.

India Ophthalmic Devices Market Trends:

Rising Prevalence of Refractive Errors and Cataracts Driving Demand for Surgical Devices

The growing incidences of vision-related conditions is steadily increasing the requirement for ophthalmic surgical interventions in India, which is positively impacting the India ophthalmic devices market outlook. Surgeons and clinics are prioritizing minimally invasive procedures using advanced devices that offer shorter recovery periods and improved precision. Cataract and refractive error corrections remain the primary drivers of surgical demand, supporting consistent market growth for intraocular lenses, phacoemulsification systems, and laser-based platforms. A research article published in March 2024, while analyzing data from 52,380 individuals aged 50 and above, reported that the overall prevalence of cataracts was 14.85%, with a surgical coverage rate of 76.95% and 23% unmet need globally. The rising surgical volume is driving demand for ophthalmic surgical devices, while the unmet need is pushing smaller hospitals to adopt compact, portable systems suited for semi-urban and rural settings. In response, manufacturers are optimizing product portfolios to deliver efficient, cost-effective solutions across both high-end and budget-focused segments.

Increasing Technological Integration

The adoption of digital technologies and integration of artificial intelligence (AI) is an emerging India ophthalmic devices market trend. AI-based platforms support screening, faster image analysis, pattern recognition, and risk stratification, particularly in retinal and corneal diagnostics. For instance, an AI system developed by Rajalakshmi et al., was deployed across 181 vision centers in India, enabling real-time screening of over 150,000 patients. The artificial intelligence (AI) software demonstrated 95.8% sensitivity and 80.2% specificity for detecting diabetic retinopathy (DR). In addition to this, digital tools are now integrated into handheld imaging systems, allowing clinicians to evaluate ocular health outside traditional clinical settings. Teleophthalmology networks are using these tools to enable screening at the community level, streamlining patient referrals for in-person consultation only when necessary. As a result, patient flow is becoming more efficient, reducing the diagnostic burden on tertiary centers. Also, developers are creating cloud-based platforms that store diagnostic data and sync with hospital information systems. This allows for real-time collaboration between primary screeners and ophthalmic specialists.

Growth of Private Eye Care Chains and Institutional Buyers

The ophthalmic devices market in India is being shaped by the rise of private eye care networks that are centralizing procurement and standardizing technologies across facilities. According to an industry report on February 15, 2025, Maxivision Super Specialty Eye Hospitals, a Hyderabad-based eye care chain, plans to open centers across the state and expand into Gujarat and Madhya Pradesh, targeting a presence in 10 to 12 states within two years. This rapid scaling is fueling increased India ophthalmic devices market demand, particularly modular diagnostic suites and integrated surgical systems. Manufacturers are responding by offering solutions that can be tailored to varying procedure volumes and infrastructure constraints, especially in Tier 2 and Tier 3 cities. Also, devices that combine affordability with dependable performance are gaining traction among expanding networks seeking to optimize capital expenditure. The market is also seeing a growing emphasis on features that support operational continuity and user efficiency, such as intuitive interfaces, high interoperability, and reduced training requirements.

India Ophthalmic Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India ophthalmic devices market, along with forecasts at the country levels from 2025-2033. The market has been categorized based on devices and end user.

Analysis by Devices:

- Surgical Devices

- Glaucoma Surgery Devices

- Cataract Surgery Devices

- Refractive Surgery Devices

- Other Surgical Devices

- Diagnostic and Monitoring Device

- Autorefractors and Keratometers

- Corneal Topography Systems

- Ophthalmic Ultrasound Imaging Systems

- Others

- Vision Care

- Spectacles

- Contact Lens

Surgical devices lead the market with around 47.5% of market share in 2024 due to the high surgical volume of the country, particularly for cataract and refractive error corrections. These devices consist of phacoemulsification systems, vitrectomy units, microkeratomes, and laser systems, which are vital to precision and effectiveness in ophthalmic surgery. Cataract surgery drives steady demand for surgical equipment, especially in government-sponsored eye care programs and charitable organizations. Both private and public healthcare centers are increasingly using femtosecond lasers and minimally invasive technology to enhance patient outcomes and minimize recovery times. The increased number of elderly and the growing incidence of diabetes-related complications are also increasing the demand for sophisticated surgical treatments. Moreover, training programs from medical device manufacturers and the growth of eye care chains in tier 2 and tier 3 cities are increasing accessibility to surgical devices across the nation.

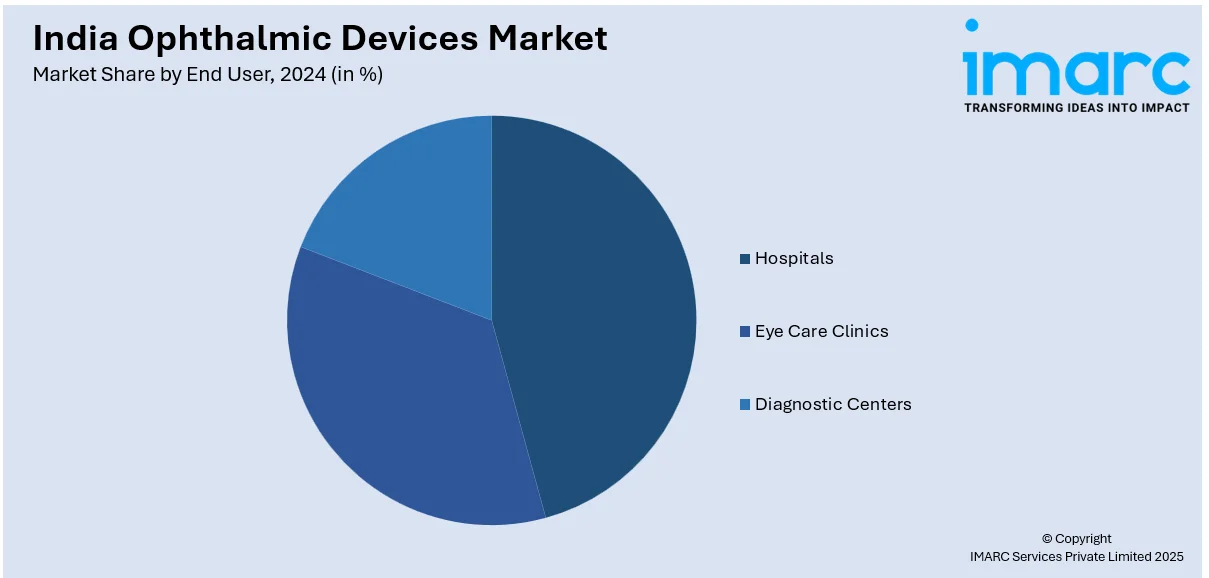

Analysis by End User:

- Hospitals

- Eye Care Clinics

- Diagnostic Centers

Hospitals lead the market with around 44.5% of market share in 2024 due to their position as first-choice facilities for eye treatments, diagnostics, and surgeries. Hospitals are well-stocked with sophisticated ophthalmic devices to perform operations like cataract extraction, glaucoma treatment, retinal diagnosis, and refractive alterations. The government and private hospitals are implementing technologies like optical coherence tomography, fundus cameras, and intraocular lenses to enhance patient outcomes and surgical efficiency. The increasing incidence of vision-related disorders, especially age-related and diabetes-related eye diseases, is increasing the need for highly accurate diagnostic and surgical equipment in hospital settings. Also, public health programs and the establishment of specialty eye hospitals in tier 2 and tier 3 cities are supporting the market expansion. Hospital procurement patterns tend to favor reliability, service support, and brand reputation, making them a critical distribution channel for device manufacturers.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

In 2024, North India accounted for the largest market share due to its high population base, presence of tertiary care hospitals, and increasing incidences of vision disorders. Delhi, Uttar Pradesh, Punjab, and Haryana experience high requirements for diagnostic and surgical ophthalmic devices, fueled by increased awareness and access to sophisticated eye care. The availability of well-known government facilities like AIIMS and big private hospital chains further enhances the role of the region in device uptake. Rising rates of diabetes and hypertension are leading to increased cases of diabetic retinopathy and cataracts, especially in urban areas. North India also experiences robust public-private partnerships in eye care programs, such as mobile screening vans and subsidized operations. All these factors and favorable government schemes fuel infrastructural growth as well as ophthalmic equipment purchases in urban as well as semi-urban cities.

Key Regional Takeaways:

North India Ophthalmic Devices Market Analysis

The ophthalmic devices market in North India is expanding due to increased awareness regarding eye health, inflating disposable incomes in urban centers like Delhi-NCR and Chandigarh, and improved access to healthcare facilities. Additionally, the implementation of government initiatives is facilitating greater outreach of ophthalmic care. The increased investment and the expansion of specialized eye care infrastructure in India drive demand for advanced ophthalmic devices across surgical and diagnostic segments. For instance, on May 14, 2024, ChrysCapital announced an investment of INR 830 Crore (about USD 99.6 Million) in New Delhi's Centre for Sight (CFS), a leading Indian eye care hospital chain. The investment will support CFS's expansion plans, enhance service offerings, and strengthen its leadership in the eye care segment. Moreover, Tier-II cities are emerging as growth hubs, with rising patient footfall for refractive error corrections, cataract surgeries, and glaucoma management. The strong presence of AIIMS and regional ophthalmic training centers is promoting the adoption of modern technologies. In addition to this, the rising requirement for contact lenses and spectacles, particularly driven by a surge in screen-related vision issues, is providing a boost to the market. Besides this, strategic partnerships between hospitals and device makers are offering equipment leasing models to lower upfront expenses for smaller clinics.

West and Central India Ophthalmic Devices Market Analysis

The ophthalmic devices market in West and Central India is witnessing consistent growth led by Maharashtra, Gujarat, and Madhya Pradesh. In metropolitan hubs like Mumbai, Pune, and Ahmedabad, there is a notable shift toward premium diagnostic and surgical solutions, including wavefront aberrometry, intraocular lenses (IOLs), and automated phoropters. Furthermore, large hospital chains, corporate eye clinics, and standalone specialists are increasingly investing in artificial intelligence (AI) powered screening and teleophthalmology platforms to serve a wider patient base. In line with this, Tier-II cities are adopting semi-automated diagnostic tools, reflecting steady infrastructure improvements. According to an industry report on February 2025, there were 932 medical device manufacturing units in Gujarat. Gujarat's robust pharmaceutical and medical device manufacturing ecosystem is encouraging local production of cost-effective ophthalmic tools. Besides this, NGOs and mobile eye units are addressing gaps, especially for cataract surgeries in remote regions. The demand for basic vision screening devices and portable slit lamps is increasing in such areas. Apar from this, strategic partnerships with state governments for public-private eye care projects are also shaping the regional ophthalmic device landscape.

South India Ophthalmic Devices Market Analysis

South India has a well-established ophthalmic care ecosystem led by private institutions and government healthcare facilities. According to an industry report, more than 15 lakh patients travel to Tamil Nadu each year for medical diagnosis and care. The strong medical tourism and mature health infrastructure support the market for ophthalmic devices in this region. Moreover, states such as Tamil Nadu, Karnataka, and Kerala are dominant regions in the market, with increasing uptake of advanced surgical devices, including phacoemulsification systems and femtosecond lasers. Diagnostic devices like corneal topographers and optical biometers are becoming standard in private clinics and specialty centers. The region benefits from a strong presence of device distributors and localized technical support, enhancing post-sale service efficiency. Southern states also lead in implementing community outreach programs that integrate telemedicine and mobile diagnostic vans, expanding the usage of portable ophthalmic tools. Apart from this, start-ups in Bengaluru and Hyderabad are developing digital vision screening solutions tailored to rural populations. Despite widespread private sector advancement, affordability and access in tribal and remote hilly areas remain barriers. However, active NGO involvement and CSR-driven initiatives are helping reduce the gap in basic ophthalmic diagnostics and treatment.

East India Ophthalmic Devices Market Analysis

The ophthalmic devices market in East India is developing, with states like West Bengal, Odisha, and Assam, driven by urban hospital investments and public sector efforts to combat cataract and refractive errors. Kolkata is emerging as a regional hub where super-specialty hospitals and diagnostic centers are adopting advanced imaging and surgical equipment. In addition to this, government-sponsored cataract camps and school screening programs are creating opportunities for portable and low-cost devices. For instance, on March 20, 2025, the Indian Army inaugurated a special Cataract Eye Surgery Camp at 158 Base Hospital, Bengdubi Military Station, West Bengal, aiming to restore vision for over 350 veterans, dependents, and select civilians. The initiative is led by Brigadier Sanjay Mishra, a distinguished ophthalmic surgeon, and the medical team plans to perform between 300 and 350 surgeries over three days, utilizing state-of-the-art equipment and high-quality lenses. In the Northeast, geographical challenges hinder equipment distribution and servicing, prompting interest in compact, rugged devices suitable for low-resource environments. Also, local manufacturers are gradually entering the market with affordable ophthalmic tools, and teleophthalmology models are beginning to improve access in underserved districts.

Competitive Landscape:

The market is experiencing consistent competition fueled by the increasing demand for sophisticated diagnostic and surgical devices. Industry players are concentrating on broadening their product lines in diagnostic imaging, surgical equipment, and vision care devices. Continual technological advancements, including artificial intelligence (AI) driven screening devices, handheld devices, and minimally invasive surgical systems, are heightening competition. Also, local manufacturing is increasing with policy support and end-user cost sensitivity, which is slowly rewriting procurement choices. Businesses are leveraging digital platforms to build robust distribution channels and enhance after-sales services. Pricing continues to be the major differentiator, particularly in tier II and III cities. Moreover, product innovation, strategies that are adapted to local circumstances, and arrangements with healthcare suppliers are characterizing the ongoing rivalry, with companies trying to own a bigger pie in both institutional and individual segments of consumers.

The report provides a comprehensive analysis of the competitive landscape in the India ophthalmic devices market with detailed profiles of all major companies, including:

- Alcon Inc.

- Bausch Health Companies Inc.

- Carl Zeiss Meditec AG

- Essilor international SA

- Hoya Corporation

- Johnson & Johnson

- Topcon Corporation

- Mani Inc

- NOVARTIS AG

- The Cooper Companies Inc.

Latest News and Developments:

- On May 2023, Medevplus unveiled the IXanner® 7vn, a portable Optical Coherence Tomography (OCT) device, at the All India Ophthalmological Conference (AIOC) in Kochi. This innovative device is designed to transform ophthalmic diagnostics by providing high-resolution imaging for eye conditions. Medevplus aims to enhance eye care accessibility across various settings.

- On April 2024, Warburg Pincus, a worldwide growth investor, purchased a share in Appasamy Associates Pvt. Ltd., a prominent Indian manufacturer of intraocular lenses and ophthalmic equipment. This investment represents Warburg Pincus's largest commitment to India's healthcare sector to date. Appasamy Associates plans to leverage this partnership to drive product innovation and expand into export markets.

India Ophthalmic Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered |

|

| End Users Covered | Hospitals, Eye Care Clinics, Diagnostic Centers |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Alcon Inc., Bausch Health Companies Inc., Carl Zeiss Meditec AG, Essilor international SA, Hoya Corporation, Johnson & Johnson, Topcon Corporation, Mani Inc, NOVARTIS AG, The Cooper Companies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ophthalmic devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India ophthalmic devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ophthalmic devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ophthalmic devices market in India was valued at USD 943.8 Million in 2024.

The key factors driving the market are rising cases of cataract and glaucoma, increasing elderly population, expanding medical tourism, and improved access to eye care services. Also, implementation of government initiatives like Ayushman Bharat and rising adoption of advanced diagnostic and surgical technologies are providing an impetus to the market growth.

The ophthalmic devices market in India is projected to exhibit a CAGR of 5.23% during 2025-2033, reaching a value of USD 1,549.93 Million by 2033.

Hospitals dominate the market due to better infrastructure, availability of advanced ophthalmic equipment, and presence of skilled ophthalmologists. Hospitals handle high patient volumes, conduct complex eye surgeries, and are preferred for diagnosis, treatment, and post-operative care.

Some of the major players in the India ophthalmic devices market include Alcon Inc., Bausch Health Companies Inc., Carl Zeiss Meditec AG, Essilor international SA, Hoya Corporation, Johnson & Johnson, Topcon Corporation, Mani Inc, NOVARTIS AG, The Cooper Companies Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)